Key Highlights

- Carbon pricing is used to discourage polluting industries while creating incentives for cleaner alternatives

- Carbon markets can be either compliance or voluntary

- Challenges include transparency, standards for verification and illiquidity of carbon credits

What is carbon pricing?

A cost applied to carbon pollution through either carbon markets or carbon taxes.

Why do we use carbon pricing?

To shift the burden for the environmental damage of greenhouse gas emissions to those who are responsible and can reduce emissions, while also creating incentives for businesses to shift away from fossil fuels to cleaner alternatives

Use of Carbon Taxes

- Governments set a price that emitters (usually the big emitters) pay for each ton of carbon emissions

- Such taxes encourage emitters to switch to cleaner alternatives or improve their energy efficiency in order to avoid paying taxes

- The tax revenue can in turn also be used to offset the impact of existing carbon emissions by channelling investment into renewable energy sources

Carbon markets

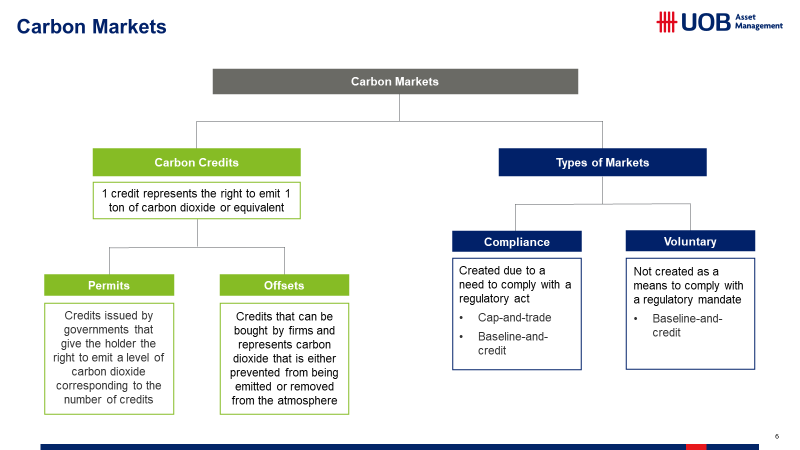

These can be divided into compliance and voluntary markets. Compliance markets are usually in the form of emissions trade systems (ETS) set up by governments to ensure that businesses comply with regulations through a cap-and-trade system and a baseline-and-credit system. As for voluntary markets, there are no obligations to comply with a regulatory mandate and employs the baseline-and-credit system. Carbon markets use carbon credits with each carbon credit accounting for a ton of carbon dioxide or any equivalent amount of a different greenhouse gas.

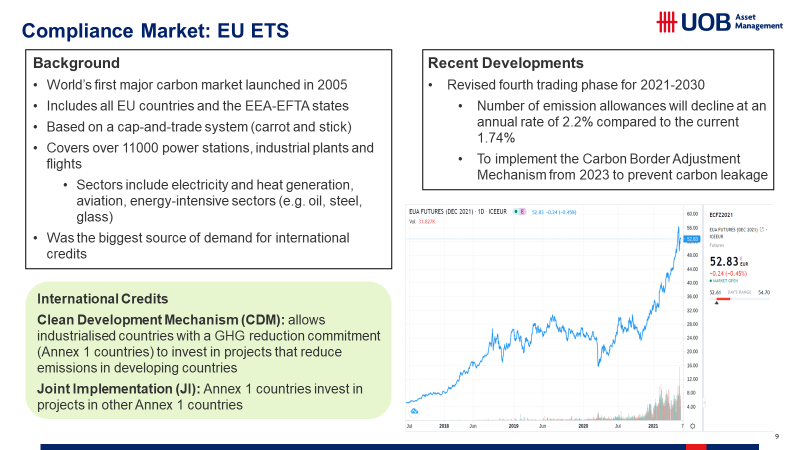

- Cap-and-trade system: where the government or regulator places a cap or maximum level of carbon emissions on specific sectors by allocating or selling carbon allowances to firms. At the end of each year, firms have to return the amount of allowances equivalent to their greenhouse gas emissions. Examples would include the European Union’s (EU) ETS which covers about 40% of the EU’s greenhouse gases with emission caps on specific sectors. China has eight pilot ETS in different provinces which set their own carbon prices and caps. The national ETS which was officially launched in February 2021 with online trading starting in June will be a similar process to the EU ETS and will focus initially on the power sector.

