Share:

The US has reported its best-ever quarterly economic figures with the advance estimates of its 3Q 2020 GDP rising by 33.1% quarter-on-quarter (Bloomberg Est 32%, UOB Est 21.6%) from -31.4% in 2Q and -5.0% in 1Q 2020, about double the previous record of 16.7% jump in 1Q 1950 since data collection started in 1947.

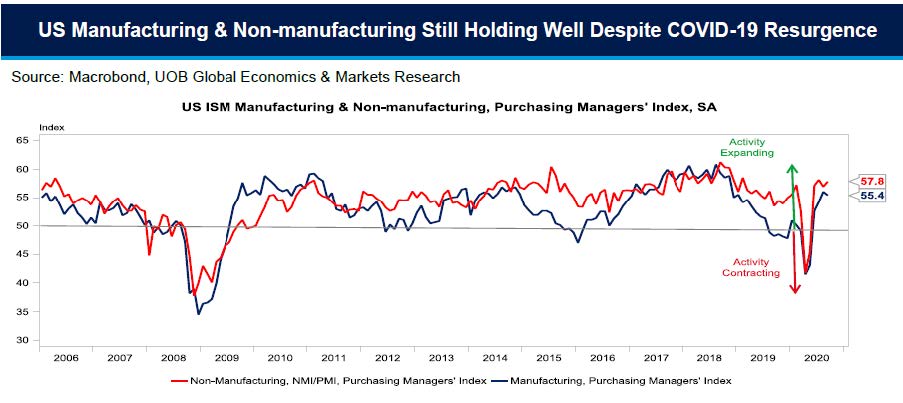

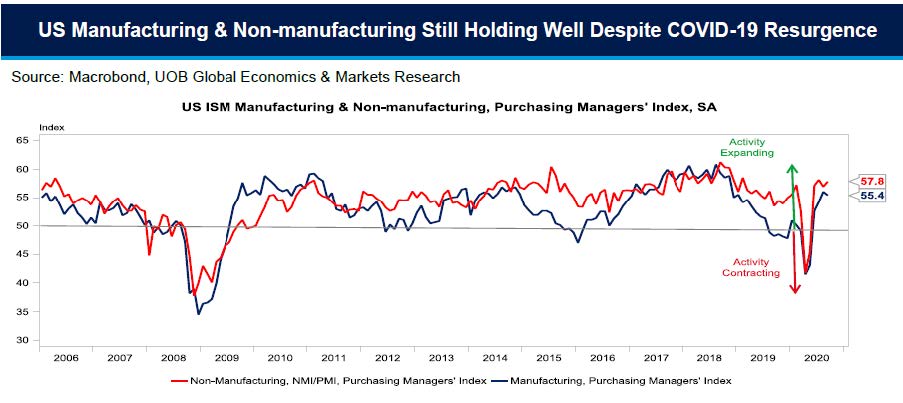

Both US manufacturing and non-manufacturing sectors saw strong rebounds in 3Q with the Institute for Supply Management’s (ISM) manufacturing PMI surveys averaging above 55 for July to September, up from the pandemic low of 41.5 in April. As for services, the ISM survey averaged even higher at 57.6 in 3Q compared to the pandemic low of 41.8 in April.

Business spending staged a strong rebound of 20.3% after plummeting -27.2% in 2Q. Residential investments also performed strongly on the back of low interest rates, rising by 59.3% in 3Q from -35.6% in 2Q. Inventories added 6.6 percentage points to headline growth in 3Q (from -3.5 ppts in 2Q) as the resumption of economic activity after the COVID-19 shutdown of factories replenished the earlier inventory drawdown.

Two components that were previously positive contributors to US headline GDP in 2Q, turned negative in the third quarter. Government’s consumption expenditure & investment (which was previously the biggest positive factor in 2Q thanks to the various fiscal stimulus packages) fell 4.5% (subtracting - 0.68 ppt from headline GDP) due to declines in both federal spending (excluding defence) which fell 18.1% (- 0.55 ppt) while state & local spending fell by 3.3% (-0.3 ppt) as government pandemic funding dried up in 3Q. The other negative component was net exports of goods and services which subtracted nearly 3.1 ppts from headline GDP growth as exports’ 59.7% jump (from -64.4% in 2Q) was more than offset by the 91.1% spike in imports in 3Q (from 54.1% in 2Q).

