The recent lift in interest rates is an opportunity for companies to achieve attractive yields and counter the impact of high inflation

Companies have multiple cash objectives

Most companies have three key objectives when it comes to their cash reserves:

- Preserve Capital: They want to ensure that their capital maintains its value over time

- Retain Liquidity: They want to be able to access their cash quickly and easily.

- Enhance yield: They want to earn a good yield compared to a normal commercial account.

Clearly, it is not possible to optimize all three objectives without making some trade-offs. For instance, to pick up additional yield relative to normal savings rates, it may be necessary to give up some degree of liquidity and/or take on some investment risk. On the other hand, if liquidity is a priority, it may be necessary to forego some yield.

A company’s cash management strategy and the importance of each objective can vary according to its line of business or stage of development. However, cash strategies can also change based on external factors such as the during periods of economic expansion or contraction.

The hunt for higher yields in low rate scenarios

For example, from 2009 – 2015, when interest rates globally were close to zero, companies flush with cash scrambled to find ways to enhance their yields. Many sought conservative investment instruments such as money market funds, commercial paper and government bonds. However, a review of the 10 richest US companies’ balance sheets found that a number also invested in asset-backed and other marketable securities i.e. highly liquid securities that can be converted back into cash within a year of investment.

The need for liquidity in times of crisis

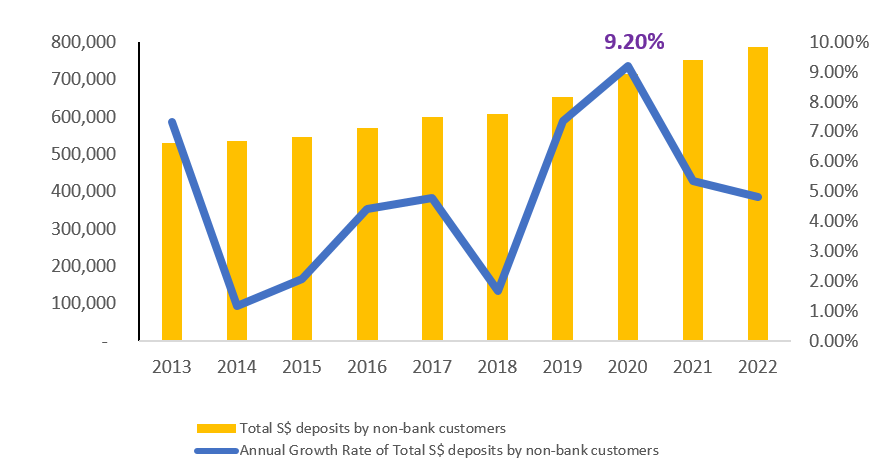

In contrast, when the global economy was hit by the COVID-19 pandemic in 2020, companies reverted strongly back to bank deposits. During this time, there was much uncertainty about the severity of the virus and the impact of global lockdowns. Companies also feared their customers would be unable to meet payments on time, causing many to increase their liquidity. As a result, total Singapore Dollar (SGD) deposits by non-bank customers increased by 9.2 percent in 2020, the fastest rate in a decade.

Figure 1: Total SGD Deposits (S$ million) and Annual Growth Rate (%) by non-bank customers

Source: Monetary Authority of Singapore- Money and Banking I4 Commercial Banks: deposits and balances (excluding S$ncds) by types of non-bank Customers. May 2022.

Tightening monetary policies offers new opportunities

This year, the US Fed along with other central banks have started to hike interest rates in an attempt to quell mounting inflationary pressures. This means that the yields on bank deposits are set to improve. However, bank deposits alone may not be the answer and companies should consider a diversified cash management that includes low risk investments.

This is because:

- High inflation erodes the value of cash. A combination of post-pandemic supply chain issues and the Russia-Ukraine war has caused inflation to rise around the world. In many countries, the inflation rate exceeds bank deposit rates, causing cash to lose its value if simply deposited in the bank. If, for example, inflation is growing at 3 percent per annum and the 12-month fixed deposit rate is 2 percent, the inflation-adjusted return on a fixed deposit is actually negative ie [(1+2%)/(1+3%)]-1 = - 0.97%. And the longer the deposit, the greater the value erosion.

- Banks are likely to delay offering higher deposit rates to their clients. Despite recent central bank hikes in interest rates, banks are slow to adjust their deposit rates. Awash with billions of dollars of deposits in the wake of the pandemic, banks are still hesitant to pay higher rates until the demand for bank loans picks up. In the absence of such demand, banks are not incentivised to attract or retain customers with higher deposit rates. According to the Monetary Authority of Singapore, the Singapore dollar Loan-toDeposit (LTD) ratio stood at 72 percent in May 2022, compared to 88 percent in June 2018 . Until this LTD ratio improves, bank deposit rates look set to lag policy rates.

UOBAM offers two distinct cash management solutions

UOB Asset Management offers two solutions that fit well with a low risk profile but potentially offer a high yielding cash management strategy. The United SGD Money Market Fund and the United SGD Fund offers a gross yield (ie interest paid before deducting expenses or taxes, if any) of 1.67percent and 4.13percent per annum respectively (data valid as of 17 June 2022)

- United SGD Money Market Fund

This Fund invests in highly liquid and high-quality instruments, enabling companies to preserve their capital during periods of high inflation without sacrificing liquidity. The liquid and short duration (about 3 months) nature of the Fund allows for potentially higher returns higher than fixed deposits. It also allows investors to keep pace with rising interest rates. This is because money in the Fund is actively re-invested, allowing the Fund to enjoy higher market rates in a fast-moving interest rate environment. - United SGD Fund

This Fund has a duration of about 1.55 years, and invests in high grade, short-term debt securities maturing or callable or puttable on a rolling 3 years or less basis. This Fund mainly focuses on Asian securities given the opportunities in the region. By keeping the duration short and employing a laddered bond strategy, the Fund is better able to take advantage of fast-rising interest rates.

