Share:

The advent and development of artificial intelligence (AI) has altered the way companies interact with customers.

While banks’ traditional methods of dealing with customers involved mostly standardised offerings by way of a “transactional model”, customers now expect more tailored services in the new “engagement model”.

The age-old ways of communicating with customers include cold-calling, email campaigns with template offerings, reacting to issues after customers called the contact centre, and lengthy manual application processes.

In the new paradigm, customers expect their banking habits to be “remembered”, their needs to be anticipated, immediate response to queries, prompt advice on savings and investments, digitised on-boarding process and personalised recommendations.

To power this new customer journey, AI is increasingly being employed in banking and finance.

While much has been said about the benefits and promise of AI, there is varied understanding of what it really means. UOB’s Executive Director and Head of Group Enterprise AI, Data Management Office, Mr Johnson Poh, attempted to de-mystify the topic at a Masterclass following UOB Asset Management’s 2020 Investment Outlook Seminar.

The definition of AI is broad – ranging from intelligent automation in its simplest form such as automating appliances in a home, to behaviour that mimics humans in its most complex manifestation such as developing self-driving cars.

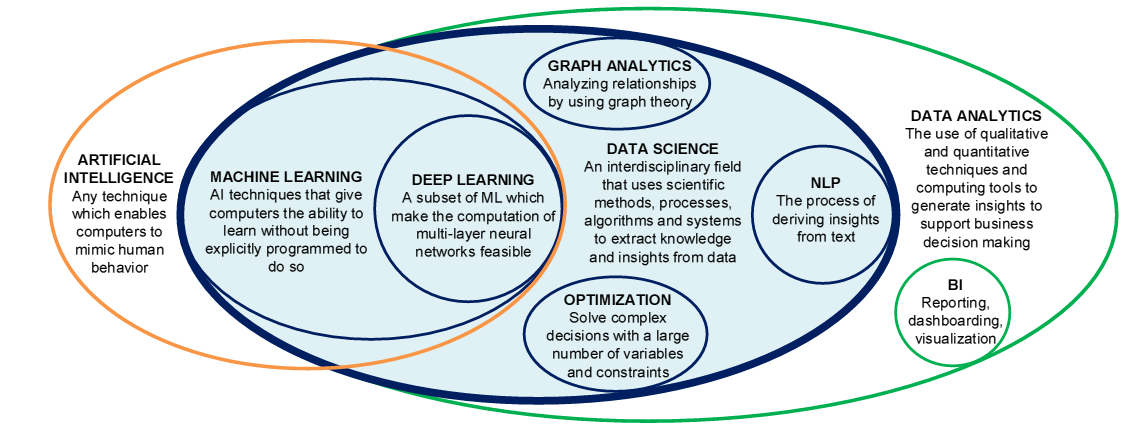

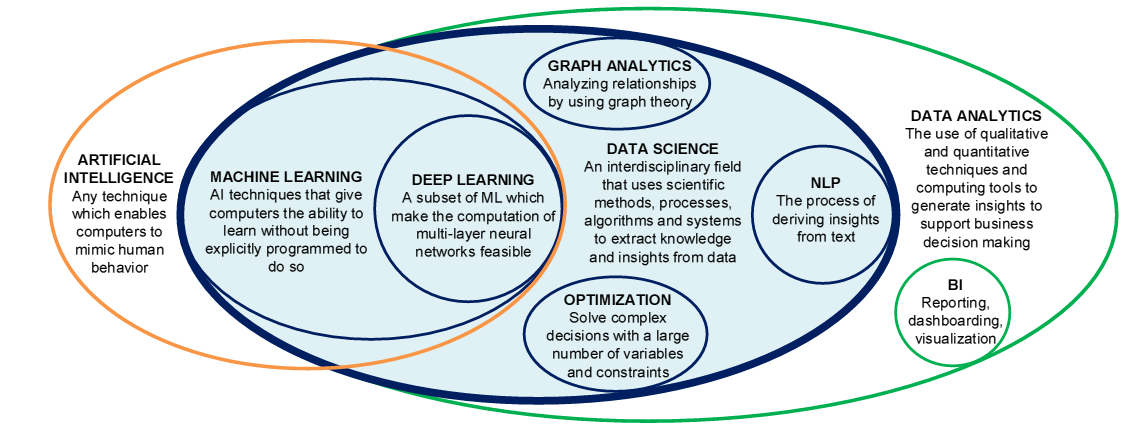

The field of AI encompasses Machine Learning (ML), which is an AI technique that gives computers the ability to learn without being explicitly programmed to do so. Deep Learning (DL) is a subset of ML where the computation of multi-layered neural networks is made feasible, in an attempt to replicate the workings of a human brain.

Both ML and DL are also fields within Data Science and Data Analytics, where qualitative and quantitative techniques and computing tools are used to generate insights to support business decision-making.

Using the various facets of AI, ML and data analytics, each step of the customer journey can be enabled for a smoother ride. The key is in matching the right technology to the appropriate business use case.

The four main phases of the customer journey are:

- Brand awareness and marketing where campaign optimisation, product recommendation and chatbot/robo-advisers can be activated with AI tools such as classification, optimisation and natural language processing (NLP).

- Account opening and on-boarding where credit scoring, know your customer (KYC) and behaviour scoring can adopt regression, classification and object detection tools.

- Transaction and service delivery where ATM location optimisation, anti-money laundering (AML)/fraud detection and payment default can utilise anomaly detection, graph analytics and optimisation technology.

- Retention, engagement and advocacy where cross-sell recommendations, and sentiment analytics can use AI tools such as recommender systems and NLP.

Having identified the AI tools to adopt for each phase of the process, the next step is to figure out how to go about implementing them.

Mr Poh identified three key enablers:

- People where capabilities need to be built up with AI champions possessing diversified skillsets to collaboratively drive specific initiatives. These include AI product developers and architects, data scientists and engineers and product or business owners.

- Domain expertise and processes need to be established with standardised and agile AI development and governance processes based on best practices. The development cycle would involve understanding the business goals, collecting and preparing the data, modelling and then evaluation. Moving on to the operationalisation cycle, this would involve a pilot model validation step, followed by pre-product testing and product deployment.

- Programming and technology to implement an operational model using the modern stack and solutions. A suite of tools – some open-source and others proprietary – could be used on top of distributed computing infrastructure to perform large-scale data processing and machine learning.

With these three key enablers: people equipped with the expertise to drive processes and adopt the right technology, the AI tools can be implemented to better serve customers.

At the end of the day, with the use of AI to power business, customers will be able to benefit from improved engagement with a more seamless and pain-free experience. The use of AI in investment management can also potentially facilitate more dispassionate decision-making, which would ultimately produce better outcomes for investors.

Visit UOBAM.com.sg/perspectives/theyearahead.page for more on our 2020 outlook and insights.