Share:

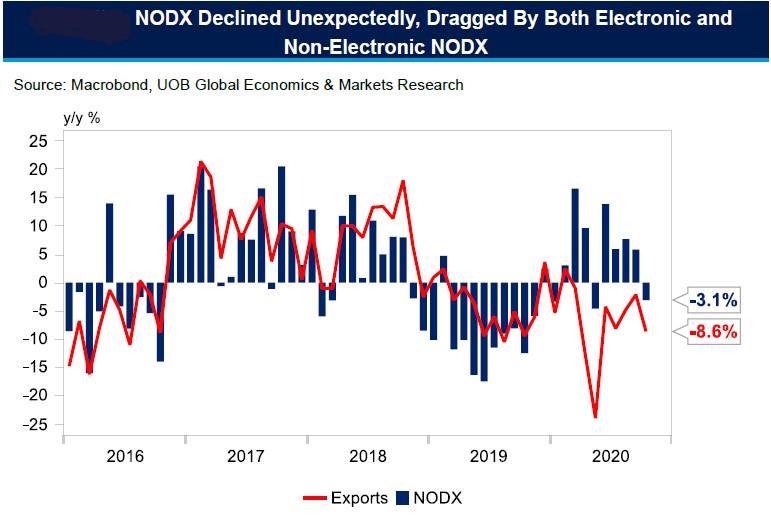

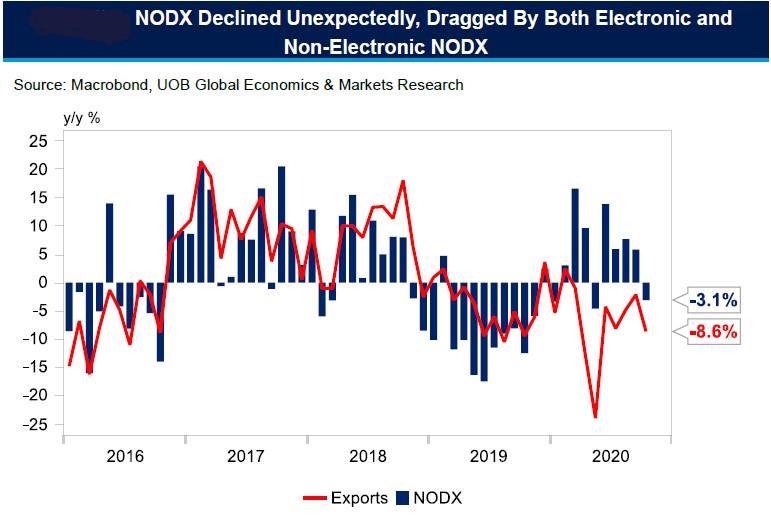

Singapore’s non-oil domestic exports (NODX) for October fell unexpectedly by 3.1% year-on-year (y/y), bucking four straight months of gains between June and September. On a month-on-month (m/m) seasonally adjusted basis, NODX fell 5.3%, marking its second straight month of decline. Total trade fell 9.0% y/y for the month, marking the worst decline in three months due to contractions in overall exports (-8.6% y/y) and imports (-9.3% y/y). Accounting for the latest data, NODX expanded 5.0% in the first ten months of 2020 compared to the corresponding period last year.

The overall decline in NODX was led by dips in both electronic exports (- 0.4% y/y) and non-electronic exports (-3.9% y/y). Exports of integrated circuits (ICs) were down 12.8% y/y for the first time in seven months due in part to a strong base of comparison (S$1.8 billion worth of ICs exports in October 2019) coupled with fallback in regional demand especially from Malaysia and Thailand. Exports of assembled printed circuit boards (PCBs) also fell by 1.0% y/y in October 2020 vs a 22.7% y/y expansion in September. Other products such as computer peripherals (-6.9% y/y) and personal computer (PC) parts (-1.0% y/y) also contributed to the decline in electronic NODX.

Non-electronics NODX which had been underpinned by exports of non-monetary gold (NMG) in the past fell for the first time in five months. Other products such as petrochemicals (-15.3% y/y for 26 straight months of decline), circuit apparatus (-12.2% y/y, four consecutive months of contraction) and electrical machinery & apparatus (-8.9%, first fall in three months) also led overall non-electronic NODX lower. On the flip side, exports of pharmaceuticals (+2.7% y/y) rose after contracting 27.3% y/y in September.

