Share:

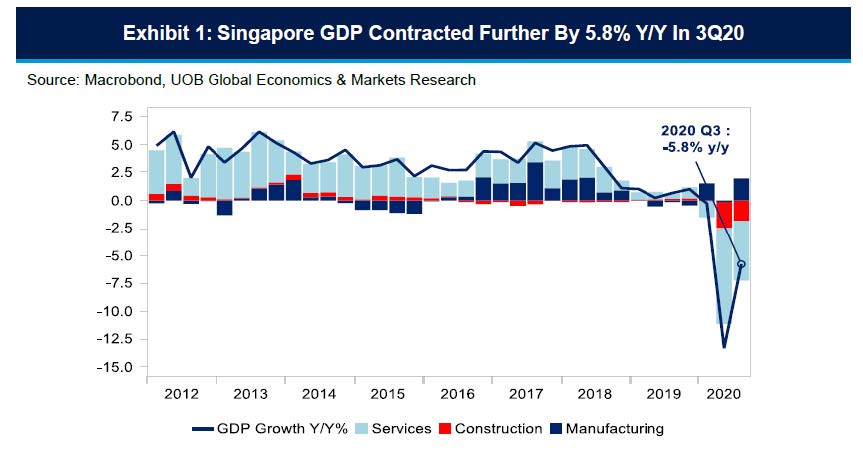

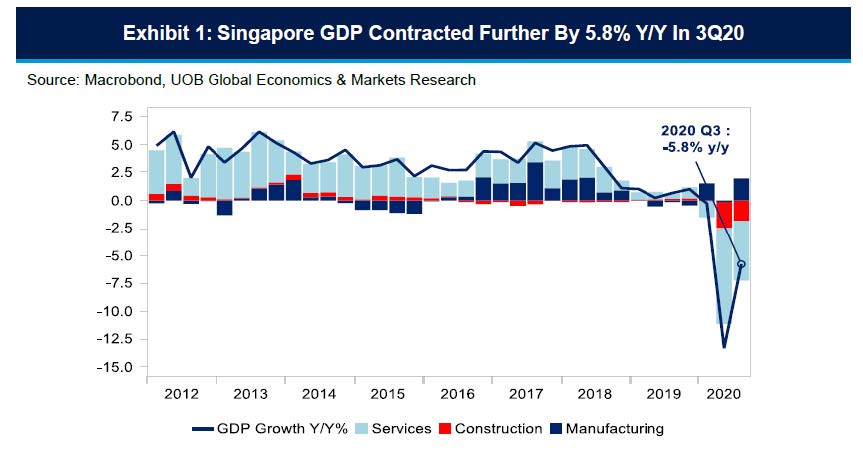

Singapore’s 3Q20 GDP has improved from the previous advanced estimates by the Ministry of Trade and Industry (MTI), according to the latest data. The 3Q20 GDP fell 5.8% year-on-year (y/y) (+9.2% quarter-on-quarter, seasonally adjusted), up from the advanced estimates at -7.0% y/y (+7.9% q/q). Given the better-than-estimated numbers, the economy had contracted by 6.5% in the first three quarters of 2020, compared to previous MTI’s advanced estimates at -6.9% and market estimates at -5.5% (+9.7% q/q) and closer to UOB’s estimates at -5.6% y/y (+9.5% q/q).

