The steep decline in Singapore Government Securities (SGS) bond rates has prompted many investors to seek out other low-risk options, including investment grade bond funds. But with so many such strategies available in the Singapore market, how do you pick one that suits you best?

To help you decide, here are three questions you should ask yourself

Q1: Do I need regular income?

Bond returns have two components – yield and capital gains – and bond funds typically focus on one or the other, or a balance of both. So it is important to know which type of return you are aiming for.

If you are a retiree or need to supplement your salary, you may already be investing in income-paying instruments such as Singapore Government Securities (SGS). However, SGS yields have been decreasing steeply, with 10-year bonds down to only about 1.9 percent, compared to 2.9 percent at the start of the year, and 3.2 percent just a year ago.1

To counter the drop, it is useful to find a fund that prioritises steady and regular income payouts and is able to deliver yields of at least 2.5 percent. This can help you keep risks low, while still staying ahead of future price rises, as most governments target to keep inflation at 2.0 percent or below.2

Such yields are achievable by investing in a bond fund that invests in short-duration, investment grade bonds issued by governments and corporates, and hedged into SGD. This keeps the duration, credit and currency risks in check, and therefore these types of funds do not experience much price volatility.

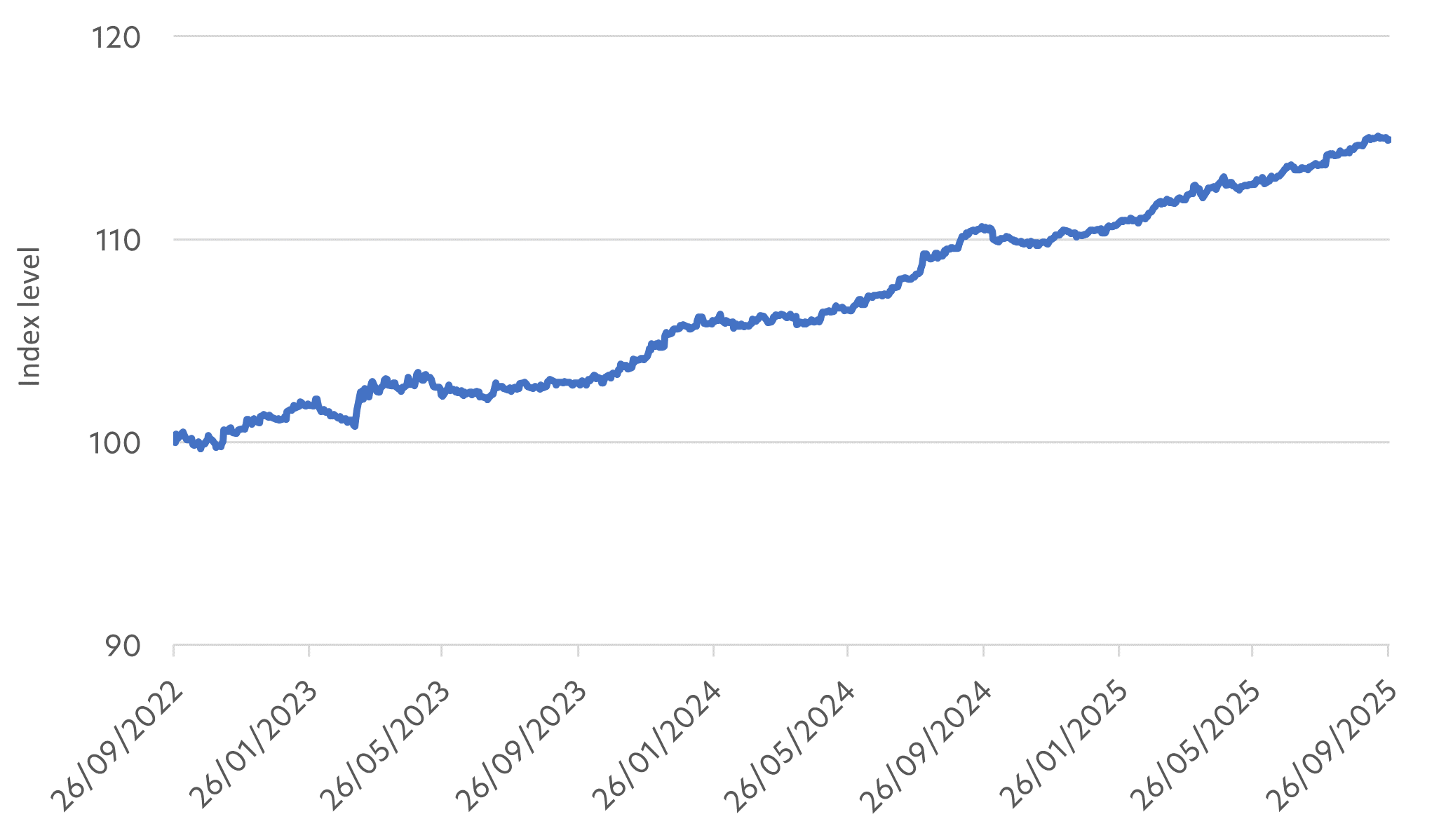

Fig 1: Bloomberg US Aggregate 1-3 Years Index, Sept 2022 – Sept 2025

Source: Bloomberg, as of 26 Sep 2025. Index has been rebased to 100 as of 26 Sep 2022

Q2: Do I want to take advantage of current market opportunities?

