Key Highlights

- Markets have fallen in the wake of daily record high Covid cases in Shanghai

- China’s economic indicators are showing a worrying trend

- With no imminent end to lockdown measures, investors are hoping for a policy boost

Activity halt

Markets hoping for a quick end to lockdowns in Shanghai have been sorely disappointed. Now entering its third week, the number of Covid cases rose to a new record of over 26,000 cases on Sunday. With its 25 million residents in strict lockdown, normal economic activities have ground to a halt. Instead, the city appears to be entering a crisis mode with widespread reports of food and medicine shortages.

Shanghai’s Covid woes come at the end of a series of localised outbreaks and lockdowns in China since early March. Restrictions on factory activities have come and gone in Shenzhen and Changchun, but with Shanghai in the mix, the potential for damaging supply disruptions is becoming harder to ignore. There is also the threat of more lockdowns to come if the Covid virus spreads to other provinces.

Worrying signs

One of the first major indications that all is not well came last week with the release of China’s Purchasing Manager’s Index (PMI) for March. Comprised of measures such as the new orders, inventory levels and deliveries, PMIs are a check on the health of a country’s manufacturing sector. A value below 50 percent suggests economic slowdown, and China’s came in at 49.5.

In further unwelcome news, the China’s National Bureau of Statistics reported yesterday that inflation for March rose more than expected. The country’s Producer Price Index (PPI), a measure of factory prices, rose 8.3 percent compared to last year. Meanwhile, China’s Consumer Price Index (CPI) that tracks the cost of everyday goods and services, rose by 1.5 percent in March year-on-year, slightly higher than the 0.9 percent rise seen in February.

Lower earnings

These numbers are largely attributed to higher energy prices. However, the large gap between the PPI and CPI numbers suggests that manufacturers are not able to pass these higher costs to consumers. Instead, companies are taking a hit to their profitability and earnings.

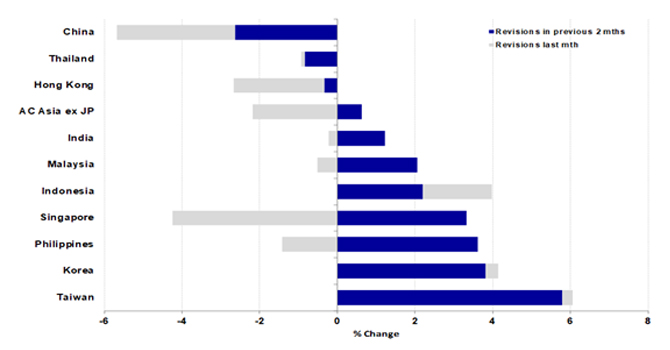

This may help to explain the ongoing earnings downgrades weighing on Chinese companies. In March, corporate earnings were revised down by 3.3 percent, bringing the estimate downgrades since the start of the year to 5.4 percent, the biggest drop in the region.

Figure 1: Earnings downgrades continue for Chinese companies

MSCI Asia ex Japan Estimate Revisions in March vs previous 2 months

Source: UOBAM/MSCI/Factset, 1 April 2022, for 2023 earnings estimates

These factors have conspired to weaken the Shanghai (SSE) Composite Index by 3.1 percent and the Hang Seng index by 4.6 percent over the past five days. The falls have been led by growth-oriented tech stocks. While valuations are now looking cheap, these stocks have borne the brunt of concerns around China’s growth prospects, supply disruptions and US tensions.

Policy leg-up

Many economists are starting to question whether China’s forecast of 5.5 percent growth in 2022 is achievable without the implementation of some major policy stimulus. Within Beijing’s toolbox is the ability to ease domestic interest rates, given that inflationary pressures, while rising, remains well below that in the US and Europe. Due out this week, the US’s CPI data is expected to have risen by over 8.0 percent year-on-year in March.

Also signalled by China’s regulator is a softening of its stance towards US auditing rules. The cause of significant uncertainty in terms of offshore investments into US-listed Chinese companies, there appears to be new willingness to allow these companies to meet global accounting standards. This would help address investor fears about the possibility of these companies – a total of 11have been identified so far – being expelled from the New York stock market.

Long term opportunities and risks

There is clearly much that we believe the Chinese government can and will do in the near term to stabilise markets and soothe investor worries. However, we would also note that some structural imbalances are taking longer to resolve.

For example, aside from the lingering effects that current lockdowns will have on the economy, problems within its real estate sector are far from over. Recent moves to relax home ownership and extend loans to developers and home buyers have not stemmed the number of credit defaults by developers, nor helped to revive property sales. It is estimated that new home sales are down by 40 percent for the largest developers. If this continues, it is thought that many developers will not survive into the second half of the year.

We also have our eye on the potential impact of wider geo-political forces, including the ongoing Russia-Ukraine war. With the prospect of a ceasefire now slowly fading, any mis-steps going forward could deepen long-simmering US-China tensions. While we do not expect any near term policy shifts, the continuation and possible intensification of the conflict puts China’s neutral stance under increased pressure. In the event of US sanctions against China, the intertwining of these two economies would make such a move highly detrimental to both.

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.