Key highlights

- Sophisticated investment technology combined with professional acumen, previously available exclusively to institutions and wealthy investors, is now accessible to all investors with as little as S$1 to invest.

- To serve smaller investors well, we think a robo-adviser needs to have five elements: Be able to produce and manage highly tailored portfolios; blend sophisticated technology with the expertise of experienced professionals; be transparent; be low-cost; and simplified for all investors.

- In Asia, 65% of investors say technology has made investing more efficient and effective.

Large institutions such as pension funds and sovereign wealth funds have for decades benefited from access to a blend of top investment professionals and sophisticated algorithms. Using their investment expertise, these professionals gain an insight into the institutions’ risk profiles, investment goals and time horizon. Based on this understanding, a personalised portfolio is designed and tested with the aid of technology. Throughout the lifetime of the portfolio, the investment professionals continue to track, rebalance and execute the rebalancing using both technology and robust investment processes. Technology’s role is to automate some of these steps, leading to higher accuracy and consistency, and leaving the investment professionals with greater bandwidth to concentrate on value-added tasks such as in-depth research and analysis.

Now, this institutional-grade combination of tech and professional acumen is easily accessible to all individual investors with as little as S$1 to invest.

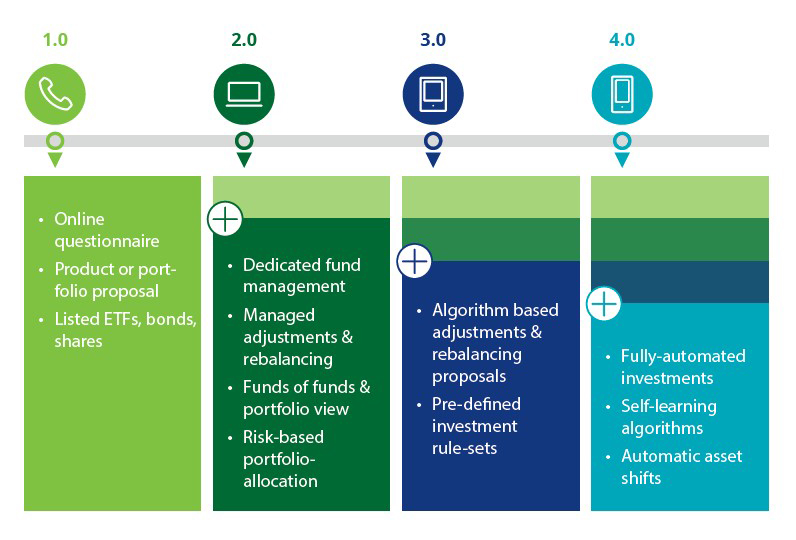

UOB Asset Management (UOBAM) believes that all investors, including those starting with just a few dollars, deserve personalised portfolios that receive ongoing attention by seasoned investment professionals, all done at a low cost and high transparency. This approach might be called digital wealth management 3.5, to borrow a term from the professional services firm, Deloitte. UOBAM Invest, our robo-adviser, has the 3.0 features of algorithm-based adjustments and rebalancing with pre-defined investment parameters as well as the 4.0 features of automatic asset shifts and fully automated investments.

Figure 1: Evolution of Digital Wealth Management from 1.0 to 4.0

Source: Deloitte, ‘The expansion of Robo-Advisory in Wealth Management’, August 2016.

