AI + ESG is a powerful path forward for Asia’s ESG Funds

Strong Asia inflows

Nowhere is there greater interest in ESG (environmental, social, governance) funds than in Asia. This year’s inflows to Asian ESG exchange traded funds (ETFs) are on track to reach US$8.8 billion. This is in stark contrast to the US$4.3 billion in net outflows from comparable US ESG funds. Meanwhile in Europe, currently the largest ESG investing market, inflows are estimated be just $1.7 billion so far this year.

Interest rate policy differences

The interest in Asia ESG funds has been helped by the divergence in monetary policy between East and West. While US and European central banks continue to keep interest rates higher for longer, many Asian central banks have either paused rate hikes or are already cutting rates.

Long-term ESG investments such as solar power plants or wind turbines are particularly sensitive to higher interest rates. When rates are high, the future cashflows generated by such investments are more heavily discounted and thus worth less today.

Profitable road to net zero

Also contributing to inflows are steps being taken by Asian governments to speed up their net zero commitments. This is opening up growth opportunities for a wide range of industries. For instance, Asia is a key electric vehicle (EV) battery hub, with China, Japan and South Korea currently dominating the global EV battery market1.

Overall, according to Boston Consulting Group, Asia’s transition to net zero is projected to deliver a revenue opportunity of $4.3 trillion by 2030, driven by renewable power, energy efficiency in buildings, transportation and agriculture, and greater efficiencies in the use of raw materials2.

United SAT-50 Fund: Integration of AI tools and analyst expertise

The United Sustainable Asia Top-50 Fund (the “Fund”) aims to achieve long-term capital appreciation by investing in Asia’s top 50 sustainable corporations who are shaping the region. Unlike other ESG funds, this fund actively adopts an AI-Augmentation framework based on integrating AI (artificial intelligence) techniques and deeply-embedded analyst research.

.

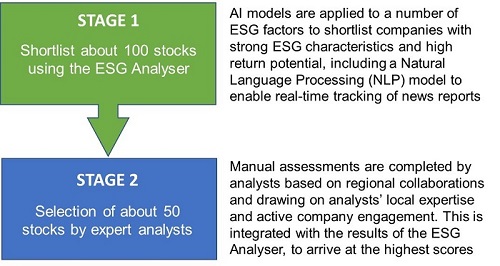

Figure 1: AI-Augmentation investment framework

Learn more

Can AI (artificial intelligence) transform ESG (environmental, social, and governance) investing? In the second half of their chat, Paul Ho, UOB Asset Management's Senior Director of Asian Equities explains to Elsa Pau, Benchmark Award's Curator, how AI is helping fund managers build high-performing, sustainable portfolios.

Are you comfortable investing in funds managed using AI?

Tell us how you feel about AI-driven investing by completing this short survey.

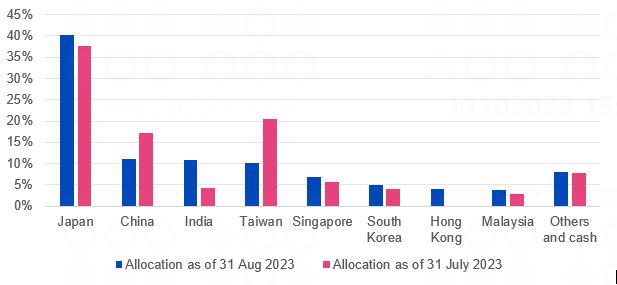

Riding Japan’s upside potential

The Fund has a 40 percent allocation to Japan (40 percent) on expectations that improved corporate governance and positive earnings will continue to drive upside potential over the next few months. In line with results of its AI model, the Fund has also increased its India and Hong Kong exposure, at the expense of China and Taiwan.

.

Figure 2: Fund geographical allocation (%) as of 31 Aug 2023

Figure 3: Fund Top 10 holdings as of 31 Aug 2023

| Company | Weighting (%) | Sector | Geography | Description |

| Taiwan Semiconductor Manufacturing | 4.43 | Information Technology | Taiwan | World’s largest independent semiconductor foundry |

| Obic Co Ltd | 3.01 | Information Technology | Japan | Computer system integration provider |

| Toyota Industries Corp | 2.97 | Industrials | Japan | Manufacturer of automobiles, industrial vehicles and textile machinery |

| Sembcorp Industries Ltd | 2.96 | Utilities | Singapore | Energy and urban solutions provider |

| Mitsubishi UFJ Financial Group | 2.89 | Financials | Japan | One of the world’s leading global financial services group and one of the largest banking institutions in Japan |

| Sinopac Financial Holdings | 2.77 | Financials | Taiwan | Financial holding company engaged in banking, bills finance, credit card, and other financial businesses |

| Daikin Industries Ltd | 2.55 | Industrials | Japan | One of the world's largest air conditioning manufacturers |

| Makemytrip Ltd | 2.47 | Consumer Discretionary | India | Online travel company engaged in air ticketing, hotels, and bus ticketing |

| West Japan Railway | 2.39 | Industrials | Japan | Railway operator in Osaka, Kyoto, and the rest of western Japan |

| Infosys Ltd | 2.34 | Information Technology | India | Provider of digital services and business consulting |

