The Great Covid Reminder that life is short

One of the more surprising outcomes of the Covid pandemic is the “Great Resignation”, and also what many are now referring to as the “Great Reshuffle”.

Both are driven by the same phenomenon i.e. the record number of individuals who are changing jobs or leaving the job market altogether. In the US, resignations have been above four million a month for over a year. And in Singapore, a survey1 in July found that 51 percent of Singapore-based employees are planning to quit their jobs in the next 12 months.

Most human resource experts agree that, while not directly linked to the pandemic, this trend is spurred on by pandemic-era experiences that have caused individuals to take mid-career breaks, spend more time with their families, pursue more leisure activities, be better rewarded for their work, and generally aim for more fulfilling lives.

Financial journeys are also changing

Alongside this shift in life priorities, individuals are also having to reassess their financial goals. Many want sufficient funds to buy a new home and retire comfortably. At the same time, they also want to be able to increase their emergency cash reserves and pay off existing loans.

However, it is clear that these financial objectives do not necessarily align with each other. A good example of this is a recent survey2 of 1,000 Singapore residents who had recently resigned or intended to resign. Despite this decision, nearly half of them were unprepared for retirement and one in five expect to have to delay their retirement plans.

Multiple financial goals require multiple portfolios

It has always been the case that individuals have multiple, and sometimes conflicting, financial goals. But the list is getting longer and more varied, especially among early and mid-career professionals, given higher incomes and changing values.

This means the need for careful financial planning is more important than ever. To juggle across a number of financial goals, it is useful to regard each one independently. This means aligning each goal to a distinct savings and investments portfolio.

But without the right tools, creating and maintaining multiple portfolios for multiple goals can be a daunting task. In most cases, individuals simply opt to aggregate their goals into a one-size-fits-all portfolio.

Portfolio design underpinned by financial needs

However, such an approach is far from optimal. Rather, every goal and hence every portfolio should be underpinned by clearly-defined financial needs. In particular, an investor's target return, risk budget and time horizon are key considerations.

When setting these, it is useful to bear the following in mind:

- Keep your target returns realistic.

