The United Japan Small and Mid Cap Fund is benefiting from the increased focus on shareholder value

Corporate governance reforms are a key driver of the current Japan stock market rally. It is not hard to understand why. Half of the companies listed on the Tokyo Stock Exchange (TSE) trade at a price-to-book (P/B) ratio of less than 1.0 times. Only 3 percent of firms listed on the S&P 5001 have such low P/B ratios.

More shareholder value

A P/B ratio of less than one generally reflects investors’ view that a company has low profitability and growth potential, and that the company is valued less than what its assets are worth.

To shore up investor confidence, the TSE made the call earlier this year for firms to focus on increasing their P/B ratios. Notably, companies that consistently trade below book value are now required to disclose their plans to improve capital efficiency. Companies have also been urged to boost their capital efficiency and profitability by reinvesting in their businesses.

In the short term, this has sparked a rush of share buybacks and higher dividend payouts as companies seek to increase shareholder returns. There are also longer-term plans to scale up research and development (R&D), invest in new equipment and facilities, and restructure their business portfolios.

Impact even greater for smaller companies

Smaller companies are reaping the benefits of this attention to improved shareholder value. Compared to their larger counterparts, they tend to trade under book value and lag in corporate governance standards and therefore potentially have more to gain from these reforms.

An example of such a company is FUKOKU Co Ltd (“FUKOKU”, not related to Fukoku Capital Management, one of UOBAM’s sub-managers). A leading manufacturer of wiper blade rubber products in Japan, FUKOKU has close to 100 percent share of this market domestically and 50 percent globally2.

Other business segments include the manufacture of hoses, dampers and mounts, medal components for trucks, and office automation products.

FUKOKU’s efforts are paying off

In 2020, the company begun full-scale corporate reforms with the intention of achieving a P/B ratio of 1.0 times. The company president is no longer a member of the founding family, structural changes have been instituted, and dividend payouts have increased significantly from 22 yen per share in 2020 to 55 yen per share this financial year.

As a result, FUKOKU has steadily increased its P/B ratio from 0.35 times in 2020 to 0.60 times3 today. Despite struggles in recent years due to production cuts and rising material prices, the company looks on track to grow its profits significantly from this fiscal year and its share price has already doubled since its low in 2020, with room for more upside.

Fig 1: Performance of FUKOKU, year to date

Source: Bloomberg, as at 15 August 2023

About the United Japan SMID Cap Fund (“the Fund”)

High exposure to Industrials and Information Technology (“IT”)

The Fund aims to achieve long term capital growth through investing in securities of small and mid-cap corporations listed, domiciled, or having substantial operations, in Japan.

Currently the Fund is focused on investing in Japanese companies that, like FUKOKU, are well-positioned to benefit from the corporate reforms and other structural shifts happening in the country. This includes companies showing improvements in human capital management, digital transformation, and productivity enhancement.

As such, the Fund has approximately 62 percent exposure to the Industrials and IT sectors4. In particular, the Fund focuses on domestic demand-led companies, namely:

- Human resource companies that provide staffing solutions for Japan’s ageing society

- Information Technology (IT) companies that provide systems integration, software development and cloud support to help Japanese corporates increase productivity and accelerate digital transformation

