Share:

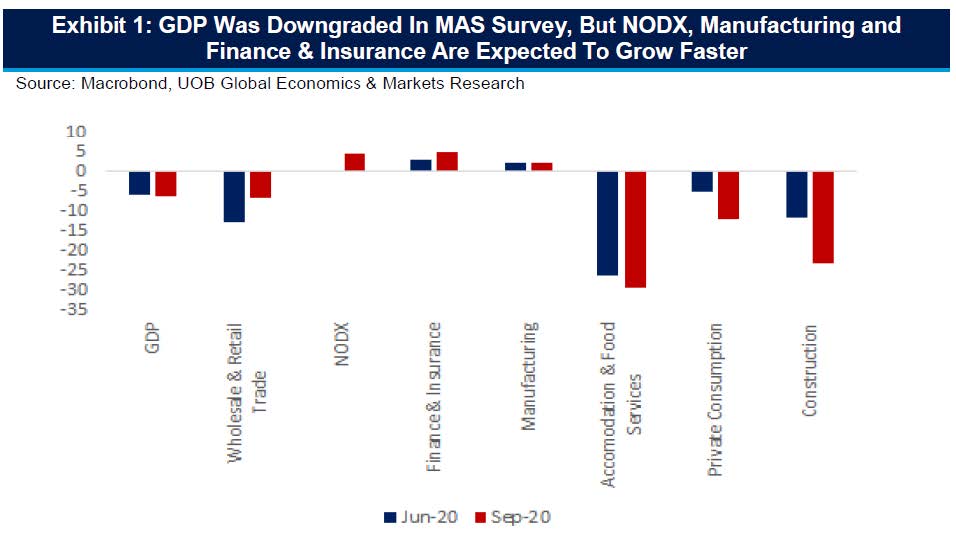

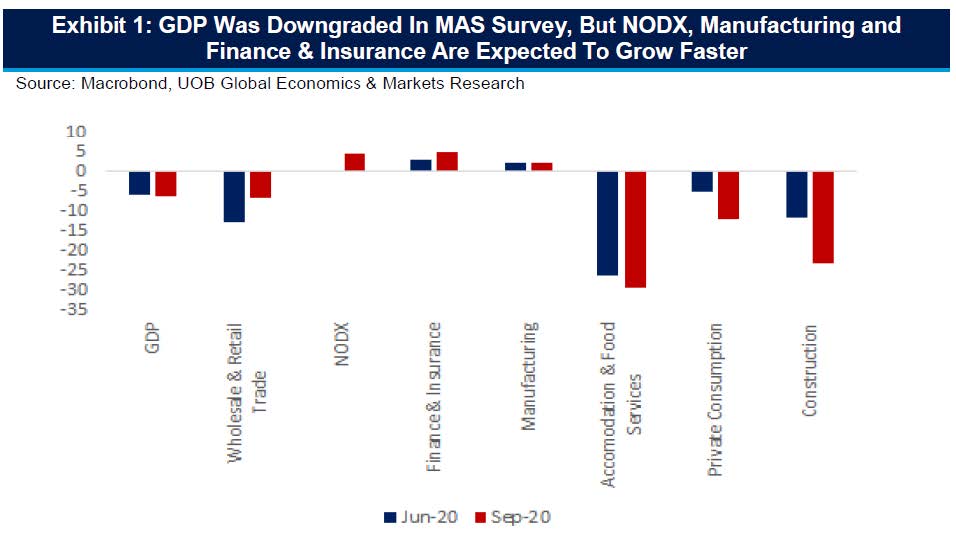

In the latest MAS Survey of Professional Forecasters, respondents shaded their median GDP outlook for 2020 lower to -6.0%, down from a previous outlook of -5.8%. Across sectors, respondents downgraded their 2020 outlook for accommodation & services (-29.1%), construction (-23.0%), and private consumption (-11.8%). Other industries such as finance & insurance (+4.9%), NODX (+4.5%) and manufacturing (+2.3%) are expected to grow faster than previously forecasted. Please see exhibit 1 for more details.

Our outlook for Singapore’s GDP was recently downgraded to - 5.0% for 2020 in view of the protracted COVID- 19 situation worldwide and the persistent downturn in Singapore’s construction and services sectors. Second quarter GDP had contracted 13.2% year-on-year (y/y) from advanced estimates of -12.6% y/y which confirmed that Singapore had experienced its first technical recession since the first quarter of 2009 and its worst quarterly contraction on record.

Given the impact of COVID-19 spread in Singapore’s worker dormitories, the construction sector may stay soft in the 2H2020 with downside risks if the spread of the virus among construction workers turns out to be more severe and protracted than expected. The sector was primarily affected by manpower disruptions arising from movement restrictions at foreign worker dormitories, which led to the stoppage of almost all construction activity during the ‘circuit breaker’ period. The construction sector contracted 59.3% year-on-year in the second quarter of this year, after a 1.2% contraction in 1Q2020. We expect the construction sector to remain in contraction zone in 2H20, coupled with intensified concerns on the spread of COVID-19 in worker dormitories on news that some dormitories previously cleared of the virus have since reported new infection cases in the past weeks. Moreover, the construction sector was badly impacted in the first half of 2020.

In the same vein, the downgrade in private consumption growth is likely due to the deeper-than-expected drop in domestic consumption in the second quarter of this year. Domestic consumption contracted 28.2% y/y in the second quarter, a record decline since public data became available in 1975. Private consumption is likely to stay soft, as indicated by the continued fall in retail sales which dipped 8.5% y/y in July 2020, a smaller decline compared to June’s -27.8% y/y. Excluding motor vehicle sales, retail sales fell by a smaller margin of 7.7% y/y. Despite this, retail demand has been gradually improving post Circuit Breaker (7 April – 1 June) as retail sales surged 27.4% month-on-month in July, similar to in June.

