Have you noticed that your usual packet of economic rice now costs more than it did last year? Or that you’re paying the same price for noticeably smaller food portions, a phenomenon known as shrinkflation?

The effects of rising prices are all around us as Singapore’s inflation climbs to its highest level in 14 years1. Adding to the cost pressure, the goods and services tax (GST) will be hiked to 8 per cent in January even as inflation is expected to remain high next year2.

For investors seeking income and stability in the current environment, short duration bond funds could be the answer.

What are short duration bond funds?

Short duration bond funds invest in bonds that mature in 1 to 3 years. Such funds can hold short-term government or corporate bonds, as well as certificates of deposit and commercial papers. In the current market environment, these funds offer distinct advantages:

- Able to capitalise on higher interest rates

Short duration bond funds allow you to take advantage of rising interest rates more effectively compared to fixed deposits.

For fixed deposits, the rate is fixed for the tenor of the product. But for short duration bond funds, the yield may potentially rise in tandem with prevailing rates. Since the underlying bonds have a shorter time to maturity, the fund manager can reinvest proceeds from maturing bonds into new bonds with higher yields more quickly.

- Offers above-inflation income

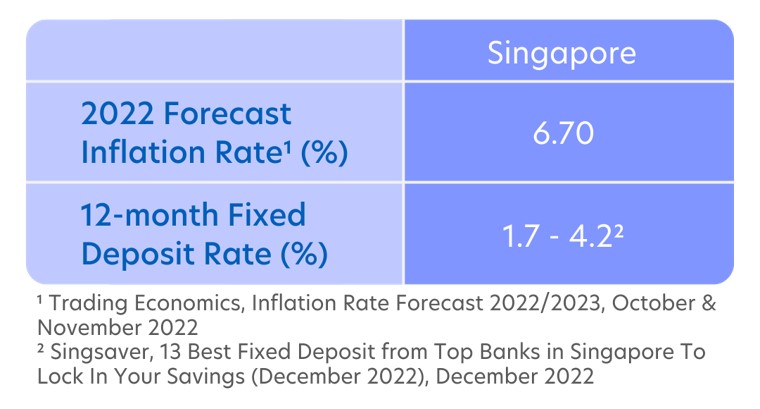

As interest rates climb, fixed deposits have become increasingly popular among Singaporeans. But if you are looking to earn above-inflation returns, short duration bond funds may be a better option considering how fixed deposit rates are currently lagging inflation levels.

Image: UOBAM

- Has less risk than long duration bond funds…

For bonds, interest rate fluctuations are considered a risk. When interest rates rise, bond prices fall, and vice versa.

Duration is a concept that captures the sensitivity of a bond’s price to interest rate changes. When interest rates rise by 1 per cent, a 2-year duration bond will drop in price by about 2 per cent. But a 4-year duration bond will fall by about 4 per cent.

In today’s rising interest rate environment, short duration bonds offer less sensitivity to rate hikes and hence, more stable returns compared to long duration bonds.

- ...but is currently higher yielding

Plus, short-term bonds are currently yielding more than longer-term bonds.

The 2-year US Treasury now yields about 4.4 per cent (as of 12 December 2022) while the 10-year US Treasury yields only around 3.6 per cent.

A negative yield spread between the 10-year and the 2-year Treasury is also known as an inverted yield curve. This phenomenon is unusual because the longer the duration, the higher the yield typically offered to compensate for interest rate risk.

So, if you invest in short-term bonds now, you are essentially getting higher returns while taking less risk!

Who are short term bond funds good for?

Generally, short duration bond funds can be a good choice for investors seeking stable cash flow amid high inflation. They can also be useful for investors looking to balance the risks in their stock portfolio with a more defensive investment.

Investment grade bonds can help reduce risk

Bonds are usually considered less risky than stocks, but this does not mean they have no risk. For instance, a company might face financial difficulties and default on the bond.

To mitigate that risk, you can choose funds that hold short duration bonds from investment grade issuers. Investment grade bonds are those that have a higher quality rating and carry less default risk than lower rated bonds.

How to invest in short duration bond funds

For those looking to gain exposure to short duration, investment grade bond funds, one UOBAM solution to consider is the United SGD Fund (“Fund”). Here’s a look at the highlights:

- High grade, short duration

The Fund has an effective duration of about 1.33 years (as of 31 November 2022), and invests in high grade, short-term debt securities.

- Higher yield, lower volatility

The Fund has a lower volatility than the Singapore 10-Year Government Bonds and the Singapore Straits Times Index, but offers a higher weighted average yield to maturity3.

- Above-inflation yields

Despite its short duration, the Fund’s weighted average yield to maturity, as of November 2022 is 5.62 per cent4.

- Rides the rising rates momentum

The Fund uses a laddered investment strategy, which takes advantage of an environment of rising interest rates.

The fees and minimum investment amount for the United SGD Fund5 are set out as below:

| United SGD Fund | |

| Management Fee | Currently 0.63% p.a., maximum 1.5% p.a. |

| Subscription Fee | Subscription fee: currently up to 2%; maximum 5% |

| Minimum Investment | S$1,000/US$1,000 (initial) S$500/US$500 (subsequent) |

1Bloomberg, “Singapore Inflation at Highest in 14 Years on Food, Fuel”, August 2022

2The Straits Times, “Inflation in Singapore will stay high next year even as pace of economic growth slows: MAS”, October 2022

3Bloomberg, October 2022

4Morningstar, United SGD Fund Factsheet, November 2022

5UOB Asset Management, United SGD Fund Facts. Information is accurate as of 15 December 2022

All information in this publication is based upon certain assumptions and analysis of information available as at the date of the publication and reflects prevailing conditions and UOB Asset Management Ltd (“UOBAM”)’s views as of such date, all of which are subject to change at any time without notice. Although care has been taken to ensure the accuracy of information contained in this publication, UOBAM makes no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for the accuracy or completeness of the information.

Potential investors should read the prospectus of the fund(s) (the “Fund(s)”) which is available and may be obtained from UOBAM or any of its appointed distributors, before deciding whether to subscribe for or purchase units in the Fund(s). Returns on the units are not guaranteed. The value of the units and the income from them, if any, may fall as well as rise. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. An investment in the Fund(s) is subject to investment risks and foreign exchange risks, including the possible loss of the principal amount invested. Investors should consider carefully the risks of investing in the Fund(s) and may wish to seek advice from a financial adviser before making a commitment to invest in the Fund(s). Should you choose not to seek advice from a financial adviser, you should consider carefully whether the Fund(s) is suitable for you. Investors should note that the past performance of any investment product, manager, company, entity or UOBAM mentioned in this publication, and any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance of any investment product, manager, company, entity or UOBAM or the economy, stock market, bond market or economic trends of the markets. Nothing in this publication shall constitute a continuing representation or give rise to any implication that there has not been or that there will not be any change affecting the Funds. All subscription for the units in the Fund(s) must be made on the application forms accompanying the prospectus of that fund.

The above information is strictly for general information only and is not an offer, solicitation advice or recommendation to buy or sell any investment product or invest in any company. This publication should not be construed as accounting, legal, regulatory, tax, financial or other advice. Investments in unit trusts are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited, UOBAM, or any of their subsidiary, associate or affiliate or their distributors. The Fund(s) may use or invest in financial derivative instruments and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund(s)’ prospectus.

In the event of any discrepancy between the English and Mandarin versions of this publication, the English version shall prevail.

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd. Company Reg. No. 198600120Z