The US equity rally is spreading to more countries and more sectors. This bodes well for quality companies

The Magnificent Seven tech stocks – Apple, Microsoft, Meta, Amazon, Alphabet, Nvidia and Tesla – accounted for more than 60 percent of the S&P 500’s total gains in 2023. This year, there are signs that the rally is broadening out and helping to drive global markets to new highs.

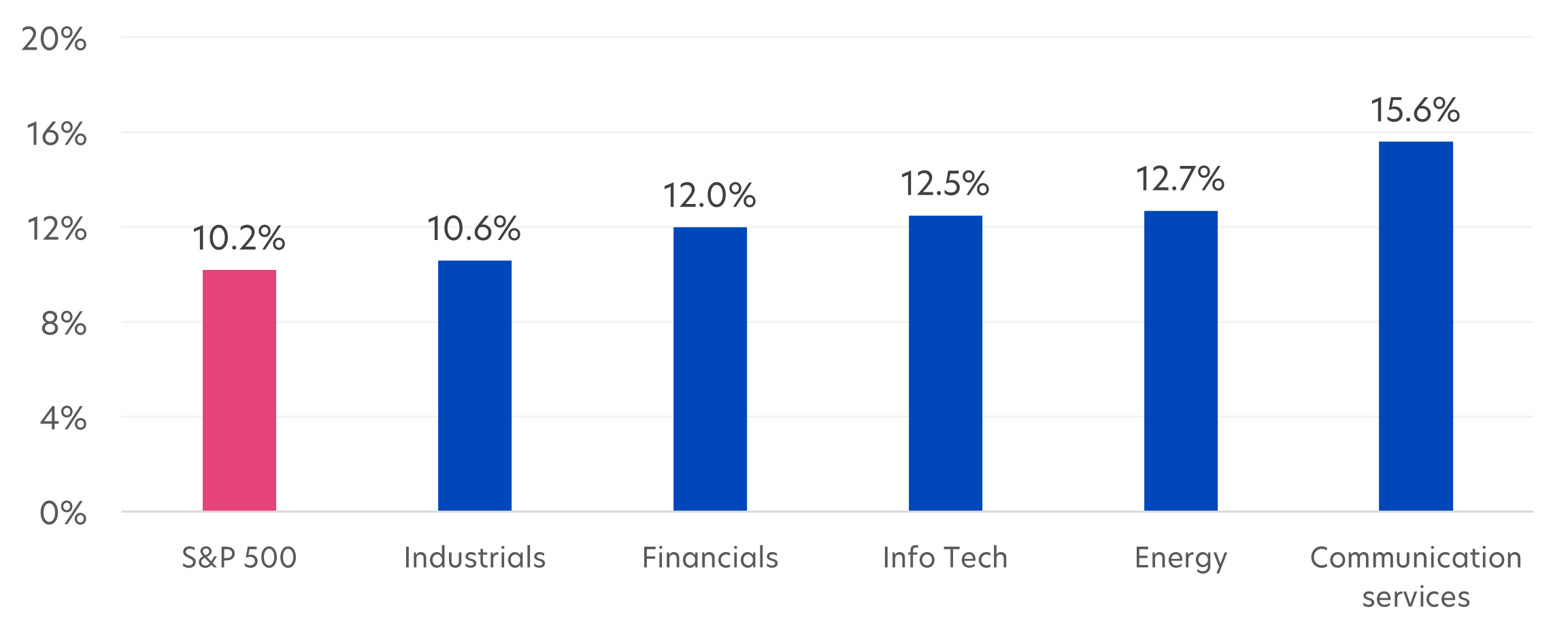

Energy, financials and industrials outperformed the S&P 500 in the first quarter of 2024, an indication that investors are looking outside of the Magnificent Seven for opportunities. This contrasts with last year when only tech, communication services and consumer discretionary – sectors that house the Magnificent Seven stocks – outperformed the S&P 500.

