Asian markets are well-suited to benefit from artificial intelligence (AI)

Finding alpha in developed markets is not easy

The application of big data, artificial intelligence (AI) and machine learning (ML) started to become popular in the early 1990s as a way to produce “insights” not available via human analyses. Not surprisingly, many wondered whether these techniques could be applied to reliably predict stock market and stock price movements, and thereby generate above-average returns.

However, in the US and Europe, where the majority of such studies have been carried out, the results have not been overwhelming. While AI and ML clearly brings benefits, beating the market over the long term is challenging when most kinks have already been ironed out. This led the CFA Institute Research Foundation’s 2020 report to conclude that, “Ultimately, the jury is still out as to whether AI implementations are generally superior to more traditional implementations1.

AI is more useful for Asia’s diverse markets

On the other hand, data scientists are more optimistic about the potential for AI to deliver value in less developed markets, and especially in Asia. These are several reasons for this:

- As of March 2022, the Asia Pacific universe comprised 31,000 stocks2 - more than half of the world’s listed stocks. It is not possible for Asian fund managers to manually monitor all available stocks on a regular basis, resulting in missed opportunities and risks.

- Asian markets have wide geographical, environmental, social and regulatory variations. This means that markets are driven by local idiosyncratic risks, and relying on regional or global macro trends alone are insufficient when analysing Asian markets.

- Studies suggest that stocks listed in Asia are driven by many non-linear factors, such as seasonal effects, retail trends and local competition3. These factors are as important to track as the more traditional measures like earnings and valuations.

- Much developed markets outperformance is thought to stem from identifying “limits to arbitrage” ie situations where normal price equilibriums are not in place4. Emerging market outperformance is likely based on a wider range of inefficiencies.

These characteristics make AI an invaluable tool for managers of Asian assets. However, AI also has limitations, not least the need for large datasets covering a wide range of macro and corporate variables. These datasets are not always available especially in the more frontier Asian markets.

Are you comfortable investing in funds managed using AI?

Tell us how you feel about AI-driven investing by completing this short survey.

United Asia Fund leverages AI-Augmentation

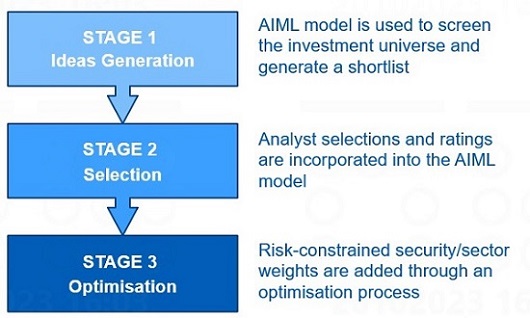

Given this, UOBAM embarked on a journey in 2018 to see whether AI and ML tools could enhance investment performance. In 2020, the United Asia Fund became one of the first funds to formally apply the firm’s AI capabilities. This fund was selected because of the advantages outlined above, but it was evident from early on that these advantages could not replace the on-the-ground expertise provided by the firm’s Asia investments team.

Instead, the team focused on building a framework that integrated AI insights into the team’s existing investment process in a structured and disciplined way. This AI-Augmentation framework has been in operation for over three years and the United Asia Fund is evidence of its success.

Figure 1: AI-Augmentation framework

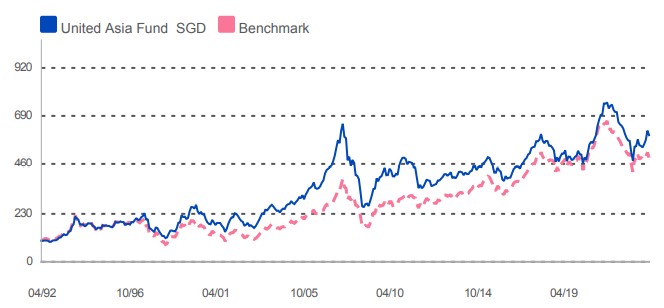

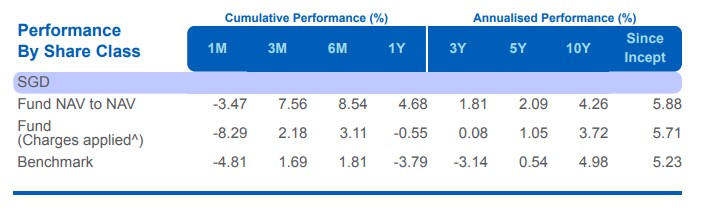

Market-beating performance

Since supplementing the fund’s research process with AIML insights, the United Asia Fund – SGD (the “Fund”)’s performance has beaten both the market and industry peers. Over the past 12 months as of end-Aug, the fund has delivered gains of 4.7 percent, compared to the benchmark loss of -3.8 percent. The fund is in the top quartile of all Asia-category funds and is rated 4-stars by Morningstar.

