Share:

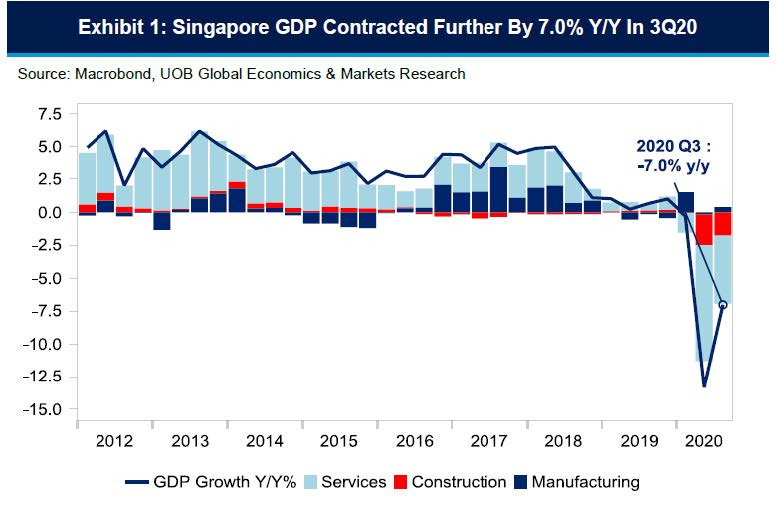

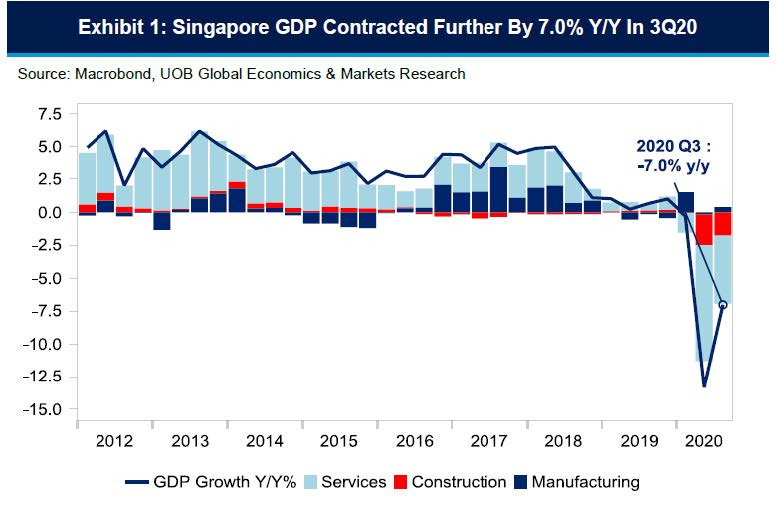

Singapore’s 3Q20 GDP contracted 7.0% year-on-year (+7.9 quarter-on-quarter, seasonally adjusted) according to advance estimates from the Ministry of Trade and Industry (MTI) versus market estimates of for a softer decline of 6.8% y/y (UOB estimate: -6.3% y/y). MTI has also lowered 2Q20 GDP growth to -13.3% from an earlier estimate of -13.2%. With the latest GDP print, Singapore’s economy fell by 6.9% in the first three quarters of 2020.

Despite the three consecutive quarters of contraction, the latest GDP print at -7.0% (+7.9% q/q sa) is significantly better compared to 2Q20 GDP at -13.3% y/y (-13.2% q/q sa) due to the phased re-opening of the economy after the Circuit Breaker from 7 April to 1 June 2020.

High-frequency data such as the Purchasing Managers’ Index (PMI), industrial production and non-oil domestic exports (NODX) point to continued progress. The September PMI data was relatively upbeat considering first-time expansion in new orders (50.1 points) in 8 months; faster rates of expansions in new exports (Sep 2020: 50.4 points vs Aug 50.2) and factory output (Sep: 50.8, Aug: 50.6). Manufacturing had expanded 13.7% y/y (+13.9% m/m sa) in August 2020, the fastest pace since March 2020 (+21.0% y/y) while NODX rose for the third straight month by 7.7% y/y in August. On a month-on-month seasonally adjusted basis, NODX grew by 10.5%, the strongest since April 2013 led by increase in both electronics exports (+5.7% y/y) and non-electronic exports (+8.3% y/y).

Decline led by construction and services sector

The construction sector fell 44.7% y/y in 3Q20 amid the slow resumption of construction activities amid reports of fresh COVID-19 infections in the foreign worker dormitories. The services sector contracted 8.0% y/y in 3Q20 vs 2Q20’s plunge of -13.6% y/y, as aviation and tourism-related sectors stayed lacklustre.