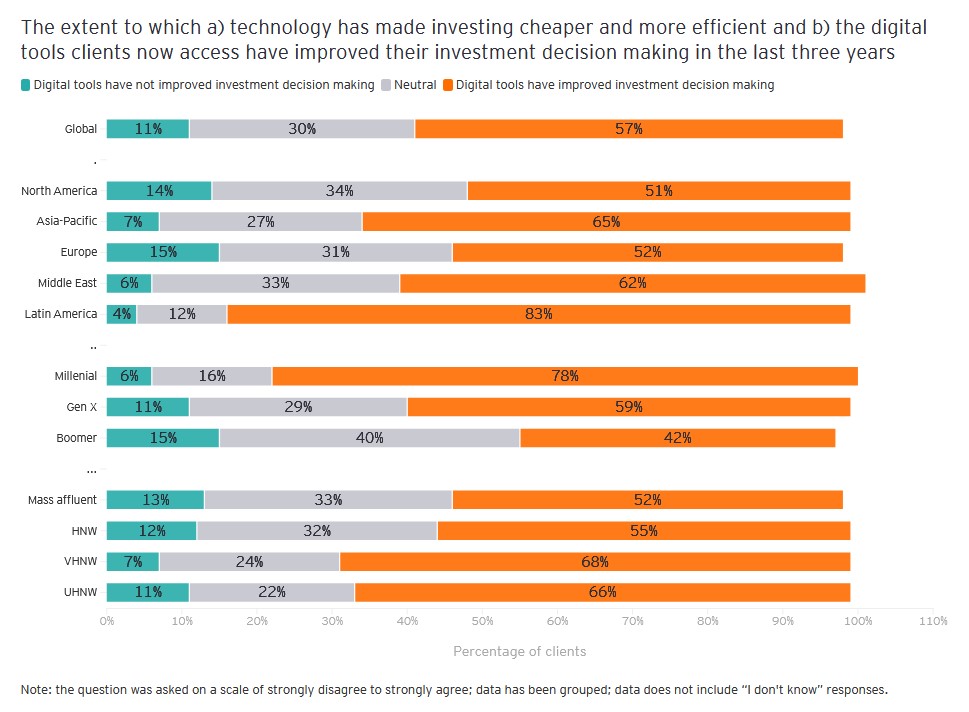

Multiple studies over the years have shown that technology has made investing more effective and efficient for individuals. A survey by Ernst & Young asked 2,500 people across the world whether digital tools helped them make better investment decisions. The survey results were published in the 2021 EY Global Wealth Research Report: Where Will Wealth Take Clients Next? 57% of global respondents said yes; in the Asia Pacific, 65%; and among mass affluent investors, 52%.

Interestingly, the proportion of very high networth and ultra high networth individuals saying the use of technology had improved their investment decisions were higher at 68% and 66% respectively. This could be due to several reasons: First, it might reflect the varying quality of technology available to the various wealth groups in the past. Currently, even investors with small investment amounts can have access to sophisticated robo-advisers. Secondly, there is usually a greater variety of investment choices available to wealthier investors which makes them feel that their portfolios are better optimised. Such niche investments may however not suit all investors for various reasons: illiquidity and leverage add cost and complexity, which make them riskier.

Figure 2: Technology’s Usefulness in Investment Decisions

Source: Ernst & Young, ‘2021 EY Global Wealth Research Report: Where Will Wealth Take Clients Next’, April 2021.

Note: HNW – High Net Worth; VHNW – Very High Net Worth; UHNW – Ultra High Net Worth.

To serve smaller investors well, we think a robo-adviser needs to have five elements: Be able to produce and manage highly tailored portfolios; blend sophisticated technology with the expertise of experienced professionals; be transparent; be low-cost; and simplified for all investors.

Highly personalised portfolios

In the past, automated investing generally meant getting a pre-determined portfolio based on your risk profile, and everyone with similar risk profiles ended up with the same portfolio which might not be adjusted adequately to keep up with market fluctuations and with changes in your circumstances and goals. We believe that investors deserve better and technology is making it possible to have a more personalised portfolio. Just like how no two individuals are exactly the same, investment portfolios should differ as well.

With UOBAM Invest, your investment journey begins with an insight into not just your risk tolerance but also your investment goals, the amount of time you have to reach that goal (called the investment horizon) and the amount of contributions you can make in the future.