Source: UOBAM

In terms of sectors, the Fund’s largest sector allocation – about 19 percent – is to the information technology industry. Another 17 percent is invested in industrials while financials and consumer discretionary companies each make up about 13 percent of the Fund.

Award winning

The Fund was awarded the Top ESG Performance and Temperature Alignment award at the Benchmark Top Sustainable Fund Awards 20203 and provides investors with a unique opportunity to invest in many of Asia’s sustainability leaders, supported by attractive valuations, and the region’s drive to meet its net zero commitments.

Fund Details

| United Sustainable Asia Top-50 Fund, as of 31 August 2023 | |

| Fund objective | To achieve long-term capital appreciation by investing in 50 in total, of the top corporations incorporated in, or whose principal operations are in, Asia including Japan. These companies are selected following the Fund’s investment focus on ESG factors using UOBAM’s proprietary ESG selection process. |

| Geographical allocation (%) | Japan: 40.18 China: 11.13 India:10.95 Taiwan: 10.16 Singapore: 6.88 South Korea: 4.96 Hong Kong: 3.96 Malaysia: 3.80 Cash & Other: 7.98 |

| Sector allocation (%) | Information Technology: 18.64 Industrials: 16.91 Financials: 13.11 Consumer Discretionary: 12.60 Communication Services: 12.42 Consumer Staples: 6.55 Health Care: 4.68 Utilities: 3.92 Cash & Others: 11.17 |

| Top 5 holdings (%) | Taiwan Semiconductor Manufacturer: 4.43 Obic Co Ltd: 3.01 Toyota Industries Corp: 2.97 Sembcorp Industries: 2.96 Mitsubishi UFJ Financial Group: 2.89 |

| Fund class available | Class A SGD Acc, Class B SGD Acc |

| Management fee | Class A: Currently 1.50% p.a.; maximum 1.75% p.a. Class B: Currently 0.75% p.a.; maximum 1.75% p.a. |

| Subscription fee | Up to 5% |

| Minimum subscription / trading size | Class A: S$1000(initial); S$500 (subsequent) Class B: S$500,000 (initial); S$100,000 (subsequent) |

All statistics quoted in the write-up are sourced from Bloomberg as of 31 August 2023 unless otherwise stated.

1SNE Research, May 2023

2Boston Consulting Group, The battle for net zero will be won or lost in Asia, April 2023

3Please refer to uobam.com.sg/awards for the latest list of UOBAM awards

If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider:

|

This document is for general information only. It does not constitute an offer or solicitation to deal in units in the Fund (“Units”) or investment advice or recommendation and was prepared without regard to the specific objectives, financial situation or needs of any particular person who may receive it. The information is based on certain assumptions, information, and conditions available as at the date of this document and may be subject to change at any time without notice. No representation or promise as to the performance of the Fund or the return on your investment is made. Past performance of the Fund or UOB Asset Management Ltd (“UOBAM”) and any past performance, prediction, projection or forecast of the economic trends or securities market are not necessarily indicative of the future or likely performance of the Fund or UOBAM. The value of Units and the income from them, if any, may fall as well as rise, and is likely to have high volatility due to the investment policies and/or portfolio management techniques employed by the Fund. Investments in Units involve risks, including the possible loss of the principal amount invested, and are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited (“UOB”), UOBAM, or any of their subsidiary, associate, or affiliate (“UOB Group”) or distributors of the Fund. The Fund may use or invest in financial derivative instruments, and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund’s prospectus. The UOB Group may have interests in the Units and may also perform or seek to perform brokering and other investment or securities-related services for the Fund. Investors should read the Fund’s prospectus, which is available and may be obtained from UOBAM or any of its appointed agents or distributors, before investing. You may wish to seek advice from a financial adviser before making a commitment to invest in any Units, and in the event that you choose not to do so, you should consider carefully whether the Fund is suitable for you. Applications for Units must be made on the application forms accompanying the Fund’s prospectus.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd. Company Reg. No. 198600120Z