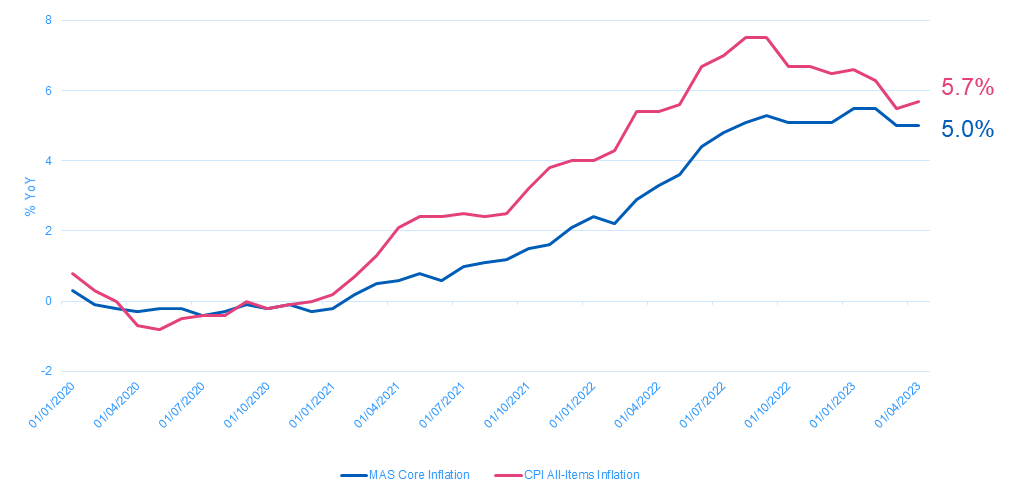

Singapore inflation reached a high in 2022 and everyone had hoped that it would start to fall steadily this year. But this has not happened. While inflation has eased a little, it is still hovering at around 5 percent.

This is far higher than historical levels and a concern for all Singaporeans because it erodes their purchasing power. And given Singapore’s relatively tight labour market and resilient consumer demand, we may have to live with higher-than-normal inflation for some time to come.

Figure 1: MAS Core and CPI-All Items inflation

Source: Singstat, MAS, UOBAM, June 2023

This does not mean that nothing can be done. One way to counter stubbornly elevated inflation is to invest in instruments that hedge against inflation. An inflation hedge is an investment that can hold or increase its value through periods of inflation, thereby cushioning the adverse effects of rising prices.

Gold’s potential to outperform

Gold is often used as an inflation hedge. This is because when prices rise, cash loses its purchasing power. In contrast, precious metals like gold will tend to see price rises, and therefore have the potential to preserve their value in an inflationary environment.

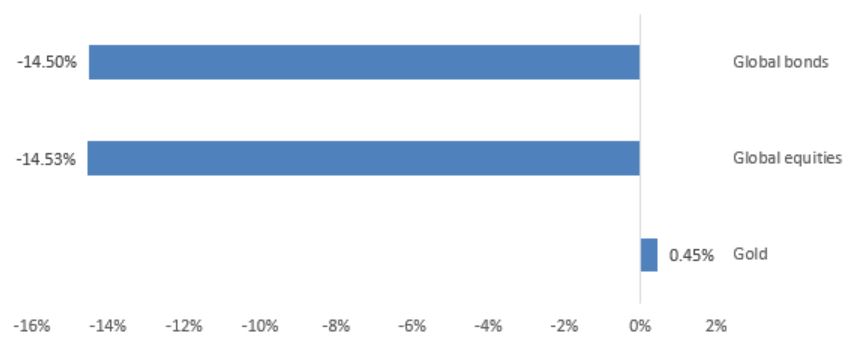

At the same time, rising inflation is often accompanied by interest rate hikes which causes both equities and bonds to decline. For example, in 2022, gold was able to strongly outperform traditional asset classes.

Figure 2: 2022 returns for gold, global bonds and global equities

Based on Bloomberg Barclays Global Bond Aggregate Index, MSCI World Index, and LBMA Gold Price PM. Price performance from 1 Jan 2022 to 31 Dec 2022. All calculations are in SGD. Sources: Bloomberg, ICE Benchmark Administration, World Gold Council.