New bond opportunities have recently emerged in the wake of President Trump’s tariff policies. With US growth prospects in the balance, the US Fed took the decision last month to cut US interest rates by 25 bps. More cuts are expected in the coming months.

This resumption of the US easing cycle has many implications for global bond markets. When interest rates start to fall, short term yields tend to move in tandem. Also, US interest rate cuts will put pressure on other central banks to follow suit. In such environments, intermediate duration bonds, typically those within 3 – 7 years, tend to be in high demand as market players try to lock in higher yields.

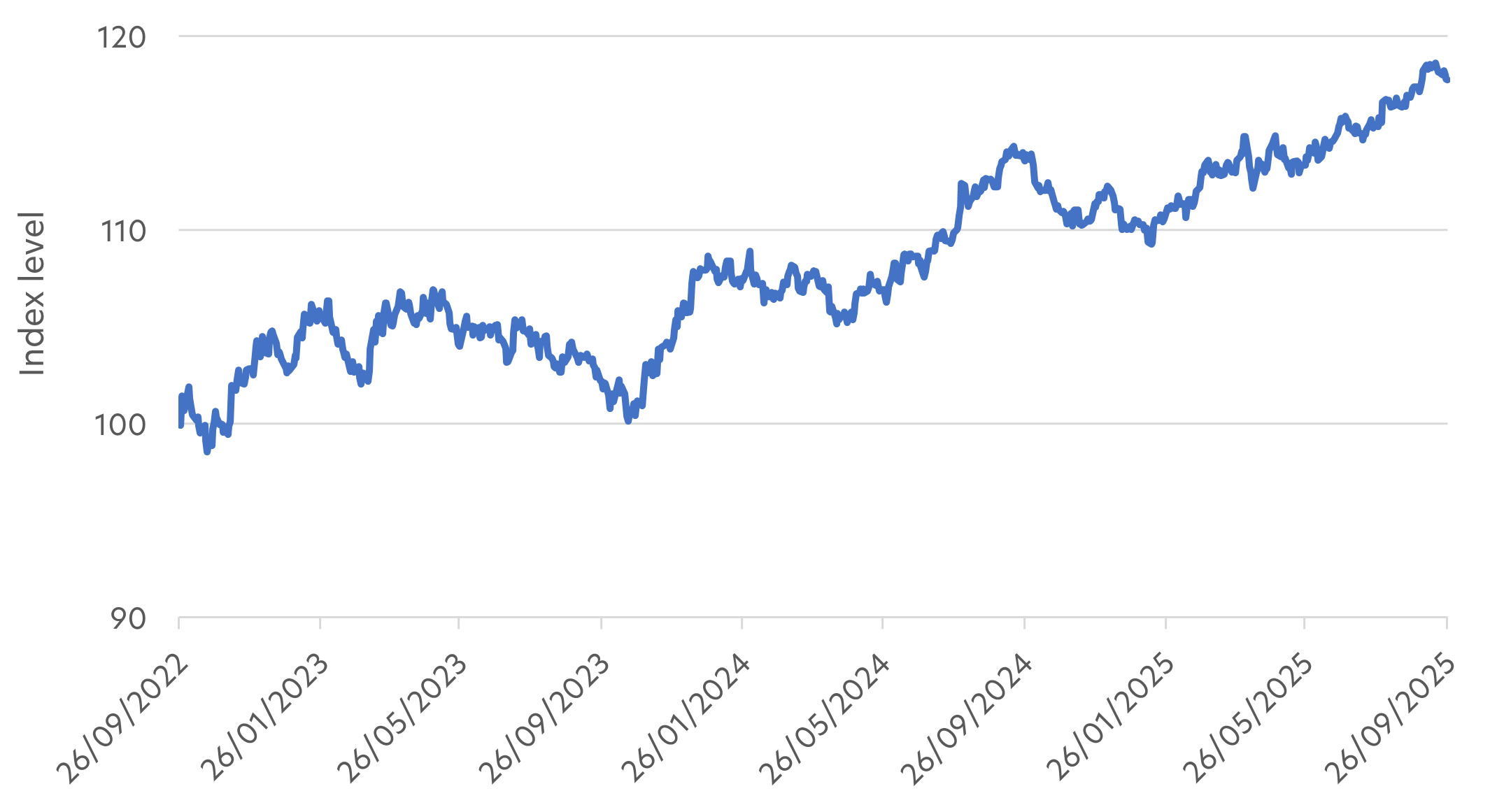

Fig 2: Bloomberg US Aggregate 5-7 Years Index, Sept 2022 – Sept 2025

Source: Bloomberg, as of 26 Sep 2025. Index has been rebased to 100 as of 26 Sep 2022

Q3: Do I want to accumulate some of my returns for the long term?

