With economic growth in Asia returning to pre-Covid levels, Asian high yield bonds are a potential source of inflation-beating income and positive returns

As financial markets look forward to interest rate cuts later this year, corporate bonds offer the potential for capital appreciation and the ability to lock in yields at current high levels. However, investment grade (IG) corporate bonds have already rallied significantly and are looking less attractively valued.

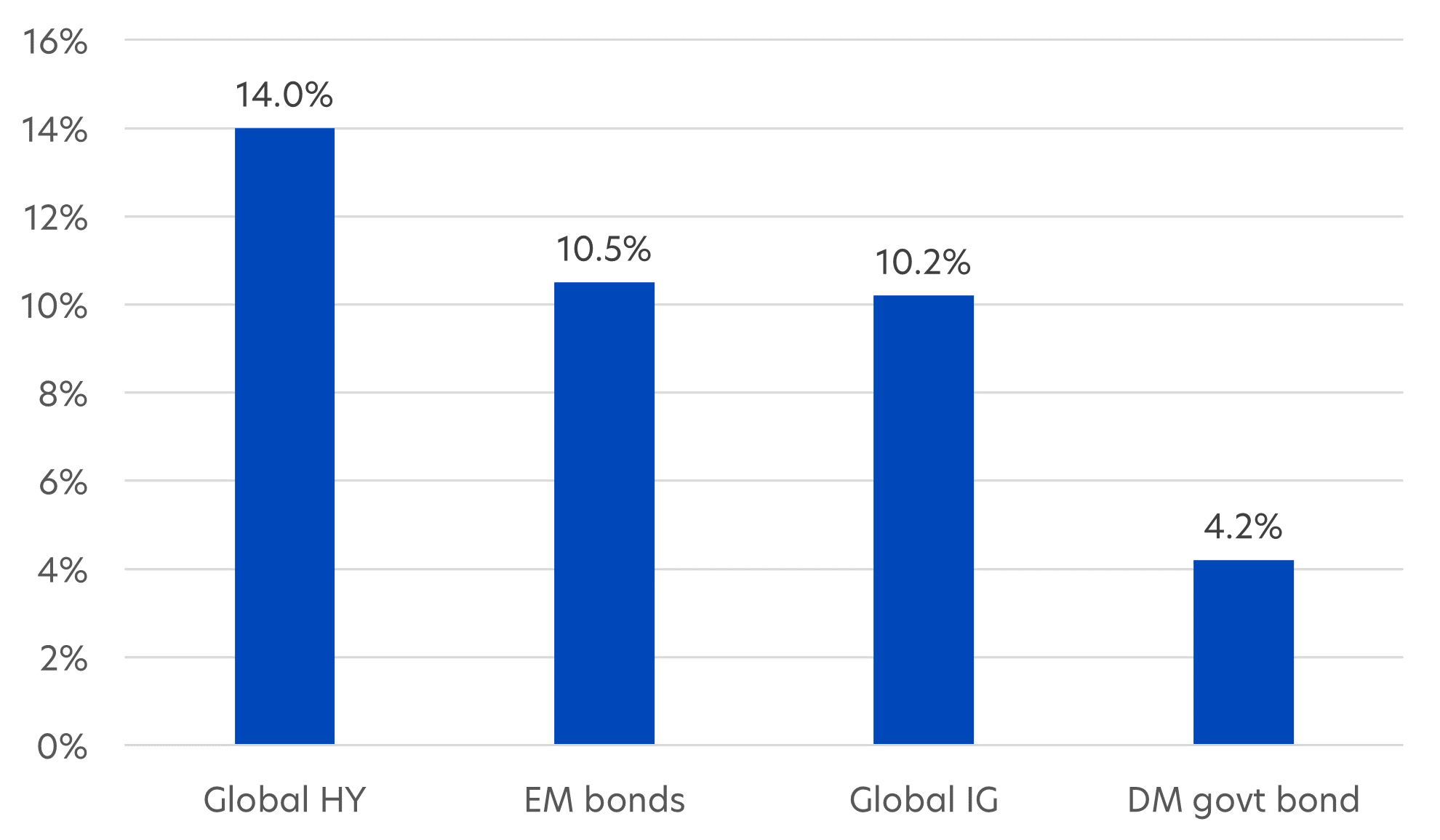

As a result, interest is shifting to high yield corporate bonds. Investors currently appear to favour high yield (HY) bonds given that that the income offered is the highest they have been in years and in most cases, is more than double that of fixed deposits. On a total return basis, high yield bonds are also beating other bond asset classes such as government and IG bonds.

