Share:

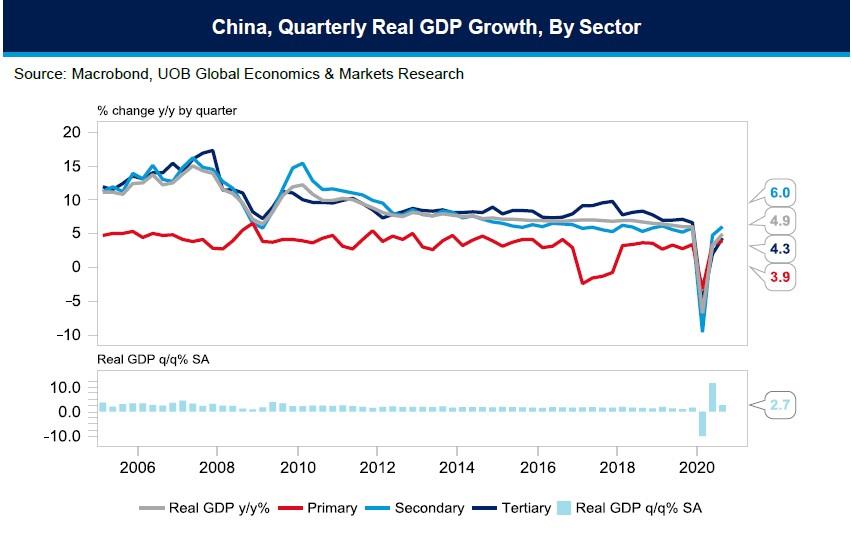

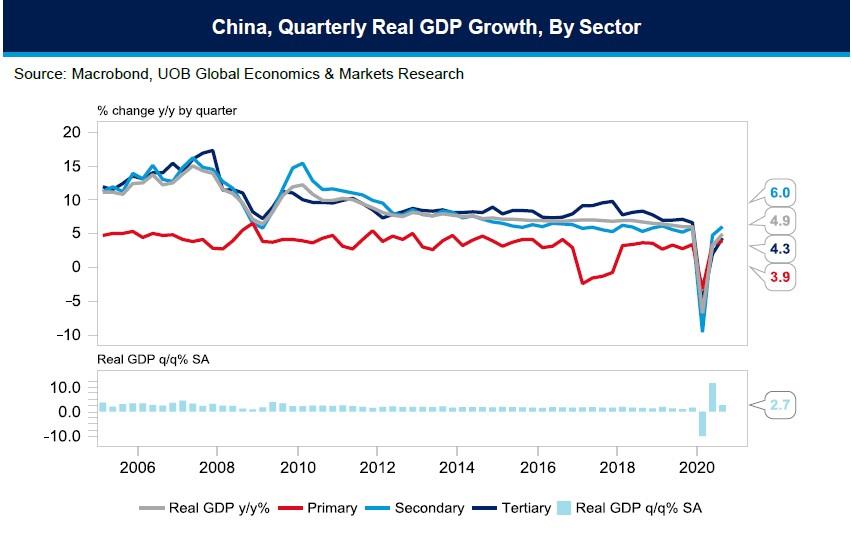

China’s economy continues to show signs of recovery turning in a third-quarter GDP growth of 4.9% year-on-year (y/y), up from 3.2% for 2Q20. That was in line with our forecast but below Bloomberg’s consensus poll of 5.5% y/y. The recovery was broad-based across the three key industries with the exception of tertiary (service) industry recovery which lagged expectation at 4.3% y/y (2Q20: 1.9% y/y) while the secondary industry stood out with a growth of 6.0% y/y (2Q20: 4.7% y/y), the fastest pace since 1Q19. Primary industry growth edged higher to 3.9% y/y from 3.3% in 2Q20.

