Share:

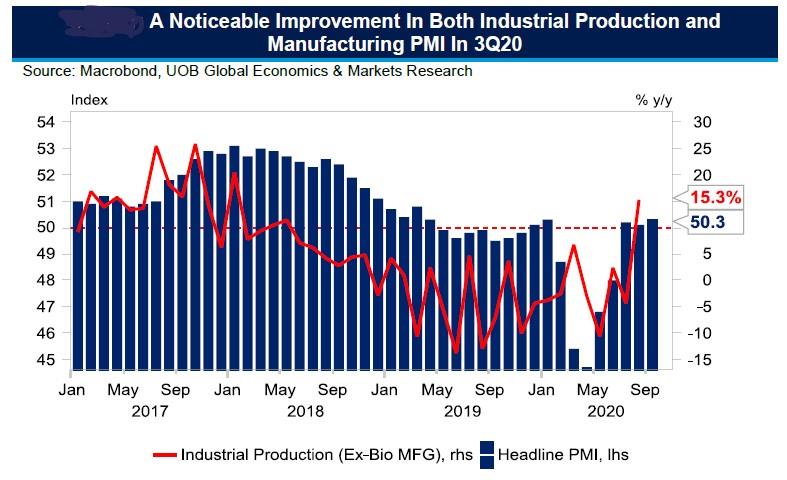

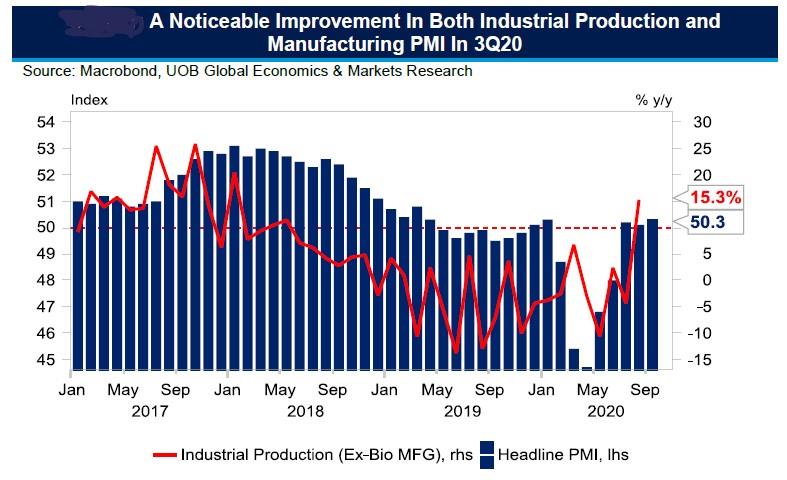

The Singapore manufacturing and electronic Purchasing Managers’ Index (PMI) continued to rise in September, according to the latest report by the Singapore Institute of Purchasing & Materials Management (SIPMM). Headline manufacturing PMI gained 0.2 points to 50.3, marking its third straight month of expansion. Similarly, the electronic PMI rose at a faster pace at 0.3 points to end at 50.9, the highest since a year ago.

The latest PMI data reflects a relatively rosier economic backdrop, compared to when the PMIs remained below the 50.0 mark in the period between February and June 2020. It is relatively more upbeat, considering first-time expansions in new orders (50.1 points) in 8 months, as well as faster rates of expansions in new exports (Sept 2020: 50.4 points, versus Aug’s 50.2) and factory output (Sept: 50.8 versus Aug: 50.6).

These data continue to suggest that Singapore’s manufacturing and exports have continued to recover post Circuit Breaker and Phase One restrictions in 2Q20. Encouragingly, the uptick in the PMI data also coincides with the expansions in both industrial production and non-oil domestic exports (NODX) in August. Specifically, Singapore’s industrial production surged 13.7% y/y (+13.9% m/m), the fastest pace since March 2020, while NODX grew for its third straight month by 7.7% y/y in August 2020.

In a separate survey by IHS Markit, Singapore’s private sector economy continued to contract for its 8th straight month, albeit at a slower pace in September 2020. Specifically, the whole economy PMI rose to 45.1 in September, up from 43.6 previously. Despite the contraction, the average PMI reading in 3Q20 at 44.8 is markedly higher compared to the average reading in 2Q20 at 32.8, suggesting that the economy had seen a rebound from the peak negative fallout from COVID-19.

Across the sub-sectors, business activities continued to fall as seen from the “reduced output concentrated in sectors relating to accommodation & food services as well as administrative & support services.” On the flip-side, construction activities have “returned to growth” while manufacturing output was “broadly stable.”

Outlook

The higher readings in both manufacturing and electronic PMIs reinforces our view that a recovery is taking place, coupled with the expansions in industrial production and NODX which underlines a relatively better economic environment in 2H20. Given the growth momentum in Singapore’s NODX and manufacturing environment, we maintain our view that the trough in Singapore’s economic performance is likely seen in 2Q20 (-13.2% y/y), with GDP penciled to contract by a smaller margin of 5.0% for this year. More importantly, the continued improvements in Singapore’s economic backdrop supports our view for the Monetary Authority of Singapore (MAS) to keep its monetary policy parameters unchanged in its upcoming meeting that will be held no later than 14 October 2020.

The employment index however continues to contract for its 8th straight reading at 48.8 in September 2020, suggesting that hiring sentiments remain soft. It is our view that labour conditions will weaken further into 2H20, following the tapering of the subsidies for businesses (under the Job Support Scheme into 4Q20 from 75% for the first S$4,600 of gross monthly wages which will be lowered to between 0% and 50% in 1Q21). A softer labour market has also been echoed by Deputy Minister Heng Swee Keat which in his ministerial statement on 17 August noted that retrenchments will be inevitable despite the Government's best efforts.