Joyce Tan, Head of Fixed Income, Asia/Singapore

De-dollarisation trend is gaining momentum

The shift away from the US dollar is nothing new. Over the past two decades, central banks have been slowly but surely diversifying their foreign reserves away from the USD into other currencies. However, as the IMF1 pointed out in its 2024 report, this diversification is no longer only into “traditional” USD alternatives such as the euro, yen and pound.

Instead, many central banks are choosing to hold more so-called “non-traditional” currencies, and in particular the Australian dollar, Canadian dollar, Chinese renminbi, South Korean won, the Nordic currencies, and the Singapore dollar. The report noted that this shift was masked by the continued demand for USD from private investors, thereby keeping the USD elevated.

However, this has started to change. Amid more US uncertainties and the pressure to lower interest rates, private investors have been looking for opportunities outside the US. As a result, the USD peaked in January 2025, and since then has dropped by around 9.5 percent against a basket of currencies.

SGD is helping to pick up the slack

In this de-dollarising world, it is not just Singaporeans who are looking for SGD exposure. Increasingly, foreign investors are doing so to take advantage of Singapore’s reputation as a global financial hub governed by strong political institutions and populated by stable, well-run corporations.

The unique way in which the MAS manages its monetary policies has also added to the SGD’s attractiveness. Rather than relying on interest rates, the MAS allows its currency to float with the S$NEER (Singapore Dollar Nominal Effective Exchange Rate) policy band. The band’s slope, width and level can be adjusted based on a basket of currencies of Singapore’s major trading partners.

By focusing on exchange rates rather than interest rates, many analysts believe that Singapore is able to respond more quickly to trade-driven currency shocks, including those that could emerge as a result of US trade tariffs. They point to the fact that the MAS reduced the slope of its policy band in January and April this year, effectively an easing action. Yet the SGD remained supported, with gains of around 7.0 percent versus the USD year-to-date, making it one of the strongest currencies in Asia this year.

The SGD’s stability has not gone unnoticed among the international community. In a SWIFT report published in June 2025, the SGD ranked as the ninth most influential currency in the world, ahead of the Swiss franc and Swedish krona.

Fig 1: Top 10 most influential currencies 2025

| 1. US dollar |

| 2. Euro |

| 3. Pound sterling |

| 4. Japanese yen |

| 5. Chinese renminbi |

| 6. Canadian dollar |

| 7. Hong Kong dollar |

| 8. Australian dollar |

| 9. Singapore dollar |

| 10. Swiss franc |

Source: SWIFT, June 2025

The SGD conundrum

Whether or not investors are Singapore-based, the developments discussed above suggest that there is good reason to hold at least some assets in SGD.

However, as many Singaporeans are discovering, the strong demand for the SGD has caused Singapore bond yields to drop steeply. This has led to low fixed deposit rates, with many banks’ SGD fixed deposit rates now ranging from 0.05 to 1.65 percent3, a long way from the 3.0 percent or more seen last year. The yields on Singapore Savings Bond (SSB) and Singapore Government Securities (SGS) have also fallen significantly, with 2-year SGS bonds currently yielding only around 1.55 percent4.

For those seeking an attractive income stream in SGD, this poses a dilemma, given that the three main options to achieve higher bond yields all come with higher risk. Investors can choose to invest beyond Singapore government bonds to include corporate bonds. However, this involves an assessment of the corporate bond issuer’s business fundamentals, and the lower the credit rating, the higher the risk.

Another way to enjoy higher yields is to diversify globally and hedge the currency exposure back to SGD. Currency hedging is a strategy used by investment professionals to minimise the impact of currency exchange fluctuations on an investment, typically by applying sophisticated financial instruments such as FX forwards. But hedging can either contribute to or eat into returns.

A third way is to include bonds that have a longer maturity and therefore a higher yield. However, bonds with long maturities are more susceptible to price swings, and can be affected by factors such as inflation expectations and short-term interest rate movements.

The United SGD Fund: FAQs

Given the SGD’s current appeal, but also the challenges of achieving an attractive yield at lower risk, the United SGD Fund (the “Fund”) has attracted increased attention from both local and global investors. Here are responses to a few common questions that we have received recently.

- How is the Fund performing in the current environment?

Despite the increased pressure on bond yields, the Fund is managing to deliver good yields and returns at lower risk.