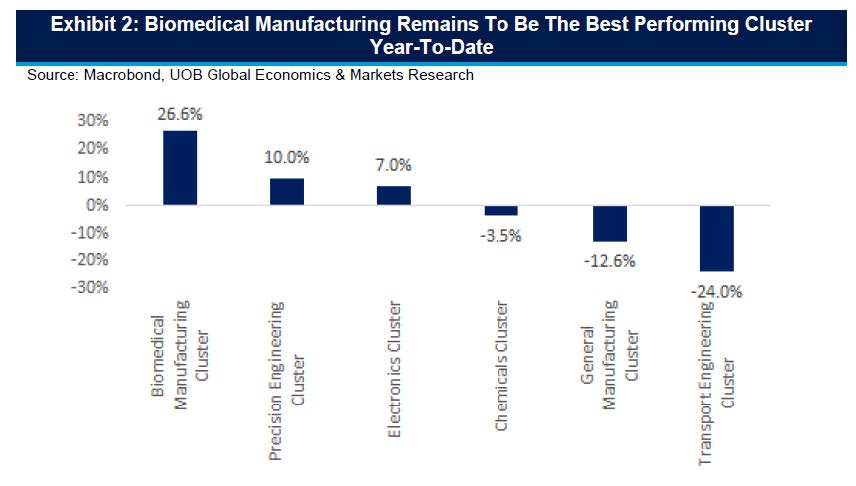

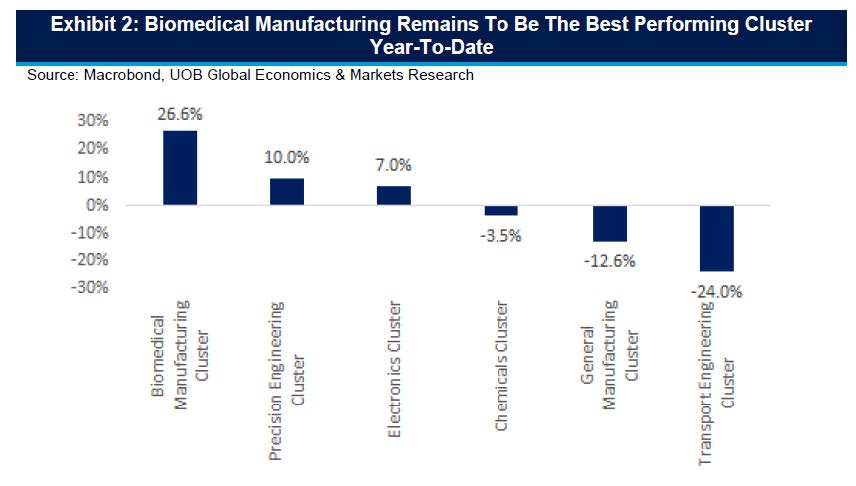

The improved GDP data was driven by an uptick in manufacturing momentum which clocked a strong 10.0% y/y growth in 3Q20, up from the previous advanced estimates of +2.0% y/y. This is in line with our call for industrial production (IP) to average 10% in 3Q20. The strong performance in the biomedical manufacturing cluster (+89.8% y/y) was supported by the demand for pharmaceutical-related products with the surge in the biomedical manufacturing cluster backed by strong pharmaceutical production (+113.6% y/y). Semiconductor-related clusters such as precision engineering (+10.0% y/y) and electronics (+7.0% y/y) had also expanded in September 2020.

Contraction in other key sectors however exceeded previous MTI estimates with services down by 8.4% y/y (from advanced estimates of -8.0% y/y) and construction plunging 46.6% y/y (down from estimates of -44.7% y/y). The decline was led by the aviation and tourism-related sectors such as air transport and accommodation. The transportation and storage sector fell 29.6% y/y in 3Q20 (-39.2% y/y in 2Q20) with the air and water transport segments declining on sluggish air travel demand and dip in sea cargo volumes. Elsewhere, the accommodation and food services sector sank 24.0% y/y despite improving from the -41.8% y/y print in 2Q20 as poor international visitor arrivals and fall in sales volume across all sub-segments within the food services industry dragged the overall sector lower.

Despite a third straight quarter of contraction, the latest GDP print suggests that Singapore’s economy will probably see better days ahead in 2021. The official GDP projection in 2020 has been narrowed to a range of between -6.0% and -6.5%, from a previous range of between -5.0% and -7.0%. The economy is thereafter expected to expand by between 4.0% and 6.0% in 2021, according to the latest MTI outlook, which is in line with the latest MAS Survey of Professional Forecasters (Sept 2020) where Singapore is expected to contract by 6.0% in 2020 and expand by 5.5% in 2021. Importantly, the tone in the 3Q20 GDP press release by MTI was relatively more upbeat, citing that “the major advanced and developing economies are expected to recover from the massive economic disruptions caused by COVID- 19” in 2021 and “on balance, given the improved growth outlook for key external economies, the Singapore economy is projected to return to growth in 2021.”

It is also our view that the global recovery backdrop will likely be favourable for Singapore’s economy into the next year due to three drivers that would likely propel growth into 2021. Firstly, there is the signing of the Regional Comprehensive Economic Partnership (RCEP) which is the world’s largest free trade agreement (FTA) accounting for 30% of global GDP and population and 27% of the world’s total trade value in 2019. The goal of the RCEP “is to lower tariffs, open up trade in services, facilitate the flow of foreign investments, and enhance protections in areas such as e-commerce and intellectual property.” These joint endeavours by the RCEP participants following the expected ratification in 2021 would likely be beneficial to Singapore’s market-oriented and open economy.

Second, it is likely that the incoming US Biden administration will take on a more constructive and multilateral approach in trade with other countries, which may mean better relations within the geopolitical environment and improved global trade prospects. Singapore’s PM Lee Hsien Loong said in a virtual meeting with the Asia-Pacific Economic Cooperation (APEC) group that he hopes for the new administration to be “more coherent, systematic approach – one which will take into account a broader range of US interests, not just a trade balance, but also their overall relationship with China and the overall interest which the US has in the Asia-Pacific and in the world."

Third, Singapore’s position in producing and supplying biomedical products and supplies especially during this COVID-19 pandemic will continue to lift overall manufacturing activities into 2021. The biomedical industry has been the best performing manufacturing cluster year-to-date and is expected to play a key role in the Republic’s production of COVID-19 vaccines due to the presence of major global pharmaceutical firms located here.

Outlook

We have penciled a full-year GDP contraction of 6.0% in 2020 (previous estimate of -5.5%) as Singapore’s construction and services sectors (which accounts for about 80% of Singapore’s GDP) are likely to underperform in 4Q20 following the slow restart in the construction sector amid COVID-19 concerns and non-existent tourism-led demand in 4Q20. Nonetheless, the latest 3Q GDP data signals that Singapore’s economy has been improving since the trough in 2Q20 based on the strength of the manufacturing sector. Should the pace of recovery carry over into 2021, Singapore’s economy should revert to positive growth, and comfortably see an average growth of 5.0% in 2021.