Key Highlights

- The yuan's surprising stability earlier this year has given way to weakness

- Investors are becoming less convinced about the yuan as a top global reserve currency

- China's easing stance also points to a weaker currency, at least in the short term

Damaging lockdowns

The economic news emerging from China this past week has been unmitigatedly bad. A protagonist in the early days of the Russia-Ukraine war, China has since become mired in its own domestic issues, and in particular Covid lockdowns. Faced with tough restrictions, China’s two largest cities, Shanghai and Beijing, have struggled to overcome food and other basic shortages, let alone maintain normal economic activity. Many other smaller cities and industrial centres have had to cope with full or partial restrictions.

As a result, analysts had predicted a drop in China’s April business sentiment indicators, but were unprepared for how steep this drop would be. The non-manufacturing PMI (Purchasing Managers’ Index) forecast of 46.0 was already well below the March level of 49.5, yet still a long way from the final figure of 41.9.

The decline in manufacturing PMI was less stark at 47.4 compared to 49.5 in March, but served nevertheless to highlight the many logistical fissures caused by Covid lockdowns. Both upstream and downstream firms were severely affected, with a shortage of raw materials and key component parts, and suppliers’ delivery times down to their lowest levels since early 2020. Meanwhile, finished products could not be shipped out, causing existing orders to be cancelled, and new orders to drop dramatically.

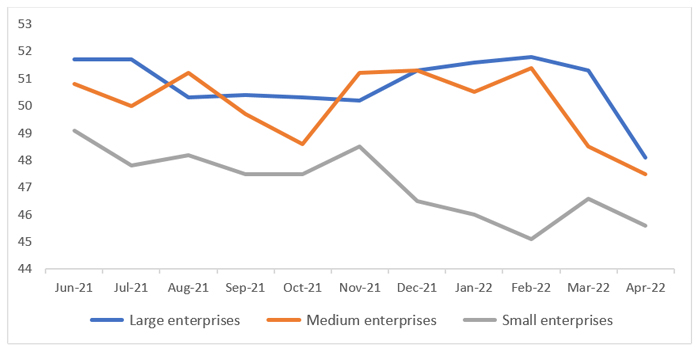

No companies spared

Taking a closer look at affected companies, it would appear that few were spared. Manufacturers of all sizes took a hit but larger ones were disproportionately represented given Shanghai’s position as a manufacturing hub for large semiconductor and auto firms.

Figure 1: PMI by enterprise scale

Source: NBS, UOBAM

The Caixin services PMI, released late last week, revealed even worse results. At 36.2, this was the second lowest level since the survey started in 2005. Significantly below the neutral 50 mark, the survey signifies a strong contraction of services sector activity and sentiment.

Foreign businesses in China were also badly affected. The EU Chamber of Commerce in China said last week that nearly 60 percent of European businesses expect lower revenues for 2022. Starbucks and other large US multinationals have also issued revenue warnings. The coffee giant said same-store sales had fallen by 23 percent quarter-on-quarter, while Apple expects current quarter sales to fall by US$4 to US$8 billion. US household products manufacturer, Proctor & Gamble, noted that even their online sales had been affected due to the inability to deliver.

Fund outflows

This disruption to business has further soured global investors’ love affair with China, although support had already been waning since the start of the year. Many are nervous about China’s increasingly complex geo-political relations with the US and Europe, especially in the wake of the Russia-Ukraine war.

In fact, according to the International Institute of Finance (IIF), the first three months of 2022 was the worst quarter on record in terms of fund outflows from China. In March alone, a total of US$17.5 billion – US$11.2 billion in bonds and US$6.3 billion in stocks – was withdrawn. IIF noted that this was an "unprecedented dynamic that suggests a market rotation" away from China assets

Structural positives

Despite these outflows, China’s currency managed to stay afloat in the early months of 2022 even as other Asian currencies were starting to weaken. This is likely due to several structural developments in the yuan’s favour. Firstly, it was announced in October 2021 that Chinese government bonds would comprise about 6 percent of the influential FTSE World Government Bond Index (WGBI). This process would require global funds tracking the FTSE WGBI to buy Chinese bonds at a rate of US$4.5 billion a month over 36 months.

Secondly, it was thought likely the IMF would increase the yuan’s allocation within its Special Drawing Rights (SDRs). SDRs are a stable asset in central banks’ international reserves, and made up of a basket of the world’s leading currencies, including the yuan. Reviewed once every five years, the 9.6 percent annual growth rate of Chinese exports since 2017 (leading to record-high trade and current account balances) suggested that a higher allocation to the yuan was overdue. This would have prompted central banks around the world to hold more yuan, especially amid speculation that the CNY could act as a counterbalance to USD dominance.

The winds of change

However, a number of factors have caused global investors to turn bearish on the yuan, precipitating a decline of over four percent against the USD since mid-April. Importantly, the schedule of interest rate hikes in the US has given US bond yields a strong upward momentum. The attractive yield differential of 1.26 percent between 10-year Chinese and US bonds at the start of the year has since turned negative. The same applies to all other bond tenors and has eroded the strong incentive to buy China assets.

Figure 2: 10-year China Government Bond yields vs US Treasury yields

Source: Bloomberg, UOBAM

Furthermore, the economic woes caused by China’s Covid lockdowns has made it even more likely that monetary policy will be eased further. In Shanghai alone, economic output in the city is estimated at US$50 to US$70 billion, which equates to 0.30-0.40 percent of China’s full year GDP. As such, market analysts have now downgraded the country’s 2022 GDP forecasts to 4.4 - 4.7 percent, well below the authorities’ 5.5 percent target.

This appears to us unachievable without substantial easing, and soon. We expect the Medium Term Lending Facility (MLF) rate, that is, the rate at which the central bank lends to large commercial banks, to be lowered by at least 30 bps, on par with that seen in 2020. Meanwhile, having recently lowered the Reserve Requirement Ratio (RRR) for banks by 25 bps, we would expect the authorities to at least equal the two 50 bps cuts conducted in 2021. Although past easing moves have not had a major impact on the yuan, we think this will not be the case this time round, given the current negative yield differentials.

Longer term diversification benefits

Some other clouds hang over the yuan in the short to medium term. While China sanction fears now look unlikely to materialise, more China bashing cannot be ruled out in the run-up to the US’s May primaries and mid term elections. This may not result in actual policy actions, but even threats of policy actions could be enough to turn investors away from China assets. In the meantime, dollar strength looks set to continue, despite the US Dollar Index (DXY) having already gained eight percent year-to-date. There is therefore a good chance that the yuan will continue to weaken over the next few months.

However, the yuan offers some safe haven characteristics that may appeal to investors over the longer term. Unlike the US, China enjoys low inflation and a high current account surplus, allowing for a divergent monetary policy, low implied volatility and modest correlation to other assets. Also, while unlikely to rival the USD as the world’s top reserve currency any time soon, the structural developments mentioned earlier will see increasing demand for the yuan as it steadily grows in importance.

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.