If you do not rely on your bond investments to supplement your income, you may want to consider a bond fund that is focused on delivering total returns. Rather than maximising regular payouts, such funds are managed to achieve a healthy balance of interest payments and capital appreciation.

Not surprisingly, such funds tend to have a more flexible approach than other strategies, and can invest in both short, intermediate and longer duration bonds, with an average duration that can extend to 10 years and beyond. They can also choose to re-invest some of the interest received in order to achieve higher capital gains.

This level of flexibility means total return bond funds can adapt to different interest rate environments and therefore are well-suited for investors who are looking for an evergreen bond fund. While these funds generally aim to preserve capital, the volatility of such funds can be higher than those described above. However, the capital gained over the long term tends to overcome any short term volatilities.

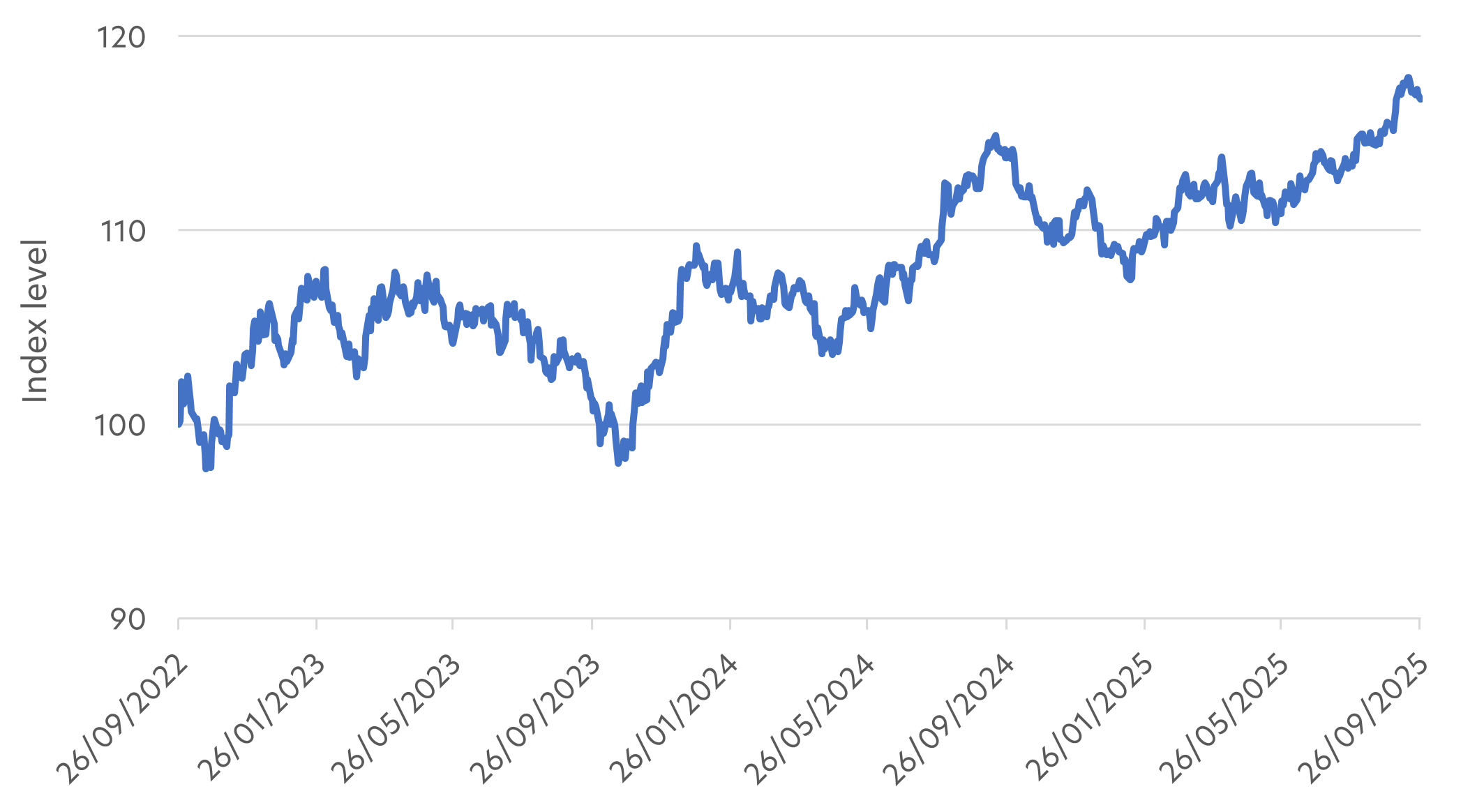

Fig 3: Bloomberg US Aggregate 7-10 Years Index, Sept 2022 – Sept 2025

Source: Bloomberg, as of 26 Sep 2025. Index has been rebased to 100 as of 26 Sep 2022

A comparison of UOBAM bond solutions

UOBAM offers a wide range of bond funds for the Singapore investor. To help investors find a fund that matches their investment objectives, here is a quick summary of three of UOBAM’s most popular bond funds across the duration, yield and returns spectrum.

Fig 4: Select UOBAM Bond Funds, Duration vs Yield vs Returns

Source: UOBAM, as of 31 August 2025

Here is a quick summary of useful fund info. Further information can be found by scanning the attached links.

|

|

United SGD Fund |

United Asian Bond Fund |

United Singapore Bond Fund |

|

Weighted Average Yield to Maturity |

2.95% |

5.85% |

2.64% |

|

1, 3-year returns p.a. |

1Y: 4.07% |

1Y: 3.89% |

1Y: 10.68% |

|

Volatility (3-year standard deviation) |

1.11% |

4.58% |

4.15% |

|

Effective Duration (years) |

1.81 |

4.75 |

8.86 |

|

Credit Rating |

Investment Grade |

Investment Grade |

Investment Grade |

|

Distribution |

Class A – 4.0% p.a. |

4.5% p.a. |

3.5% p.a. |

|

Distribution Frequency |

Monthly |

Monthly |

Quarterly |

|

Fund Size |

S$2,988 mil |

S$40 mil |

S$207 mil |

|

Subscription Fees |

Currently up to 2%, |

Currently up to 3%, |

Currently up to 2%, |

|

Investment Currencies |

SGD, USD |

SGD, USD |

SGD |

|

Further info |

|

|

|

Source: UOBAM, as of 31 August 2025. Distributions (in SGD) are not guaranteed. Distributions may be made out of income, capital gains and/or capital. This relates to the disclosed distribution policy as set out in the Fund’s prospectus

1Source: MAS, as of 30 Sep 2025

2MAS, What is the objective of monetary policy in Singapore?

|

If you are interested in investment opportunities related to the theme covered in this article, here are some UOB Asset Management Funds to consider:

