Investors’ appetite for global equities is returning as the macroeconomic outlook improves

Global equities are up nearly 12 percent so far this year, a stark contrast to 2022 when the MSCI All-Country World Index (MSCI ACWI) dropped more than 20 percent after being hit by high inflation and high interest rates.

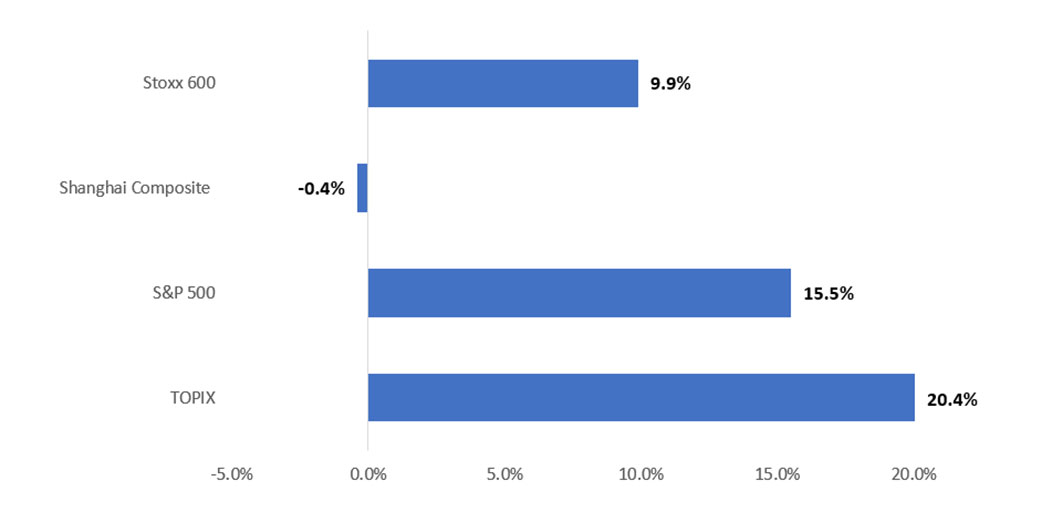

US equities have been a key contributor to this rise, having gained 16 percent year to date. The US is home to the world’s largest stock market, and accounts for about 60 percent of global equity indices.

Japan, the next largest, is one of the best performing markets globally with the TOPIX up by 20 percent so far this year in local currency terms.

Fig 1: Performance of key market indices, year to date

Source: Bloomberg, as at 23 August 2023, in local currency terms

Why take the equities plunge?

Global equities appear poised to maintain this momentum, supported by four key drivers:

- Unexpectedly resilient growth

In its latest World Economic Outlook, the International Monetary Fund (IMF) raised its projection for global real gross domestic product (GDP) growth to 3 percent in 2023, up 0.2 percent from its April forecast.

The IMF say economic activity across the world has proved more resilient than expected. Despite several warnings at the start of the year, forecasts of a severe global recession have not come to pass. The global Purchasing Managers' Index (PMI) remains above 501, the threshold between contraction and growth. - Services-driven expansion

Much of the US's current economic activity is being driven by services. Meanwhile manufacturing and trade is lagging given China's slugging growth.

Traditionally, a manufacturing downturn would be expected to spill over to other parts of the economy. However, in the current cycle, it appears that many service sectors have yet to return to their pre-COVID levels of employment.

This lends strength to UOB Asset Management's view that a deep recession is unlikely. Instead, service sectors have room to keep growing, enabling them to compensate for the drop in goods demand and crucially, help support strong employment levels. - Inflation easing not a one-off

While in major economies, inflation is still above the 2.0 percent target, prices have shown signs of cooling for several consecutive months. In the US for example, July’s core inflation rate – which excludes the prices of food and energy – is the lowest since October 2021.

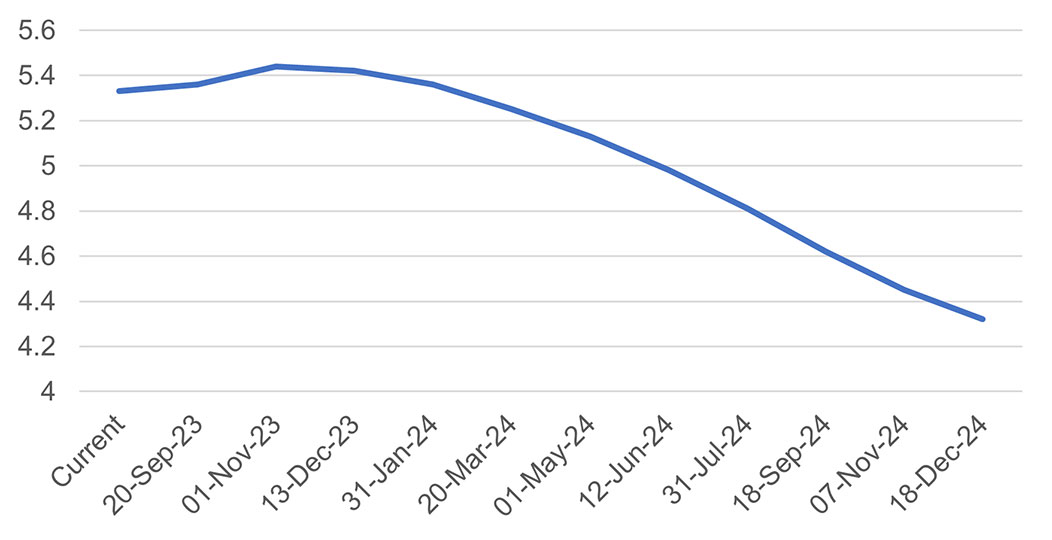

As such, reasons for the US Fed to keep hiking interest rates are dissipating. Looking ahead, it is unlikely that interest rates will rise much further in the US. As more parts of the CPI data improve, the Fed to looks set to pause, then possibly cut rates. We don’t expect this to be a quick process, but it is nevertheless positive for global equity markets.Fig 2: Implied Fed policy rate (%)

Source: Bloomberg, 17 August 2023

- Equities now more on-trend

Global fund managers have significantly pared back their net underweight positions in global equities from 24 percent in July to 11 percent in August2. Not only are risk appetites increasing, but there is also a greater demand for real returns (i.e. returns net of inflation).

If, as we suspect, inflation stays structurally higher, over time a bond’s income payments will generally lag in terms of real returns because bonds pay a fixed income that does not change.

On the other hand, companies have the ability to grow their earnings above the inflation rate. As such, the combination of capital gains and dividends offered by equities have the potential to keep pace with high prices.

Risks

- The biggest tail risk for global equity markets is if inflation pressures pick up again, forcing central banks to keep up their rate hikes.

- China’s faltering economy could also weigh on global growth. For instance, weaker consumer spending in China could impact exporters to China as demand cools.

Ultimately, sustained equity market performance would depend on whether the economy can continue to weather high interest rates and defy recession expectations. Based on our economic analysis, we expect this to be the case and as such, have a slight equities overweight within our multi-asset portfolios.

1Source: Global IHS Markit, Bloomberg, 31 July 2023

2Bank of America's global fund manager survey, August 2023

If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider:

|

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person.You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.

This publication has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd. Company Reg. No. 198600120Z