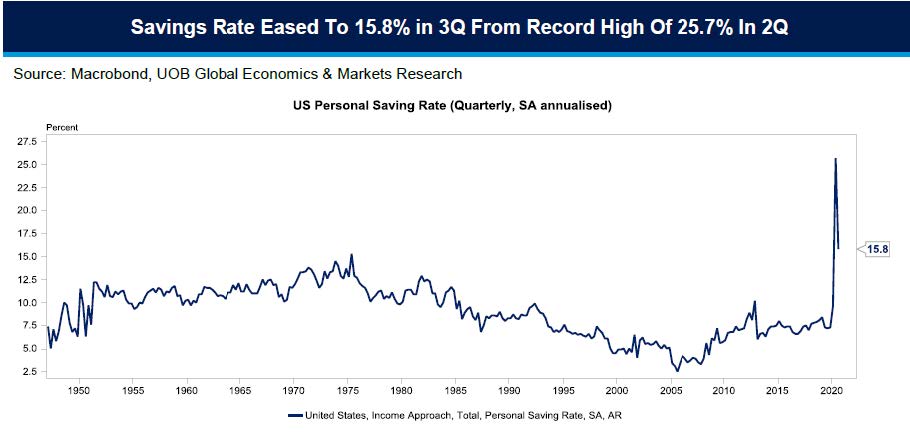

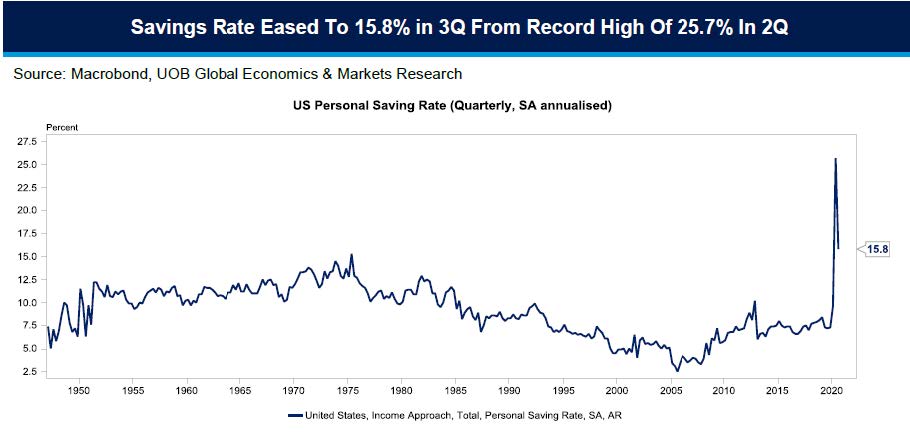

US Savings Rate Off Record Highs

In 3Q, personal savings as a percent of disposable personal income eased markedly to 15.8% from the record 25.7% in 2Q as government social benefit payments slowed. That said, US savings at 3Q is still at higher rate compared to previous decades.

Going forward, the income part of the savings equation will likely decline further in 4Q as the lack of agreement on a fiscal stimulus before the US elections means that personal income has declined for millions of Americans. While we still expect a stimulus package to be announced down the road, the size of the deal including additional payouts for the affected Americans will likely be dependent on the outcome of the US elections – more economic relief under a Democrat clean sweep and less under a divided US Congress.

GDP Outlook – Smaller Contraction, But Economy Not Out Of The Woods Yet

The US may have emerged from most severe technical recession – i.e. two consecutive quarters of sequential declines – since the Great Depression. Further progress on the recovery path, especially for services despite the unprecedented 3Q GDP expansion, however looks shaky and remains "extraordinarily uncertain" due to the failure of the Trump administration and US lawmakers to agree on a new round of fiscal stimulus and rising COVID-19 case counts to unprecedented levels. Much will also hinge on a viable vaccine which we project will likely emerge in early 2021 and available for widespread and effective distribution in mid-2021.

We now project flat 4Q 2020 growth (0% q/q) as the rebound in the second half will still not offset the 1H contraction even though it is less severe than previously projected. Full-year 2020 GDP is now expected to contract by 3.8% (from the previous projection of - 4.5% made in September). This is slightly less optimistic compared to the Fed’s forecast of 3.7% contraction for 2020, but better than the 4.3% contraction estimated by the International Monetary Fud (IMF) in its October 2020 update. As for 2021, our projection is for a US GDP rebound at 2.8%.

Much however ride on the trajectory of the virus and degree of success in its containment. If the infection rates continue at its current pace or worsen, it may necessitate some of the previous restrictive measures to curb the spread which will re-inflict damage to the labor market.

The US economy had lost a staggering 22 million jobs in March and April. Even with the sterling gains between May and September, total non-farm employment is still 10.7 million or 7% lower than in February. The virus resurgence could derail the jobs recovery.

The 2nd estimate of the 3Q 2020 GDP will be on 25 November which will also include 3Q corporate profits data while the next US Federal Reserve's FOMC has been scheduled for 4-5 Nov 2020 – after the US elections on 3 Nov – with decision on 6 Nov followed by a press conference helmed by Fed chair Jerome Powell. In the event of a contested US election result leading to uncertainty, we are likely to see the Fed stepping up to smoothen market volatility.

Click here for more details from the US 3Q 2020 GDP advance estimate by BEA.