Share:

This article is brought to you by Victor Wong, Head of Asia-ex Japan ESG, UOB Asset Management

Many new Sustainability Initiatives were announced by Deputy Prime Minister and Finance Minister Mr Heng Swee Keat in the Singapore Budget 2020 last Tuesday (18 February 2020).

Some of these include a S$5bn Flood Protection and Coastal Defence Fund to safeguard Singapore against rising sea levels, a commitment of close to S$1bn for research in Urban Solutions and Sustainability (i.e. Renewable Energy) as well as a whole slew of measures to promote the use of Hybrid and Electric Vehicles.

Singapore aims to phase out vehicles with Internal Combustion Engines (ICE) and have all vehicles run on cleaner energy by 2040. To encourage motorists to switch to cleaner vehicles, the government has announced several incentives. They will expand Singapore’s existing public charging infrastructure and aim to increase the number of Electric Vehicle Charging points from 1,600 to 28,000 island-wide by 2030. The road tax methodology for cars will also be revised from January 2021 which will lead to an across-the-board reduction in road taxes for Electric Vehicles and some Hybrid Vehicles. Motorists who purchase fully electric cars and taxis will also receive a rebate on the Additional Registration Fee. In 2018, the government started offering upfront rebates for cleaner car models under the Vehicular Emissions Scheme and will be extending the scheme to Commercial Light-goods Vehicles this year.[1]

UOBAM performed a study on how a switch to cleaner car models would affect Singapore’s emissions.

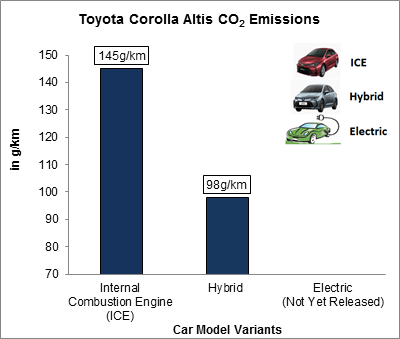

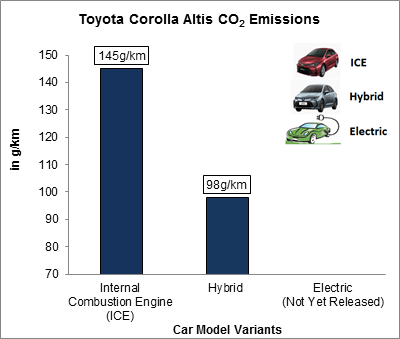

Case study: Toyota Corolla Altis

Ranked among the most popular cars in Singapore (according to sgCarMart). For the purpose of this study we will be looking at the ICE, Hybrid and Electric variants.

| |

Internal Combustion Engine (ICE) |

Hybrid |

Electric (Not yet released) |

| Fuel Efficiency |

15.6km/L |

22.7km/L |

0km/L |

| CO2 Produced |

145g/km |

98g/km |

0g/km |

Source: Toyota Corolla Altis Brochure, 2020

Toyota intends to launch more than 10 Battery Electric Vehicles by 2025 with China as their first target market.[2]

The standard ICE variant emits 145g of Carbon dioxide (CO2) per kilometre while the Hybrid version of the same car produces only 98g of CO2 per kilometre. The Electric version will not have an ICE and will not produce CO2 at all.[3]

According to the Land Transport Authority’s Annual Vehicle Statistics and Data.gov, the total number of private cars registered in Singapore was 615,452 in 2018 with an average annual mileage of 17,500km per car. Using the Toyota Corolla Altis as an example, each ICE car produces 145g of CO2 per kilometre and using data from 2018 we can estimate emissions of 1.5 million tCO2e[4] from private cars alone. If Singapore were to switch to fully electric vehicles, they would be able to cut the nation’s annual direct tCO2e emissions by about 3%, using 2017’s total emission figures of 52.5 million tCO2e.