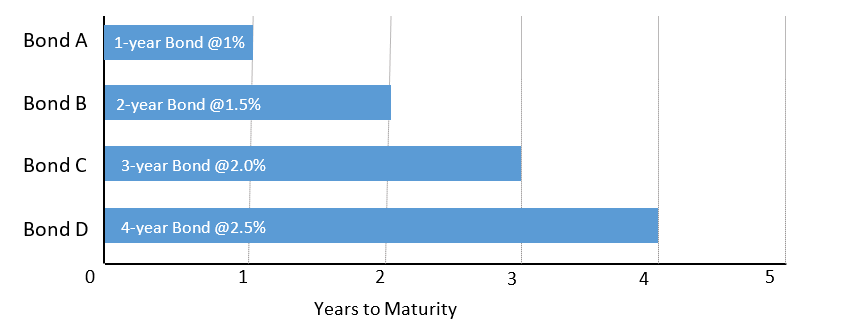

How bond laddering works

This is an important investment strategy for ensuring that a bond portfolio is able to ride the momentum of rising interest rates and overcome yield dips during periods of falling interest rates. Here is a simple illustration of how a laddered investment strategy takes advantage of the maturity feature within a bonds portfolio during rising rates

This portfolio has four bonds with staggered maturities

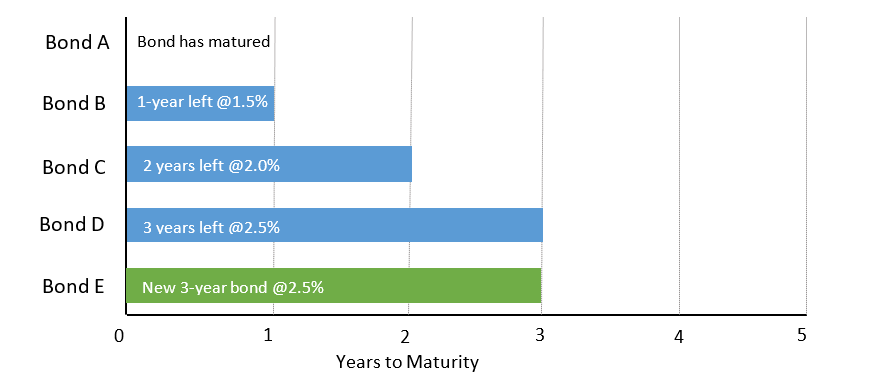

After one year, Bond A matures. The principal that is re-paid is used to re-invest in Bond E, ie a new shorter-term, higher-yielding bond

In a stable interest rate environment, the principal from matured bonds can be re-invested in new longer term bonds to maintain the yield profile of the fund. But in an environment such as the one we are experiencing today, when interest rates are rising quickly, the principal can be re-invested in new higher-yielding bonds while reducing the duration of the portfolio. Also, the market prices of these bonds have become cheaper as rates rise.

A new era of enhanced yields and high liquidity

After decades of low inflation and low interest rates, the world appears poised to enter a new era of aggressive central bank tightening. Since the US Fed started to hike in March 2022, when rates were close to zero, we have seen a 150 basis points rise, and the market expects the Fed Funds rate to reach 3.4 percent by the year-end. Other central banks are set to see similar if perhaps more moderate rises.

This means that the opportunity cost of not earning more with your cash is also rising. Companies content to leave their cash in bank deposits risk falling prey to high inflation and missing out on the current regime of up-trending rates. On the other hand, companies that diversify out of bank deposits have the opportunity for higher returns while continuing to maintain good capital preservation and liquidity.

All information in this publication is based upon certain assumptions and analysis of information available as at the date of the publication and reflects prevailing conditions and UOB Asset Management Ltd (“UOBAM”)’s views as of such date, all of which are subject to change at any time without notice. Although care has been taken to ensure the accuracy of information contained in this publication, UOBAM makes no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for the accuracy or completeness of the information.

Potential investors should read the prospectus of the fund(s) (the “Fund(s)”) which is available and may be obtained from UOBAM or any of its appointed distributors, before deciding whether to subscribe for or purchase units in the Fund(s). Returns on the units are not guaranteed. The value of the units and the income from them, if any, may fall as well as rise. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. An investment in the Fund(s) is subject to investment risks and foreign exchange risks, including the possible loss of the principal amount invested. Investors should consider carefully the risks of investing in the Fund(s) and may wish to seek advice from a financial adviser before making a commitment to invest in the Fund(s). Should you choose not to seek advice from a financial adviser, you should consider carefully whether the Fund(s) is suitable for you. Investors should note that the past performance of any investment product, manager, company, entity or UOBAM mentioned in this publication, and any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance of any investment product, manager, company, entity or UOBAM or the economy, stock market, bond market or economic trends of the markets. Nothing in this publication shall constitute a continuing representation or give rise to any implication that there has not been or that there will not be any change affecting the Funds. All subscription for the units in the Fund(s) must be made on the application forms accompanying the prospectus of that fund.

The above information is strictly for general information only and is not an offer, solicitation advice or recommendation to buy or sell any investment product or invest in any company. This publication should not be construed as accounting, legal, regulatory, tax, financial or other advice. Investments in unit trusts are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited, UOBAM, or any of their subsidiary, associate or affiliate or their distributors. The Fund(s) may use or invest in financial derivative instruments and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund(s)’ prospectus.

In the event of any discrepancy between the English and Mandarin versions of this publication, the English version shall prevail.

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd Co. Reg. No. 198600120Z