Share:

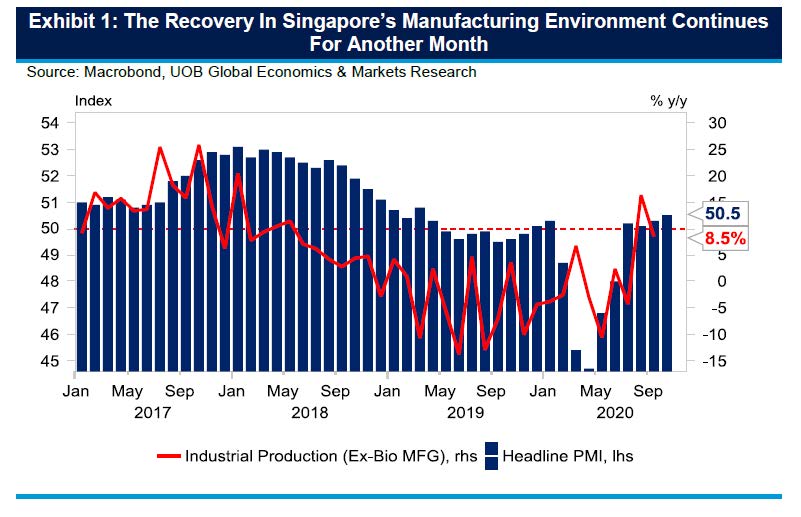

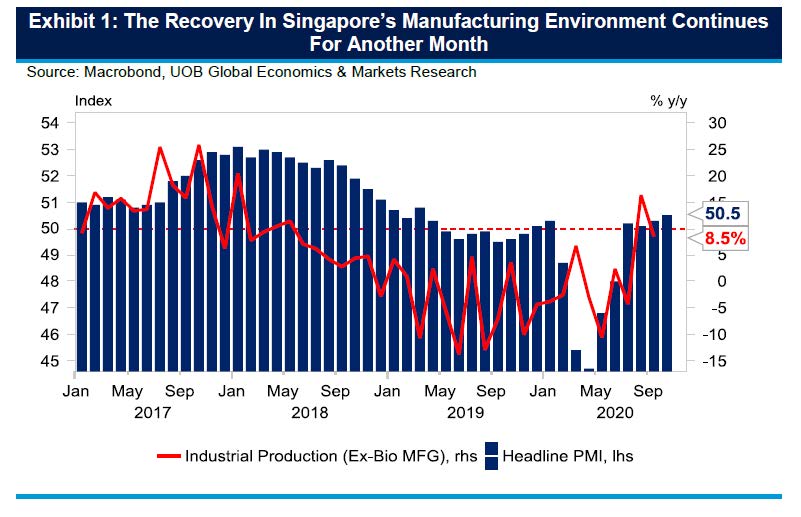

Singapore’s manufacturing output as measured by the Purchasing Managers’ Index (PMI) from the Singapore Institute of Purchasing & Materials Management (SIPMM) rose 0.2 points to 50.5 in October 2020, marking the fourth straight month of expansion and the highest reading since March 2019. The electronic PMI rose 0.1 points to 51.0, clocking its third consecutive month of growth and the highest level since September 2018.

The latest PMI data points to continued recovery. Encouragingly, there was further expansion in new orders (Oct: 50.6, Sep: 50.1) which saw first-time expansion in September after eight months of contraction. There were also faster rates of expansions in new exports (Oct: 50.8, Sep: 50.4) and factory output (Oct: 51.3, Sep: 50.8) suggesting that the improving external demand was one of the key drivers behind the manufacturing momentum.

