Share:

The novel coronavirus (COVID-19) has a tendency to turn things upside down. That was precisely what happened on Monday when the May futures contract price for the US oil benchmark, West Texas Intermediate (WTI) turned negative for the first time in history.

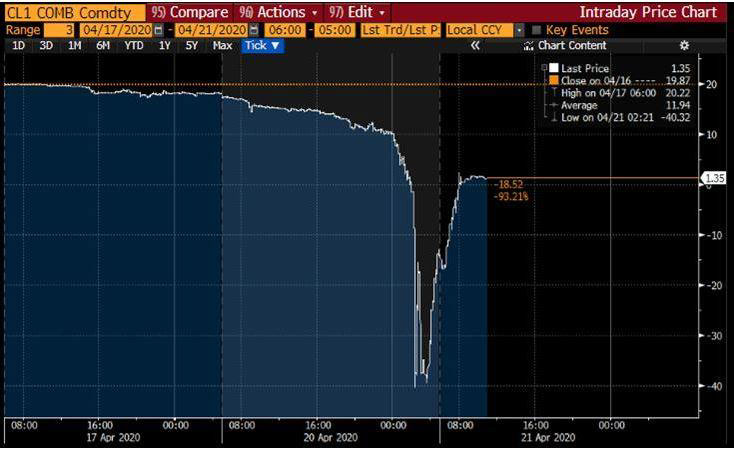

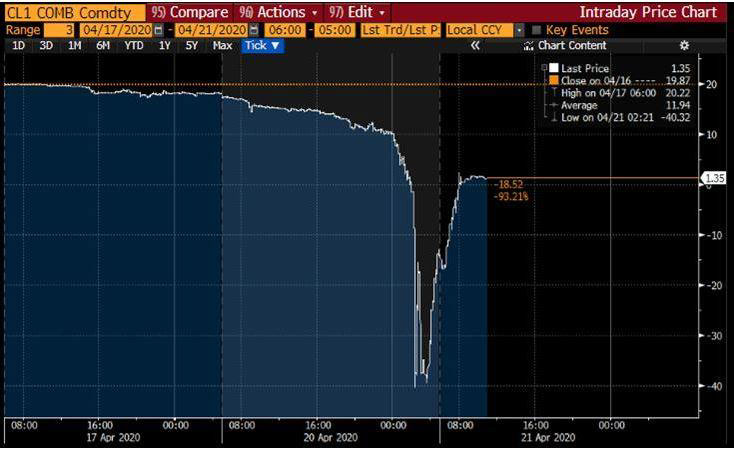

The WTI May contract had broken below US$20/barrel and closed at US$18.30/barrel on Friday 17 April. It opened weaker on Monday before collapsing later in the day to close US trading hours at minus US$37.63/barrel. It had since rebounded to US$1.76/barrel in early Asia trading on Tuesday. The dramatic overnight fall essentially means that owners of contracts which expire on 21 April will have to pay buyers to take the barrels off their hands on the back of rising concerns that US storage capacity may run out in May.

Futures contracts trade by the month and are tied to specific delivery dates. Typically, the price will converge with the physical price of oil on expiry. The final buyers of the contracts are likely to be refiners. Trading of May WTI contracts had been relatively thin on Monday with volumes at 15% that of June contracts, which should be tracking back to around US$20 levels.

Source: Bloomberg

The overnight plunge did however lead to the S&P 500 index closing 1.79% lower on Monday, led by stocks of US oil-related and financial companies on fears of oil-related defaults. Many oil firms are caught in a bind as shutting down an oil well is expensive, which explains why many of the world’s oil producers have been reluctant to slash output amid a global glut, hoping that the demand shrinkage due to COVID-19 lockdowns across the world will be temporary. Many oil firms have already resorted to leasing tankers to store excess supplies, causing freight rates to rise.

For now, the oil price dislocation has been confined to WTI May contracts though such distortions may still surface for subsequent month contracts if lockdowns are prolonged. Brent crude which is the other international oil benchmark is less likely to experience the same phenomenon as it is more widely traded, unlike WTI which has been constrained by the limited export infrastructure in the US Gulf Coast, and is largely piped to neighbouring Canada.

Our base case view of the global pandemic is that the lockdowns in Western countries should see more signs of success in “flattening the curve” amid the declining number of daily new cases. Several countries in Europe are gradually loosening up on lockdown measures. If that continues with the resumption of normal economic activities in the second half of 2020 – as in the case in China – the global GDP will likely pick up and mount a recover by the year’s end.

That should help to stabilise weaknesses in oil markets though it should be noted that as the commodity is tied mostly to transport related sectors, which in the case of air travel will likely be among the last to return to normal. Over the medium to longer term, post-COVID-19 demand may still be dented by lifestyle changes such as increased remote working and teleconferences replacing business trips. While lower oil prices are generally an economic stimulus, extreme low levels that trigger oil-related bankruptcies do have negative effects, especially for the reeling US shale oil sector.

Our house view

We are Neutral on commodities with a preference for safe assets such as gold. Oil does appear oversold but the recovery will likely lag those of equities and credits in sectors that will be the first to restart when lockdowns end. We are Neutral on equities and Overweight investment grade credits.