- Yield: As of 31 July 2025, the Fund’s yield to maturity stands at 3.24 percent, still substantially above current SGD fixed deposit and short-term government bond rates5

- Returns: Year-to-date, the Fund has returned 2.58 percent (as of 31 July 2025), ahead of its benchmark (6-month Compounded Singapore Overnight Rate Average) which returned 1.58 percent6

- Risk: At the same time, the Fund’s three-year volatility (i.e. standard deviation) is 1.14 percent, significantly lower than the 4.96 percent average of its Morningstar peer group over the same period7. The fund has not experienced a single month of negative returns since 2022 amid the US’s post-Covid rate hikes.

- What is the Fund’s allocation to Singapore bonds?

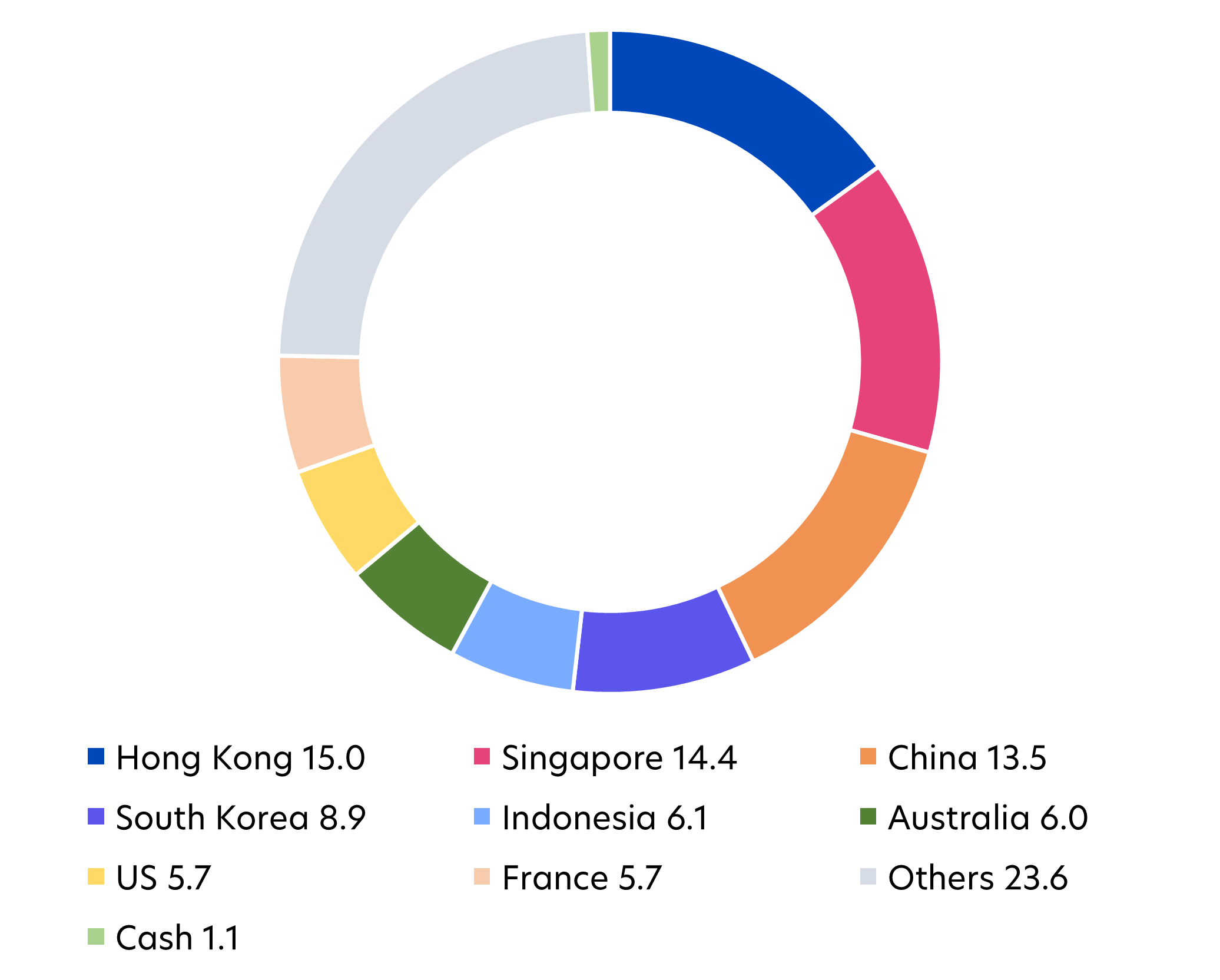

The fund’s second-largest country exposure (14.4 percent) is to Singapore bonds across sovereigns, quasi-sovereigns and corporates. However, one of our key strategies is to also invest in bonds issued outside Singapore so that we can best optimise the Fund’s yields, returns, risks and liquidity. These can be across many different geographies, including China, Hong Kong, South Korea, and other markets as shown below. To minimise foreign exchange (FX) risks, we actively hedge the currency back to SGD.

Fig 2: United SGD Fund geographic allocation (%)

Source: UOBAM, as of 31 July 2025

- Has the Fund moved down the credit curve in order to achieve higher yields?

