Key Highlights

- After five days of gains, volatility has returned to the China property sector, sparked by Shimao rumours

- These are fears that further bad news could impact the broader economy, although the government is unlikely to stand by if this happens

- While we believe that we are close to the bottom, we would resist bargain hunting for now

Shaky sentiment

Fresh volatility has erupted in China’s property sector after a week of relative calm. Last week investors had breathed a sigh of relief on news that the government would help some property developers’ restructure their debt. But rumours surfaced yesterday of financial difficulties at Shimao, the country’s 13th largest developer with over US$ 10 billion of debt issuances. This caused Shimao’s share price to drop 12% in one day, forced trading to be halted for six of Shimao’s yuan bonds and sparked a new round of property sector weakness.

While other property developers have defaulted with much less fuss, Shimao’s problems, if true, take the sector into a new paradigm. The Group’s bonds still carry a BBB investment grade rating from Fitch Ratings, although they are assessed as high yield by S&P Global Ratings and Moody’s Investor Services. This opens the doors to fears that there is nowhere safe to hide within China property and the scale of the stress is economically impactful.

As mentioned previously, investors are on the lookout for a tipping point to be reached as a result of developers’ leverage. It is clearly disastrous if a large number of developers are forced to offload existing unsold stock at highly discounted prices. But even if this does not happen, potential homebuyers could decide to defer their purchases and wait to see if prices fall. This in turn causes a drop in transaction volumes and becomes a self-fulfilling prophecy that affects broader economic growth.

Stability, stability, stability

A bright light at the end of this dark tunnel is the Central Economic Work Conference, a three-day, closed door meeting that traditionally sets China’s economic priorities for the coming year. Its close last Friday led to the release of a Meeting Note that seemed to convey a clear pro-growth message. Given the political restructuring set to take place in 2022, we would interpret growth “within a reasonable range” to mean that existing targets will be met or even exceeded.

To achieve economic “stability” (mentioned 25 times in the Meeting Note), there were proposals for monetary policies to become more accommodative. It is possible to achieve this in a number of ways and we think there is the potential for new Local Government bond quotas for 2022 with an emphasis on infrastructure investments, a slight relaxation of Local Government Financial Vehicles (LGFV) requirements, and further cuts to China’s Reserve Requirement Ratio (RRR).

In relation to the property sector, investors were somewhat spooked by the reiteration of the phrase “housing is for living in, not for speculation” in the Meeting Note. While regularly used by President Xi Jinping, it did not appear in the notes from the Politburo Preparatory Meeting. It would seem to signal that the property sector can expect to recover and expand, but at a controlled and “healthy” pace. Proposals include the long term development of the rental sector and city-specific housing policies.

Staying clear but watchful

Over the course of 2021, we have been gradually reducing our exposure to the China real estate sector, and we currently have no holdings in China property companies in any of our equity portfolios. As 2022 unfolds, we expect the above measures to stabilise the property market, with the potential for public housing to offset some decreased demand for private properties.

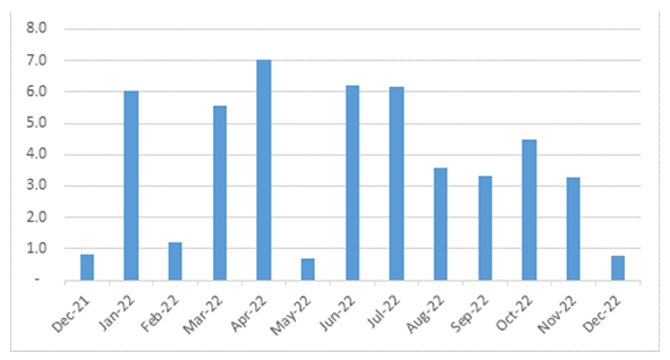

Figure 1: China Property Issuances USD Bond Maturity (US$ billions)

Source: UOBAM/Bloomberg

However, we note that there remains a significant debt repayment schedule in 2022. Financially strapped developers will be relying on sales proceeds to meet these repayments. A fall in the volume of property transactions next year could therefore result in more default news and downside surprises. This has the potential to delay a recovery in China property stocks.

On the plus side, it is likely that the Chinese government is closely tracking the situation and will step in as required. However, we intend to resist bargain hunting in this sector until there are clearer signs of a turnaround.

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.