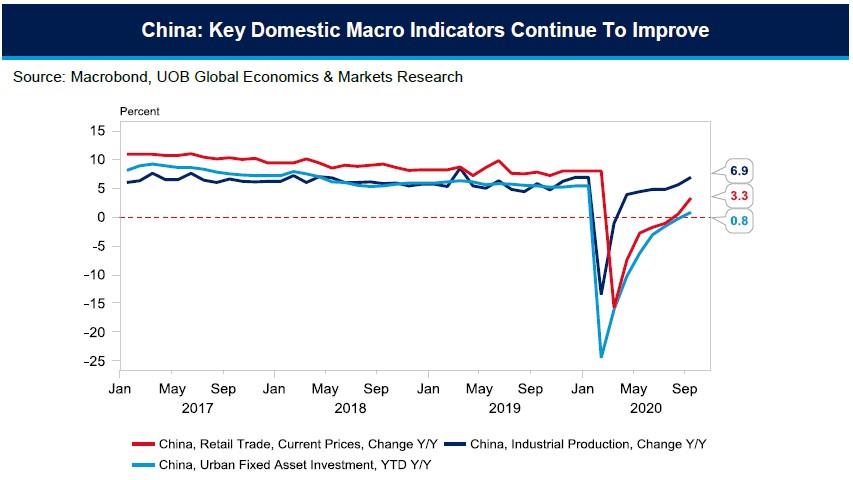

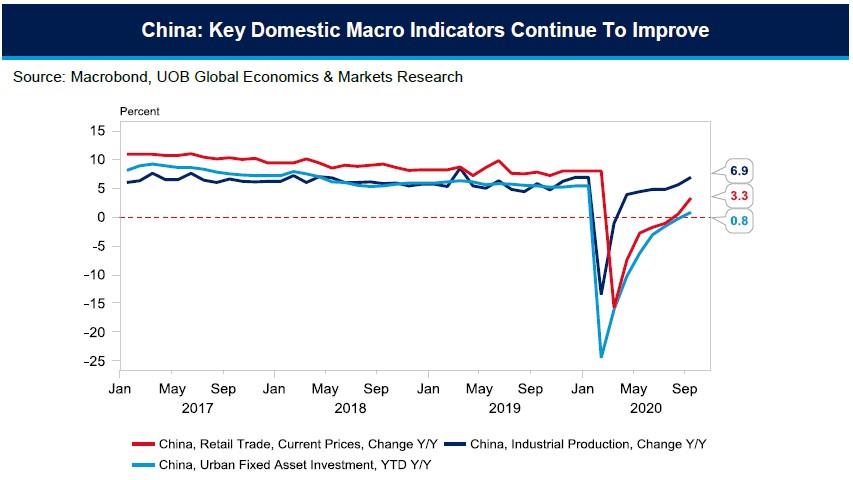

The economic data for September showed recovery gaining further traction with industrial production growing at its fastest pace this year at 6.9% y/y (Aug: 5.6%), outstripping consensus forecast of 5.8%. Year-to-date (YTD), industrial output was up 1.2% y/y compared to -1.3% y/y in the first half of the year on the back of rapid growth in high-tech manufacturing and equipment manufacturing.

Retail sales also outperformed expectation at 3.3% y/y growth in September (Bloomberg est: 1.6%; Aug: 0.5%). It was the second straight month of expansion in retail sales as domestic demand is seen taking off with further moderation in the labour market pressure. The jobless rate fell to 5.4% in September from 5.6% in August and as high as 6.2% in February. This was almost back to December 2019 jobless rate of 5.2%.

Retail sales however has not returned to pre-pandemic levels and remained weighed down by weak sales at restaurants (-2.9% y/y in September and -23.9% y/y YTD) due to the lack of international tourism and generally more cautious sentiment. YTD, retail sales were still in contraction of -7.2% y/y but better than the -11.4% y/y in the first half. Ecommerce sales remain robust and is up 9.7% y/y YTD.

What is encouraging though is that fixed asset investment (FAI) for September had turned positive for the first time with growth of 0.8% y/y YTD – reversing from -3.1% in the first half. Gains were seen in infrastructure investment (0.2% y/y YTD) and real estate investment (5.6% y/y YTD) while manufacturing investments were down 6.5% y/y YTD. External uncertainties including the pandemic and US-China frictions continue to weigh on investor sentiment but the opening up of the economy to foreign investments should bode well as global demand improves.

Trade data released last week showed Chinese exports maintaining strong growth in September while imports reversed two preceding months of contraction with a surprise surge. YTD, exports and imports were still in contraction at -0.8% y/y and -3.1% y/y respectively. We expect the sustained recovery in both global demand and domestic consumption to bring full-year export and import to growth of 1.2% (2019: 0.5%) and 0.0%(2019: -2.8%) respectively.

PBoC keeps key rate on hold

The People's Bank of China (PBoC) has maintained the loan prime rate (LPR) steady since May following 30 bps cut in the earlier part of the year. With the acceleration in economic recovery, the pressure to ease monetary policy has been greatly reduced which will now allow the PBoC to pay attention to financial risks mitigation ahead. PBoC Governor Yi Gang again voiced concerns over the increase in macro leverage ratio and a possible increase of non-performing loans in the banking system.

The September credit growth has remained strong with combined new renminbi loans reaching CNY16.26 trillion in the first three quarters of the year or CNY2.63 trillion more than the same period in 2019. The bulk of CNY10.56 trillion new loans in the period went to corporates while CNY6.12 trillion were new household loans. Given such strong credit growth, we do not think it is necessary to cut interest rates further. As such, our forecast remains for the 1Y LPR and the 5Y above LPR to be kept unchanged at 3.85% and 4.65% respectively into 2021.

Outlook – Revising 2020 GDP forecast to 1.9%

China’s economy expanded by 0.7% y/y in the first three quarters GDP compared to a contraction of -1.6% y/y in the first half of 2020. Given stronger pick-up in domestic demand in the last two months, we see greater prospects for the GDP growth to normalise to its potential level in 4Q20. We expect greater growth contribution from the tertiary industry in 4Q20 while secondary industry growth may soften on the back of a higher base of comparison. We now factor in a stronger GDP growth in 4Q20 at 6.2% y/y compared to our previous forecast of 5.7% with our full-year 2020 GDP growth marginally higher at 1.9% compared to 1.8% previously. While the outlook for domestic demand has improved, we still see external risks arising from the US-China trade conflicts, the November US presidential election and the worsening pandemic outbreak in parts of Europe and the US.

Ahead, the attention will be on China’s 14th 5-Year Plan (2021-25) as well as the midterm “2035 vision” to be announced at the fifth plenary session of the 19th Central Committee of the Communist Party of China (CPC) on 26-29 October. Chinese leaders had indicated previously at the last National People’s Congress that the GDP growth targets will be deemphasized and focus is on the quality and composition of economic development and other policy targets.