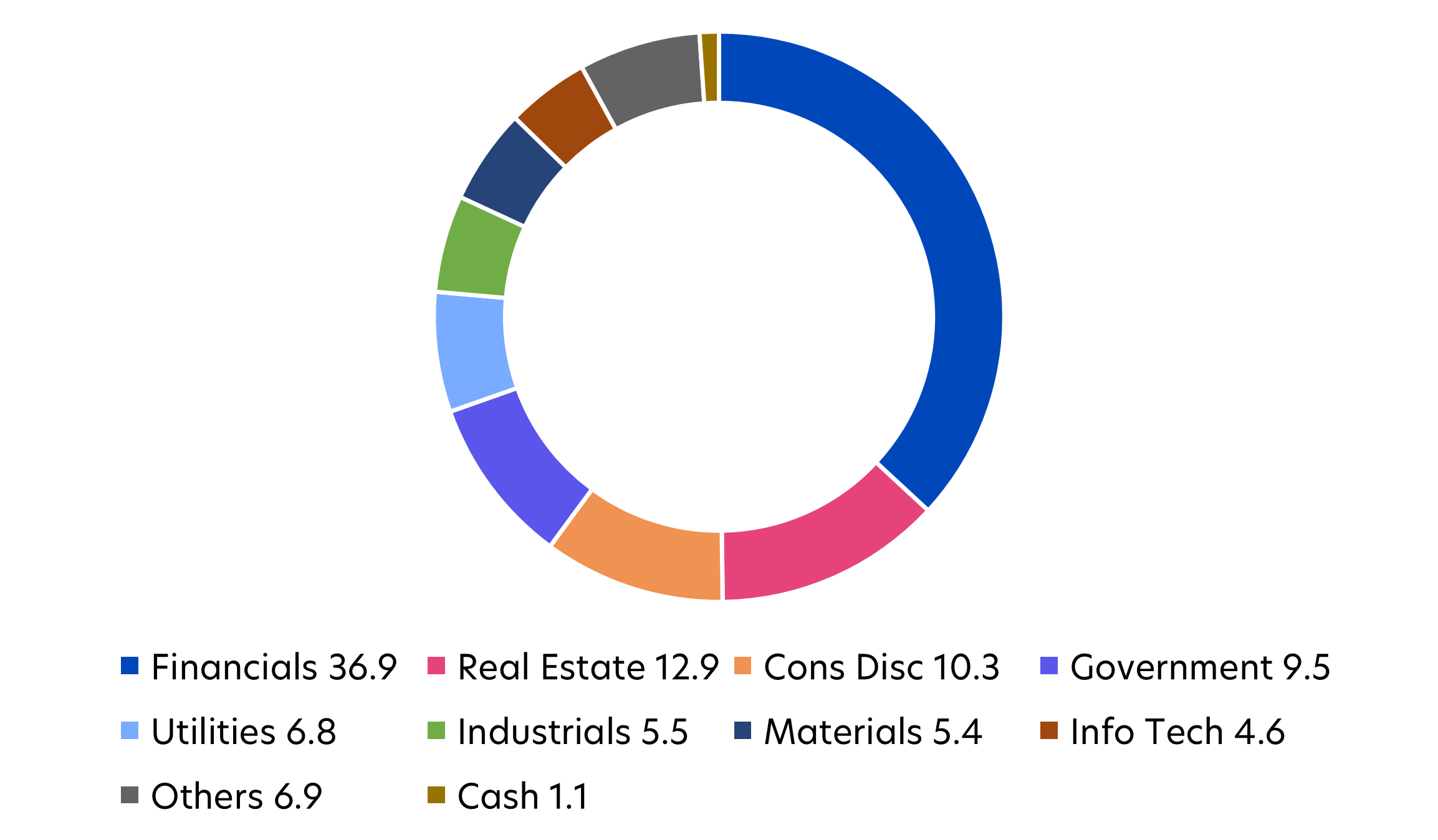

No. The Fund’s average credit rating remains strongly investment grade i.e. BBB+ (as of 31 July 2025). However, we ensure that the Fund is well diversified across many sectors, and we maintain our preference for bonds issued by financial institutions, given their strong fundamentals and attractive valuations.

The Fund also has good exposure to high quality bonds within defensive sectors such as utilities, telecommunications, consumer goods, insurance, and government-related entities which are characterised by resilient balance sheets and systemic importance.

Fig 3: United SGD Fund sector allocation (%)

Source: UOBAM, as of 31 July 2025

- How is the Fund managing interest rate risk in the current market environment? Given that the Fund holds bonds of 1,2 and 3-year maturities, will the Fund manager be buying more bonds with 3-year maturities to lock in higher yields?

The Fund remains committed to minimising interest rate sensitivity by investing in bonds with maturities of up to three years. The current average duration of the portfolio stands at 1.79 years, consistent with its historical range, and is achieved through a laddered approach involving 1-, 2-, and 3-year bonds. The Fund has been actively adding 3-year bonds since last year and will continue its laddered approach.

Click here for more details on the United SGD Fund.

1Source: IFC, Currency Composition of Official Foreign Exchange Reserves, Dollar Dominance in the International Reserve System: An Update, June 2024

2Source: SWIFT, June 2025

3Source: Beansprout, as of 23 August 2025

4Source: MAS, as of 25 August 2025

5Source: Morningstar, as of 31 July 2025

6Source: Morningstar, as of 31 July 2025. Fund performance is calculated on a NAV to NAV basis. Past performance is not

necessarily indicative of future performance. Does not include the effect of the current subscription fee that is charged, which an investor might or might not pay.

7Source: Morningstar, as of 31 July 2025

| If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider: United SGD Fund

You may wish to seek advice from a financial adviser before making a commitment to invest in the above fund, and in the event that you choose not to do so, you should consider carefully whether the fund is suitable for you. |

All information in this publication is based upon certain assumptions and analysis of information available as at the date of the publication and reflects prevailing conditions and UOB Asset Management Ltd (“UOBAM”)'s views as of such date, all of which are subject to change at any time without notice. Although care has been taken to ensure the accuracy of information contained in this publication, UOBAM makes no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for the accuracy or completeness of the information.

