China’s progress from consumer-based to manufacturing-based innovations is gathering steam. But with several UOBAM funds offering exposure to China-based hi-tech firms, which one suits you best?

After almost three years of self-imposed isolation, China has thrown open its borders to the world, easing restrictions under its strict zero-COVID regime.

China’s reopening is expected to reinvigorate its economy as cross-border business picks up and people go out again. The positive outlook is further strengthened by the government’s shift to pro-growth policies such as supporting private businesses and boosting domestic consumption.

Given these catalysts, we anticipate China’s GDP to rebound to 4.9 percent this year, from 3.0 percent in 2022.

Underpinning this growth will be China’s continued emphasis on innovation and technology development, as highlighted at the Central Economic Work Conference (CEWC) attended by President Xi Jinping and other top leaders last December.

Self-reliance a key driver of China’s innovation push

At the CEWC, China’s leaders identified several priorities for 2023 including:

- Supporting technology innovation and green development

- Promoting emerging strategic industries

- Leading breakthroughs in key and core technologies

Amid US restrictions on selling advanced semiconductor chips to Chinese companies, China wants to develop its own technology prowess and reduce its reliance on foreign technologies.

This means a greater preference for hard tech rather than the consumer-focused tech developed by the likes of Alibaba and Tencent. Hard tech refers to tech that requires continuous research and development (R&D) and advanced scientific and technological capabilities. It includes sectors such as:

- Semiconductors

- New energy vehicles

- Renewable energy generation

- Healthcare

- High-end manufacturing

- Artificial intelligence (AI)

In a push for major tech breakthroughs, China has pledged to scale up R&D investments by 7.0 percent per year between 2021 and 2025, as indicated in its five-year development plan. China’s over 1,700 government guidance funds also continue to direct capital to strategic industries1. These funds are estimated to have raised nearly US$1 trillion2 to support such sectors.

Results are encouraging but hurdles to overcome

Reflecting the shift in government policy, job postings in China reveal that openings within the hard tech sector have jumped by as much as 382 percent in 2022, while that for the Internet sector fell by 40 percent3.

After years of increasing policy focus on technological innovation, China has also become a leader in clean energy innovation - as evidenced by its solar power and electric vehicle sectors – as it strives to achieve carbon peaking by 2030 and neutrality by 20604.

Also, China retains an advantage in older-generation chips due to lower labour costs and government subsidies5. However, the country has yet to achieve self-sufficiency in advanced chips, despite the billions poured into the semiconductor industry.

Some analysts think that China’s regulated socialist market economy could stifle the incentives for entrepreneurs to strive for innovation. Amid the ongoing US-China tech war, China may need to moderate its top-down model of innovation, or review its private sector policies, in order to achieve its top priority of self-sufficiency at an accelerated pace.

Opportunities offered by UOBAM

UOBAM offers two solutions that are highly geared to China’s high-tech firms: The United China A-Shares Innovation Fund and UOBAM Ping An ChiNext ETF.

Both are sub-managed by Ping An Fund Management Company Limited, a well-established Chinese fund manager.

Here is a comparison of the two funds.

| United China A-Shares Innovation Fund | UOBAM Ping An ChiNext ETF | |

| Objectives | Achieve long-term capital appreciation by investing primarily in A-shares of companies listed in China, which are likely to be the main beneficiaries of technology, innovation and other growth trends. | Replicate as closely as possible the performance, before expenses, of the ChiNext Index, which comprises 100 of the largest and most liquid A-shares listed on the ChiNext Market. The ChiNext market represents over 1,100 fast-growing Chinese companies in traditional and emerging industries. |

| Fund performance | 1-Year: -35.78% Since inception: -7.83%* From 14 Nov 2022 – 30 Dec 2022: -1.07%** |

1-Year: N.A From 14 Nov 2022 – 30 Dec 2022: - 2.01%^ |

| Top 3 holdings | Beijing Oriental Yuhong Kweichow Moutai Longshine Technology Group |

Contemporary Amperex Technology East Money Information Shenzhen Mindray Bio-Medical Electronics |

| Top 3 sector allocations | Materials Consumer Discretionary Consumer Staples |

Industrials Healthcare Information Technology |

*The United China A-Shares Innovation Fund was incepted on 17 August 2020. Performance data as at 30 November 2022, SGD basis, as retrieved from Fund Factsheet

**Performance data sourced from Bloomberg

^The UOBAM Ping An ChiNext ETF was incepted on 14 November 2022. Performance data sourced from Bloomberg

How to choose the right fund for your needs

Wondering which fund is right for you? To decide between the two, it is useful to consider your investment priorities. For example:

1. I want a fund that is actively managed

Some investors prefer actively managed funds because they offer opportunities to beat the market. In an active fund, a team of experts will identify stocks that they think have the best chance of outperforming their benchmark.

