Key Highlights

- Moderation of US inflation in July raises hopes that inflation has peaked

- Economic normalization is within sight, but unlikely in the short term

- In the meantime, range-bound markets point to opportunities for stock and bond selection

Latest CPI fuel hopes that inflation has peaked

Very few monthly data announcements had been as eagerly anticipated as the US’s July consumer price index (CPI) results, released this week. But well before their release, market watchers were already firmly of the view that inflation was on its way down and recession was the new enemy.

This view took hold two months back and initiated a softening of commodity prices that has continued ever since. At their peak in early June, oil prices were nearly 60 percent above levels seen at the start of the year. Last week, they were only about 18 percent higher, with WTI crude down to around US$90 per barrel.

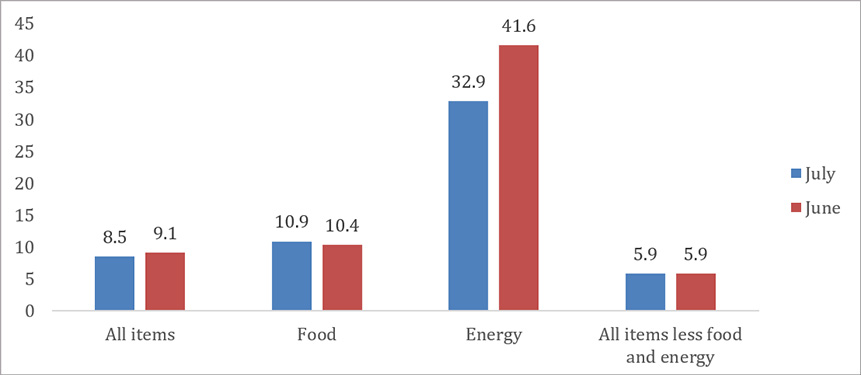

In a case of self-fulfilling prophecy, this drop in oil and gasoline prices did indeed enable a dip in the US’s latest inflation numbers. Consumer prices in July grew by 8.5 percent compared to a year ago, below the 40-year high of 9.1 percent registered in June, and leading to widespread hopes that the worst is now over.

Price growth stable across most economic sectors

As expected, the biggest drop in July’s overall inflation came from the slower growth in energy prices, including gasoline and natural gas. This drop helped to offset the slight increase in food and shelter prices. Over the next few months, these latter two economic sectors will be under much scrutiny for signs of easing.

Figure 1: 12-month percentage change. Consumer Price Index, June 2022 vs July 2022

Source: US Bureau of Labour Statistics/ UOBAM

Nevertheless these increases were small enough to limit the rise in the Index for All Items less Food and Energy to just 0.3 percent. This was a smaller increase than in the previous three months and helped prompt a healthy equity market reaction immediately following this CPI announcement. Major global equity indices, including in Europe and Asia, rallied to close the day up by 1 to 3 percent. Tech stocks were the big winners with Facebook parent, Meta up by close to 6.0 percent.

The Fed warns against over-optimism

Bond markets however were more subdued. Despite falling sharply for a few short hours, 10-year US Treasury yields eventually changed course and ended the day less than 1 basis point lower at 2.79 percent. Initial optimism was dampened by sobering remarks from a US Fed official that the Fed was “far, far away declaring victory” on inflation and that markets should expect the Fed’s rate hike programme to stay on course.

Nevertheless the debate appears to have shifted away from the possibility of a 75 basis point hike and towards a 50 basis point hike instead. High wages and high employment rates in the US point to the fact that inflationary pressures may have slightly subsided but not gone away. According to the US Bureau of Labor Statistics, non-farm employment increased by 528,000 in July, and the unemployment rate is now down to 3.5 percent. The former figure exceeds pre-pandemic levels, while the latter is back to pre-pandemic levels

Our “soft landing” base case points to range bound markets in the short term

Without a recalibration of interest rate rises going into 2023, a recession scenario for the US cannot be ruled out.

There are other worrying signs. Consumer confidence around the world continues to tumble, with the Conference Board reporting that its US Consumer Confidence Index had fallen for a third consecutive month in July. The index now stands at 95.7 (1985 = 100), down from the June figure of 98.4. The Board noted that consumer spending and economic growth would continue to face headwinds over the next six months based on current inflation and rate hike forecasts.

US GDP has also slowed for two consecutive quarters, and therefore meets the formal definition of a recession. But given the US’s labour market strength, most economist refer to the current situation as a “technical recession” and one unlike any other that the US has ever experienced.

UOBAM’s 3Q22 Quarterly Investment Strategy report also noted this disconnect, and concluded that the US economy is more likely to see a soft landing than a deep recession. Our base case is that inflation improvements can be expected and therefore a steep interest rate trajectory that could result in a hard landing will not be required. This means investment opportunities in both bonds and equities can already start to form.

However, a normalisation of the US economy may take several months, and in the meantime, markets are expected to trade within a broad range. Investors must therefore make the most of such markets by carefully selecting quality assets that have the potential for good returns over the long term.

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.

UOB Asset Management Ltd. Company Reg. No. 198600120Z