MTI noted that other trade-related services such as wholesale trade were “weighed down by weak external demand as major economies around the world continued to grapple with the COVID-19 pandemic.” The ministry also cited that other consumer-facing services sector such as retail and food services seeing “improvement in performance” but remain in contraction on a year-on-year basis. On a flipside, several sectors such as the finance & insurance and information & communication sectors continued to expand in 3Q20.

Bright spot

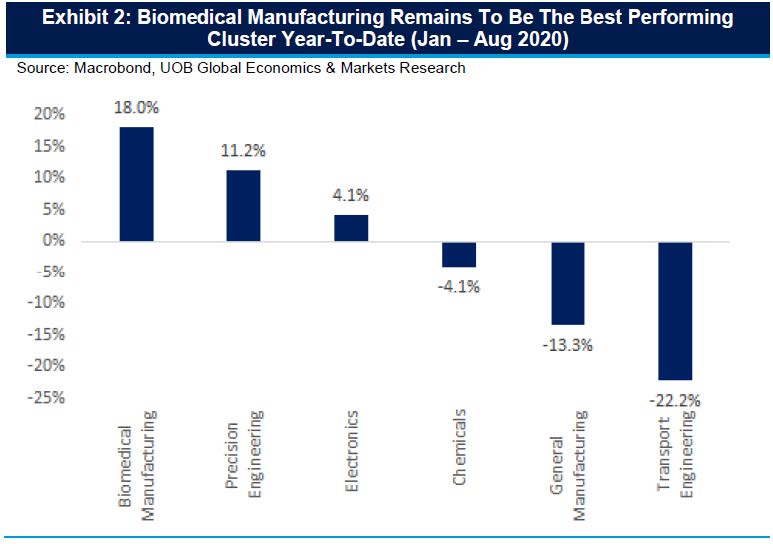

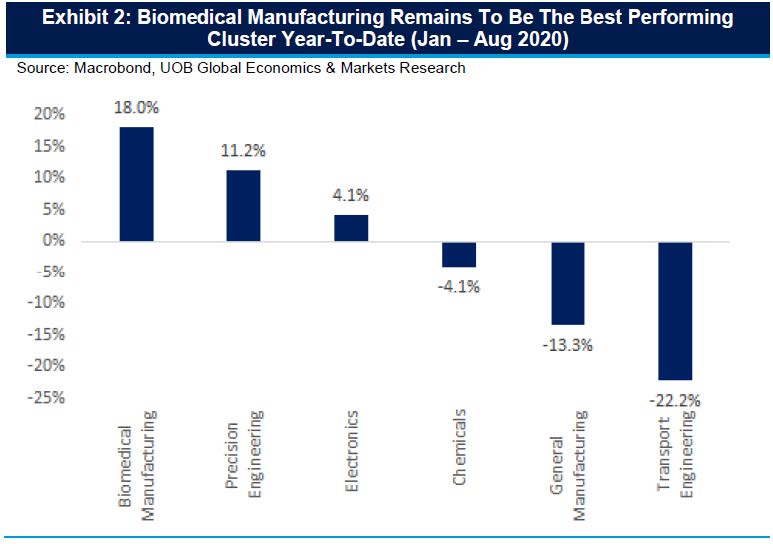

The manufacturing sector was a key bright spot, expanding at 2.0% y/y in 3Q20 and compared to a contraction of 0.8% y/y in 2Q20 led by output expansions in the electronics and precision engineering clusters and continued demand for biomedical products, digital solutions and semiconductor equipment. The biomedical manufacturing cluster is the best performing sector year-to-date given the higher export demand for medical instruments and high output of biological products.

Outlook

With the downside surprise in 3Q20 GDP of -7.0% y/y (+7.9% q/q sa), we expect 4Q20 GDP to weigh in at -5.2% y/y which will round up the full-year GDP growth to -6.5% in 2020, down from our initial outlook of -5.0%. Several bright spots such as the manufacturing sector amid improvements in Singapore’s high-frequency data further confirms that Singapore’s economy has been on the mend since the trough in 2Q20.

Based on the assumption that the pace of recovery can be sustained into 2021, we see growth likely weighing in at +5.0% in 2021, up from our prior outlook of +4.5%. Despite the recovery, real GDP in SGD terms will likely be lower than pre-COVID-19 levels. Our econometric models suggest that the pace of contraction in services and construction will decelerate further in the last quarter of 2020; while manufacturing growth in 4Q20 should improve due to a low-base print in 4Q19.

FX Outlook

Our view that is that USD/SGD will remain weighed by broad USD weakness. Easy monetary policy from the US Federal Reserve and the commitment to keep the Federal Funds Rate near zero under the new Average Inflation Targeting (AIT) regime will keep the USD weak. A strong CNY has also helped to anchor regional currencies, SGD included. As such, we continue to see further modest SGD gains against the USD, pushing USD/SGD lower to 1.35 by end 4Q20, 1.34 by end 1Q21 and 1.33 by end 2Q21.