|

All information in this publication is based upon certain assumptions and analysis of information available as at the date of the publication and reflects prevailing conditions and UOB Asset Management Ltd (“UOBAM”)'s views as of such date, all of which are subject to change at any time without notice. Although care has been taken to ensure the accuracy of information contained in this publication, UOBAM makes no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for the accuracy or completeness of the information.

Potential investors should read the prospectus of the fund(s) (the “Fund(s)”) which is available and may be obtained from UOBAM or any of its appointed distributors, before deciding whether to subscribe for or purchase units in the Fund(s). Returns on the units are not guaranteed. The value of the units and the income from them, if any, may fall as well as rise, and is likely to have high volatility due to the investment policies and/or portfolio management techniques employed by the Fund(s).

Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. An investment in the Fund(s) is subject to investment risks and foreign exchange risks, including the possible loss of the principal amount invested. Investors should consider carefully the risks of investing in the Fund(s) and may wish to seek advice from a financial adviser before making a commitment to invest in the Fund(s). Should you choose not to seek advice from a financial adviser, you should consider carefully whether the Fund(s) is suitable for you. Investors should note that the past performance of any investment product, manager, company, entity or UOBAM mentioned in this publication, and any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance of any investment product, manager, company, entity or UOBAM or the economy, stock market, bond market or economic trends of the markets. Nothing in this publication shall constitute a continuing representation or give rise to any implication that there has not been or that there will not be any change affecting the Funds. All subscription for the units in the Fund(s) must be made on the application forms accompanying the prospectus of that fund.

The above information is strictly for general information only and is not an offer, solicitation advice or recommendation to buy or sell any investment product or invest in any company. This publication should not be construed as accounting, legal, regulatory, tax, financial or other advice. Investments in unit trusts are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited, UOBAM, or any of their subsidiary, associate or affiliate or their distributors. The Fund(s) may use or invest in financial derivative instruments and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund(s)’ prospectus.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd Co. Reg. No. 198600120Z