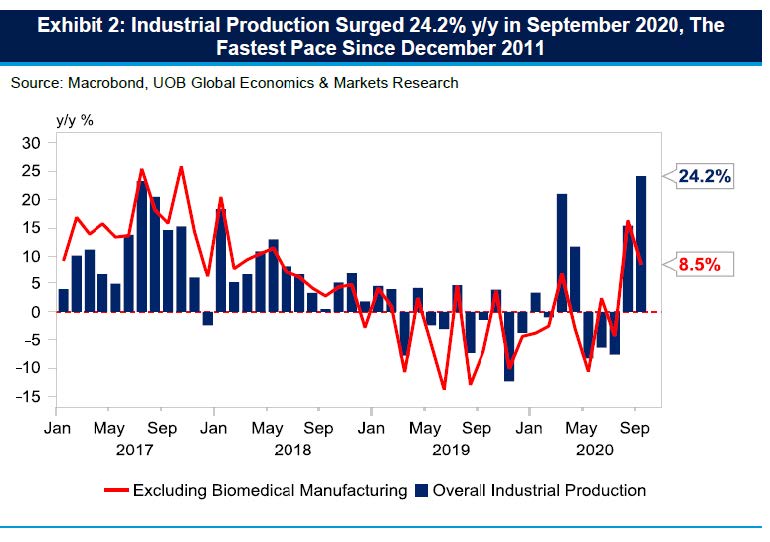

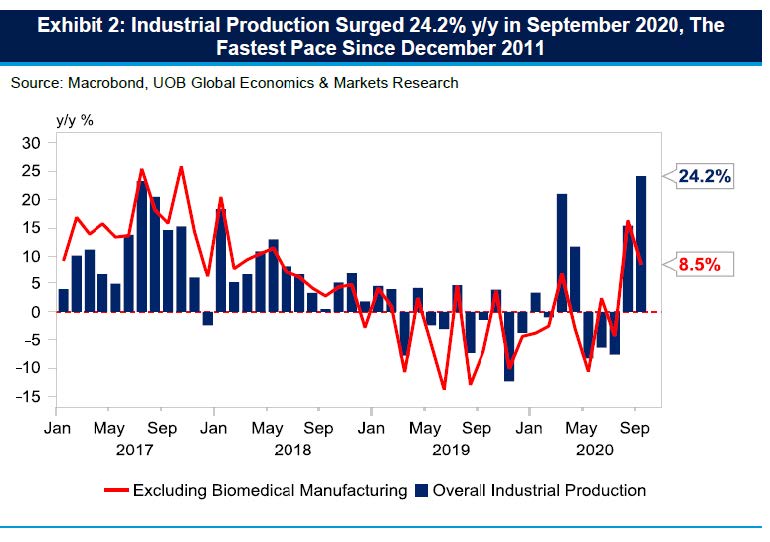

Other indexes such as inventory (Oct: 51.5, Sep: 51.8) and order backlog (Oct: 50.6, Sep: 50.5) also registered above the expansionary mark of 50.0. In a nutshell, these data suggest that Singapore’s manufacturing and exports continued to recover post Circuit Breaker and Phase One restrictions in 2Q20. The uptick in the PMIs also dovetails with the expansion in both industrial production and non-oil domestic exports (NODX) in September. Specifically, industrial production in September expanded at its fastest pace since December 2011 at +24.2% year-on-year (y/y) and up for the fourth straight month by 5.9% y/y.