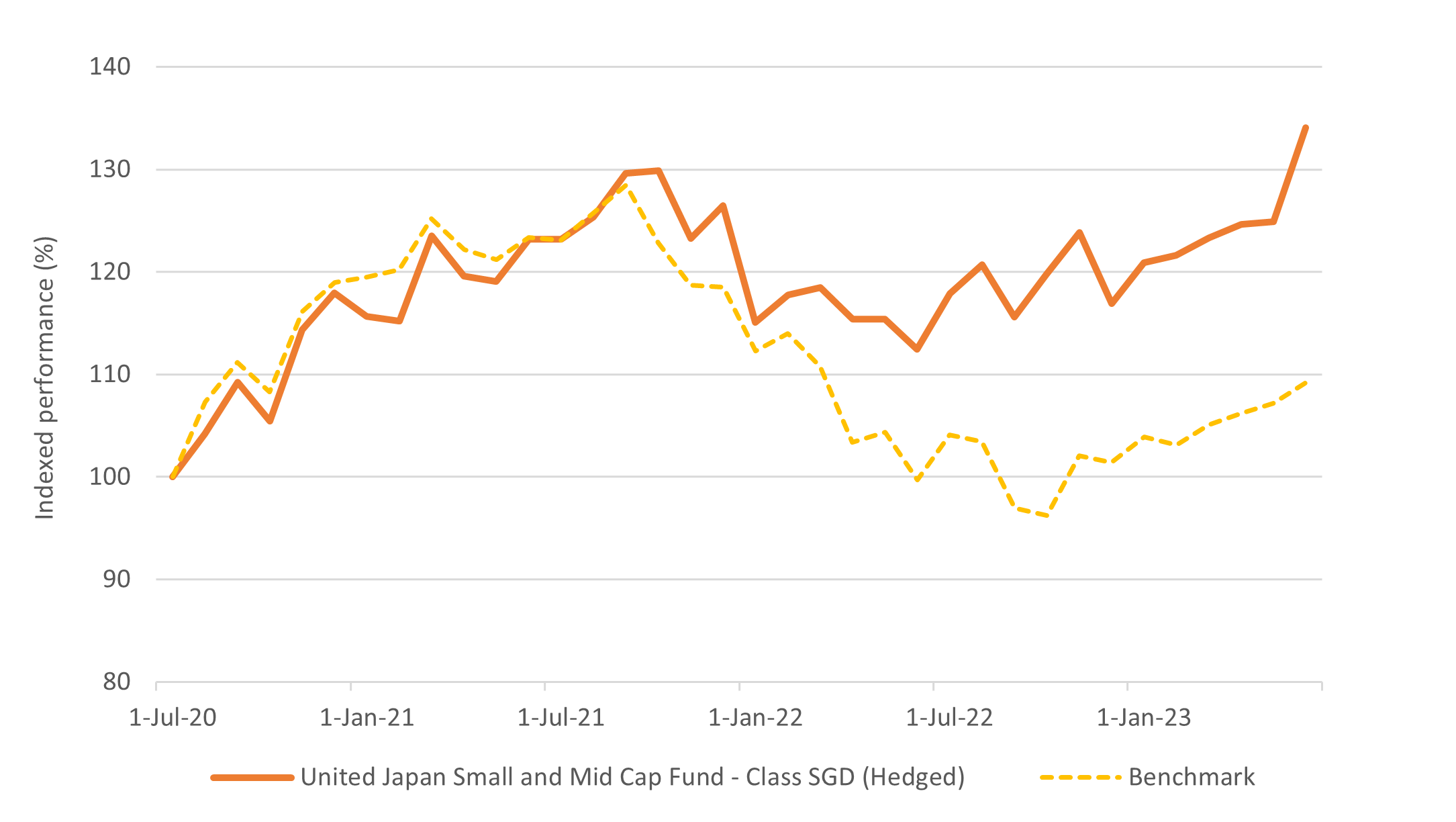

Above-benchmark returns

The Fund has shown a stellar outperformance of its benchmark over both the long and short term. In June 2023, the Fund (Class SGD (Hedged)) returned 7.32 percent, beating its benchmark by 5.43 percent5.

Fig 2: Outperformance of United Japan SMID Cap Fund over benchmark (%)

Past performance is not necessarily indicative of future performance. Fund performance is calculated on a NAV to NAV basis. Benchmark: MSCI Japan SMID Cap Index Source: Morningstar. Performance as at 30 June 2023, SGD basis, with dividends and distributions reinvested, if any.

Challenges ahead

Beyond low-hanging fruits such as share buybacks and dividend hikes, it remains to be seen if more Japanese small and mid-cap companies will embrace the longer-term reforms needed to better manage their capital allocations and drive up profitability.

Also, a weak Japanese Yen has helped to support exports, but any rise could put pressure on the stock prices of export-dependent Japanese firms.

Fund Details

| United Japan SMID Cap Fund, as at 30 June 2023 | |

| Sector allocation (%) | Industrials: 34.88 Information Technology: 26.89 Consumer Discretionary: 15.65 Materials: 7.41 Health Care: 5.04 Financials: 1.76 Real Estate 1.48 Consumer Staples: 1.16 Others & cash: 5.73 |

| Top 5 holdings (%) | JBCC Holdings Inc: 1.97 Seiren Co Ltd: 1.61 NSD Co LTdL 1.60 Meitec Corp: 1.58 Shibaura Machine Co Ltd: 1.56 |

| Fund class available | Class A SGD Acc Class A SGD Acc (Hedged) |

| Management fee | All Classes: Currently 1.75% per annum |

| Subscription fee | All Classes: Currently up to 5% |

| Minimum subscription / trading size | Class A SGD Acc / SGD Acc (Hedged): S$1,000 (initial); S$500 (subsequent) |

Source: UOBAM

1Source: CNN, Japan’s long-suffering stock market is back. This boom may have ‘staying power’, 24 May 2023

2Source: Sumitomo Mitsui DS Asset Management Company, August 2023

3Source: FUKOKU, Medium-term management plan, 30 June 2023

4Source: Source: UOBAM, as at 30 June 2023

5Source: Morningstar, Performance in SGD terms, on a Net Asset Value (“NAV”) basis excluding fees which an investor may or may not pay, with dividends and distributions reinvested (if any), as at 30 June 2023

If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider:

|

This document is for general information only. It does not constitute an offer or solicitation to deal in units in the Fund (“Units”) or investment advice or recommendation and was prepared without regard to the specific objectives, financial situation or needs of any particular person who may receive it. The information is based on certain assumptions, information and conditions available as at the date of this document and may be subject to change at any time without notice. No representation or promise as to the performance of the Fund or the return on your investment is made. Past performance of the Fund or UOB Asset Management Ltd (“UOBAM”) and any past performance, prediction, projection or forecast of the economic trends or securities market are not necessarily indicative of the future or likely performance of the Fund or UOBAM. The value of Units and the income from them, if any, may fall as well as rise, and is likely to have high volatility due to the investment policies and/or portfolio management techniques employed by the Fund. Investments in Units involve risks, including the possible loss of the principal amount invested, and are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited (“UOB”), UOBAM, or any of their subsidiary, associate or affiliate (“UOB Group”) or distributors of the Fund. The Fund may use or invest in financial derivative instruments and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund's prospectus. The UOB Group may have interests in the Units and may also perform or seek to perform brokering and other investment or securities-related services for the Fund. Investors should read the Fund’s prospectus, which is available and may be obtained from UOBAM or any of its appointed agents or distributors, before investing.You may wish to seek advice from a financial adviser before making a commitment to invest in any Units, and in the event that you choose not to do so, you should consider carefully whether the Fund is suitable for you. Applications for Units must be made on the application forms accompanying the Fund’s prospectus.

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd. Company Reg. No. 198600120Z