The United Global Quality Growth Fund invests in quality companies from around the world. In the third of our 5-part Higher-for-Longer series, we look at why quality companies have the potential to outperform in a high-rates world.

What is quality?

After a decade of low inflation and easy money, the global economy is transitioning into a new era of structurally higher inflation, driven by longer-term factors such as US-China tensions, climate change and global instability. To manage inflation, central banks will need to keep interest rates higher than they were in the past decade.

Heading into 2024 and beyond, investors need a different playbook if they are to navigate this new economic environment and the heightened volatility it brings. One strategy is to build portfolio resilience with quality businesses. There are two key features that mark out a quality company:

- Competitive advantage

This gives quality companies their strong pricing power. Competitive advantage comes from offering differentiated products or services, enjoying cost savings through economies of scale, or possessing strong branding and reputation. In an elevated inflation environment, such companies can maintain or even grow their profit margins by increasing prices beyond their higher input costs without losing customers. - Good cash flow

When interest rates were low, many companies borrowed freely in pursuit of revenue growth and market share, a strategy particularly true of the tech sector. But the increase in the cost of capital means spending-reliant growth is turning more risky. Quality companies are those that are stable, able to generate strong cash-flows and have low debt levels. These types of companies are well positioned to ride out high interest rates.

The United Global Quality Growth Fund

Manager Talks

The United Global Quality Growth Fund invests in quality stocks. The Fund is sub-managed by Lazard Asset Management, with Louis Florentin-Lee as the manager of the underlying strategy. He explains to UOB Asset Management’s Dharmo Soejanto how quality stocks are able to outperform both value and growth, especially in an era of high inflation and high interest rates.

An active, bottom-up approach to stock selection

The United Global Quality Growth Fund (the “Fund”) is focused on “compounders” – quality companies that demonstrate high levels of financial productivity. Such companies have the ability to reinvest a significant portion of their cash flows back into their business for continued growth, thus sustaining high returns for longer than the market anticipates.

This compounding pattern of cash flows and earnings has the potential to drive share prices higher and the Fund aims to identify and purchase such stocks at a reasonable price using a rigorous and repeatable investment process.

Using a range of valuation, screening, and competitive intelligence tools, the Fund’s portfolio managers seek to answer three key questions about a company’s fundamentals:

- What are the drivers of its financial productivity?

- What are the barriers to competition?

- What are the reinvestment opportunities to drive future growth?

High conviction portfolio

The result is a portfolio of 40 to 50 stocks that are deemed to possess competitive advantages capable of sustaining high levels of financial productivity. The Fund takes steps to mitigate concentration risk by avoiding large stakes in any single holding. Each position typically comprises between 2 to 5 percent of the portfolio.

Here are the Fund’s current top 10 holdings.

Figure 1: Fund top 10 holdings

| Company name | Weighting | Description |

| Microsoft | 5.34% | Leading technology company whose platforms and tools enable small business productivity, large business competitiveness, and public-sector efficiency. |

| Alphabet | 5.21% | Leading search engine and online advertising company which can reinvest in new technologies and services. |

| Aon Global | 4.13% | Insurance broker with visibility on claims; its data/analytics allow insurance providers to more accurately price risk. |

| S&P Global | 3.78% | Indices service provider whose bond ratings are critical for fixed income investors. Growing ESG data business can drive future growth. |

| Accenture | 3.67% | Leading IT services company with strong connections to decision makers in the C-suite. Can reinvest in increasing staff or acquiring capabilities. |

| Visa | 3.47% | Enjoys robust ecosystem of card issuing banks, consumers, merchants, and merchant acquirers. Beneficiary of secular shift from cash to card payments. |

| Dollarama | 3.27% | Dominant discount retailer in Canada with largest store footprint, focused product range with large private label mix. |

| Adobe | 3.08% | Creative design software company with vertical expertise, embedded in business processes. |

| Intuit | 2.92% | Accounting & tax software maker for SMEs and individuals, with products increasingly sold via a subscription model for sticky, recurring revenue stream. |

| Zoetis | 2.86% | Leader in animal health, improving livestock productivity and companion animal health |