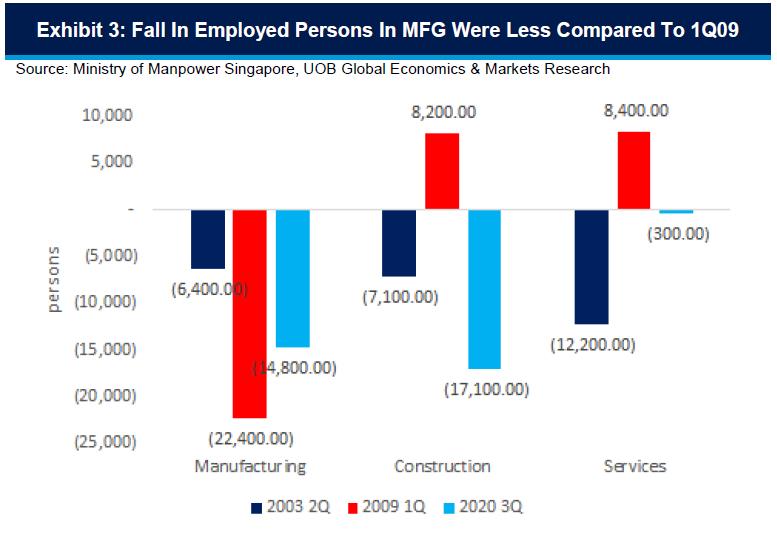

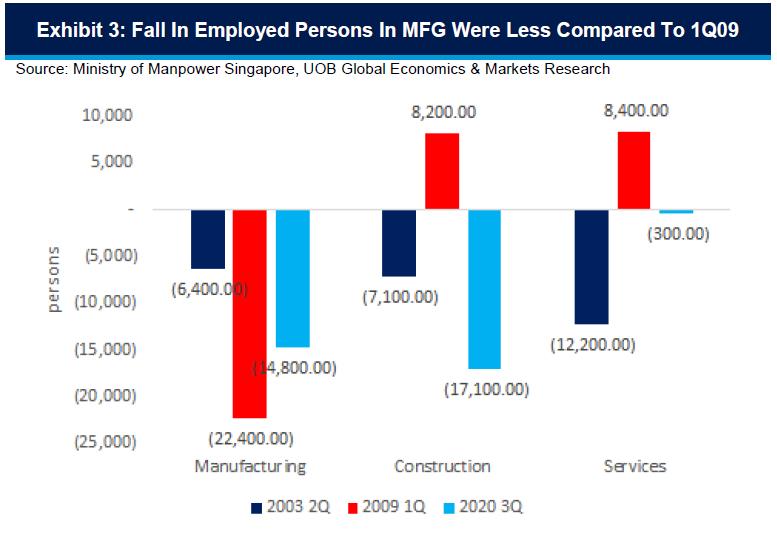

The employment index meanwhile fell for its 9th straight reading, albeit at a slower rate of contraction (Oct: 49.2, Sep: 48.8) which suggests that while hiring continued to stay soft, there may be some nascent signs of a turnaround for labour demand in 4Q 2020. Further evidence that underline a potential improvement in Singapore’s labour market can be seen in the Ministry of Manpower’s (MOM) Labour Market Advance Release 3Q20 Report. Notably, despite seeing Singapore’s overall unemployment rate rising to 3.6% in 3Q20, the rise in retrenchment and overall unemployment rate has also slowed down.

Outlook

In a separate report by IHS Markit, Singapore’s whole economy PMI rose further to 48.6 in October 2020, up from 45.1 in September. This marks the highest reading in nine months since January 2020. Given that it remained below the 50.0 mark, it still showed a lag in the private economy, albeit at a more gradual pace. In the IHS Markit PMI report, output in all three key sectors including manufacturing, construction and services saw broad expansions, suggesting that “improved consumer confidence and an increasing number of businesses resuming operations amid a lower number of infection cases had boosted activity.”

Overall, the higher readings in both the PMI readings released by SIPMM and IHS Markit signal that a recovery is taking place, while recent high-frequency data point toward a relatively better economic environment in 4Q20. Encouragingly as well, there are also nascent signals for a recovering labour market. However, risks are still felt among manufacturers, including concerns over an uncertain geopolitical environment amid fears of new COVID-19 pandemic waves which may once again dampen global demand and the manufacturing recovery.

Looking ahead, the introduction of Phase Three of its re-opening by end-2020 will likely signal an important milestone in Singapore’s relative success in containing the virus spread. Barring a delay of the introduction of Phase Three, further relaxation of social restrictions by the end of this year should continue to not only drive consumer optimism and domestic demand, but may also mean further improvement in Singapore’s external environment and manufacturing momentum.