Why invest in the United Global Quality Growth Fund?

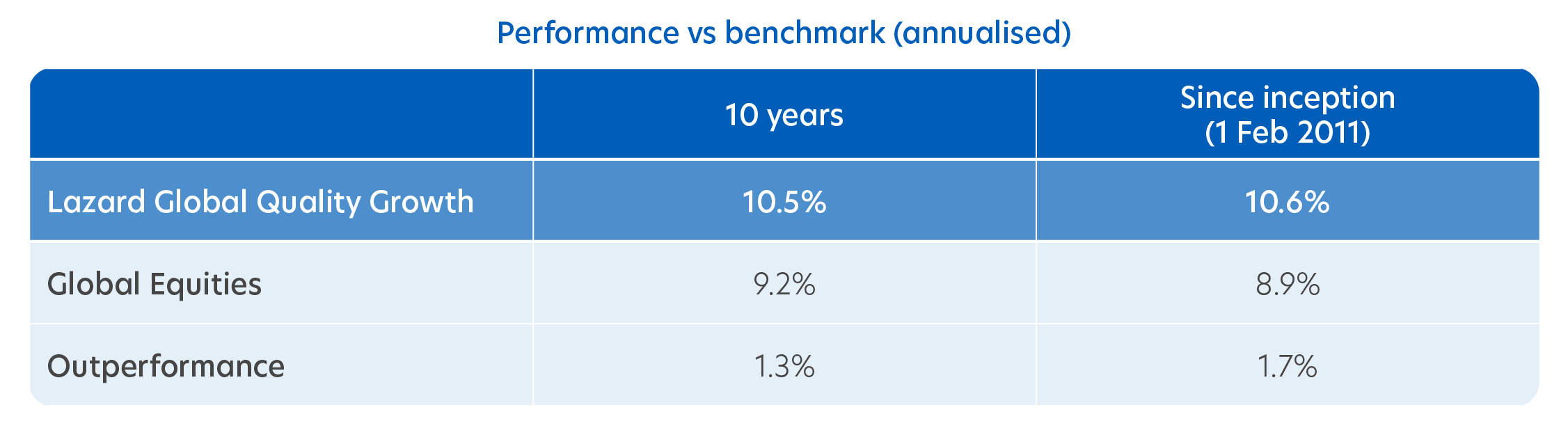

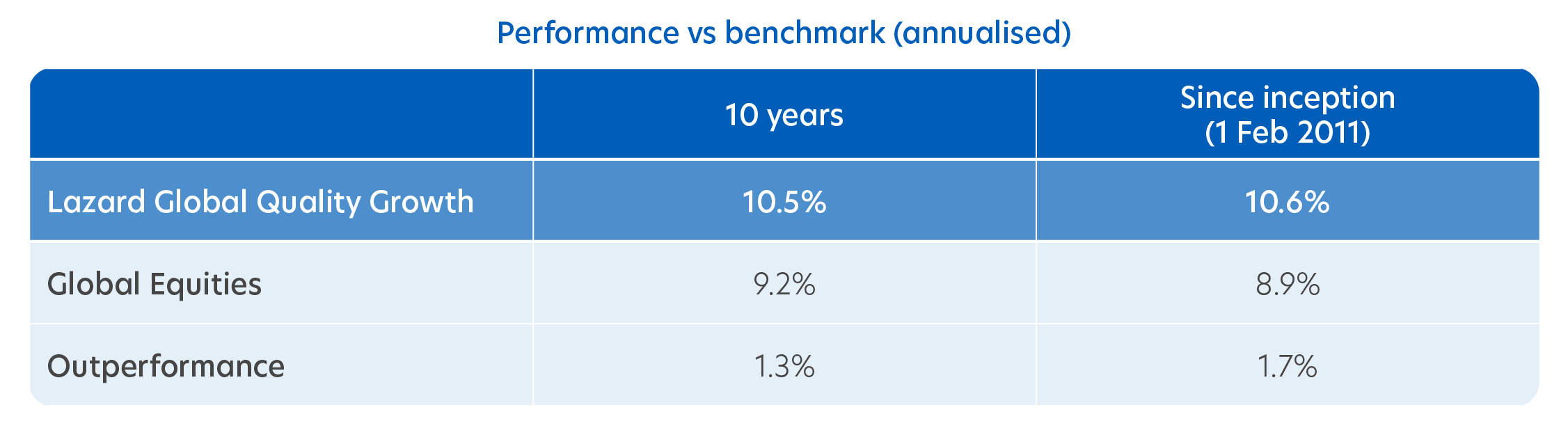

1) Consistent outperformance against benchmark

Over a 10-year period, the underlying manager, Lazard Asset Management, has delivered an annualised absolute return of 10.5%, outperforming its broad global benchmark by 1.3%.

