Share:

Key takeaways

- Equity market volatility over the past few days was triggered by a spike in new coronavirus (Covid-19) cases across the world, concern over the impact on global growth and profit warnings on Wall Street.

- UOB Asset Management (UOBAM) maintains our view that the virus outbreak will eventually pass and markets will recoup their losses after the temporary weakness, as has been the case in previous outbreaks.

- As our mainland China case study below suggests, the domestic China market bottomed when the number of new cases in the country appeared to peak and subsequently decline. Outside of mainland China, new cases have just started to increase and we think it is still too early to say when it will peak and the extent of economic impact.

- We retain our positioning to be neutral between equities and fixed income and stay balanced in 2020 as global risks such as this Covid-19 outbreak warrant some caution. Within Asian equities, we remain positive on mainland China.

Market volatility

The Covid-19 outbreak continues to trigger volatility in markets. In the past couple of weeks, bond yields and global currencies have strongly reflected the anxieties of global investors. The US 10-year Treasury bond yield fell from 1.9% at the start of the year to 1.3%, suggesting risk aversion and a flight to safety. Asian currencies like the Singapore dollar have declined 2% in value with Asia being the origin and epi-centre of the virus outbreak.

Equities had been more resilient to the virus contagion risks but starting on 24 February 2020, the US Dow Jones Industrial Average and other developed market indices have fallen more than 6% over a few days. Many major markets have now given up their year-to-date gains for 2020.

We think the reason for this latest down-move was the spike in Covid-19 cases across the world in Korea, Italy and Iran over the weekend, with growing fears that a global pandemic will stifle economic growth. Markets also appear to have corrected on the back of a profit warning from Apple Inc and a decline in global flash purchasing managers’ indices (PMIs). We expect global economic data and corporate profits around the world to be extremely weak in the first quarter of 2020 due to the viral outbreak.

Our view

Our base case House View is that this virus outbreak will eventually pass like many such instances in the past, but it will take a few months to play out and markets will be volatile meanwhile.

As we have highlighted in previous updates, we think global investors should treat the Covid-19 outbreak as a serious global risk that is already more significant than the severe acute respiratory syndrome (SARS) outbreak in 2003. In SARS and other virus outbreaks, markets returned to normal and recovered all losses once the outbreak convincingly subsided. But in the current outbreak of the Covid-19 virus, we think it is still too early to be confident about when it will peak and how significant the economic declines will be.

In mainland China and some parts of Asia (excluding South Korea), we think there is evidence that the outbreak is being contained. But the current volatility has been triggered by outbreaks outside of mainland China, where there remains significant risk that the outbreak can spread further. Encouragingly, the preventive measures employed in mainland China and elsewhere such as Singapore appear to be able to suppress the outbreak and may be a model for countries with new outbreaks.

The global concern is that the economic effects of the preventive and mitigating measures are likely to significantly drag down economic growth in the first quarter of 2020 and potentially weigh on the second quarter of 2020 as well, but we think any economic and company earnings impact will be temporary.

Market moves

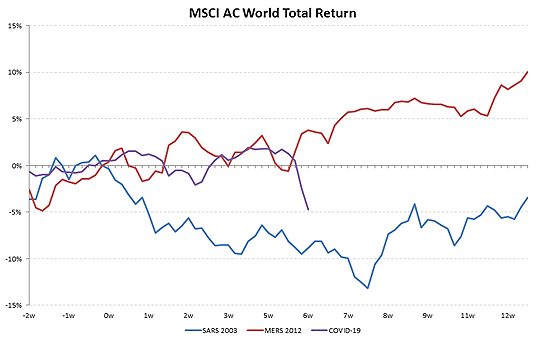

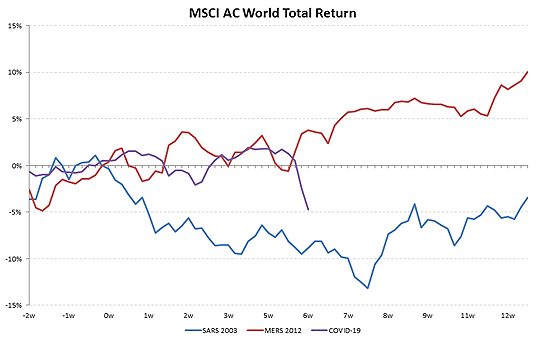

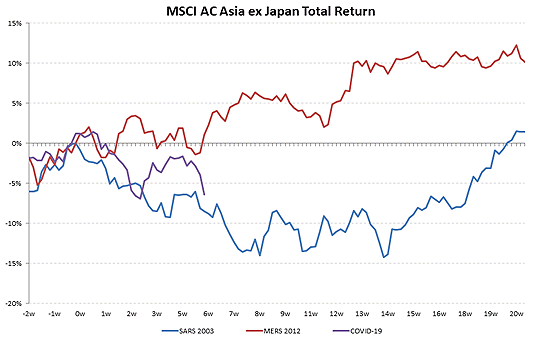

We note that despite the volatility and weak markets of the past week, equity markets have until recently held up better than in 2003 during the SARS outbreak.