- Baseline-and-credit system: where firms purchase credits to offset their emissions, and the money they pay goes towards financing an environmental or climate-action project, such as reforestation or renewable energies.

Source: UOB Asset Management, June 2021.

Carbon credits

There are two different types of credits. First, carbon allowances deployed in the cap-and-trade system give the holder a right to emit a specific level of carbon dioxide, depending on how many credits they hold. Carbon offsets used in baseline-and-credit systems on the other hand are credits that represent carbon dioxide that is either prevented from being emitted or removed from the atmosphere.

Source: UOB Asset Management, June 2021.

Benefits of carbon markets

- Reduces carbon emissions as putting a price on carbon makes it less competitive

- Use of carbon offsets to finance climate-action projects to create a positive environmental or even social impact by investing in technology to support renewables

Pricing carbon credits

Compliance markets: The price depends very much on a supply and demand mechanism. The cap on emissions influences the price of carbon allowances as there is a limited supply in the market, such as when there are fewer credits than companies wanting them, the price will increase. In an ETS, the number of carbon allowances issued is usually reduced each year to make carbon more expensive, which is why the general trend from 2016 to 2020 shows the price of allowances increasing.

Voluntary markets: Prices of carbon offsets often depend on the project which takes into consideration not only emission reductions but also how directly it benefits the community. Smaller scale projects tend to have greater positive impacts as they are more focused, but are often more expensive and produce fewer credits, and hence are generally priced higher.

Credits are also likely more expensive in locations where it is more difficult to implement projects due to lack of infrastructure and resources, as more capital is needed to implement the project. The quality of the project matters and is assessed by the certification standards and that the emissions reduction is genuine via a rigorous approach that projects have to follow.

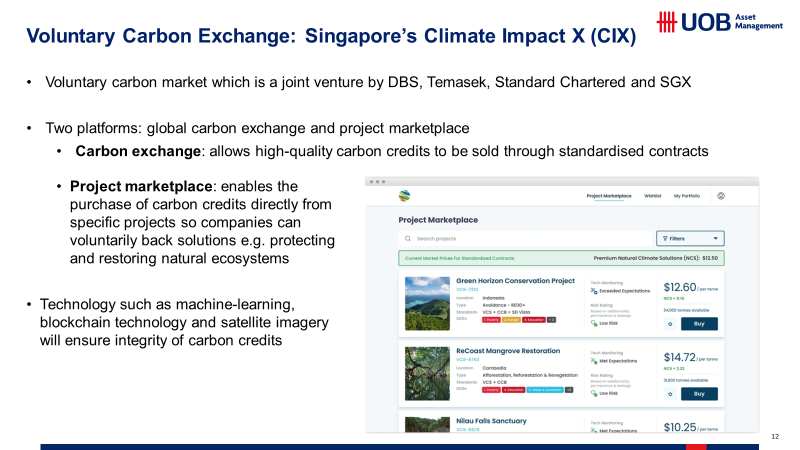

One example of a voluntary carbon exchange is Singapore’s Climate Impact X (CIX) which will be launched at the end of 2021. It will have two platforms for high-quality and verified credits to be traded through standardised contracts as well as enable the purchase of credits directly from projects. To overcome or reduce the challenges of the voluntary market, machine-learning and blockchain technology as well as satellite imagery will be used to monitor the impact of projects to ensure integrity of the credits.

Source: UOB Asset Management, June 2021.

Challenges

Compliance markets: Challenges include issuing the right-size caps and prices of allowances that are effective without being too onerous for industries and companies who may struggle to cover the cost of moving to lower carbon production thus impacting jobs. Some businesses may opt to relocate their production to countries without the same restrictions. This is known as carbon leakage, a loophole which may be addressed to some extent by imposing carbon border tariffs on countries with no carbon emissions limits. Finally, carbon markets can sometimes be illiquid which could make trading inefficient.

Voluntary markets: Transparency is often the biggest problem, which may compromise the environmental integrity of carbon credits. It is difficult to verify if emissions reductions are genuine or permanent. These can be addressed by employing rigorous yardsticks to projects to verify the credits as well as raise their quality. Technology such as satellite monitoring can also be employed to determine the impact of carbon credits.

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd ("UOBAM") and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.