On the other hand, passively managed funds such as Exchange-Traded Funds (ETFs) do not involve stock picking. Instead, an ETF typically holds all the stocks within an index and seeks to replicate the performance of that index.

The United China A-Shares Innovation Fund is an actively managed fund that selects companies at the forefront of China’s technology, innovation, and other growth trends.

2. I want a fund with low management fees

Passively managed funds typically have lower fees than those charged by active funds. They require less extensive research and there is less frequent buying and selling of stocks within the fund.

With actively managed funds, investors often pay higher fees for the skills and expertise of the fund manager.

The UOBAM Ping An ChiNext ETF is a passively managed ETF that aims to track the performance of the ChiNext Index. With a management fee of 0.5 percent per year and a maximum expense ratio of 1.25 percent, it is a lower-cost option as compared to the United China A-Shares Innovation Fund.

Fees and minimum investment amount for the United China A-Shares Innovation Fund and UOBAM Ping An ChiNext ETF

| UOBAM Ping An ChiNext ETF | United China A-Shares Innovation Fund | |

| Management Fee | 0.50% p.a. | 1.75% p.a. |

| Expense Ratio | Maximum 1.25% p.a. | - |

| Subscription Fee | - | Currently up to 5% p.a. |

| Trustee Fee | Currently not more than 0.05% p.a. | - |

| Minimum investment | Buy/sell on SGX: Minimum 1 unit per lot | Min. initial investment: S$1,000 Min. subsequent investment: S$500 |

Information reflected is accurate as of 18 January 2023

3. I want a fund that focuses more on hard tech

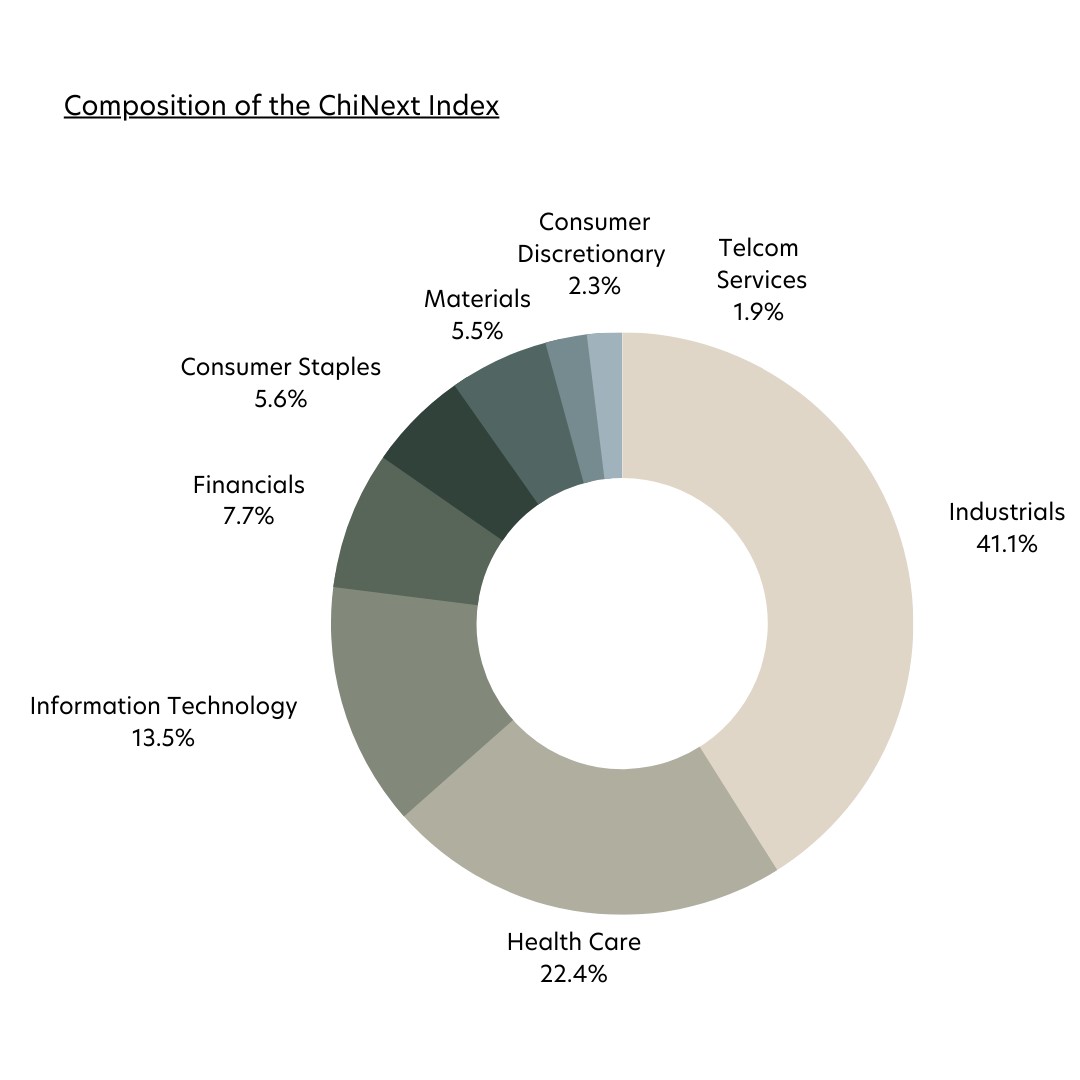

The Industrials and Healthcare sectors comprise about 60 percent of UOBAM Ping An ChiNext ETF.