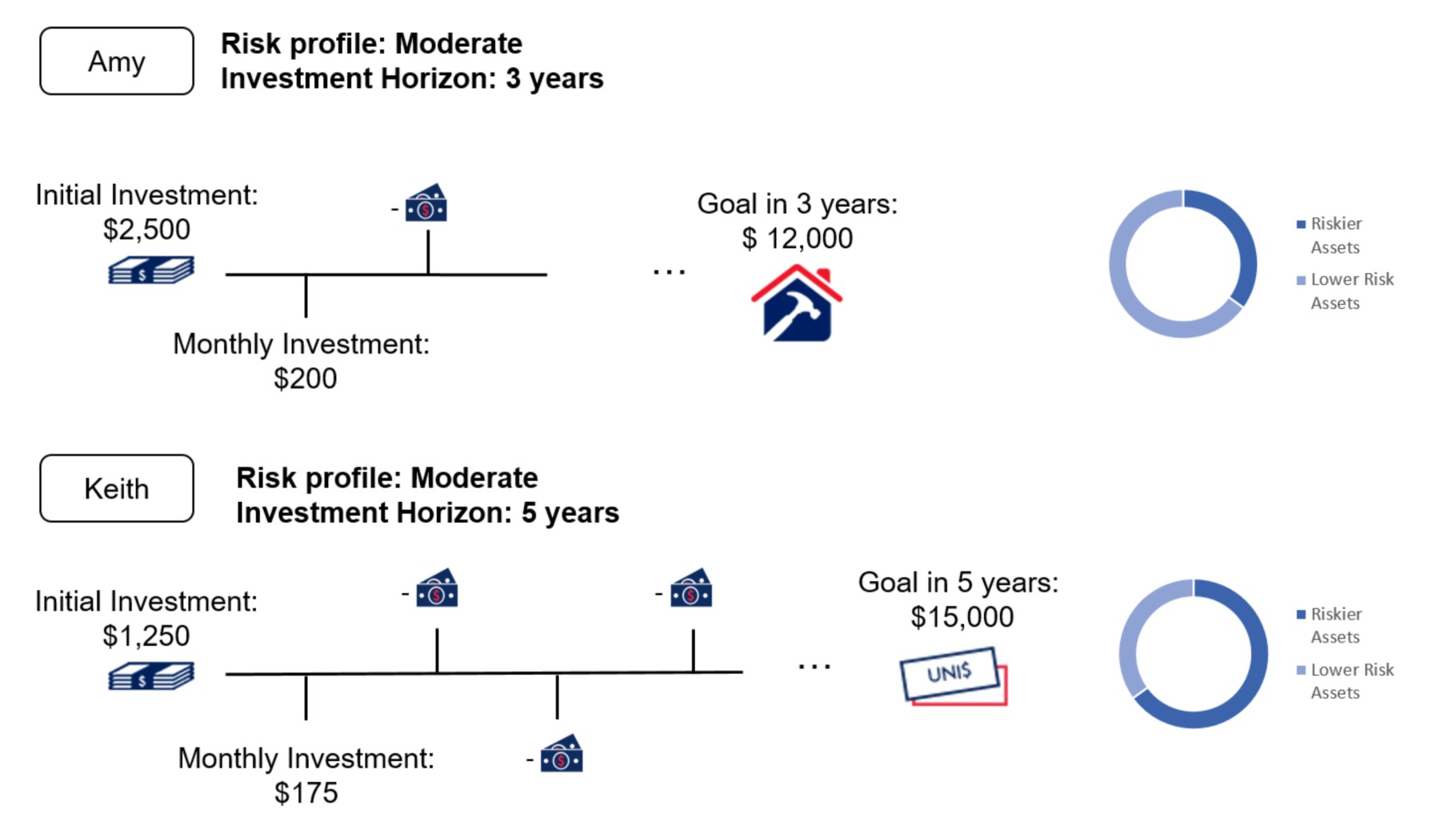

Let’s take Amy and Keith as examples. Both have a moderate risk profile but Amy’s investment horizon is three years while Keith’s is five years. This means that Keith’s portfolio can have slightly riskier assets because there is more time for the fluctuations in returns to smoothen out.

Amy’s goal is to have $12,000 in three years time for her home renovation and she is starting her portfolio with $2,500, along with monthly contributions of $200. Keith’s goal is to have $15,000 in five years time for his son’s university expenses and he is starting the portfolio with $1,250, with a plan to contribute $175 every month.

Source: UOBAM, September 2021.

Note: For illustrative purposes only.

Given these differences, Amy’s and Keith’s portfolios will end up with rather different allocations although they both have a moderate risk profile. Should Amy’s or Keith’s goals, horizon or ability to make regular contributions change in the future, they can adjust them and their portfolios will be reallocated accordingly.

Even if Amy and Keith do not experience any changes in their circumstances or goals, their portfolios will be adjusted quarterly because the markets fluctuate and their portfolios need to be rebalanced to stay true to their risk level. For example, Keith’s portfolio is supposed to have 5% global equities, but over the course of the quarter global equities were bullish and rose to 6.5% of the portfolio. It will be rebalanced back to 5%. Rebalancing also occurs whenever Amy and Keith make contributions or withdraw funds from their portfolios.

Toward the end of Amy’s and Keith’s investment horizon, UOBAM Invest systematically shifts their portfolios into less risky assets to protect the gains already accumulated and to increase the chances of their portfolios meeting their investment goals. This is called the glide path and the process is unique among robo-advisers currently available.

The high level of personalisation improves the chances of meeting each investor’s unique needs.

Combining sophisticated technology with ongoing professional attention

Robo-investing does not mean letting the algorithm do its work with no human intervention. Seasoned investment, risk, product and operations professionals are involved at every step at UOBAM Invest: They select suitable asset classes; curate appropriate funds; input the firm’s proprietary assessment of returns, risks, correlations and other factors (known as capital market assumptions) into the algorithm; and implement investment parameters to ensure that the personalised portfolios are in line with investors’ risk profiles and goals.