Source: Lazard, as of 31 December 2024. USD terms. Performance is presented in a gross fee basis. Past performance is not an indicator of future results. Global equities refer to MSCI ACWI Index.

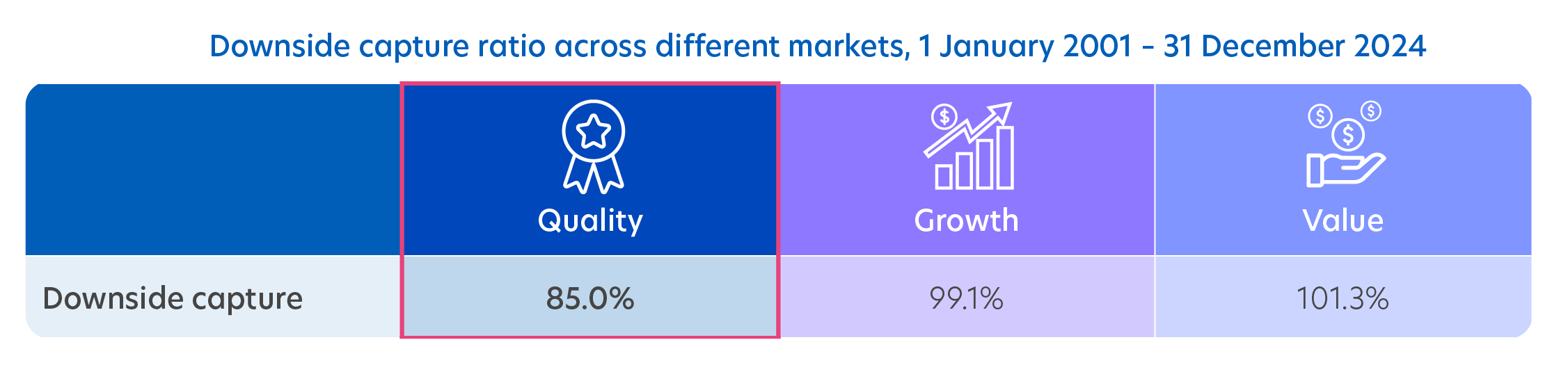

The underlying strategy, Lazard Global Quality Growth, has outperformed its benchmark in up markets, while also protecting capital in down markets. Since inception, it performed an average 3% better than its benchmark during months when market returns were positive, and 8% better during months when the market declined.

Source: UOBAM, Lazard, as of December 2024. Based on period February 2011 to December 2024.