Fig 1: 2023 total returns across different bond segments

Source: BlackRock, LSEG Datastream, as of 31 Dec 2023. Global HY: Bloomberg Barclays Global High Yield Index, EM bonds: JP Morgan Emerging Market Bond Index (EMBI) Global Composite, Global IG: Barclays Global Corporate Credit Index, DM govt bond: Bloomberg Barclays Global Treasury Index

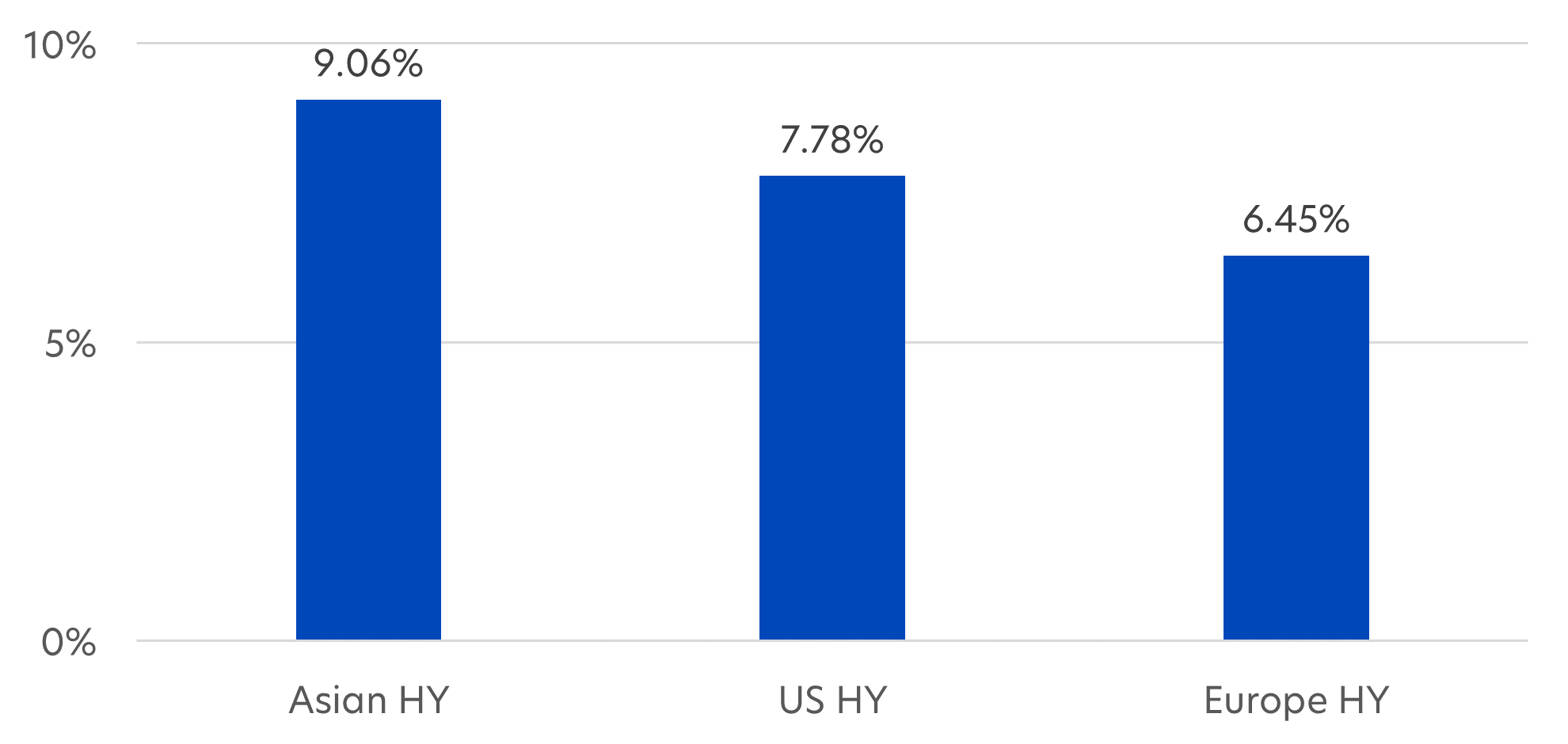

Asian HYs offer higher income than equivalent US/European peers

Asian HY bonds stand out within the HY space because of the region’s growth prospects. According to the IMF, Asia is projected to grow 4.5 percent in 2024, well above the global average of 3.1 percent1. In addition, Asian corporates are showing strong credit fundamentals. Yet for the same credit quality, Asian HY bonds typically offer higher yields than their US and Europe counterparts.

Fig 2: Weighted average yield to maturities of Asian, US and Europe HY bonds

Source: iShares, as of 15 Mar 2024. Asian HY: iShares USD Asia High Yield Bond ETF, US HY: iShares iBoxx $ High Yield Corporate Bond ETF, Europe HY: iShares € High Yield Corp Bond UCITS ETF