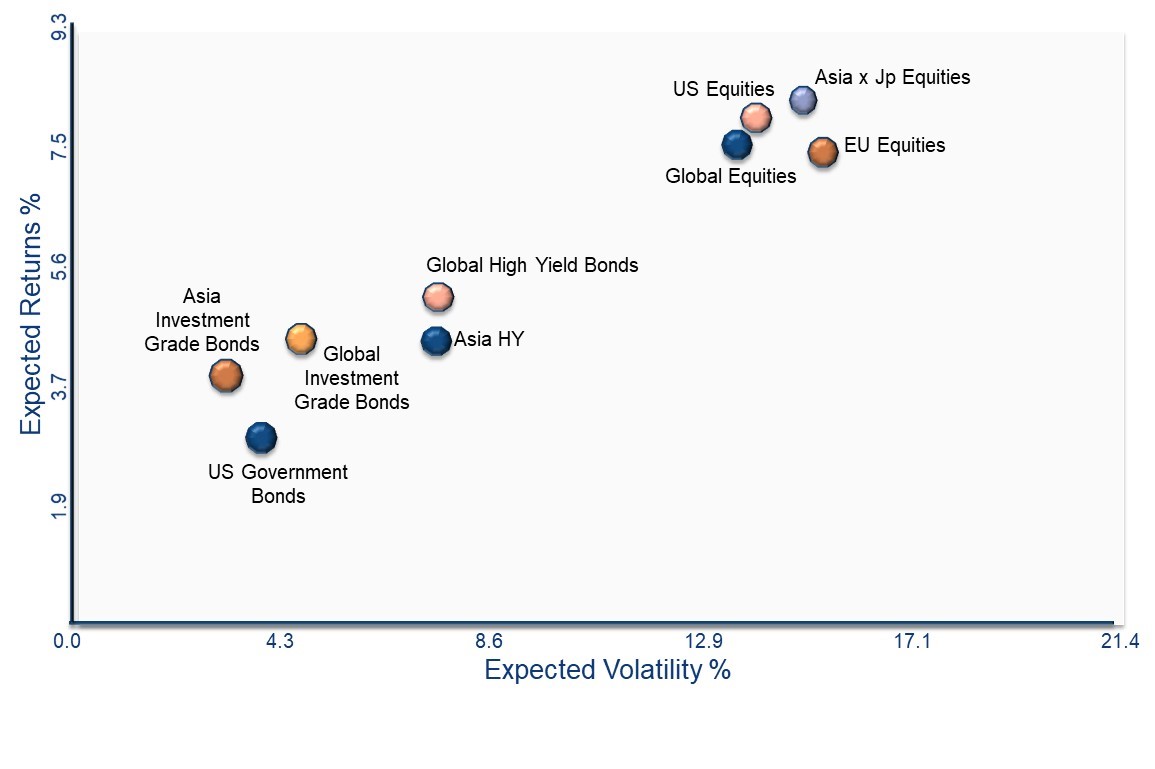

It is easy to over-estimate returns especially when you have ambitious goals. Different asset classes have different return and risk characteristics. Typically, the higher the return, the higher the risk. Also note that, each of your portfolios, regardless of your goals, should be well-diversified across several asset classes. As such, your portfolio's expected return and risk will be a blend of its component asset classes.

Capital Market Assumptions (CMAs) are estimates of an asset class's long-term return and risk profile. While they do not apply to short term returns, CMAs can serve as a useful guide to understand how different asset classes can be expected to perform over the long term.

Here are some of UOBAM's USD-denominated 10-year capital market assumptions

Source: UOB Asset Management, data as of August 2022, valid through 4Q2022. Estimates are for the 10-year period from 4Q2022 to 4Q2032, returns annualized.The capital market assumptions are estimates and for illustration purposes only. Any projection or forecast is not necessarily indicative of the future or likely performance.

Note: Asia HY: Asia High Yield; Asia x Jp: Asia ex Japan - Understand your risk appetite. One way to achieve higher returns is to dial up a portfolio's risk budget. It may be tempting for example to opt for portfolios with a high concentration of risker assets for example emerging market equities or high yield bonds. However, by doing so, your portfolio also has a higher chance of underperforming if markets do not unfold as expected.

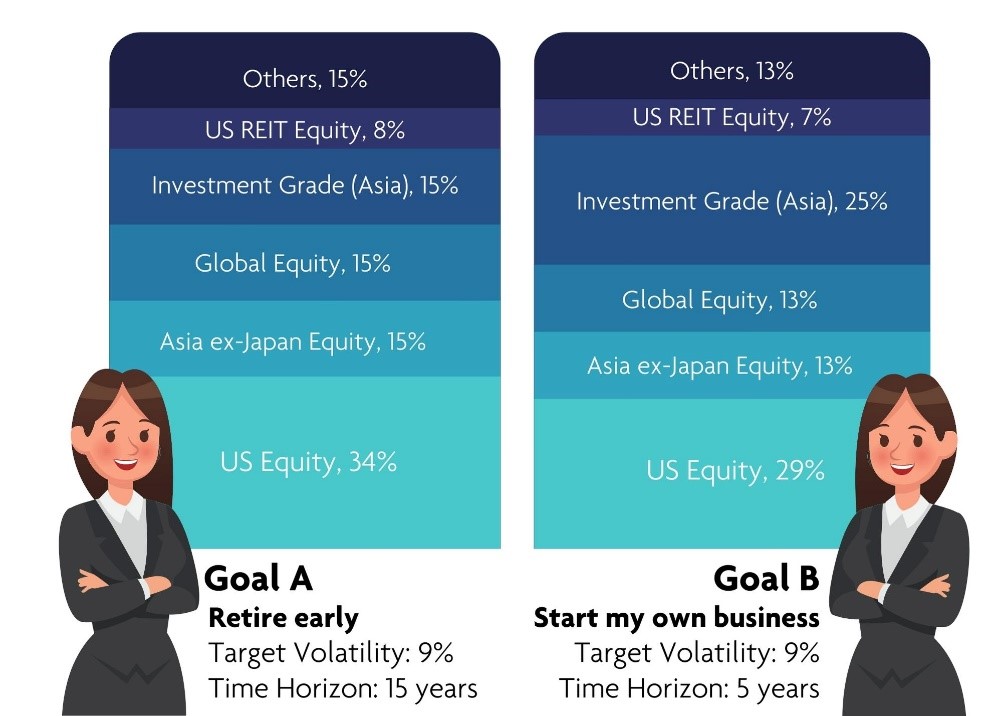

- Know your time horizon. The longer your investments holding period, the more likely you are to ride out shorter term volatility and achieve normalised returns. It is crucial therefore that you accurately identify the time frame for each of your goals. Here is an example of how time frames can affect your portfolio allocation.

