With trade and geopolitical uncertainties on the rise, there are increasing concerns that global growth could start to deteriorate. That said, markets are still proving highly resilient, and investors are watchful but not pessimistic.

In this environment, intermediate-risk equity funds are high on investors’ agendas. We ask manager of the United Global Durable Equities Fund, Daniel Pozen, to explain his strategy for delivering strong and stable returns during such challenging times.

Daniel Pozen, Senior Managing Director, Partner, and Equity Portfolio Manager, Wellington Management

Global Outlook

Q1: Given global tariffs and trade tensions, how do you see global GDP and corporate earnings evolving over the next 12 to 18 months?

As a result of shifting policy landscapes, we see the potential for modestly slower global growth. The global economy is becoming less integrated in supply chains, migration flows and even potentially, cross border capital and saving flows. In addition, governments are emphatically loosening their fiscal policies despite still tight labour markets and high inflation.

We also see more dispersion in geographic and industry performance. Europe, for instance, is showing signs of relative strength due to more accommodative monetary policy, fiscal stimulus, and improving industrial indicators. Meanwhile, China’s economy continues to meet its growth targets, supported by targeted stimulus measures and consumption incentives. Therefore, while global GDP growth may moderate, it won’t be uniformly weak.

On corporate earnings, we continue to have a constructive view on earnings growth but appreciate certain sectors will see greater constraints in rising input costs, supply chain disruptions, and weaker global demand stemming from trade frictions.

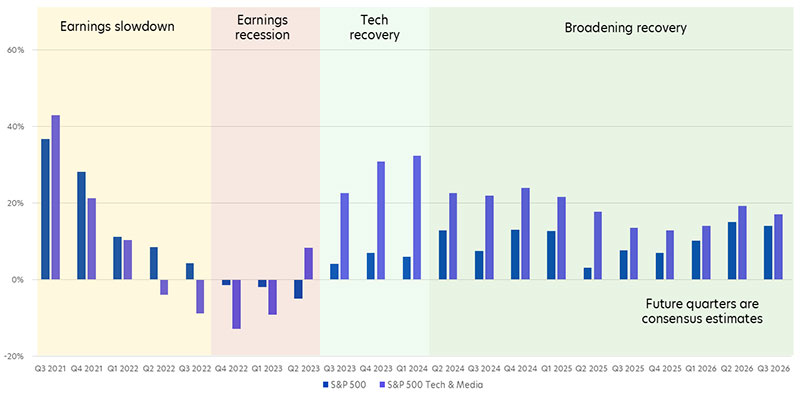

Fig 1: Earnings growth year-on-year (%)

Sources: Wellington Management, Bloomberg | As of 31 March 2025 | Data represents year-on-year change in EPS ($/share) for S&P 500 index and the technology and media industries within S&P 500 index.

Q2: What are the key downside risks that markets may still be underpricing?

I think there are a number of factors the market may not be pricing correctly. To name a few,

- A protracted trade tension period which further dampens corporate capex plans, consumer spending and broadly aggregate demand.

- Inflation reacceleration driven by higher core inflation, which may be a function of higher wage pressures and supply-side constraints. This will make it more challenging for central banks given the need to balance between inflation and growth.

- Geopolitical risks including the ongoing conflict in Ukraine, Middle East instability and tensions in the Taiwan Strait.

Fund outlook

Q3: What is the Fund’s criteria for company “durability”

Our durable equities approach is to focus on identifying a set of companies with low economic sensitivity, are mission critical to society, and where stronger pricing power exists.

This means that we aim for our portfolio of companies to have a meaningful level of earnings resilience to such external factors. We try to ensure that these businesses are economically important and enjoy consistent demand for their products and services.

Q4: How has your quantitative criteria changed in today’s context of trade uncertainties and volatile markets?

It is precisely in these periods of volatility and uncertainty that we find the most value in focusing on our North Star objective of double-digit performance, achieved at modest levels of valuation and risk. This approach is also well suited to the current period of heightened technological change, and unusually wide range of potential economic and geopolitical outcomes.

We will continue to exclude any company where we think cash flows could decline by more than 15 percent, and we do this by seeking out companies that have:

- profit bases that are durable, capable of long-term compounding, and not inflated by last decade’s operating environment.

- a compelling value proposition where the customer is getting “a good deal”.

- limited new competition, given their business model of sustainable (i.e. not exceptional) demand, returns and growth. They also tend to operate within an aggregate market that has a modest profit pool.

- flexible investment options with shorter paybacks.

- conservative balance-sheets.

Q5: In the event of a US stagflation, how do you assess the resilience of the companies within the United Global Durable Equities Fund?

To assess business resilience, we include all possible economic scenarios, including a US stagflation, where overall company cash flows could decline by more than 15 percent.

While the economic sensitivity of the Fund is not zero, we believe it is significantly less than that of the broad market. The majority of our companies are not capital intensive and entered the year with very conservative balance sheets. This combination should enable our businesses to weather any period of stagflation, relative to both peers and the broad market.

Q6: Are there aspects within today’s macro environment that the Fund is actually able to benefit from?

Given that we are facing broader uncertainty, and most of our companies entered the year with very conservative balance sheets, we are quite excited about the opportunity to deploy capital.