Source: UOBAM, Lazard, as of 31 Oct 2023

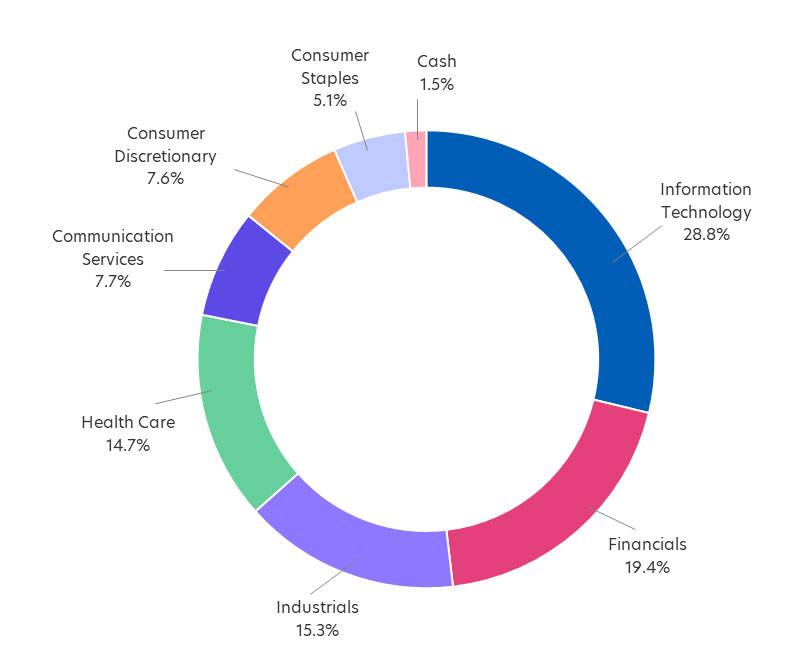

Overall, information technology (IT) and financials companies make up nearly half of the Fund’s portfolio, although healthcare and industrial companies are also well-represented. On the other hand, the Fund avoids sectors such as utilities, telecoms and mining where suitable compounders are usually missing.

Figure 2: Fund sector allocation

Source: UOBAM, as of 31 Oct 2023

Long-term outperformance

Lazard Asset Management’s Global Quality Growth strategy has a long track record and appears to be working. Over the past decade, it has delivered an annualised return of 9.4 percent, compared to the broad global equities return of 6.8 percent1.

The strategy also has the benefit out outperforming in both up and down markets. Since inception, the Fund has beat the market by an average of 5.0 percent during months when market returns were positive, and 8.0 percent during months when the market declined2.

| Upside capture | 105% |

| Downside capture | 92% |

Source: UOBAM, Lazard, as of 31 Oct 2023

Fund Details

| United Global Quality Fund, as of 31 Oct 2023 | |

| Fund objective | To provide long-term total returns by investing in equity and equity-related securities of companies listed and traded on stock exchanges globally. |

| Sub Manager | Lazard Asset Management (as of 1 September 2023) |

| Top 5 geographical allocation (%) | United States: 57.6 Ireland: 7.8 Japan: 7.7 Netherlands: 6.0 Canada: 4.8 |

| Fund Classes Available3 | Class SGD Acc, Class SGD Acc (Hedged); Class USD Acc, Class USD Dist; Class SGD Dist Class SGD Dist (Hedged); Class B SGD Acc; Class C SGD Acc (Hedged) |

| Subscription Mode | Class SGD: Cash & SRS Class USD and Class B: Cash Class C: CPF-OA |

| Subscription Fee | Class SGD, Class USD and Class B: Currently up to 5%, maximum 5% Class C: Currently none, maximum none |

| Management fee | Class SGD and Class USD: Currently 1.5% p.a., maximum 2.5% p.a. Class B and Class C: Currently 1.0% p.a., maximum 2.5% p.a. |

1Source: Lazard, as of 31 Oct 2023, in USD terms. Performance is presented in a gross fee basis. Past performance is not an indicator of future results

2Source: Lazard, as of 31 Oct 2023, in USD terms. Performance is presented in a gross fee basis. Past performance is not an indicator of future results

3Investors should refer to the Fund’s prospectus for more details on the different classes available. Please check with our distributors on the availability of the Fund classes.

If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider:

|

This document is for general information only. It does not constitute an offer or solicitation to deal in units in the Fund (“Units”) or investment advice or recommendation and was prepared without regard to the specific objectives, financial situation or needs of any particular person who may receive it. The information is based on certain assumptions, information and conditions available as at the date of this document and may be subject to change at any time without notice. No representation or promise as to the performance of the Fund or the return on your investment is made. Past performance of the Fund or UOB Asset Management Ltd (“UOBAM”) and any past performance, prediction, projection or forecast of the economic trends or securities market are not necessarily indicative of the future or likely performance of the Fund or UOBAM. The value of Units and the income from them, if any, may fall as well as rise, and is likely to have high volatility due to the investment policies and/or portfolio management techniques employed by the Fund. Investments in Units involve risks, including the possible loss of the principal amount invested, and are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited (“UOB”), UOBAM, or any of their subsidiary, associate or affiliate (“UOB Group”) or distributors of the Fund. The Fund may use or invest in financial derivative instruments and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund’s prospectus. The UOB Group may have interests in the Units and may also perform or seek to perform brokering and other investment or securities-related services for the Fund. Investors should read the Fund’s prospectus, which is available and may be obtained from UOBAM or any of its appointed agents or distributors, before investing. You may wish to seek advice from a financial adviser before making a commitment to invest in any Units, and in the event that you choose not to do so, you should consider carefully whether the Fund is suitable for you. Applications for Units must be made on the application forms accompanying the Fund’s prospectus.

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd. Company Reg. No. 198600120Z