X-axis – No. of weeks prior to and after starting point of the Covid-19 outbreak

Source: Bloomberg, MSCI, February 2020

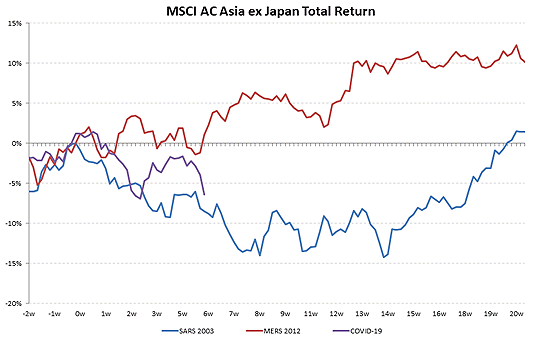

X-axis – No. of weeks prior to and after starting point of the Covid-19 outbreak

Source: Bloomberg, MSCI, February 2020

In fact, in the few weeks after the Covid-19 outbreak in late January, the US markets reached new highs and was trading at valuations that were expensive relative to other Asian and emerging markets especially mainland China, which first took a hit when the Covid-19 outbreak started. Many of the US blue-chip technology stocks were arguably technically overbought. Hence, there had to come a time when a correction was due and the fear that the virus spread was turning into a global pandemic may be the spark that triggered profit-taking.

Mainland China case study

Interestingly enough, China’s domestic ‘A’ share market, actually bottomed on 3 February 2020 when the markets re-opened after the Lunar New Year holiday. The market has been trending up since as the number of new virus cases especially in mainland China outside of Hubei province (ex-Hubei) have come down sharply.

It was the same case in SARS when global markets took a hit from February to April 2003 when the SARS virus spread rapidly throughout Asia, but had actually started and peaked in mainland China months earlier. Similarly, China ‘A’ shares also outperformed global markets during that same period as they had already taken a hit earlier.

We see the same playbook being enacted again. If mainland China is able to control the spread of Covid-19, we believe the spread of the virus globally will eventually be contained too until a vaccine or effective treatment is found.

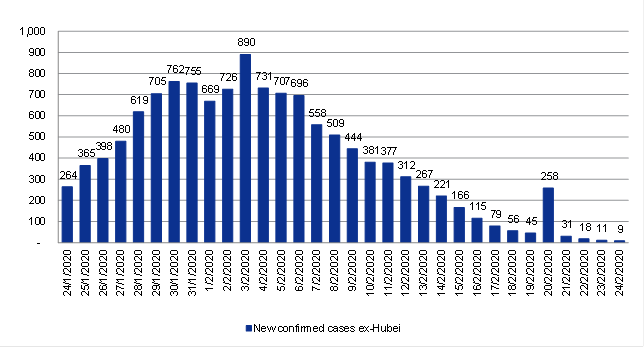

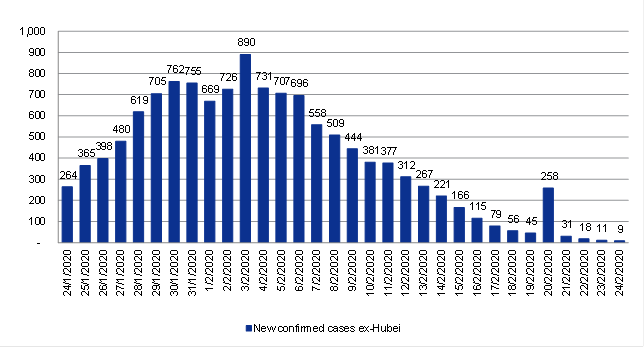

Daily new cases of Covid-19 in mainland China outside of Hubei

Source: http://www.nhc.gov.cn/xcs/yqfkdt/gzbd_index.shtml, http://wjw.hubei.gov.cn/, February 2020

We note the new cases outside of mainland China’s Hubei province spiked on 20 February 2020 when the authorities took the count from its prisons, but it is clear that new cases have been coming down since it peaked on 3 February 2020.