Fig 1: Best-performing S&P 500 sectors in Q1 2024

Source: LSEG data, as of 28 March 2024

Equity returns are also broadening beyond the US. The “GRANOLAS”1 and “Seven Samurai”2 group of stocks in Europe and Japan respectively have powered their respective markets to new highs this year. Both are less tech-heavy than the Magnificent Seven and offer further evidence that the current global equities rally is not concentrated to a few megacap stocks.

Quality has the potential to benefit

Quality companies are those that display certain key attributes. According to the MSCI World Quality Index, these companies must be able to demonstrate high return on equity (ROE), stable year-over-year earnings and low financial leverage.

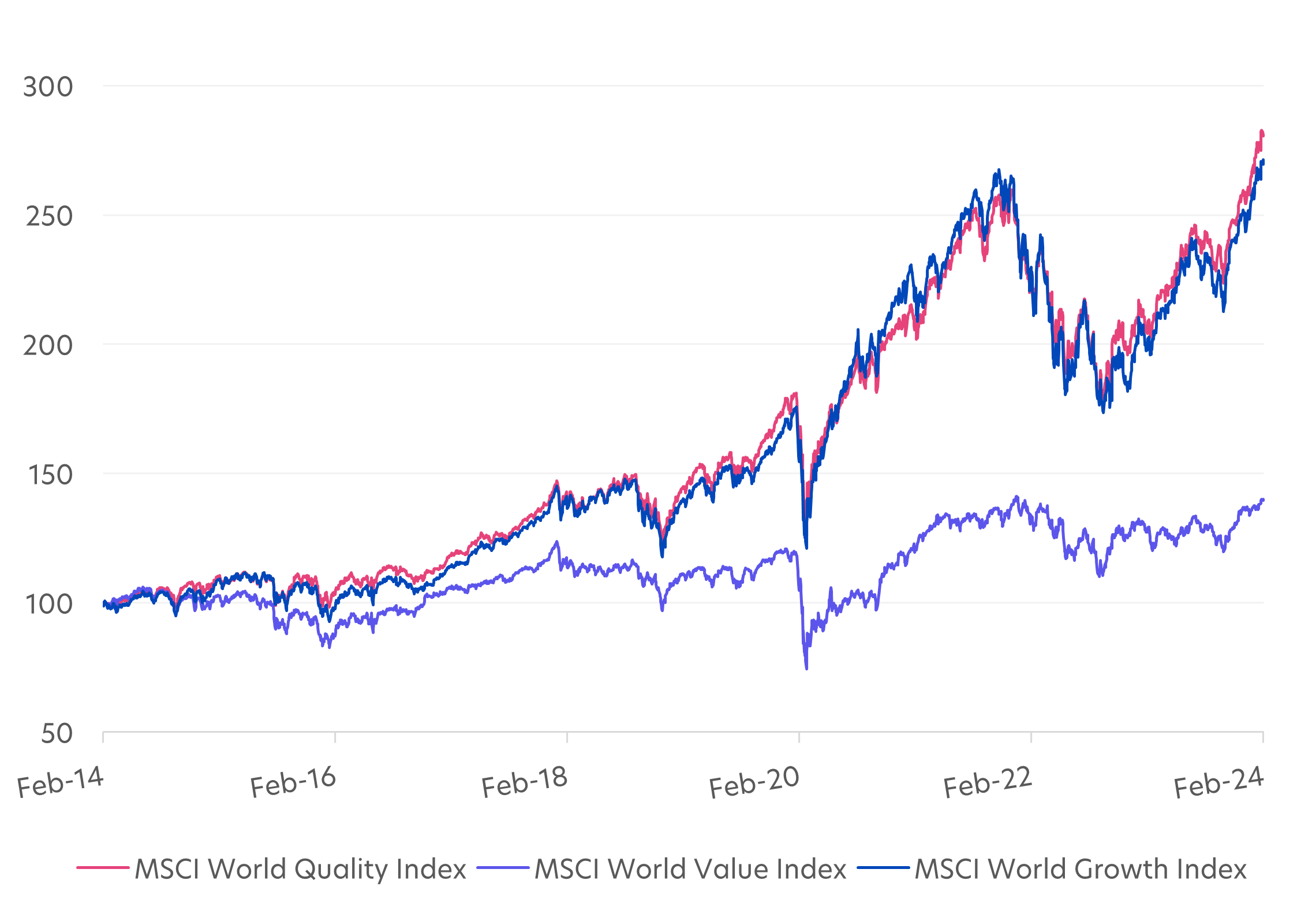

As such, the broadening trends within global equities represent a better environment for global quality investing. They offer investors the opportunity to make consistent gains in less expensively-valued stocks. And over the long term, these stocks have proven their ability to beat those that fall into the “value” and “growth” buckets.

Fig 2: Quality vs growth and value indices, Feb 2014 – Feb 2024

Source: Bloomberg/UOBAM as of 29 Feb 2024. All data in USD.

United Global Quality Growth Fund

What is the strategy?

The United Global Quality Growth Fund (the “Fund”) seeks to provide long-term total return by investing in high-quality global stocks.

Beyond the typical features of quality stocks, the Fund applies additional criteria to their “quality” assessment by focusing on “compounders” i.e. quality companies that also:

- Demonstrate high financial productivity

- Possess competitive advantages

- Reinvest in their business to drive future growth

Financial markets often undervalue these types of companies because they assume that their returns will fade over time. But quality companies with the above characteristics often grow and sustain their high returns for much longer than markets expect.

Which sectors are favoured?

Information Technology (28.5 percent) is the Fund’s largest sector allocation currently but these include stocks beyond the Magnificent Seven. The Fund is also avoiding frothy artificial intelligence (AI) names, given that the current exuberance surrounding AI has the potential to drive some stocks to unsustainable levels in the short term.