To ensure that investors’ portfolios stay true to their aims and risk levels even when the markets fluctuate, much research and strategy work is done on a regular basis by UOBAM’s investment and product professionals. The investment team comprising of strategists, portfolio managers and analysts responsible for the full range of asset classes come together every quarter to determine the investment strategy for the quarter.

This strategy is then used by the algorithm to automatically rebalance investors’ portfolios. For example, Amy’s portfolio currently has a 16% allocation to global corporate bonds and the investment strategy calls for a higher weight of 18% for her risk profile and horizon. The algorithm will automatically adjust her portfolio to hold 18% global corporate bonds.

This dynamic, high-touch-high-tech combination potentially optimises investment performance and lowers risks. In the one year since its launch1, the UOBAM Invest portfolios ranging from “very conservative” to “very aggressive” gained 6.6% to 29.5%2, beating inhouse projections of 3.8% to 8.3%3.

Low cost, low risk and high transparency

To avoid putting too many eggs into one basket, most portfolios will have five to seven exchange-traded funds (ETFs) in order to spread out the risks. For example, Amy’s portfolio comprises mostly fixed income investments that are spread across government, corporate and high-yield bonds, as well as a smaller allocation to equities to diversify the risks. Only very aggressive risk profiles will have close to 100% allocation to equities using just a few ETFs.

An ETF is a basket of assets mimicking the allocation and returns of a bond or stock index. ETFs are listed on major stock exchanges such as the New York Stock Exchange. UOBAM Invest uses ETFs to build portfolios because they are highly liquid; they trade throughout the day and in large volumes; they are highly transparent, with all the holdings and weights publicly available; and they charge lower fees than active unit trusts. In the interest of transparency, UOBAM Invest’s fees are also clearly displayed and made publicly available.

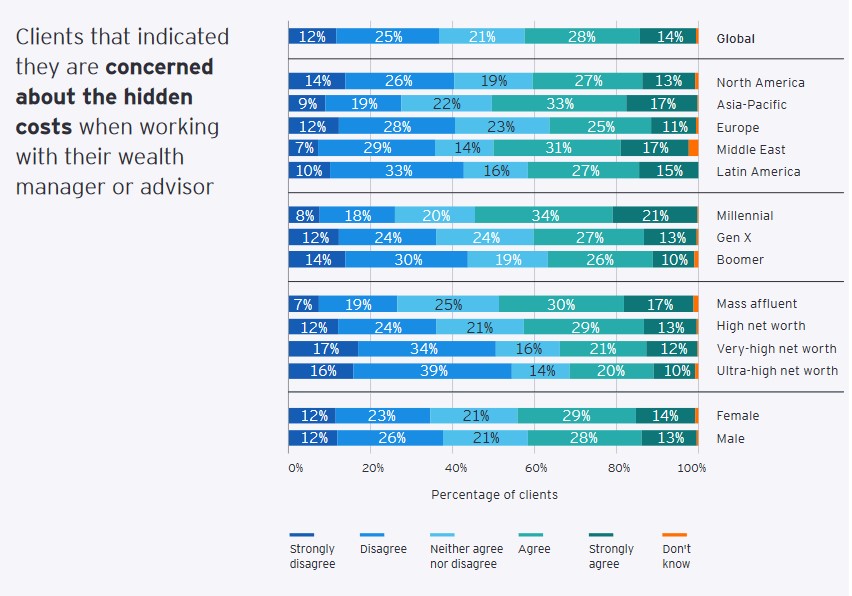

Investors are concerned about costs, especially hidden costs, as they can reduce net profits. A study by Ernst & Young4 shows that Asia-Pacific, millennial and mass-affluent investors are among the most concerned about hidden costs. Among Asia-Pacific investors, 50% strongly agree or agree that hidden costs are a concern, higher than 42% globally. When it comes to mass affluent investors, 47% are concerned vs 42% for the high networth and 33% among very high networth individuals.

Figure 3: Investors indicating concern over hidden costs of wealth management or advisory

Source: Ernst & Young, ‘2021 EY Global Wealth Research report: Where will Wealth Take Clients Next?’, April 2021.

With all the costs kept low, as well as broken down and made readily available, clients of UOBAM Invest have greater certainty and are less likely to get unpleasant surprises in their net investment returns.

Simplifying complexity

Institutional-grade, low-cost investing is only helpful if it’s easy to use. UOBAM Invest has made it as easy as downloading an app and taking three simple steps: Plan, save, track. Planning involves setting the investment horizon and goal or multiple goals, such as buying a home, retirement, children’s education or wealth accumulation. Saving involves making regular contributions or putting up a lump sum. The tracking tools enable investors to stay on track to meet their goals. For example, an investor can raise the probability of achieving their aims by increasing their regular contributions, lengthening the horizon or changing the risk level.