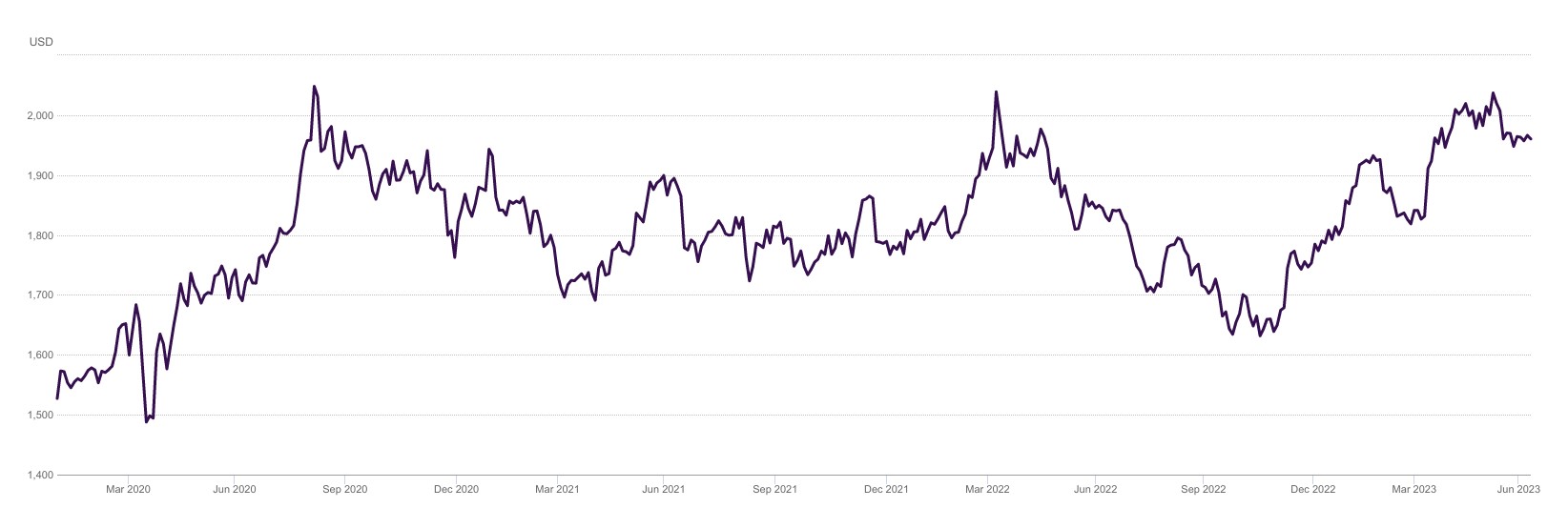

Despite the price of gold dipping in the second half of 2022 due to the strong US dollar, it started to pick up again in 2023. The backdrop of peaking interest rates and elevated inflation has allowed gold’s traditional inflation-hedging properties to shine. As of 9 June 2023, gold is around US$1,960 per ounce, not too far from its all-time high of US$2,069.40 set in 2020.

Figure 3: Gold price per ounce, 2023

Data as of 9 June 2023. Sources: FastMarkets, ICE Benchmark Administration, Thomson Reuters, World Gold Council.

Demand for gold continues to grow

A key catalyst of the current gold price rally is central banks’ aggressive gold buying in recent months. During the first quarter of 2023, the central banks of Singapore, China and Turkey were the largest buyers of gold. Worldwide, central banks added more than 1,130 tonnes of gold to their 2022 holdings. This was worth around US$70 billion1 – the highest buying level since 1950.

This strong demand can be attributed to central banks using gold as an inflation hedge for their monetary reserves. Gold is particularly attractive in times of economic uncertainty, as it is seen to be a more reliable store of value than paper currencies. With central bank buying expected to continue in the months ahead, there could be more room for gold prices to rise.

Risks to the outlook

That said, interest rates and the strength of the US dollar remain risks that gold investors should watch out for. Should inflation stay persistent in the latter half of 2023, the US Federal Reserve could choose to continue to hike interest rates.

This could cause the US dollar (USD) to strengthen. Gold has historically been inversely correlated to the US dollar. As gold is US dollar-denominated, all things being equal, a stronger US dollar tends to give rise to a weaker gold price.

However, our house view is that US interest rates are close to their peak and we have a neutral outlook on the USD.

Gold as a safe haven investment

Besides acting as an inflation hedge, gold serves as a safe haven asset. In times of uncertainty, gold can provide stability and shelter from the volatility that typically hits other risky assets such as equities.

Perhaps the strongest example of this was during the Global Financial Crisis. As investors turned to gold for safety, the price of gold rose 24 percent in 2009 – the year after the crisis – and continued climbing well into 2011.

Price stability aside, gold has several unique characteristics that contribute to their reputation as a safe haven.

- Liquidity: Gold can easily be bought and sold at any time

- Functionality: Apart from jewellery, gold is also used in electronics

- Store of value: Unlike paper currencies, gold cannot be devalued by overprinting

- Limited supply: As a finite physical commodity, gold supply cannot be easily increased

All these factors add to the appeal of gold as a safe haven during periods of economic turmoil.

Ways to invest in gold

Investors can invest in physical gold by buying gold bars or coins from a bank or brokerage. However, this method often comes with additional costs for safe storage of the gold assets.

Apart from purchasing physical gold, investors can invest in companies that mine for gold. As gold prices rise, the profits of gold mining companies tend to rise too, which could result in share price gains. Gold mining stocks may also pay dividends. This could be attractive for some investors since physical gold does not provide any dividends.

That said, investing in gold mining stocks is not without risks. Investors need to consider a mining company’s management and future prospects before making any investment.

Gold funds offer another option for investors. Funds provide diversified exposure to gold since they typically hold physical gold as well as stocks of gold miners. Some funds also invest in other precious metals and bulk commodities to enhance diversification and returns.

1 World Gold Council

If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider:

|

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person.You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.

UOB Asset Management Ltd. Company Reg. No. 198600120Z