Instead of buying into the hype, the Fund seeks out financially productive tech companies with sustainable competitive advantages and reinvestment opportunities. These include names such as Microsoft, Alphabet, Taiwan Semiconductor Manufacturing Company (TSMC), ASML, and Adobe.

The Fund also has healthy exposure to financials, industrials and healthcare. These three sectors make up 50.8 percent of the Fund’s portfolio and stand to benefit from the broadening equity rally.

Fig 3: Fund top 10 holdings

| Company name | Weight (%) | Description | Sector |

| Microsoft | 5.39 | World’s largest computer software maker | Info Tech (IT) |

| Alphabet | 4.80 | Parent company of Google | Communication Services |

| Accenture | 3.83 | Global strategy and consulting services firm | IT |

| S&P Global | 3.83 | Global provider of financial intelligence solutions | Financials |

| Aon Global | 3.49 | Global provider of risk, retirement and health solutions | Financials |

| Visa | 3.44 | One of the world’s most recognised digital payment brands | Financials |

| Intuit | 3.23 | Global financial technology platform | IT |

| Iqvia Holdings | 3.18 | Global provider of analytics and clinical research services for life sciences industry | Healthcare |

| Amphenol Group | 3.07 | One of the world’s largest providers of sensor and antenna solutions | IT |

| Dollarama | 3.07 | Canada’s leading dollar store retail chain | Consumer Discretionary |

Source: UOBAM, as of 29 Feb 2024

Strong and consistent performance

This Fund is managed to resist extremes in volatility. For example, even in today’s rising market, unexpected upticks in inflation or a delay in the Fed’s rate-cutting cycle could spark market nervousness. The Fund’s focus on compounders helps it weather these periods of market volatility.

As a result, the Fund has managed to chalk up solid performances over both the short and long term. Over the past one and three years, the Fund’s underlying strategy, Lazard Global Quality Growth, has delivered an annualised return of 22.8 and 7.2 percent3 compared to the broad global equities return of 23.2 and 6.8 percent. Over the past 10 years, the strategy’s annualised return has been 10.7 percent4, outperforming the broad global equities return of 8.4 percent.