UOBAM Invest’s professionals and algorithm do the heavy-lifting such as navigating the markets and large pool of investment products. Although ETFs are transparent, navigating the increasing number and complexity of ETFs available requires some expertise. There are 8,821 ETFs with 17,920 listings worldwide as of end-May 2021, according to ETFGI4, a research consultancy focusing on ETFs.

A growing number of ETFs are known as synthetics in that they do not actually invest directly into the assets represented by the index – but instead use derivatives to gain a similar exposure. Using derivatives increases risks significantly as they can be costlier to trade than direct assets and there is greater uncertainty on how well they can replicate the returns of the index (called tracking error). UOBAM Invest does not use synthetic ETFs.

Some ETFs are inverse, meaning they aim to make profits when markets fall, which requires the uncanny ability to time the markets in order to make profits. Some inverse ETFs add on leverage, which multiplies the risks. According to ETFGI5, there were 864 leveraged and inverse products listed globally, with US$106.7 billion in assets, as of end-May 2021. UOBAM Invest does not invest into inverse or leveraged ETFs.

Even among plain-vanilla ETFs, there are subtler considerations such as liquidity, track record and reputation of the issuer, tracking error, proper diversification, among other evaluations undertaken by UOBAM Invest to select ETFs.

Building upon a strong base

The better-than-expected performance of the UOBAM Invest portfolios over the past one year shows that all investors can benefit from an institutional-grade blend of technology and investment acumen. We consider this to be just the foundation for continued improvements and leadership in the future.

Find out more about UOBAM Invest

1UOBAM Invest was launched for retail customers in July 2020.

2Source: UOBAM. Performance from 31 July 2020 to 30 July 2021 in SGD terms, on a Net Asset Value basis, before fees.

3Projected annual portfolio return based on UOBAM’s in-house proprietary market assumptions and the historical performance of various asset classes. Past performance is not a guarantee of future return and figures stated above should only be used as a reference.

4‘ETFGI reports assets in the global ETFs and ETPs industry broke through the US$ 9 trillion milestone at the end of May 2021.’ June 2021.

5ETFGI press release titled "ETFGI reports assets invested in Leveraged and Inverse ETFs and ETPs listed globally reached a record US$106.7 billion at the end of May 2021.’ June 2021.

This document is for your general information only. It does not constitute investment advice, recommendation or an offer or solicitation to deal in Exchange Traded Funds (“ETFs”) or in units in any Unit Trusts (“Unit Trusts”, ETFs and Unit Trusts shall together be referred to as “Fund(s)”) nor does it constitute any offer to take part in any particular trading or investment strategy. This document was prepared without regard to the specific objectives, financial situation or needs of any particular person who may receive it. The information is based on certain assumptions, information and conditions available as at the date of this document and may be subject to change at any time without notice. If any information herein becomes inaccurate or out of date, we are not obliged to update it. No representation or promise as to the performance of the Fund or the return on your investment is made. Past performance of any Fund or UOB Asset Management Ltd (“UOBAM”) and any past performance, prediction, projection or forecast of the economic trends or securities market are not necessarily indicative of the future or likely performance of the Fund or UOBAM. The value of any Fund and the income from them, if any, may fall as well as rise, and may have high volatility due to the investment policies and/or portfolio management techniques employed by the Fund. Investments in any Fund involve risks, including the possible loss of the principal amount invested, and are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited (“UOB”), UOBAM, or any of their subsidiary, associate or affiliate (“UOB Group”) or distributors of the Fund. Market conditions may limit the ability of the platform to trade and investments in non-Singapore markets may be subject to exchange rate fluctuations. The Fund may use or invest in financial derivative instruments and you should be aware of the risks associated with investments in financial derivative instruments which are described in the respective Fund’s prospectus. The UOB Group may have interests in the Funds and may also perform or seek to perform brokering and other investment or securities-related services for the Fund. Investors should read the Fund’s prospectus, which is available and may be obtained from UOBAM or any of its appointed agents or distributors, before investing. You may wish to seek advice from a financial adviser before making a commitment to invest in any Funds, and in the event that you choose not to do so, you should consider carefully whether the Fund is suitable for you. Any reference to any specific country, financial product or asset class is used for illustration or information purposes only and you should not rely on it for any purpose. We will not be responsible for any loss or damage arising directly or indirectly in connection with, or as a result of, any person acting on any information provided in this document. Services offered by UOBAM Invest are subject to the UOBAM Invest Terms and Conditions.

UOB Asset Management Ltd Co. Reg. No. 198600120Z