Share:

The US Federal Reserve (Fed) chair Jerome Powell laid a new marker at the virtual Jackson Hole Symposium in Kansas City last week ((27 Aug 2020) by announcing a new tack in US monetary policy setting, that of average inflation targeting (AIT).

In the revised Statement on Longer-Run Goals and Monetary Policy Strategy which was first adopted in 2012, the US central bank injected two key modifications. One, that it will not be confined by a 2% forward-looking inflation target but rather 2% on average “over time” and will allow inflation to overshoot at moderately above 2% for some time following prolonged periods of persistent undershoot. While the Fed chair did not clarify what “moderately above 2%” means; the Dallas Fed President, Robert Kaplan later said it probably meant inflation in a range of a 2.25% to 2.5% annual rate.

Secondly, the Fed will place more emphasis on the employment side of the equation on “a broad-based and inclusive goal” in which policy decisions will be defined by “shortfalls” from maximum employment and not just deviations. Mr Powell noted that the latter change “reflects our view that a robust job market can be sustained without causing an outbreak of inflation” and that “employment can run at or above real-time estimates of its maximum level without causing concern.”

The revised stance means that rather than raising rates once the unemployment rate drops below a certain level, Fed officials will wait until the jobs market has tightened and pushed inflation higher before thinking about tightening its monetary policy. Such “pre-emptive” action will stay in the toolbox, until monetary conditions are able to stimulate a much stronger and sustained recovery by allowing the “US economy to run ‘hotter for longer’ before the central bank considers hiking interest rates to rein in inflation.

In short, there is a shift in focus to employment rather than inflation with a strong tilt towards “leaving no one behind” in light of the coronavirus (COVID-19) shock to the economy and the American workforce. Mr Powell said the policy shift was motivated by underlying changes to the economy including lower potential growth, persistently lower interest rates and low inflation.

He however did also highlight that the Fed is not tying itself to any particular method to define average inflation and that monetary policy "will not be dictated by any formula" but also assured that the Fed will "not hesitate to act" if inflation rises "above levels consistent with our goal" adding that the review of monetary policy strategy will be an ongoing process, likely every five years.

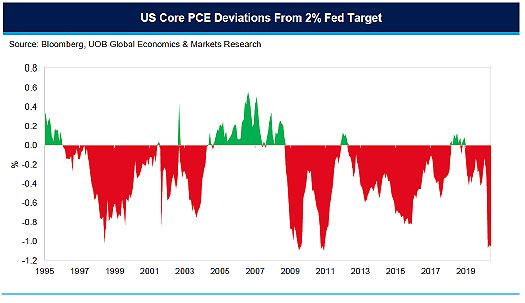

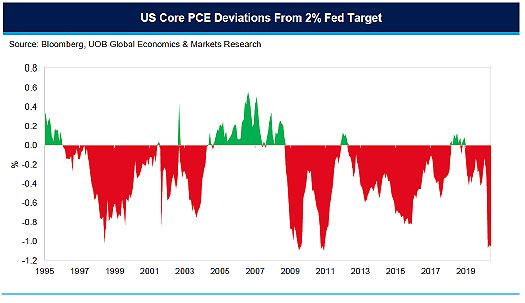

Having said that, it will be still tough on the part of the Fed officials to convince the investment community that they can guide inflation higher in the near to medium term as the central bank has struggled to get inflation up to the 2% level which is seen as consistent with a growing economy. Such a target provides policymakers with enough policy room in times of economic stress. The central bank had previously hiked rates pre-emptively to head off higher levels of inflation.

Higher levels of inflation are seen as a negative for bonds, especially those of longer maturities as investors worry that it will blunt the appeal of US assets. Most Wall Street economists do not expect the runaway inflation witnessed in the 1970s to re-emerge any time soon. The Fed’s revised stance might have also alleviated fears of a repeat of the taper tantrum in 2013 when a collective panic triggered a spike in US Treasury yields after investors got wind of talk that the central bank would be unwinding its quantitative easing (QE) programme.