Figure 2: United Asia Fund performance

Fund performance is calculated on a NAV to NAV basis. Benchmark: Apr 1992 – Dec 2011: MSCI AC FE ex Japan; Jan 2012 to present: MSCI AC Asia ex Japan

Source: Morningstar. Performance as at 31 August 2023, SGD basis, with dividends and distributions reinvested, if any. Performance figures for 1 month till 1 year show the % change, while performance figures above 1 year show the average annual compounded returns. Since inception performance under 1 year is not annualised.

Fund allocations

The United Asia Fund is currently almost equally weighted in China and India stocks. These comprise about half of the Fund’s portfolio and include Indian financial sector stocks such as IDFC First Bank and Bank of Baroda, as well as Chinese consumer-related companies like Hisense.

The fund also has a significant exposure to Taiwan, Singapore and Hong Kong companies with a lesser exposure to South Korea and Taiwan. Three sectors - consumer discretionary, financials and IT - make up about half of all holdings.

Fund Details

| United Asia Fund, as of 31 August 2023 | |

| Fund objective | The investment objective of the Fund is to achieve long term capital growth mainly through investing in the securities of corporations in, or corporations listed or traded on stock exchanges in, or corporations which derive a significant proportion of their revenue or profits from or have a significant proportion of their assets in, Asia (excluding Japan) |

| Geographical allocation (%) | China: 25.85 India: 21.82 Taiwan: 16.00 Singapore: 12.73 Hong Kong: 6.98 South Korea: 4.89 Malaysia: 2.74 USA: 2.55 Cash & Others: 6.44 |

| Sector allocation (%) | Consumer Discretionary: 18.67 Financials: 16.23 Information Technology: 14.77 Consumer Staples: 11.03 Real Estate: 8.25 Communication Services: 7.95 Industrials: 7.15 Utilities: 5.43 Cash & Others: 10.52 |

| Top 5 holdings (%) | IDFC First Bank Ltd: 3.43 Hisense Home Appliances Group 3.40 MakeMyTrip Ltd: 3.26 Bank of Baroda: 3.25 Singapore Technologies Engineering : 3.17 |

| Fund class available | Class A SGD Acc, Class B JPY Acc |

| Management fee | Class A SGD Acc: Currently 1.25% p.a.; maximum 1.25% p.a. Class B JPY Acc: Currently 0.5% p.a.; maximum 1.25% p.a. |

| Subscription fee | Up to 5% |

| Minimum subscription / trading size | Class A SGD Acc: S$1000(initial); S$500 (subsequent) Class B JPY Acc: At our discretion (initial); at our discretion (subsequent) |

All statistics quoted in the write-up are as of 31 August 2023 unless otherwise stated.

1Artificial Intelligence in Asset Management, CFA Institute Research Foundation, 2020

2World Federation of Exchanges (WFE), May 2022

3Combining nonlinear independent component analysis and neural network for the prediction of Asian stock market indexes, Dai et al, March 2012

4Machine learning and the cross-section of emerging market stock returns, Emerging Markets Review, June 2023

If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider:

|

MSCI Data are exclusive property of MSCI. MSCI Data are provided “as is”, MSCI bears no liability for or in connection with MSCI Data. MSCI full disclaimer here.

This document is for general information only. It does not constitute an offer or solicitation to deal in units in the Fund (“Units”) or investment advice or recommendation and was prepared without regard to the specific objectives, financial situation or needs of any particular person who may receive it. The information is based on certain assumptions, information, and conditions available as at the date of this document and may be subject to change at any time without notice. No representation or promise as to the performance of the Fund or the return on your investment is made. Past performance of the Fund or UOB Asset Management Ltd (“UOBAM”) and any past performance, prediction, projection or forecast of the economic trends or securities market are not necessarily indicative of the future or likely performance of the Fund or UOBAM. The value of Units and the income from them, if any, may fall as well as rise, and is likely to have high volatility due to the investment policies and/or portfolio management techniques employed by the Fund. Investments in Units involve risks, including the possible loss of the principal amount invested, and are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited (“UOB”), UOBAM, or any of their subsidiary, associate, or affiliate (“UOB Group”) or distributors of the Fund. The Fund may use or invest in financial derivative instruments, and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund’s prospectus. The UOB Group may have interests in the Units and may also perform or seek to perform brokering and other investment or securities-related services for the Fund. Investors should read the Fund’s prospectus, which is available and may be obtained from UOBAM or any of its appointed agents or distributors, before investing. You may wish to seek advice from a financial adviser before making a commitment to invest in any Units, and in the event that you choose not to do so, you should consider carefully whether the Fund is suitable for you. Applications for Units must be made on the application forms accompanying the Fund’s prospectus.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd. Company Reg. No. 198600120Z