Positives

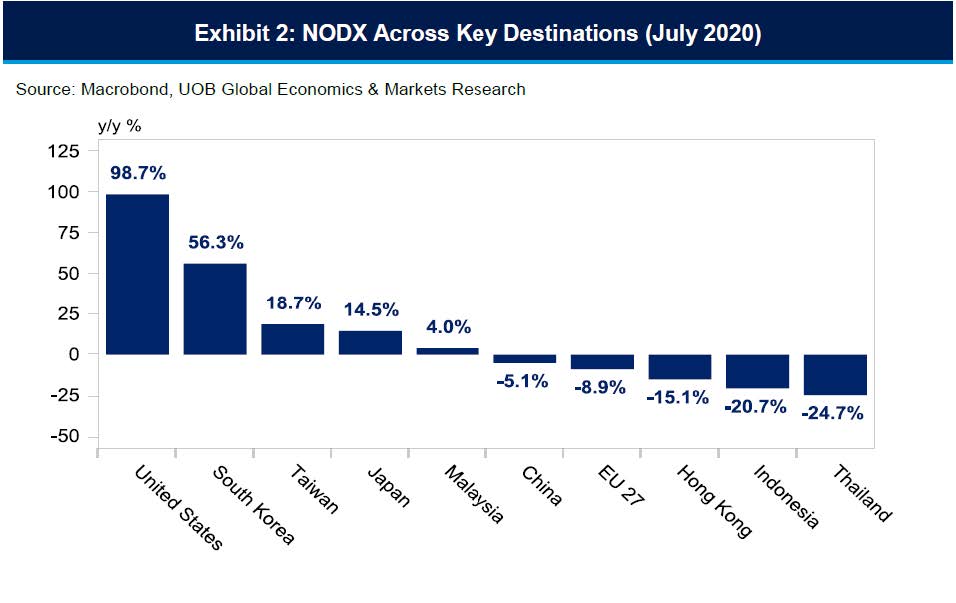

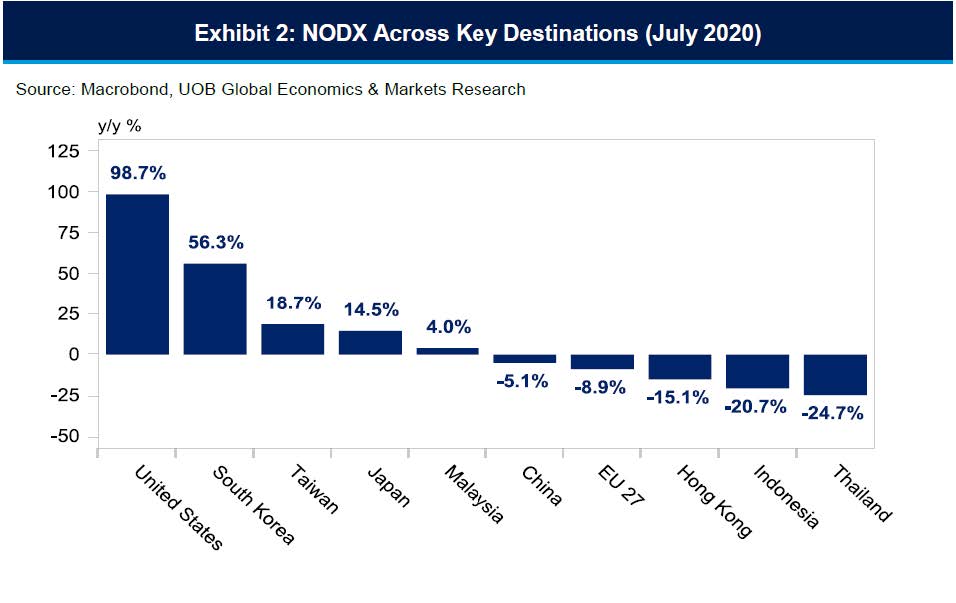

Bright spots are still being observed at this juncture especially on the export front with non-electronic exports (NODX) were buoyed by another month of strong pharmaceutical exports in July, up by 15.5% after 30.8% growth in June. Elsewhere, non-monetary gold exports also surged 227.9% on the back of safe-haven demand, following 238% growth in June. Furthermore, a relatively stronger economic backdrop amongst Singapore’s key trading partners may buoy Singapore’s export growth, especially for the manufacturing sector: outbound shipments to South Korea (+56.3%) was led by exports of specialised machinery and pharmaceuticals. Similarly, exports to Taiwan were underpinned by shipments of integrated circuits and specialised machinery.

Brighter 2021 outlook

The survey respondents pointed to a robust 5.5% GDP growth in 2021, up from a projected contraction of 6.0% in 2020. This compares to our outlook for GDP to contract 5.0% in 2020 before expanding by 4.5% in 2021. We see three factors that could spur a gradual recovery of Singapore’s economic performance into 2021. These include (1) the improvement in the COVID-19 situation in Singapore especially with the prospect of a vaccine by then, (2) the potential re-introduction of tourism-led demand especially given the reopening of the attractions since 1 July 2020, and (3) the support from the biomedical industry in the midst of stronger pharmaceutical-related demand globally. We also expect demand for semiconductor-related manufacturing products for the rest of 2020 and for 2021 to be stronger than expected, given the new-normal environment with telecommuting and work-from-home arrangements increasingly being adopted. Moreover, pockets of the services sector, such as the finance & insurance and information & communications sectors, could see further expansions into 2021.