Market reaction and outlook

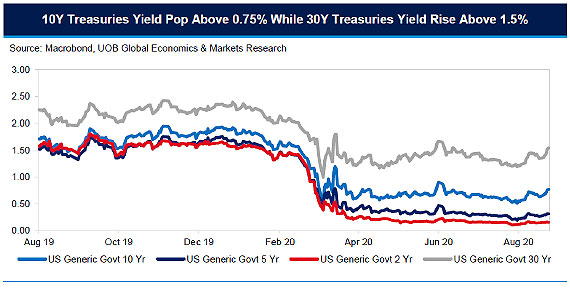

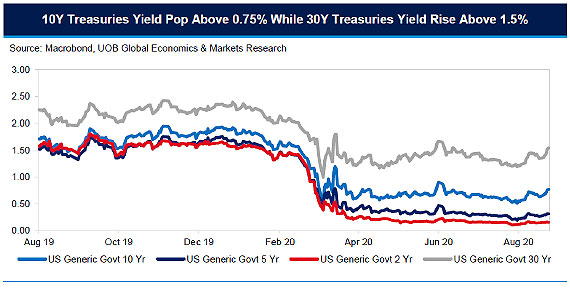

For markets, there are two immediate implications in that it will mean lower benchmark interest rates for longer periods. First, front-end short dated money market rates will be locked near zero for much longer. Second, the backend long-dated yield will likely rise on higher inflation tolerance over time which will lead to the steepening of the US Treasuries yield curves and a slight uptick in US real yield.

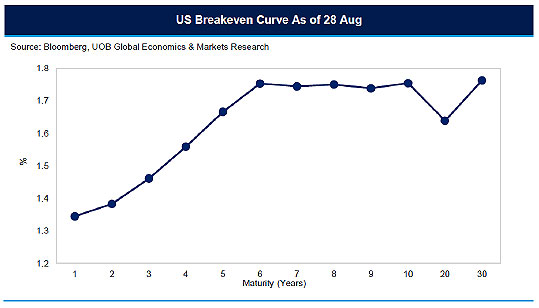

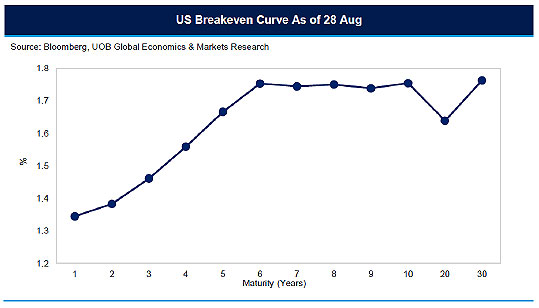

A snapshot of the US breakeven inflation curve on 28 Aug, shows that the curve is largely flat beyond the 5-year tenor stretching out to the 30-year treasury bonds. In short, the market does not think that inflation outcomes will be materially different between the short-term and the long-term bonds post the AIT announcement.

That is especially so as the US Core Personal Consumption Expenditure (PCE) index have struggled to rise above the Fed’s 2% target since 1995.

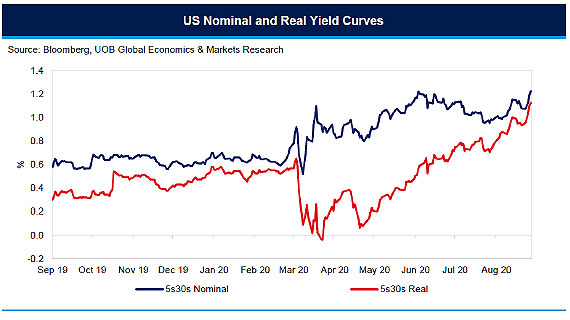

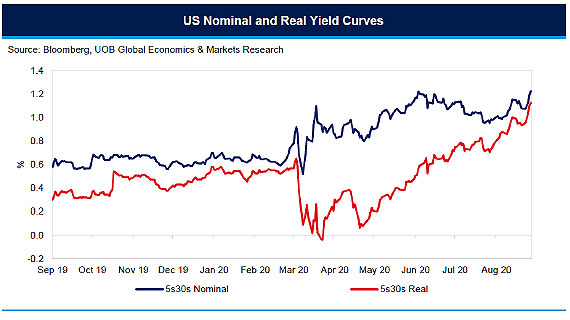

Given the Core PCE’s track record and prevailing economic conditions, inflation is unlikely to be of immediate concern. The steepening of the nominal yield curve post AIT announcement has mostly been driven by changes in the real yield space. With the 30-year real yield at -0.26% on 27 August, it is not difficult to see room for upside when the pandemic recovery becomes more broad based.

For more on the Fed’s statements: