- China’s power cuts are likely to have a short term impact on the economy

- Companies’ production halts due to energy shortages look set to continue

- China likely to stay on course in its shift towards lower carbon emissions

China is currently in the grip of a power crunch, possibly the worst in a decade. Electricity rationing for households has been in place for several weeks, and appears to be getting worse. With residents in the North East starting to experience falling temperatures, calls for this rationing to be eased has become louder and more urgent.

Meanwhile, power shortages are hitting shops and factories in up to 20 provinces, including the country’s large industrial hubs. The result has been factory shutdowns, cuts in production and shorter working hours. Local officials in Guangdong, a major centre for manufacturing and shipping, said some companies there were down to opening just two or three days a week or only during off-peak times of 11.00pm to 8.00am. No surprise that steel, aluminium and cement factories – all highly energy-intensive– are among the hardest hit.

A combo of factors

The reasons for this power shortage can be divided into two buckets – short term and long term. At the short end is the post-Covid release of pent up export-led production demand, causing Chinese companies to ramp up their electricity usage. However coal, on which China is highly dependent for its power generation, is in short supply. This demand-supply imbalance can be seen in coal’s new price highs of around 1,100 yuan per tonne, an increase of 40 per cent since mid-August.

Ordinarily, market forces would quite quickly resolve this kind of imbalance, were it not for another, more structural factor: China’s new environmental policies. While not yet obliged to make absolute cuts in carbon emission due to its developing country status, President Xi Jinping aims to peak his country’s carbon emission before 2030 and to hit carbon net zero by 2060. This “3060” Carbon Neutrality Pledge, made in September 2020, put China on course for energy supply and consumption curbs.

One year later, this pledge is taking shape. On September 16, the National Development and Reform Commission (NDRC) issued detailed measures for limiting energy use. Under its "Dual Control Plan", energy intensity (ie energy consumption per unit of GDP) is to be reduced by 13.5 percent over the next five years, starting with a three percent cut in 2021. Energy consumption targets were also specified for each province, taking into account local conditions.

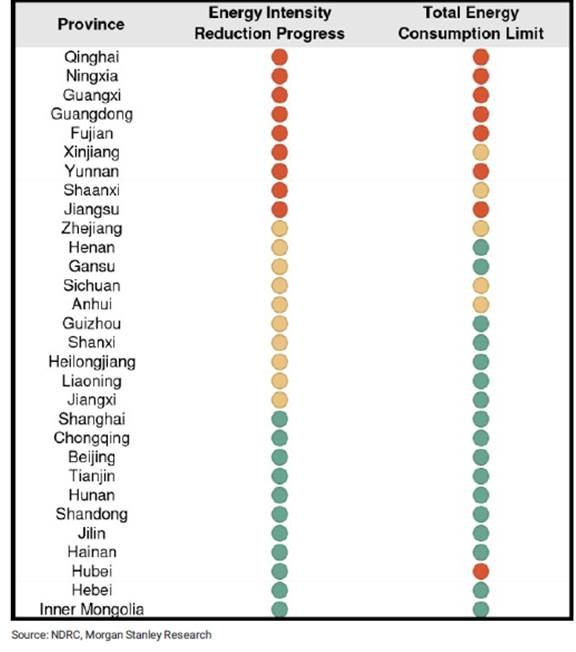

Figure 1: China’s energy intensity reduction progress, by province

But as the chart above shows, since the start of the year, some provinces have made better progress than others. Those that were way off-target in the first half of 2021 have had to take more drastic action in the second half, including energy production halts.

No Easy Answers

Over the mid to long term, energy-intensive China companies looking for consistent power supplies will have to juggle difficult options. While some may wish to switch to less carbon-emitting energy sources like natural gas, there is already a global shortage due to high demand, causing gas prices to skyrocket.

But reverting back to coal has its own problems. More than 90 percent of China’s coal is mined locally but output has become problematic. Older mines are no longer able to produce enough coal to meet demand, while production caps now in place prevent newer mines from meeting their full capacity. A law increasing the penalties for coal capacity and safety violations, was passed in March and seems to have added to the slowdown.

Without the ability to rely on local production, some companies are looking instead to imported coal. Once again, this option comes with its own roadblocks. China is having to lock horns with Europe and India to secure coal supplies amid low global stockpiles, while a political and trade dispute with Australia has caused that tap to run dry. Meanwhile coal-exporters around the world are finding it harder to secure funding given growing ESG mandates. Clearly whether or not China companies can find enough coal to meet their needs this winter, energy shortage will continue be a problem for winters to come.

Short Term Manufacturing Pain

So how will these power shortages affect China’s economy? Last week, a few analysts announced that they would be revising their full year China GDP forecasts by 0.5 to one percent. Others are still in a wait-and-see mode.

As highlighted in our previous strategy papers, we have recently downgraded our rating for China from neutral to negative. Our investment team believes that domestic regulatory policies, including those relating to China’s shift towards greener energy sources, will be a near-term overhang on both China’s economic growth as well as China companies’ profitability.

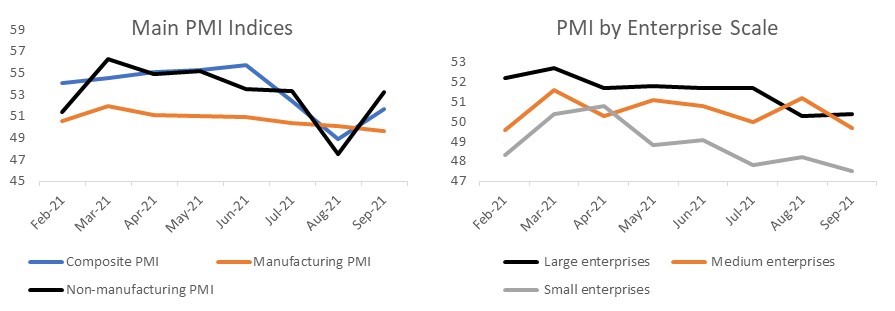

Figure 2: China’s PMI indices: Feb – Sep 2021

Source: Bloomberg

However, we note that the economic picture in China is by no means a uniform one. For example, while production activity within the manufacturing sector has been hurt by the energy shortages, non-manufacturing sactivity jumped 5.7 points in September, supported by a strong rebound in transportation, logistics, hotel and catering.

It is also interesting to note that even within the manufacturing sector, large enterprises were able to continue to expand its activity in the midst of the September crunch. On the other hand, medium and especially small enterprises were less resilitent to production curbs and supply shocks.

Long term gain for select sectors

In our view, while the Chinese government will be trying to ensure minimal disruption to households and businesses this winter, the longer term strategy will be to strike a balance between growth and energy consumption. Where energy production curbs start to severely undermine growth prospects, we would expect the government to recalibrate its policy measures. This is not to say that major policy u-turns are on the cards in the short term. Our base case is that there will be more production curbs in the last quarter of the year.

While China’s path to a greener future has, and will continue to, come under pressure, the direction is clear. Power-producing companies are heading towards renewable energy and the current coal shortage and mounting costs is further incentive to invest in green energy projects. This in turn helps speed up the ability for downstream firms, already hit by higher materials costs, to transition towards renewable energy sources.

At UOBAM, we have positioned our investments to align with China’s long-term strategic development goals. We continue to see strong long term growth potential, notwithstanding the heightened risks in the near term as the country adjusts its economy towards the production and consumptions of greener energy. Within the manufacturing sector, UOBAM favours high-end, larger companies that have switched a high proportion of their energy source to renewable energy.

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd ("UOBAM") and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.