Exports to key trading partners

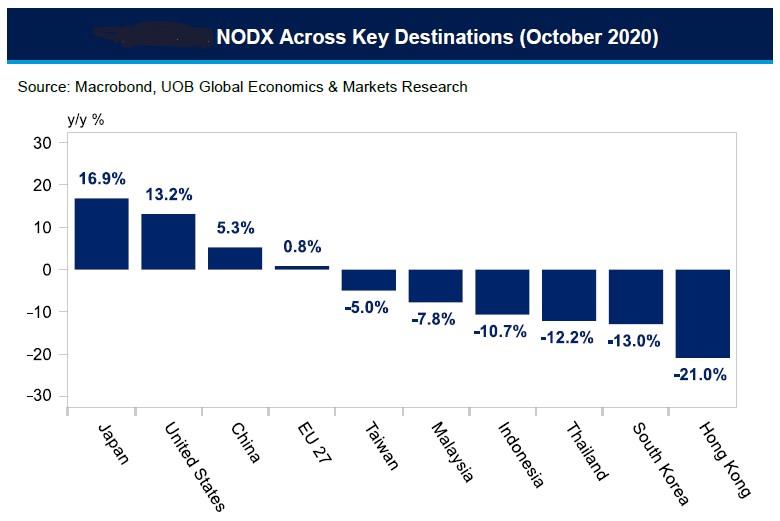

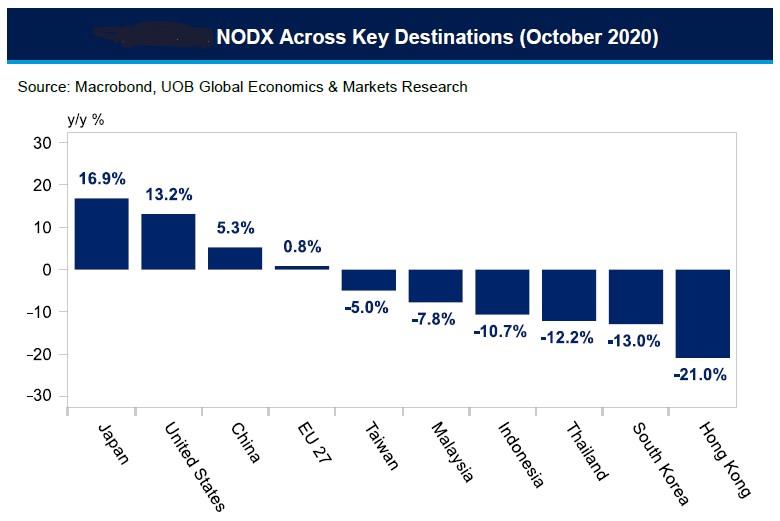

Across Singapore’s key trading partners, NODX dipped in six out of 10 economies. Exports to Hong Kong plummeted 21.0% y/y in October 2020, clocking the 7th straight month of decline due to lower NMG demand (-83.5% y/y), electrical machinery (-36.6% y/y) and ICs (-4.4% y/y).

Exports to Malaysia (-7.8% y/y vs +28.8% y/y in September) was led by lower exports of civil engineering parts (- 52.8% y/y), ICs (-26.5% y/y) and petrochemicals (-25.0% y/y); while Thailand saw lower NMG demand (-36.4% y/y) and ICs (-39.1%). Encouragingly, higher shipments to Japan (+16.9% y/y), US (+13.2% y/y) and China (+5.3% y/y) continued to cushion the overall decline.

Non-oil re-exports (NORX) widely regarded as a proxy for Singapore’s wholesale trade services rose for the third month at 2.5% y/y in October. The growth was supported by electronics exports which saw a surge of 20.0% y/y, led by diodes & transistors (+59.3% y/y), PC parts (+31.5% y/y) and ICs (+27.8% y/y). Non-electronic NORX however fell 13.3% y/y, as declines in exports of aircraft parts (-51.8% y/y) and piston engines (-51.8% y/y) persisted. Across NORX destinations, exports rose across Singapore’s top 10 markets except for Malaysia, Indonesia, Japan and Taiwan. The top three contributors were China (+43.9% y/y), Hong Kong (+26.7% y/y) and South Korea (+11.4% y/y).

Outlook

We continue to point out that exports of NMG and pharmaceutical products are highly volatile which may inject substantial risks to how overall NODX could perform for the remaining two months of 2020. In a similar vein, we are reminded that pharmaceutical exports had see-sawed from a contraction of 27.3% y/y in September 2020 to a 2.7% expansion in October 2020. Moreover, NMG demand will continue to be driven by safe-haven demand although the October decline could suggest that global economic confidence had been improving given recent news of COVID-19 vaccine developments.

Overall, the uncertainties over the COVID-19 pandemic may still continue to cloud Singapore’s trade prospects should global infection rates spike unexpectedly. Nonetheless, given the year-to-date (YTD) gains in NODX of 5.0% and a low base of comparison in 4Q20, we keep to our view for NODX to grow by 4.0% in 2020 with upside risks which falls in between Enterprise Singapore’s NODX outlook of between 3% and 5%.