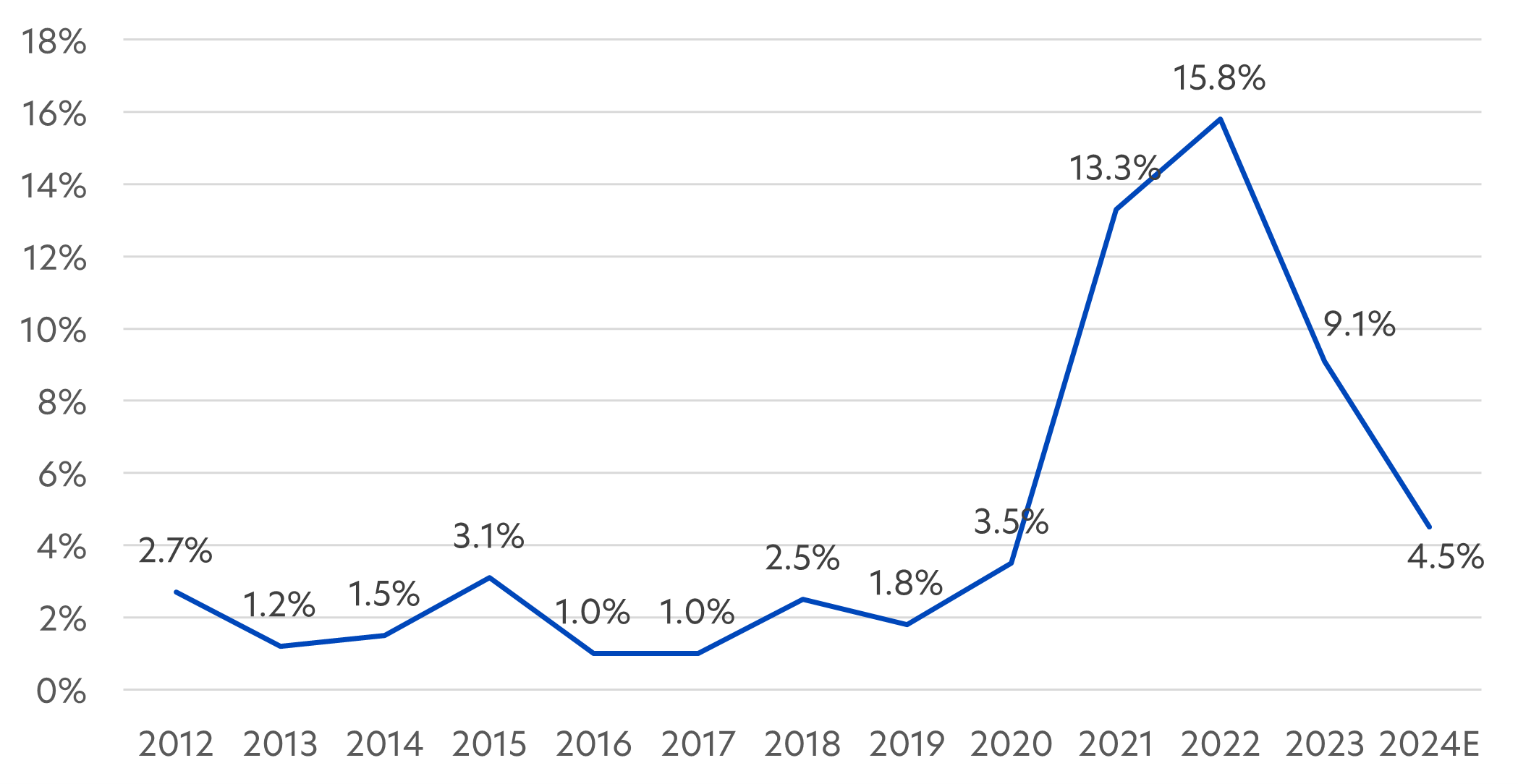

Asian HY default risks have reduced

High yield bonds are of course subject to higher default risks than IG bonds. In Asia, HY bond defaults spiked in 2021 and 2022 due to well-publicised defaults by Chinese property developers. Since then, the default rate has become more manageable. As shown below, the Asian HY default rate has decelerated dramatically and is expected to be down to 4.5 percent in 2024. This is still higher than the long term average and we would expect the rate to fall further, given strong credit fundamentals and Asia’s resilient economic growth.

Fig 3: Asian HY default rate, 2012 – 2024E

Source: JPMorgan, as of 31 Dec 2023

Aside from higher demand, the inflation picture across Asia could also help prop up HY bond prices in 2024. With inflation mostly under control, Asian central banks are in a good position to cut interest rates in the coming months, and could run ahead of the US rate-cutting timetable. Rate cuts also help ease some financing pressure on HY issuers, and serve as another positive catalyst for Asian HY bond prices.

The United Asian High Yield Bond Fund2

More defensively positioned

The United Asian High Yield Bond Fund (“the Fund”) seeks to achieve a total return consisting of high income and capital appreciation by investing primarily in HY bonds issued by Asian entities

Reflecting its defensive positioning, about 10 percent of the portfolio is invested in investment grade bonds and currently, nearly half is invested in better-rated high yield bonds, namely those rated BB. Overall, the Fund has an average credit rating of BB-, which falls within the higher end of the HY quality spectrum.

To further mitigate duration risks, 60 percent of the Fund is held in HY bonds with durations of 3 years or less. Short-duration HY bonds typically have a higher certainty of repayment. Since they are maturing soon, there is less risk of unforeseen events.

Attractive income potential

The Fund currently provides an annualised dividend yield of 7.0 percent, paid out monthly3 (Class SGD Dist).

To achieve these stable income payouts, the Fund’s portfolio manager carefully selects individual bonds from companies or industries that have solid fundamentals and good access to stable funding. This is reflected in the Fund’s top three sector allocations – Financials, Consumer Discretionary and Utilities – which comprise 61 percent of its portfolio. As a result, the Fund’s top holdings include bonds from financial companies like Bank of East Asia, casino companies such as Wynn Macau, and utility firms like Continuum Energy Levante.

Cautious on Chinese property

The fund is underweight in Chinese HY property issuers. This meant that in January 2024, the Fund saw a slight underperformance (2.9 percent versus benchmark returns of 4.0 percent) due to a rise in the price of HY bonds issued by Chinese property developers. Although sentiment appears to be improving, we remain cautious about the fundamentals within this sector, and will remain vigilant with regards to the potential opportunities and risks.