By intending to phase out CO2 emitting vehicles, Singapore has joined the ranks of forward-thinking countries which have also previously announced plans to embrace clean energy and Hybrid/Electric Vehicles. In the UK, they have just announced plans to speed up the transition to electric cars bringing the proposed date forward from 2040 to 2035, or even as early as 2032. They have also extended the ban to hybrid cars.[5]

Goodbye guzzlers, hello clean cars

| Country |

Plan announced |

Ban/phase-out by |

Vehicle type |

| Singapore |

2020 |

2040 |

Petrol/Diesel |

| Norway |

2017 |

2025 |

Petrol/Diesel |

| Netherlands |

2019 |

2030 |

Petrol/Diesel |

| UK |

2017, 2020 (adjusted) |

2040, adjusted to 2035 or 2032 |

Petrol/Diesel/Hybrid |

| Iceland |

2018 |

2030 |

Petrol/Diesel |

| Ireland |

2018 |

2030 |

Petrol/Diesel |

| Sweden |

2018 |

2030 |

Petrol/Diesel |

| Slovenia |

2017 |

2030 |

Petrol/Diesel |

| France |

2017 |

2040 |

Petrol/Diesel |

| Costa Rica |

2019 |

2050 |

Petrol/Diesel |

| Israel |

2018 |

2030 |

Petrol/Diesel |

| China |

2017 |

TBD |

Petrol/Diesel |

| Sri Lanka |

2017 |

2040 |

Petrol/Diesel |

In terms of investment implications, the move by the increasing number of countries towards cleaner vehicles will have a clear impact on energy companies. Those which are unwilling or slow to embrace more renewable energy sources will find themselves sitting on stranded assets, lose their market competitiveness and increasingly be shunned by investors. Similarly, automotive companies without a strong future model line-up of hybrids and electric vehicles will also find themselves being less attractive to investors. Conversely, companies which are actively involved in the manufacture and supply of hybrids and electric vehicle related components are likely to feature clearly on investors’ radar screens.

Singapore’s vision to phase out ICE Vehicles in 2020 comes after the implementation of a Carbon Tax announced in last year’s budget[6]. In Budget 2019, the government introduced the Carbon Pricing Act which imposed an additional tax on industrial facilities emitting more than 25,000 tCO2e of direct Greenhouse gases (GHG) annually. The regulation took effect from 1 January 2019 and aimed to discourage industrial companies from emitting excessive GHGs and reduce their carbon footprint.

Other initiatives

Singapore also launched a Flood Protection and Coastal Defence Fund with an initial injection of $5bn to combat the significant risk of rising sea levels. During the 2019 National Day Rally, PM Lee highlighted this threat and noted that Singapore may need to spend up to S$100bn over the next 100 years for Climate Change Adaptation[7]. According to the National Climate Change Secretariat (NCCS), about 30% of Singapore is less than 5m above the mean sea level and is expected to rise between 0.25m and 0.76m by the end of the century.

Singapore also intends to ramp up its solar capacity to 2 gigawatt-peak (GWp), more than seven times its current levels at 260 megawatt-peak (MWp) and will account for 4% of Singapore’s total electricity demand today.[8] The Housing & Development Board (HDB) has also raised its 2030 solar capacity to 540 megawatt-peak (MWp) which can reduce carbon emissions by up to 324,000 tCO2e a year.[9]

To promote Green Financing in Singapore, the MAS has set up a US$2bn Green Investments Programme (GIP) with the intent to place funds with asset managers who have demonstrated a strong commitment to deepening their green investment capabilities and incorporate environmental considerations into their investment processes[10]. They have also launched a Sustainable Bond Grant Scheme which provides grants for the external reviews required for Issuers to ascertain the Green, Social or Sustainability Bond Status.

Here at UOBAM, we believe that Sustainability is imperative to secure the future for our generations to come. The government is doing their part, and so must we. As asset managers we are fully committed to managing your wealth successfully, responsibly and sustainably.