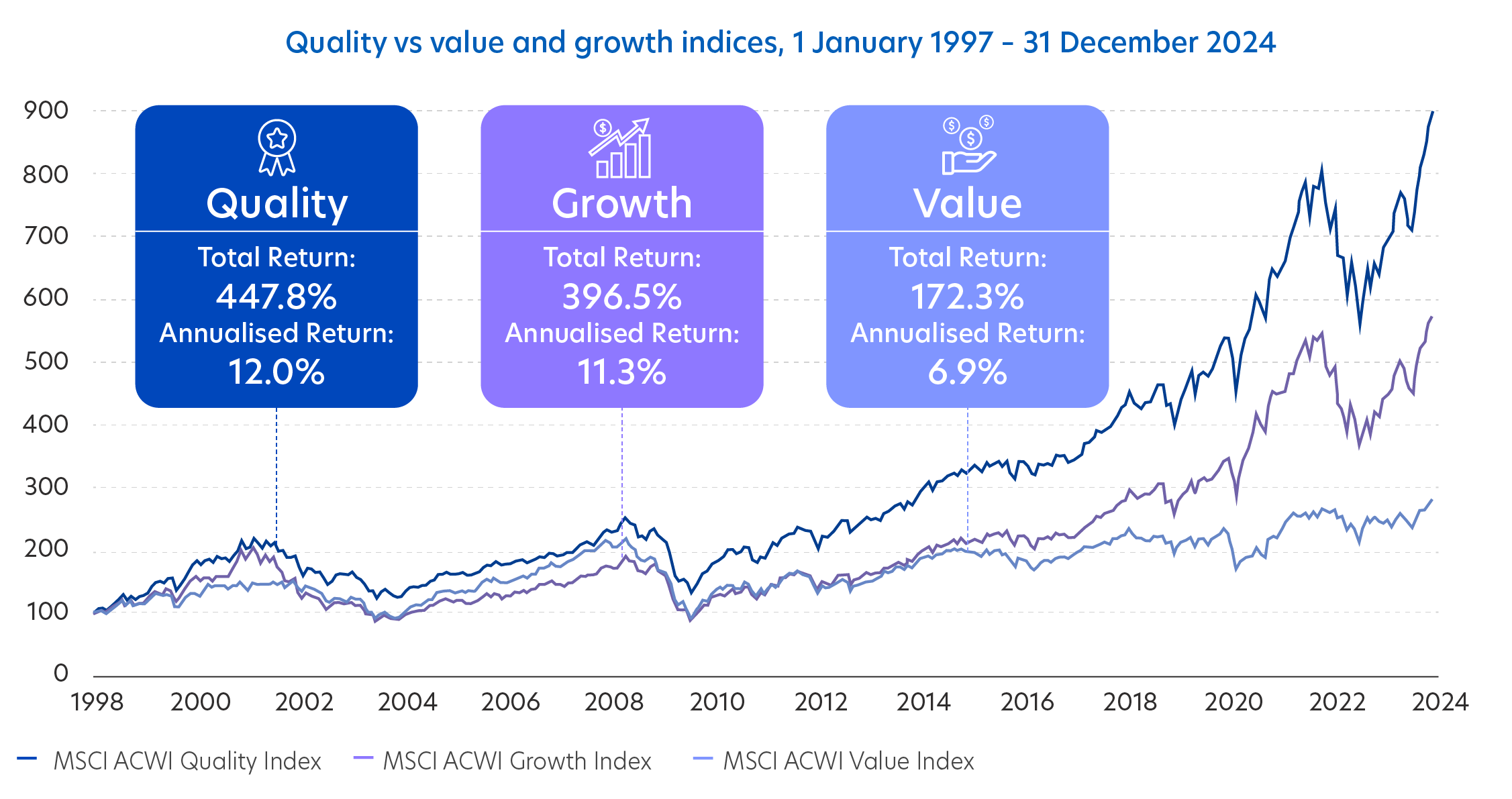

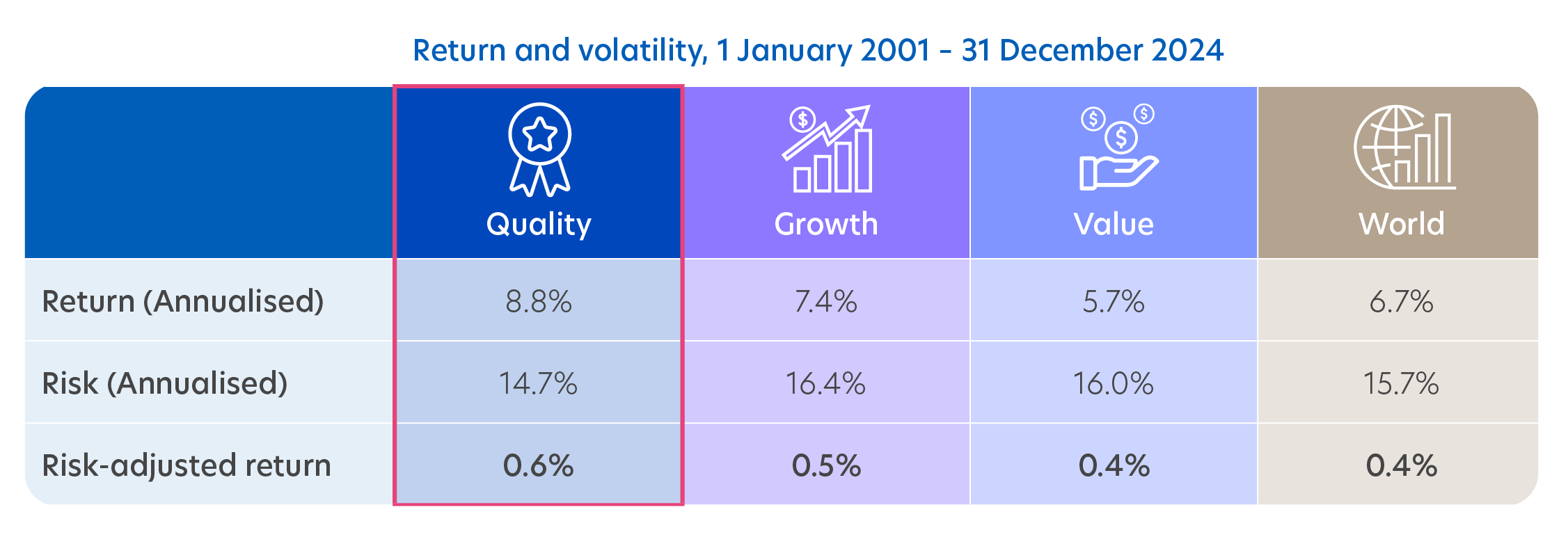

2) Invests in quality compounders to enhance returns

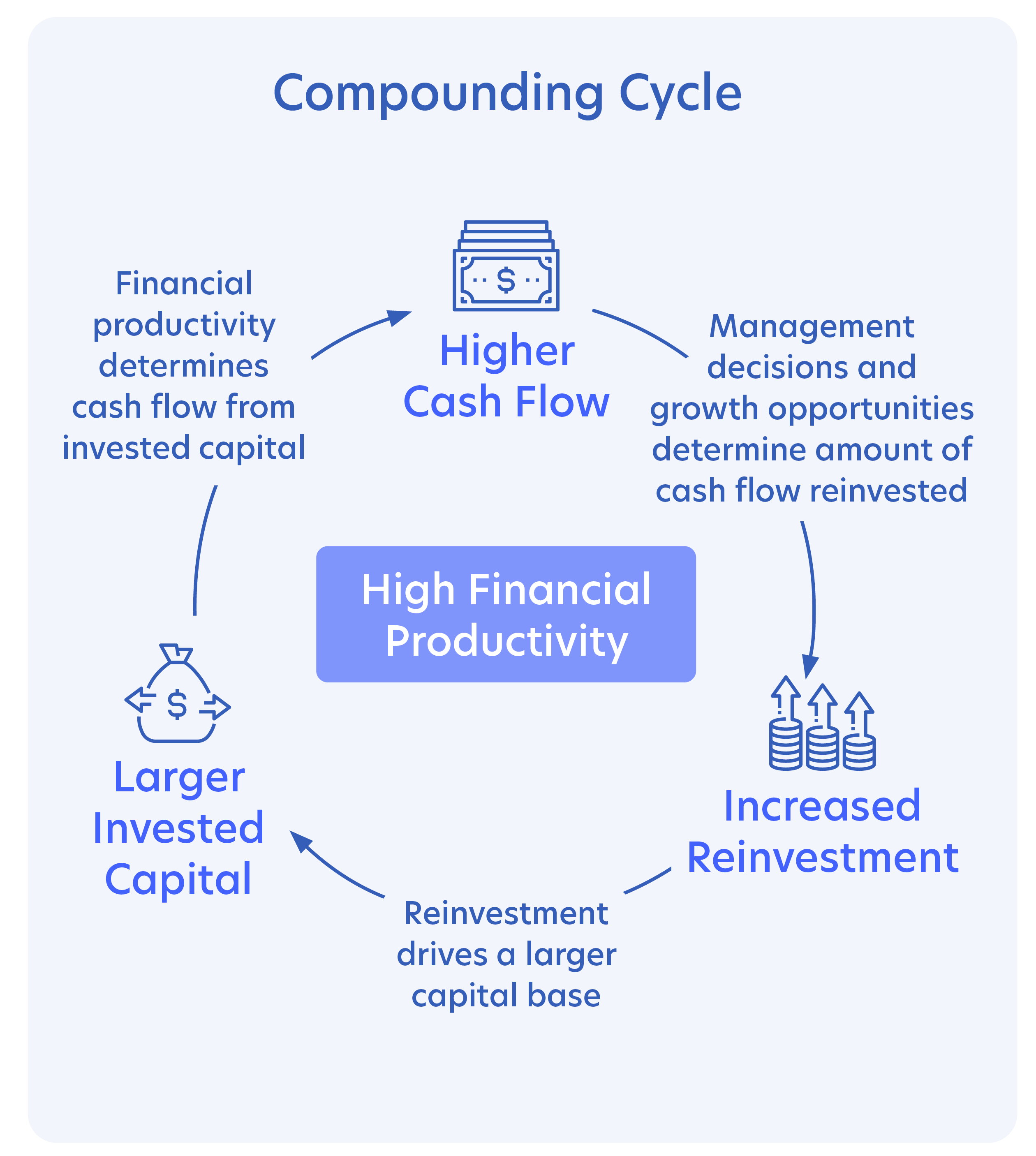

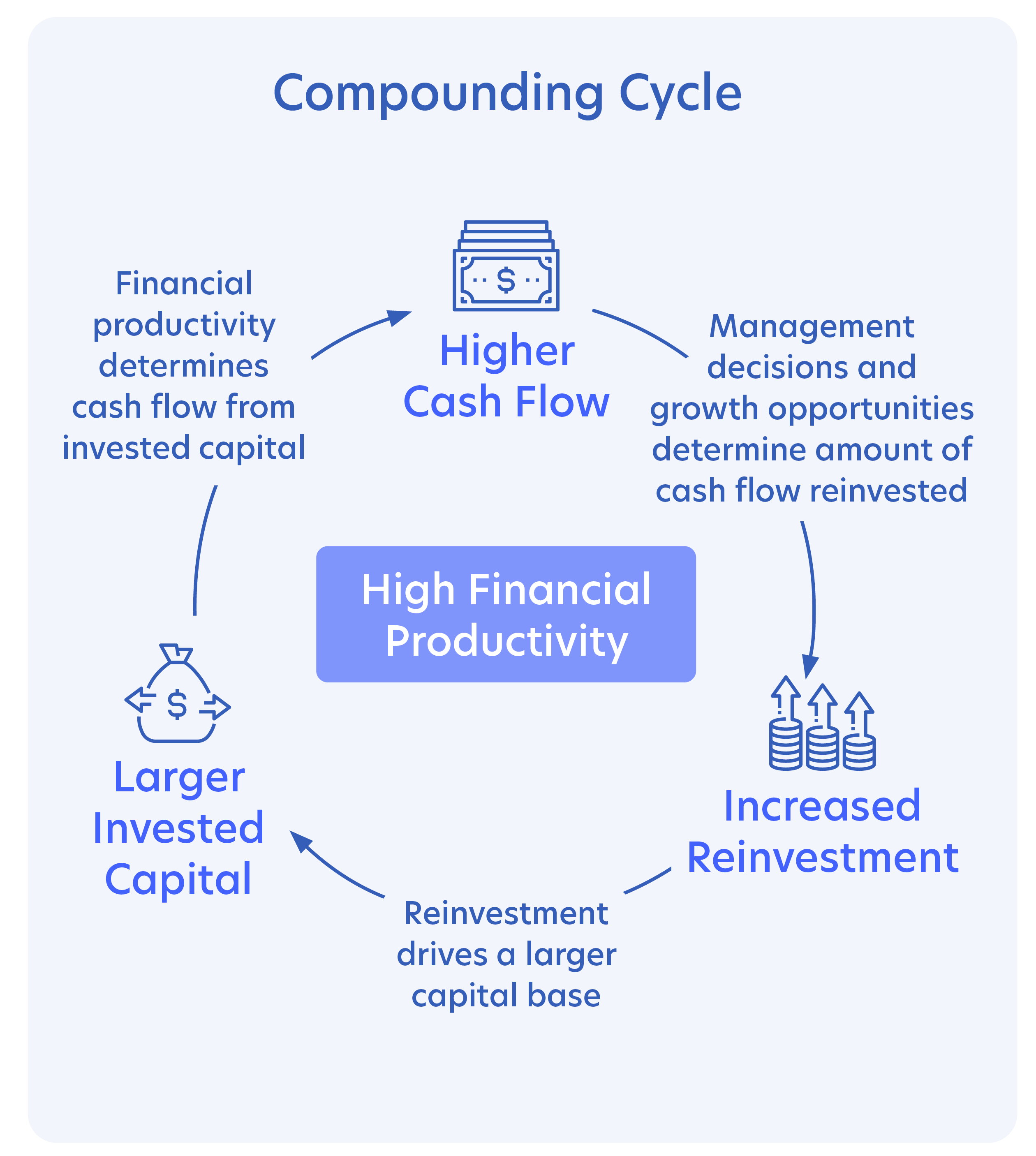

Great businesses can make great investments. The strategy defines quality companies as companies that have competitive advantages that allow them to generate sustainably high returns on capital and reinvest at similarly high returns to drive future growth. Companies with these specific characteristics are called “Compounders”.

Compounding is the process of reinvesting any interest or profits earned. This can have a dramatic impact over time, because it accelerates the return on an investor’s capital.

Quality companies can apply the same principle by reinvesting cash back into the business at similarly high levels of financial productivity. This allows them to generate high cash flows, which then enables further reinvestment, and so on. This is called the “Compounding Cycle”.

