- Chinese equities pulled back this week amid heightened US-China tensions

- But China’s economy remains on the path to recovery with economic activity rebounding in January

- Consumer and travel-related sectors are poised to be the key beneficiaries of the reopening trade

After rallying since the start of the year, Chinese equities dipped this week amid concerns that the shooting down of a suspected Chinese spy balloon will heighten US-China tensions.

Even so, such geopolitical events are unlikely to hold back the pace of China’s reopening. The country’s economic activity bounced back in January as disruptions caused by the country’s rapid reopening faded faster than expected. Manufacturing and services expanded for the first time in four months.

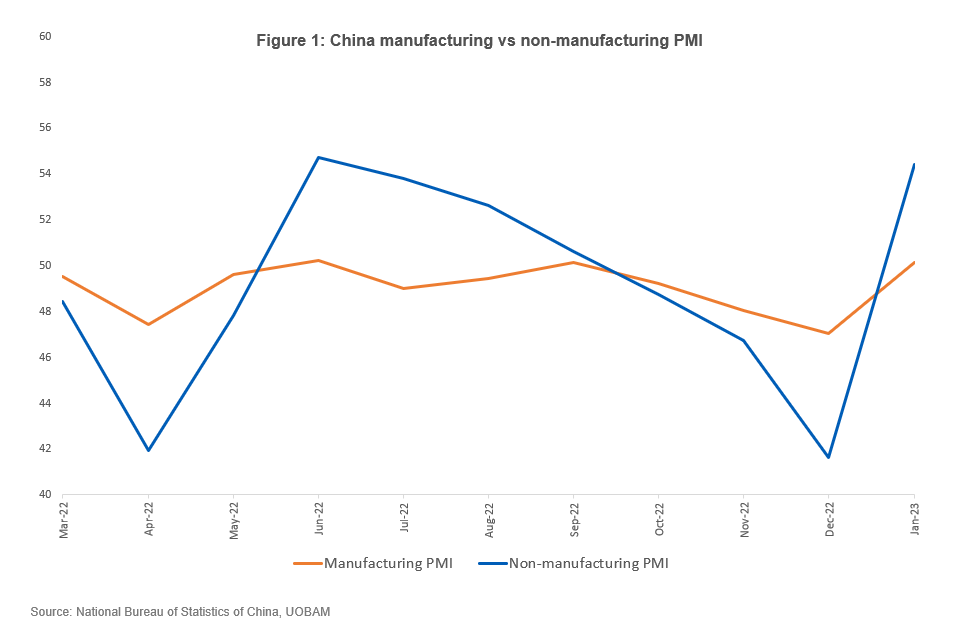

The official manufacturing purchasing managers’ index (PMI) rose from 47 in December to 50.1 in January as factories resumed production.

Non-manufacturing PMI jumped to its highest in seven months, rising from 41.6 in December to 54.4 in January as the lifting of COVID-19 restrictions encouraged consumers to head out to restaurants and shopping malls.

Moreover, China’s current wave of COVID-19 infections has likely peaked. The likelihood of another huge infection wave in the near term is low as 80 percent of the population have been infected, according to the chief epidemiologist at the China Center for Disease Control and Prevention.

As such, fresh disruptions to manufacturing and services are unlikely going forward. This bodes well for the country’s recovery prospects. The IMF has even raised its projection for China’s economic growth to 5.2 percent this year, up from the 4.4 percent it estimated last October1.

Consumption is leading the rebound

During the seven-day Lunar New Year holiday, Chinese consumers were out in force. Sales revenue of China’s consumption-related sectors rose by 12 percent from last year2, a sign that consumers are starting to open their wallets again.

Notably, more than 300 million domestic trips were made during the break, and national tourism revenue soared by 30 percent from last year.3

We expect a more meaningful consumption rebound from February onwards on further normalisation and the release of excess savings. Data from the People’s Bank of China show that household savings grew by a record 17.8 trillion yuan (S$3.5 trillion) in 2022, nearly double the growth of 9.9 trillion yuan in 2021.

Consumer spending will also be supported by government policies to stimulate domestic consumption. Last month, China’s state council said the country would promote consumption as the major driver of its economy.

Looking ahead, we expect China’s consumer discretionary sector to benefit from the consumption recovery. We favour travel-related segments like hotels, airlines, and travel agencies as international travel picks ups.

Upturn could broaden out

Alongside efforts to promote domestic consumption, the Chinese government has vowed to introduce more pro-growth policies and to support the private sector. We expect the following sectors to benefit:

1. Platform enterprises

After a challenging 2022, the outlook for China’s large internet firms like Tencent and Alibaba is improving amid signs that China’s regulatory crackdown on the sector is nearing an end.

Last month, the party secretary of the People's Bank of China said in an interview that the crackdown on internet companies was “basically over”, adding that these firms would be encouraged to lead economic growth and boost job creation.

With the regulatory environment improving and valuations still looking attractive, we expect this sector to see near-term investor interest.

2. Advanced manufacturing

China’s top policymakers have repeatedly underscored the country’s drive for self-sufficiency in science and technology. To that end, China wants to bolster its manufacturing capabilities in high quality and high-tech products. We favour local manufacturing exposures that stand to benefit from China’s continued policy support:

- Robots: Industrial robots is a strategically important sector for China with policymakers targeting to grow the robotics industry by 20 percent per year from 2021 to 20254.

- Semiconductors: China has recently created a US$144 billion funding package to boost domestic semiconductor production and support further research and development.

- Renewables: The government’s net-zero carbon targets offer policy tailwinds for renewable energy producers. According to the National Development and Reform Commission, China aims for non-fossil fuels to account for 25 percent of total energy consumption by 20305.

3. China A-shares

We anticipate an upgrade in earnings estimates for the first quarter to be driven by the improving macroeconomic environment, release of excess savings and accommodative monetary policy. We also see further catalysts in the form of more foreign fund flows and potential catch up action.

Since the year started, inflows from foreign investors have been a key driver of the China A-shares market. Flows have reached over 100 billion yuan, far exceeding 2022’s full-year total of 90 billion yuan. In the coming months, we believe there is room for further foreign buying as investors regain confidence in China’s economic prospects. However, the rate may moderate towards long term averages. From 2017 to 2021, annual foreign inflows were about 300 billion yuan.

Despite this, mainland China shares are still lagging the approximately 50 percent gain in Hong Kong shares. This suggests potential for catch up action.

Potential risks

We expect China’s economic recovery to progress at a steady pace throughout 2023, notwithstanding headwinds from weakness in the property sector, slowing global demand, a challenging job market and further geo-political tensions.

This could sustain the current upswing in Chinese equities, but we expect the upside to be relatively modest.

1IMF, World Economic Outlook Update, January 2023

2China State Taxation Administration, January 2023

3China Ministry of Culture and Tourism, January 2023

4China Briefing, “China’s Robotics Industry: Current Outlook and Market Scope for Foreign Investors”, September 2022

5National Development and Reform Commission, “Nation moves ahead with ambitious climate goals”, January 2022

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.

UOB Asset Management Ltd. Company Reg. No. 198600120Z