Sector allocation: UOBAM Ping An ChiNext ETF

Source: Shenzhen Securities Information Co Ltd, as at 14 September 2022

Many of the fund’s top holdings are high-tech manufacturing companies.

| Constituent name | Theme |

| Contemporary Amperex Technology Co Ltd | Electric vehicle battery production |

| Shenzhen Mindray Bio-Medical Electronics | Advanced medical device manufacturing |

| Sungrow Power Supply Co Ltd | Solar and wind power solutions |

| Eve Energy Co Ltd | Lithium battery production |

| Walvax Biotechnology Co Ltd | Vaccine and biopharmaceutical product development |

Source: Shenzhen Securities Information Co Ltd, as at 14 September 2022

4. I want a fund that offers broad exposure to China’s emerging opportunities

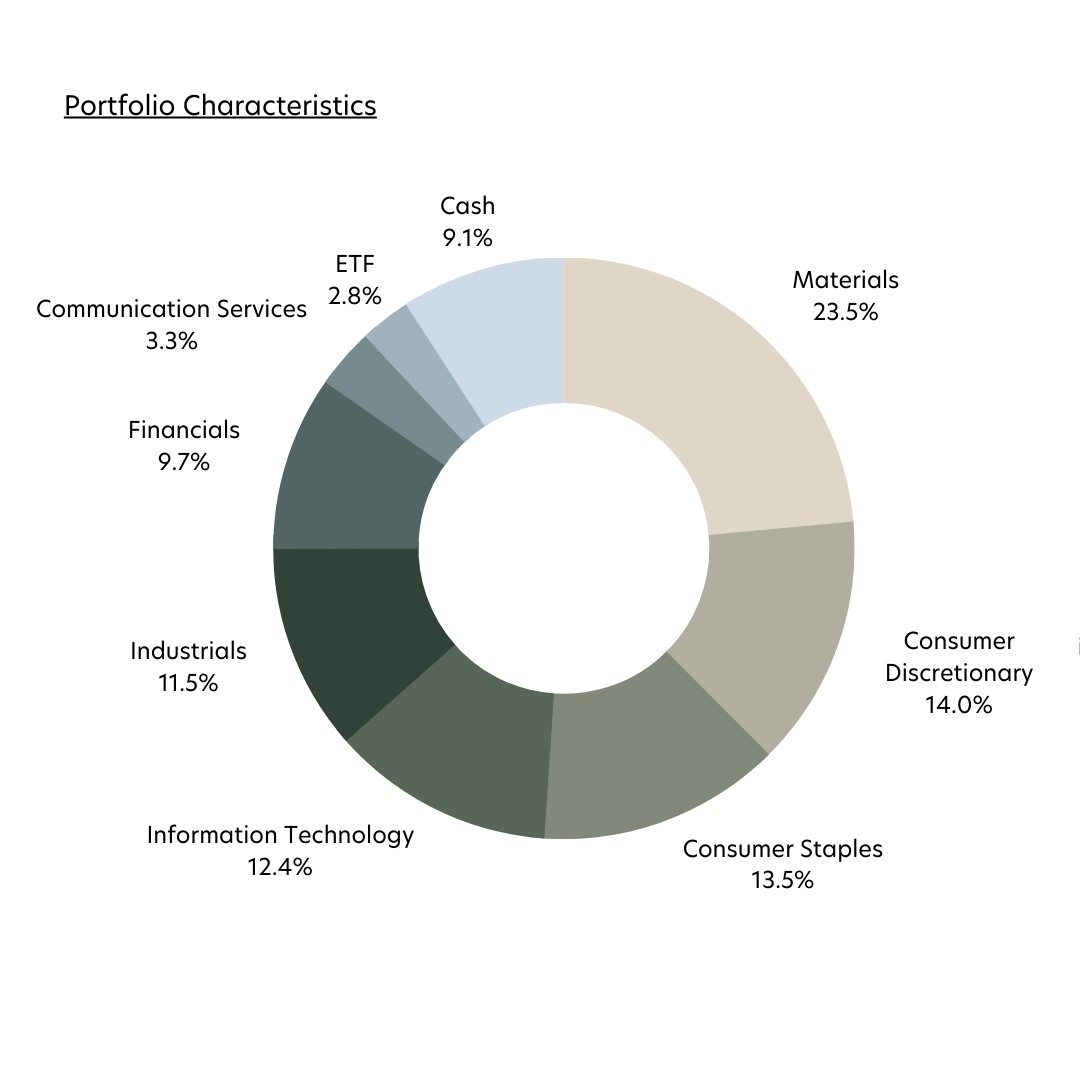

The United China A-Shares Innovation Fund provides exposure not just to hard tech sectors, but also China’s new consumer market.