Potential investors should read the prospectus of the fund(s) (the “Fund(s)”) which is available and may be obtained from UOBAM or any of its appointed distributors, before deciding whether to subscribe for or purchase units in the Fund(s). Returns on the units are not guaranteed. The value of the units and the income from them, if any, may fall as well as rise, and is likely to have high volatility due to the investment policies and/or portfolio management techniques employed by the Fund(s). Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. An investment in the Fund(s) is subject to investment risks and foreign exchange risks, including the possible loss of the principal amount invested. Investors should consider carefully the risks of investing in the Fund(s) and may wish to seek advice from a financial adviser before making a commitment to invest in the Fund(s). Should you choose not to seek advice from a financial adviser, you should consider carefully whether the Fund(s) is suitable for you. Investors should note that the past performance of any investment product, manager, company, entity or UOBAM mentioned in this publication, and any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance of any investment product, manager, company, entity or UOBAM or the economy, stock market, bond market or economic trends of the markets. Nothing in this publication shall constitute a continuing representation or give rise to any implication that there has not been or that there will not be any change affecting the Funds. All subscription for the units in the Fund(s) must be made on the application forms accompanying the prospectus of that fund.

The above information is strictly for general information only and is not an offer, solicitation advice or recommendation to buy or sell any investment product or invest in any company. This publication should not be construed as accounting, legal, regulatory, tax, financial or other advice. Investments in unit trusts are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited, UOBAM, or any of their subsidiary, associate or affiliate or their distributors. The Fund(s) may use or invest in financial derivative instruments, and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund(s)’ prospectus.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd Co. Reg. No. 198600120Z