For example, Intact Financial, the largest holding in the Fund, has already made two significant acquisitions (One Beacon and RSA)1 over the period of our ownership that have proven to be highly accretive to earnings. Its current balance sheet suggests that it is still in a very advantageous position to do another meaningful acquisition and we have high confidence in management’s M&A strategy moving forward.

Other businesses that we believe could be poised to opportunistically deploy capital include Silgan Holdings, Clean Harbors, and Waste Connections.

Q7: Given this, how has the Fund’s composition changed over the past few months?

During periods of uncertainty, our defensive starting point allows us to use such periods to play offense. The recent spike in risk premiums, which feels both overdue and healthy to a degree, has allowed us to invest in several companies exhibiting higher organic value creation. Recent portfolio purchases that fall into this category include Uber, TransUnion, and PTC. These companies have driven the bulk of our double-digit value creation hurdle through organic revenue growth2.

What equally excites us about these companies is that they currently trade at attractive absolute and relative valuations. Our estimate of future free cash flow (FCF) for Uber is about 13x, TransUnion is about 13x, and PTC is about 20x3. This despite the market having a narrow range of earnings outcomes, especially to the downside.

I would stress that with our low turnover approach, these transactions occur at the margins, and overall, the Fund still retains its defensive posture versus the broader market. We estimate that the Fund’s intrinsic return remains at the high-end of its historical range. Meanwhile, its absolute and, particularly, relative valuations remain at the bottom end of their respective historical ranges.

Investor portfolios

Q8: Low risk investors can just buy bonds or bond funds, and high risk investors like quick, substantial returns. Why bother with durable equities?

Bonds play an integral role in client portfolios especially for low risk investors like retirees. They provide ballast, steady income and higher all-in yields than in the past decade.

However, the important aspect to appreciate with equities is that it not only can provide compelling income that can rise with corporate earnings. They also act as an inflation hedge, and can provide capital appreciation over time. This is because equities tend to perform better against inflation as companies can raise prices and grow their earnings over time which leads to capital appreciation.

On the other hand, very high-risk equities, although potentially rewarding, is subject to elevated volatility and drawdowns, particularly during periods of macroeconomic stress. Portfolios that are overly reliant on extreme ends of the risk spectrum may underperform more balanced strategies over time, particularly when market shocks coincide with withdrawal periods.

This underscores the importance of incorporating intermediate-risk assets such as Durable Equities to enhance portfolio resilience across market cycles.

Dan is a portfolio manager on the Durable Equity Team. As portfolio manager of Durable Companies and Durable Enterprises portfolios, and portfolio manager of the equity portion of the Vanguard Wellington Fund, he manages global equity assets on behalf of our clients, drawing on research from Wellington Management’s global industry analysts, equity portfolio managers, and team analysts. He is based in our Boston Office.

Prior to joining Wellington Management in 2006, Dan worked as an analyst at the Investment & Development Corporation of Central America in Guatemala City (2003 – 2004), as a mathematics teacher in the Boston Public Schools (2001 – 2002), and as an investment associate at Putnam Investments in the Specialty Growth Group (1999 – 2001). Dan earned his MBA from Dartmouth College (Tuck, 2006), with high distinction and as an Edward Tuck scholar. He earned his BA in economics, cum laude, from Williams College (1999).

1, 2, 3Source: Wellington Management, June 2025

| If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider: United Global Durable Equities Fund

You may wish to seek advice from a financial adviser before making a commitment to invest in the above fund, and in the event that you choose not to do so, you should consider carefully whether the fund is suitable for you. |

All information in this publication is based upon certain assumptions and analysis of information available as at the date of the publication and reflects prevailing conditions and UOB Asset Management Ltd (“UOBAM”)'s views as of such date, all of which are subject to change at any time without notice. Although care has been taken to ensure the accuracy of information contained in this publication, UOBAM makes no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for the accuracy or completeness of the information.

Potential investors should read the prospectus of the fund(s) (the “Fund(s)”) which is available and may be obtained from UOBAM or any of its appointed distributors, before deciding whether to subscribe for or purchase units in the Fund(s). Returns on the units are not guaranteed. The value of the units and the income from them, if any, may fall as well as rise, and is likely to have high volatility due to the investment policies and/or portfolio management techniques employed by the Fund(s).

Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. An investment in the Fund(s) is subject to investment risks and foreign exchange risks, including the possible loss of the principal amount invested. Investors should consider carefully the risks of investing in the Fund(s) and may wish to seek advice from a financial adviser before making a commitment to invest in the Fund(s). Should you choose not to seek advice from a financial adviser, you should consider carefully whether the Fund(s) is suitable for you. Investors should note that the past performance of any investment product, manager, company, entity or UOBAM mentioned in this publication, and any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance of any investment product, manager, company, entity or UOBAM or the economy, stock market, bond market or economic trends of the markets. Nothing in this publication shall constitute a continuing representation or give rise to any implication that there has not been or that there will not be any change affecting the Funds. All subscription for the units in the Fund(s) must be made on the application forms accompanying the prospectus of that fund.

The above information is strictly for general information only and is not an offer, solicitation advice or recommendation to buy or sell any investment product or invest in any company. This publication should not be construed as accounting, legal, regulatory, tax, financial or other advice. Investments in unit trusts are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited, UOBAM, or any of their subsidiary, associate or affiliate or their distributors. The Fund(s) may use or invest in financial derivative instruments and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund(s)’ prospectus.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd Co. Reg. No. 198600120Z