Fund details

| United Global Quality Fund, as of 29 Feb 2024 | |

| Fund objective | To provide long-term total returns by investing in equity and equity-related securities of companies listed and traded on stock exchanges globally. |

| Sub Manager | Lazard Asset Management (as of 1 September 2023) |

| Top 5 geographical allocation (%) | United States: 56.0 Ireland: 7.3 Japan: 7.1 Netherlands: 5.9 Canada: 4.3 |

| Fund Classes Available3 | Class SGD Acc, Class SGD Acc (Hedged); Class USD Acc, Class USD Dist; Class SGD Dist Class SGD Dist (Hedged); Class B SGD Acc; Class C SGD Acc (Hedged) |

| Subscription Mode | Class SGD: Cash & SRS Class USD and Class B: Cash Class C: CPF-OA |

| Subscription Fee | Class SGD, Class USD and Class B: Currently up to 5%, maximum 5% Class C: Currently none, maximum none |

| Management fee | Class SGD and Class USD: Currently 1.5% p.a., maximum 2.5% p.a. Class B and Class C: Currently 1.0% p.a., maximum 2.5% p.a. |

1Source: 9 April 2024, GRANOLAS: GSK, Roche, ASML, Nestlé, Novartis, Novo Nordisk, L'Oréal, LVMH, AstraZeneca, SAP and Sanofi

2Source: 9 April 2024, Seven Samurai: Screen Holdings, Advantest, Disco, Tokyo Electron, Toyota Motor, Subaru and Mitsubishi Corp

3Source: Lazard, as of 29 Feb 2024, in USD terms. Performance is presented in a gross fee basis. Past performance is not an indicator of future results.

4Source: Lazard, as of 29 Feb 2024, in USD terms. Performance is presented in a gross fee basis. Past performance is not an indicator of future results.

| If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider: United Global Quality Growth Fund You may wish to seek advice from a financial adviser before making a commitment to invest in the above fund, and in the event that you choose not to do so, you should consider carefully whether the fund is suitable for you. |

MSCI Data are exclusive property of MSCI. MSCI Data are provided “as is”, MSCI bears no liability for or in connection with MSCI Data. MSCI full disclaimer here.

This document is for general information only. It does not constitute an offer or solicitation to deal in units in the Fund (“Units”) or investment advice or recommendation and was prepared without regard to the specific objectives, financial situation or needs of any particular person who may receive it. The information is based on certain assumptions, information and conditions available as at the date of this document and may be subject to change at any time without notice. No representation or promise as to the performance of the Fund or the return on your investment is made. Past performance of the Fund or UOB Asset Management Ltd (“UOBAM”) and any past performance, prediction, projection or forecast of the economic trends or securities market are not necessarily indicative of the future or likely performance of the Fund or UOBAM. The value of Units and the income from them, if any, may fall as well as rise, and is likely to have high volatility due to the investment policies and/or portfolio management techniques employed by the Fund. Investments in Units involve risks, including the possible loss of the principal amount invested, and are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited (“UOB”), UOBAM, or any of their subsidiary, associate or affiliate (“UOB Group”) or distributors of the Fund. The Fund may use or invest in financial derivative instruments and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund’s prospectus. The UOB Group may have interests in the Units and may also perform or seek to perform brokering and other investment or securities-related services for the Fund. Investors should read the Fund’s prospectus, which is available and may be obtained from UOBAM or any of its appointed agents or distributors, before investing. You may wish to seek advice from a financial adviser before making a commitment to invest in any Units, and in the event that you choose not to do so, you should consider carefully whether the Fund is suitable for you. Applications for Units must be made on the application forms accompanying the Fund’s prospectus.

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd. Company Reg. No. 198600120Z