Key Highlights

- Investors are increasingly taking ESG into consideration when making investment decisions

- A change in ESG score or ESG momentum can play a role in terms of investors’ concerns over a company’s reputation, asset allocation and hence affect its share price.

Founded by Dr Lim Wee Chai and his wife in 1991 with a single glove production line, Top Glove is now the world's largest manufacturer of rubber gloves. It is listed on the main boards of the Malaysian (2001) and Singapore (2016) stock exchanges with intentions to list in Hong Kong. It has manufacturing operations in Malaysia, Thailand, Vietnam and China with more than 21,000 employees and exports to 195 countries with a 26% of the global market share for rubber gloves.

The past year had been a rollercoaster period for Top Glove, initially as a beneficiary of the Covid-19 pandemic with both group revenue and profits soaring following a sharp spike in glove prices.

The honeymoon period for Top Glove however started to sour after it encountered several speed bumps in the wake of several negative developments that impinged on the S component in their Environmental, Social, and Corporate Governance (ESG) risks assessments of the group's business.

First, there was a decision by the US Custom and Border Protection (CBP) on 15 July 2020 to slap a ban on imports from two of Top Glove's subsidiaries over forced labour concerns. That ban was subsequently extended on 29 March 2021 to all gloves made by Top Glove in Malaysia. The reaction from markets on both occasions led to its share price tumbling by 9% to 12% understandably as the North American market accounts for some 27% of its total exports.

TIMELINE

- 15 July 2020: US Customs and Border Protection (CBP) slapped a ban on imports from two Top Glove subsidiaries over forced labour concerns.

- 17 Sep 2020: Top Glove posted its highest ever net profit (RM1.29 billion) for the quarter ended Aug 31. Revenue jumped by 161% year-on-year to RM3.11 billion.

- 1 Dec 2020: Malaysian government probed six subsidiaries for offences involving workers' dormitories.

- 6 Jan 2021: BlackRock voted against the re-election of 6 independent directors at company annual general meeting (AGM).

- 9 March 2021 Quarterly net profit up 24-fold as revenue soared 336% year-on-year.

- 29 March 2021: US CBP ban extended to all gloves made by Top Glove in Malaysia.

- 26 April 2021: Top Glove announced it has resolved all 11 International Labour Organisation (ILO) indicators of forced labour.

The company which is a leading global manufacturer of personal protective equipment (PPE) including face masks had also come under heavy criticism following virus outbreaks at several of its dormitories which affected 5,000 workers in what was one of the largest Covid-19 cluster in Malaysia.

Naturally, all these adverse developments spawned a lot of negative news from both local, regional and global media including the likes of Reuters and even The New York Times.

Which in turn, prompted a strong backlash from institutional shareholders including the world's leading advocate of sustainable business practices, BlackRock, who was scathing in its criticism of the board in its lack of oversight over workers' health and safety.

It subsequently voted against the re-election of six independent directors at the company's annual general meeting (AGM) on 6 January 2021, adding that it “intends to hold other incumbent directors not on the ballot at this AGM accountable by voting against their re-election at future shareholder meetings”.

The concerns over the company's shortcomings in catering to the welfare and health of its workers affected the ESG assessment of Top Glove, especially after photos showed that social distancing was not strictly enforced by its management at its factory premises.

ESG considerations under UOBAM framework

The ESG framework of UOB Asset Management (UOBAM) takes into account current developments in a company, rather than just relying on annual reports or disclosures by companies which can be backward looking snapshots.

When news of the US CBP ban first broke, we adjusted our ESG score for Top Glove downward to reflect the company's shortcomings on the S front based on assessment of the different variables.

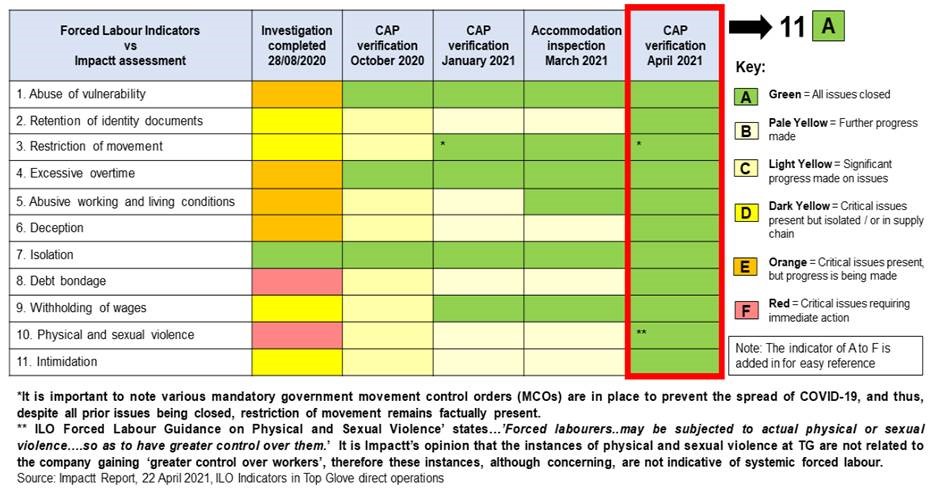

Top Glove has since carried out remedial efforts to address the issues brought up by US CBP and on 26 April 2021 announced that it has resolved 11 International Labour Organisation (ILO) indicators of forced labour. Further actions have been taken to address workers' welfare including improvements in accommodation though that is still pending final decisions by the US CBP for final closure.

Source: https://www.topglove.com/TopGlove-News/

Given the remedial efforts, we have since adjusted the Top Glove's ESG score based on the reversal of some of the penalties imposed on the company. There is scope for further fine-tuning once all issues with the US CBP and the government are sufficiently addressed.

Due to the resurgent Covid-19 spikes in many countries around the globe, demand for Top Glove products remained robust and the group's financials remain in excellent shape as one of Malaysia's most valuable corporations.

The company had estimated that annual demand for gloves would grow by 25% in 2021 and 15% thereafter with global glove demand projected to grow from a pre-pandemic level of about 10% per year to about 15% per year post-pandemic due to increase in usage and heightened hygiene awareness.

It has also announced expansion plans with allocated capital expenditure of RM10 billion between 2021 to 2025 to ensure the company remains well-positioned to meet the continued global demand. The investments would result in an increase in its current glove production capacity by about 100 billion pieces to a total capacity of over 200 billion pieces a year.

CONCLUSION

We see two main takeaways from Top Glove's rollercoaster year. Firstly, investors are increasingly taking ESG into consideration when making investment decisions. The relative performance of Top Glove when the negative news broke out lends support to the fact that while ESG may be relatively new concept in Asia compared to more developed regions like Europe, it is becoming increasingly more mainstream in Asia due in part to the global supply chain effect.

What occurs in a local setting just cannot be brush off when the goods and/or services are exported. Furthermore, it may cause lenders to step back when it comes to financing future business expansion unless the ESG issues are adequately addressed by a company.

Secondly, the change in the ESG score or ESG momentum can play a role in terms of investors' concerns over a company's reputation, asset allocation and hence affect its share price.

Prior to its setbacks on the S front, Top Glove had generally ranked well in terms of ESG score.

We believe Top Glove's ESG score had dropped but remains investible in our framework though the share price has weakened due to a loss in ESG momentum, which can pick up when its ESG practices that can lead to long-term benefits for investors are enhanced.

Typically, these would include implementing better talent management programmes, reviewing current business practices and looking to improve health and safety for employees as investors prefer to invest in an ESG positive company which focuses on improving its ESG approach before the rest of the market catches up.

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd ("UOBAM") and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.