The Consumer Discretionary and Consumer Staples sectors feature prominently in the United China A-Shares Innovation Fund, making up about 27 percent of the sector allocation.

Sector allocation: United China A-Shares Innovation Fund

Source: Fund factsheet, as of 30 November 2022

With China’s middle class expected to double from around 400 million people to 800 million people in 20356, beneficiaries of the consumption upgrade include liquor and financial companies. To tap this trend, the top holdings of the United China A-Shares Innovation Fund include Kweichow Moutai, Bank of Ningbo, and Shanxi Xinghuacun Fen Wine Factory.

Top 10 holdings: United China A-Shares Innovation Fund

| Constituent name | Weight (%) |

| Beijing Oriental Yuhong Waterproof Technology | 5.93 |

| Kweichow Moutai | 5.64 |

| Longshine Technology Group | 5.38 |

| Bank of Ningbo | 5.16 |

| Ganfeng Lithium Group | 4.75 |

| Shanxi Xinghuacun Fen Wine Factory | 4.62 |

| Shenzhen Inovance Technology | 4.46 |

| Contemporary Amperex Technology | 4.75 |

| China Merchants Bank | 3.07 |

| Xiamen Faratronic | 3.07 |

As of 30 November 2022

5. I want a fund that doesn’t pay regular dividends, but instead reinvests my investment gains

For both the United China A-Shares Innovation Fund and the UOBAM Ping An ChiNext ETF, any income generated from the fund is reinvested for you at no charge.

The former is an Accumulation (or "Acc") Class fund, which means it does not declare or pay dividend income but reinvests it so the fund’s capital can grow, or accumulate, further.

The latter’s current distribution policy, as stated in the Fund Prospectus, is to reinvest any income of the fund.

With both funds, you reap the long-term benefit of compounding. Compounding is a powerful process whereby investment gains are reinvested and used to generate additional returns over time.

1American Affairs, “Guiding Finance: China’s Strategy for Funding Advanced Manufacturing”, May 2022

2American Affairs, “Guiding Finance: China’s Strategy for Funding Advanced Manufacturing”, May 2022

3The Straits Times, China lacks the right workers to boost transition to 'Hard Tech', September 2022

4IEA, Tracking Clean Energy Innovation: Focus on China, March 2022

5MIT Technology Review, Chinese chips will keep powering your everyday life, January 2023

6Mercer, “China’s 14th Five-Year Plan”, 2020

This document is for general information only. It does not constitute an offer or solicitation to deal in units in the Fund (“Units”) or investment advice or recommendation and was prepared without regard to the specific objectives, financial situation or needs of any particular person who may receive it. The information is based on certain assumptions, information and conditions available as at the date of this document and may be subject to change at any time without notice. No representation or promise as to the performance of the Fund or the return on your investment is made. Past performance of the Fund or UOB Asset Management Ltd (“UOBAM”) and any past performance, prediction, projection or forecast of the economic trends or securities market are not necessarily indicative of the future or likely performance of the Fund or UOBAM. The value of Units and the income from them, if any, may fall as well as rise, and is likely to have high volatility due to the investment policies and/or portfolio management techniques employed by the Fund. Investments in Units involve risks, including the possible loss of the principal amount invested, and are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited (“UOB”), UOBAM, or any of their subsidiary, associate or affiliate (“UOB Group”) or distributors of the Fund. The Fund may use or invest in financial derivative instruments and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund's prospectus. The UOB Group may have interests in the Units and may also perform or seek to perform brokering and other investment or securities-related services for the Fund. Investors should read the Fund’s prospectus, which is available and may be obtained from UOBAM or any of its appointed agents or distributors, before investing. You may wish to seek advice from a financial adviser before making a commitment to invest in any Units, and in the event that you choose not to do so, you should consider carefully whether the Fund is suitable for you. Applications for Units must be made on the application forms accompanying the Fund’s prospectus..

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd. Company Reg. No. 198600120Z

Please scan the QR codes for more details on the funds, important notes and the respective funds’ disclaimers.

United China A-Shares Innovation Fund

Leverage the accelerated innovation across China’s economy to achieve long-term capital appreciation.

UOBAM Ping An ChiNext ETF

Diversify your portfolio with the fast-growing enterprises of the ChiNext Index.