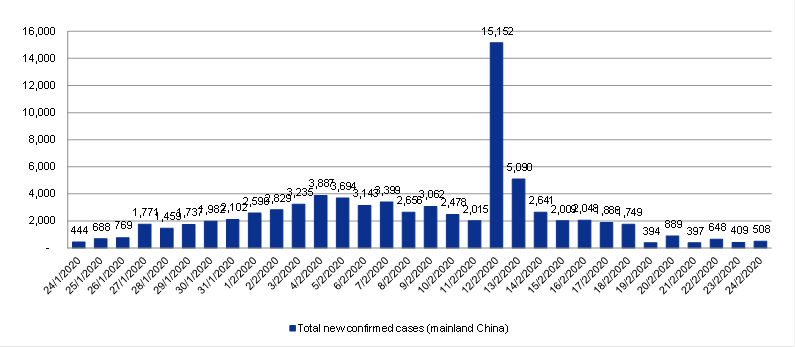

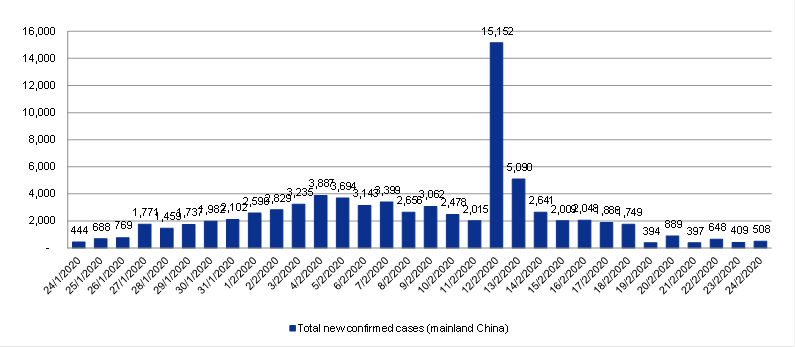

Daily new confirmed cases of Covid-19 across mainland China

Source: http://www.nhc.gov.cn/xcs/yqfkdt/gzbd_index.shtml, http://wjw.hubei.gov.cn/, February 2020

Across the whole of mainland China, the number of new confirmed cases has been generally declining since it peaked in the middle of February.

China market bottomed on 3 February 2020

Source: Bloomberg, February 2020

China ‘A’ shares (CSI300) bottomed on 3 February 2020 when the markets re-opened after the Lunar New Year holidays and have been trending up well since then, coinciding with the decline in new cases in mainland China ex-Hubei.

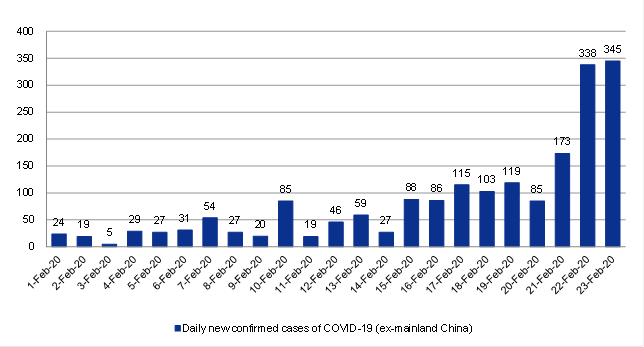

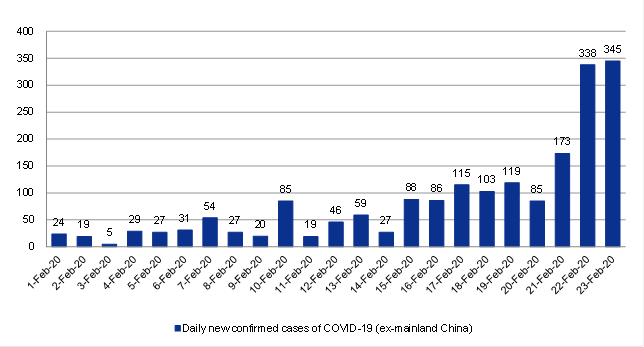

Daily new confirmed cases of Covid-19 outside of China

Source: http://www.nhc.gov.cn/xcs/yqfkdt/gzbd_index.shtml, http://wjw.hubei.gov.cn/, February 2020

However, outside of mainland China, the number of new cases has just started to increase, alarming global investors as it now appears that the Covid-19 outbreak is not confined to mainland China or Asia. It is not clear currently how and for how long this trend will continue, thus triggering global market declines.

Our strategy and positioning

We maintain our UOBAM House View to be neutral between equities and fixed income in this environment. The outlook for 2020 remains that the recession risks from 2019 have diminished and a continued expansion cycle in 2020 implies the opportunity for equities to attain high single-digit return levels during the year. However, equity valuations are full and the growth outlook was moderate even before the virus outbreak. Global risks such as the Covid-19 outbreak are significant enough to warrant some caution and thus stay balanced in 2020.

Within our Asia equities strategy, we remain positive on mainland China as we think the market has bottomed along with a peak in new cases in mainland China. We are still more cautious on the other Asian markets as we monitor how the virus develops globally. However, we remain positive for the rest of the year and look for buying opportunities.

If volatility increases and market declines become more significant, then we would reassure investors that our base case remains that virus outbreaks tend to diminish as the weather warms and preventive measures become more effective. If preventive measures can slow down the progress in high density populations like mainland China, then we believe it can work elsewhere.

When the outbreak is under control, markets will be forward-looking and we believe the growth slowdown of the first quarter will not weigh heavily on asset class performance. Overall, UOBAM continues to respect the risks associated with the outbreak, but recommends to remain calm and keep investment portfolios balanced.