Investing for profit and purpose

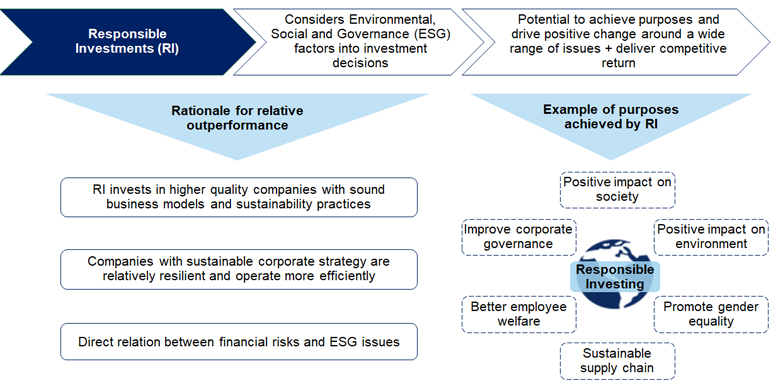

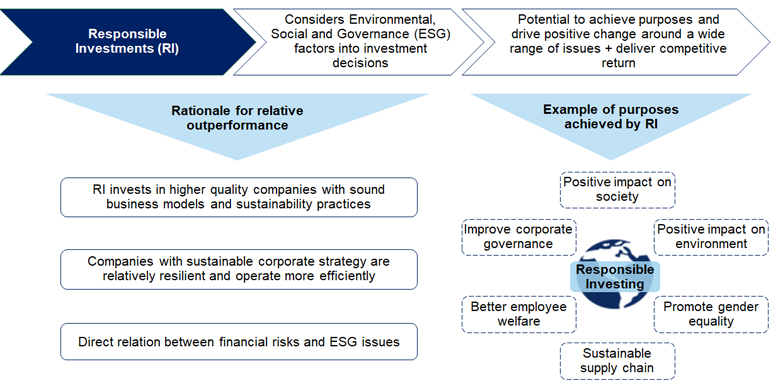

We believe that responsible investment practices can have significant contribution to the development of a more sustainable financial system that benefits the wider community.

We believe that responsible investment practices can have significant contribution to the development of a more sustainable financial system that benefits the wider community.

Singapore Stewardship Principles (SSP) for Responsible Investors

In 2018, UOBAM became a supporter of the Singapore Stewardship Principles (SSP) for Responsible Investors, a set of principles intended to encourage investors to voluntarily pursue the spirit of stewardship and good governance. Since then, UOBAM has stepped up its responsible investing efforts by incorporating ESG considerations into the investment process for Asia ex-Japan Equities and Asia Fixed Income.

United Nations-supported Principles for Responsible Investment (PRI)

UOBAM also became an official signatory of the UN supported Principles for Responsible Investment (PRI) in early 2020, a testament to UOB’s commitment to responsible investing and to developing sustainable investment solutions for customers.

The UN-supported PRI is an international network of investors working together to put the six Principles for Responsible Investment into practice.

Responsible investment practices are part of our fiduciary duty to our clients and we believe that the integration of ESG considerations into our investment processes is important not only from a risk management perspective but also key to ensuring long-term returns.

Click here to read UOBAM’s latest Sustainable Investing Policy.

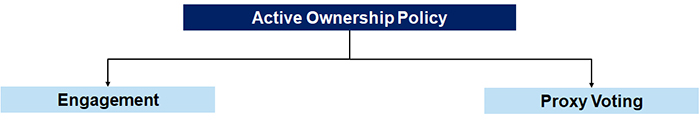

Active ownership consists of company engagement and proxy voting activities. These activities form a key component of our responsible investment approach and fulfils UOBAM’s fiduciary duty as an investment manager to act in the best long-term interests of our clients.

|

Q4 2020

|

|

|

Robeco Essentials Online Modules

|

|

Sustainability Training for UOB Asset Management

|

We also have in place a series of internal staff education plans that consist of webinars and staff-led Sustainability education workshops to improve Sustainability awareness and knowledge on key Sustainability issues relevant to UOBAM.

|

Fund Name(Asset Class)

|

Launch Date

|

Highlights

|

| United Sustainable Credit Income Fund (Fixed Income) |

April 2020 |

|

| United Equity Sustainable Global Fund (Equity) |

August 2020 |

|