- The increase in Covid infections is hindering some of China’s economic activity

- However, the country’s reopening looks set to bring about an economic recovery over the next few months

- In 2023, China is expected to see a faster pace of growth than the US or Europe, which should help lift the market

Covid cases rise in China

Since China’s unexpected relaxation of its zero-Covid controls starting in early December 2022, there has been increasing local and global alarm about a potential increase in confirmed cases and related deaths. The World Health Organisation (WHO), as of 3 January 2023, reported the number of confirmed cases in December to be around 140,000 per week, and deaths to be around 400 per week1, less than previous outbreaks.

However, there is much speculation that China could be under-reporting the seriousness of the latest situation. Rather than the 10 million cumulative cases reported to WHO, UK-based health data firm Airfinity estimates the number to be closer to 28.5 million2. As a result, some countries have introduced curbs on Chinese travellers, prompting Chinese foreign ministry officials to complain about political manipulation, but conceding that they are willing to “improve communication with the world”.

Business activities contract

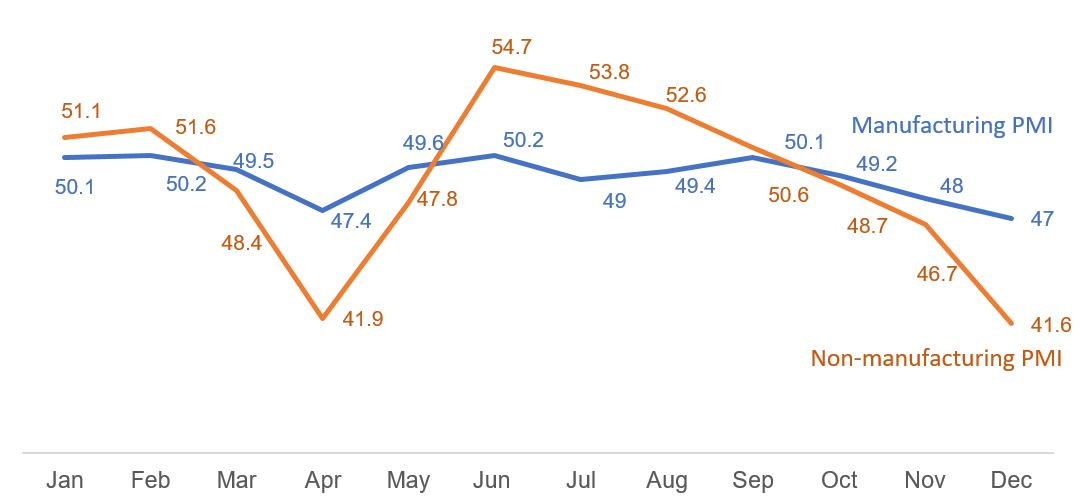

Regardless of the accuracy of China’s reported Covid data, the impact on its manufacturing and service sectors is clear. China’s Manufacturing Purchasing Managers Index (PMI) for December fell to 47, below November’s level of 48, and the 50 threshold, thereby indicating continued contraction.

Figure 1: China manufacturing vs non-manufacturing PMI, Jan – Dec 2022

Source: National Bureau of Statistics of China, Statista

These levels have not been seen since the country’s first Covid wave in February 2020, and is worse than during the tough Shanghai lockdowns in April/May last year. The numbers also show that smaller manufacturing firms suffered more than the large ones.

However, it was the non-manufacturing sector that was harder hit, falling steeply from 46.7 in November to 41.6 in December. The services sector bore the brunt of the increase in Covid cases as consumers continued to stay away from their normal activities despite the removal of Covid restrictions. This was further compounded by falling external demand amid slowing global economies. The sub-indices for retail, road transport, accommodation and catering were particularly weak at below 353.

Limited impact on markets

Despite this, the Shanghai Composite Index was flat in December and has been creeping up in the new year. Following the initial shock, infection fears are expected to dissipate and individuals and businesses should gradually return to their pre-Covid activities. From 8 January 2023, travel restrictions to and from China will also be lifted, bringing to an end its self-imposed isolation.

As such, while economic activity may not normalise ahead of the Lunar New Year holidays in January and February, this should start to turnaround by March. At this point, we would expect to see the services sector rebound from December’s low. The supply bottleneck that is hobbling the manufacturing sector should also improve by then. Only new orders may not pick up substantially given softening demand from the US and Europe.

Above-trend growth prospects

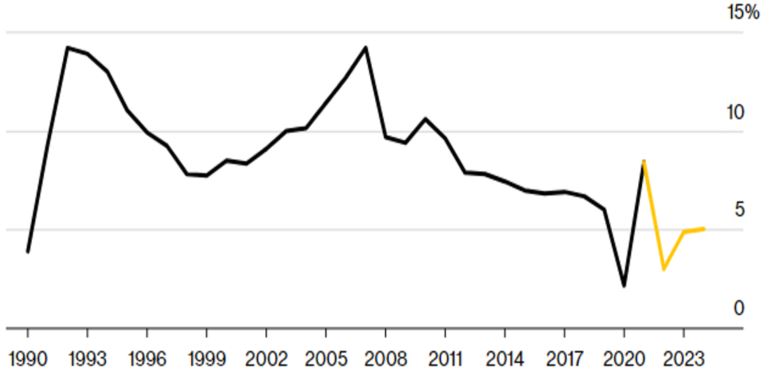

The resumption of economic activity over the next few months bodes well for China’s economic prospects in 2023. While its GDP growth is set to fall to about 3.5 percent in 2022, a low not seen in the last three decades except during the Covid crisis, we anticipate a strong rebound to 4.9 percent this year.

Figure 2: China GDP historical growth rate and forecast

Source: UOBAM, Bloomberg, National Bureau of Statistics December 2022

At a time of high inflation and low growth, this would set China apart from other markets. Not only does China still have the flexibility for further rate cuts in 2023, this growth rate is well beyond that forecast by the International Monetary Fund (IMF) for the world’s major economies, including the US (1 percent), Germany (-0.3 percent), France (0.7 percent), and Japan (1.6 percent)4. As investors grapple with the ongoing risks of a global recession, China’s strong growth potential will likely be welcomed by those seeking equity and higher yielding opportunities.

1World Health Organisation, https://covid19.who.int/region/wpro/country/cn

2Airfinitiy, https://www.airfinity.com/articles/airfinitys-covid-19-forecast-for-china-infections-and-deaths

3The State Council, the People’s Republic of China, https://english.www.gov.cn/archive/statistics/202212/31/content_WS63aff7c5c6d0a757729e4f99.html

4IMF, World Economic Outlook Report, October 2022

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.