- China’s rate cuts this week were more limited than investors had hoped

- Meanwhile, the country’s property crisis continues to deepen

- Markets set to remain volatile until economy shows signs of stabilising

Rates disappointment

On Monday this week, China’s central bank relaxed its one-year lending rate, a reference for consumer loans, by 10 basis points. This was slightly short of expectations.

Additionally, some had expected the five-year rate, which is used as a benchmark for mortgages, to see an even stronger cut. Instead, the bank left this rate unchanged.

These announcements have dashed investor hopes of prompt government action to address ongoing economic and property sector problems, following its July Politburo meeting. During the day, the Shanghai Stock Exchange (SSE) Composite index fell by close to 1.2 percent, bringing the index to its lowest level since the start of the year. Year-to-date, the index is down by around 0.8 percent.

Continuing property turmoil

While the country’s property sector woes are not new, these have come to the forefront again over the past few weeks:

- China Evergrande, having previously defaulted on its bonds, recently filed for bankruptcy protection in the US.

- Country Garden, China’s largest property developer, is on the brink of default, having missed several bond payments recently. Losses this year are likely to reach between US$6 – 7 billion.

- It is estimated that over the past few years, over 70 mostly privately-owned property companies have defaulted1.

- This comes amid a 28 percent fall in property sales by floor area. New construction starts by floor area have also fallen by 24 percent2.

Spillover effects

The deepening property crisis has spilled over into the financial sector. Last week, Zhongzhi Enterprise Group missed payments on some of its high yield investment products, sparking fears of widespread contagion. The Group is one of China’s largest private wealth managers and a prominent member of China’s shadow banking market with assets under management worth US$138 billion.

These developments have, not surprisingly, filtered through into consumer sentiment and the broader economy. The country’s second quarter GDP growth slowed to 0.8 percent quarter-on-quarter, a steep drop from the first quarter’s 2.2 percent. July’s macroeconomic data also disappointed across the board.

As a result, investment houses have started to reduce their China economic forecasts for 2023. For example, both Nomura and Barclays now believe that a 5.0 percent growth is no longer attainable and that the figure is likely to be closer to 4.5 percent. We would tend to agree, given the declines in retail sales, industrial production and Fixed Asset Investment (FAI).

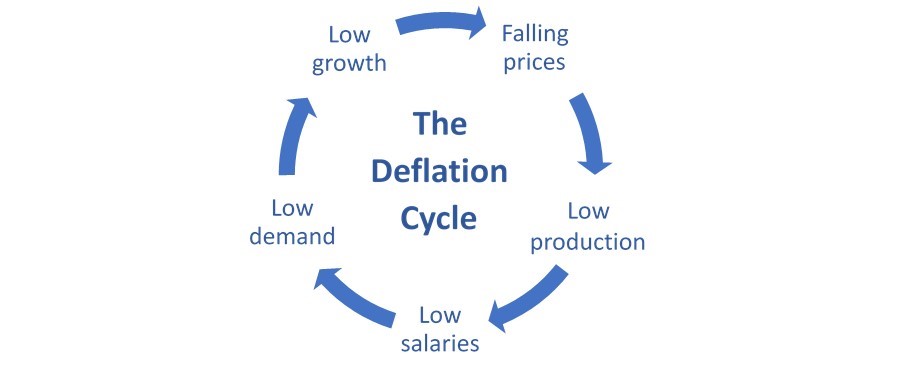

Meanwhile, the country is now facing deflation (i.e. falling prices), thereby risking a Japan-like scenario of downward-spiraling growth.

Short term caution, long term optimism

UOB Asset Management is underweight on China in the near term and have been highly cautious in terms of our exposure to the property sector since 2021. Our Asia and global funds have no or negligible exposure to China Evergrande, Country Garden or Zhongzhi and very little exposure to the property sector as a whole.

Nevertheless we note that specific segments within the China market continue to grow despite current economic wobbles, and the country’s longer term prospects remain intact. In particular, we expect China’s leadership in the green energy industrial complex to come to the fore as the world’s focus on green energy transition intensifies. The country already dominates the electric vehicle (EV) battery supply chain, solar energy supply chain and wind energy turbines market, and other countries are unlikely to catch up any time soon.

China is also the world’s largest producer of electric vehicles and as a result, has overtaken Japan as the largest automobile manufacturer in the world. China also leads in many advanced technological fields including autonomous driving and artificial intelligence, and these are becoming primary drivers of the country’s economy.

While these strengths are masked by weakness in China’s broad market indices, it is clear that astute security selection can still deliver returns for China investors. Meanwhile we maintain our positive outlook on China over the longer term.

1Source: KPMG, “Chinese Real Estate”, 13 June 2023

2Source: China National Bureau of Statistics

If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Funds to consider:

|

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person.You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.

This publication has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd. Company Reg. No. 198600120Z