The above portfolio allocations are for illustration purposes only.

Don't let limited capital put you off

You may think that investing in multiple portfolios requires you to lay down a lot of capital upfront. In fact, given current market volatility, it makes sense to start relatively small and to top up your capital on a regular basis, for example monthly or quarterly.

This is a common investment technique called dollar cost averaging and it ensures that when markets are weak, you are securing more assets, because you are buying them at a discount. When markets are strong and prices are high, you are buying fewer assets because you are buying them at a premium. Ultimately, your average cost per unit is lower than if you timed the market wrongly, which is easy to do.

Again, capital top-ups every month across multiple portfolios is highly challenging unless you have the right tools.

Maintain multiple pockets of wealth

The UOBAM Invest App recognises the need for today's multi-faceted individuals to pursue multiple goals. By using the platform, you can intelligently divide your capital into distinct pockets to service your many goals. You can also set up a plan that allows you to top up different amounts for your different portfolios.

This ultimately changes your approach to wealth growth: from one that is focused on market movements based on a single risk profile and no particular time frame, to one that is focused on achieving different financial objectives, based on different returns expectations, risk appetites, and time periods.

1Human Resources Director, “51% of Singaporeans could quit their jobs the next 12 months”, July 2022.

2Prudential Singapore, “Prudential poll: The Great Resignation sees 1 in 5 Singapore residents delaying retirement by 6 years”, June 2022.

This document is for your general information only. It does not constitute investment advice, recommendation or an offer or solicitation to deal in Exchange Traded Funds (“ETFs”) or in units in any Unit Trusts (“Unit Trusts”, ETFs and Unit Trusts shall together be referred to as “Fund(s)”) nor does it constitute any offer to take part in any particular trading or investment strategy. This document was prepared without regard to the specific objectives, financial situation or needs of any particular person who may receive it. The information is based on certain assumptions, information and conditions available as at the date of this document and may be subject to change at any time without notice. If any information herein becomes inaccurate or out of date, we are not obliged to update it. No representation or promise as to the performance of the Fund or the return on your investment is made. Past performance of any Fund or UOB Asset Management Ltd (“UOBAM”) and any past performance, prediction, projection or forecast of the economic trends or securities market are not necessarily indicative of the future or likely performance of the Fund or UOBAM. The value of any Fund and the income from them, if any, may fall as well as rise, and may have high volatility due to the investment policies and/or portfolio management techniques employed by the Fund. Investments in any Fund involve risks, including the possible loss of the principal amount invested, and are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited (“UOB”), UOBAM, or any of their subsidiary, associate or affiliate (“UOB Group”) or distributors of the Fund. Market conditions may limit the ability of the platform to trade and investments in non-Singapore markets may be subject to exchange rate fluctuations. The Fund may use or invest in financial derivative instruments and you should be aware of the risks associated with investments in financial derivative instruments which are described in the respective Fund's prospectus. The UOB Group may have interests in the Funds and may also perform or seek to perform brokering and other investment or securities-related services for the Fund. Investors should read the Fund's prospectus, which is available and may be obtained from UOBAM or any of its appointed agents or distributors, before investing. You may wish to seek advice from a financial adviser before making a commitment to invest in any Funds, and in the event that you choose not to do so, you should consider carefully whether the Fund is suitable for you. Any reference to any specific country, financial product or asset class is used for illustration or information purposes only and you should not rely on it for any purpose. We will not be responsible for any loss or damage arising directly or indirectly in connection with, or as a result of, any person acting on any information provided in this document. Services offered by UOBAM Invest are subject to the UOBAM Invest Terms and Conditions.

UOB Asset Management Ltd. Company Reg. No. 198600120Z.