Fund details

| United Asian High Yield Bond Fund, as of 31 Jan 2024 | |

| Fund objective | The United Asian High Yield Bond Fund seeks to achieve a total return consisting of high income and capital appreciation by investing primarily in high yield fixed income or debt securities (including money market instruments) issued by Asian corporations, financial institutions, governments and their agencies. |

| Top 5 geographical allocation (%) | Hong Kong: 18.98 China: 13.19 India: 12.18 Singapore: 9.24 Macau: 7.54 |

| Top 5 sector allocation (%) | Financials: 30.50 Consumer Discretionary: 18.58 Utilities: 11.82 Energy: 8.38 Real Estate: 6.88 |

| Fund classes available | Class A SGD Acc Class A SGD Acc (Hedged) Class SGD Dist Class A SGD Dist (Hedged) |

| Management fee | Class A SGD Acc, Class A SGD Acc (Hedged), Class SGD Dist, Class A SGD Dist (Hedged): Currently 1.25% p.a.; maximum 1.25% p.a. |

| Subscription fee | 3% |

| Minimum subscription / trading size | Class A SGD Acc, Class A SGD Acc (Hedged), Class SGD Dist, Class A SGD Dist (Hedged): S$1000(initial); S$500 (subsequent) |

1 Source: IMF, regional outlook update, 31 Jan 2024

2 Source: UOBAM, Morningstar. All data stated as of 31 Jan 2024

3 Distributions (in SGD) are not guaranteed. Distributions may be made out of income, capital gains and/or capital. This relates to the disclosed distribution policy as set out in the Fund’s prospectus

| If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider: United Asian High Yield Bond Fund You may wish to seek advice from a financial adviser before making a commitment to invest in the above fund, and in the event that you choose not to do so, you should consider carefully whether the fund is suitable for you. |

Distributions will be made in respect of the Distribution Classes of the Fund. Distributions are based on the NAV per unit of the relevant Distribution Class as at the last business day of the month. The making of distributions is at the absolute discretion of UOBAM and that distributions are not guaranteed. The making of any distribution shall not be taken to imply that further distributions will be made. The Managers reserve the right to vary the frequency and/or amount of distributions. Distributions from a fund may be made out of income and/or capital gains and (if income and/or capital gains are insufficient) out of capital. Investors should also note that the declaration and/or payment of distributions (whether out of capital or otherwise) may have the effect of lowering the net asset value (NAV) of the relevant fund. Moreover, distributions out of capital may amount to a return of part of your original investment and may result in reduced future returns. Please refer to the Fund’s prospectus for more information.

This document is for general information only. It does not constitute an offer or solicitation to deal in units in the Fund (“Units”) or investment advice or recommendation and was prepared without regard to the specific objectives, financial situation or needs of any particular person who may receive it. The information is based on certain assumptions, information, and conditions available as at the date of this document and may be subject to change at any time without notice. No representation or promise as to the performance of the Fund or the return on your investment is made. Past performance of the Fund or UOB Asset Management Ltd (“UOBAM”) and any past performance, prediction, projection or forecast of the economic trends or securities market are not necessarily indicative of the future or likely performance of the Fund or UOBAM. The value of Units and the income from them, if any, may fall as well as rise, and is likely to have high volatility due to the investment policies and/or portfolio management techniques employed by the Fund. Investments in Units involve risks, including the possible loss of the principal amount invested, and are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited (“UOB”), UOBAM, or any of their subsidiary, associate, or affiliate (“UOB Group”) or distributors of the Fund. The Fund may use or invest in financial derivative instruments, and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund’s prospectus. The UOB Group may have interests in the Units and may also perform or seek to perform brokering and other investment or securities-related services for the Fund. Investors should read the Fund’s prospectus, which is available and may be obtained from UOBAM or any of its appointed agents or distributors, before investing. You may wish to seek advice from a financial adviser before making a commitment to invest in any Units, and in the event that you choose not to do so, you should consider carefully whether the Fund is suitable for you. Applications for Units must be made on the application forms accompanying the Fund’s prospectus.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd. Company Reg. No. 198600120Z