The Fund focuses on identifying and investing in “Compounders" i.e. quality companies that are best able to leverage this powerful Compounding Cycle.

Compounders that sustain high financial productivity have historically outperformed the market, as their high financial productivity has allowed them to reinvest for growth.

Source: Bloomberg, Credit Suisse, Lazard, MSCI, as of 31 December 2023. Relative returns represent the equally weighted MSCI ACWI companies that were in the top decile for financial productivity (Cashflow Return on Investment (CFROI)) relative to companies their MSCI Industry Group, and maintained that decile ranking for the following year.

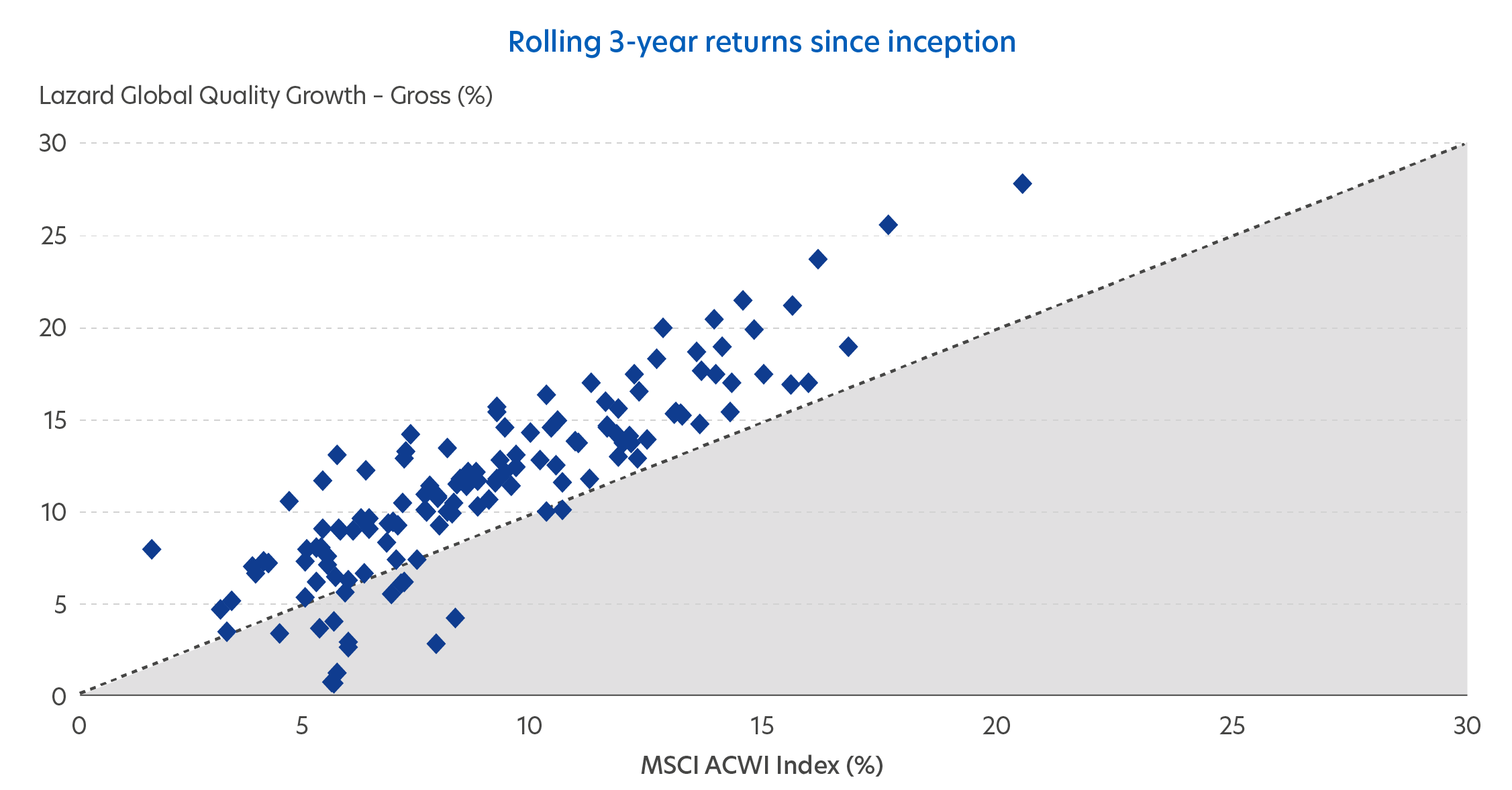

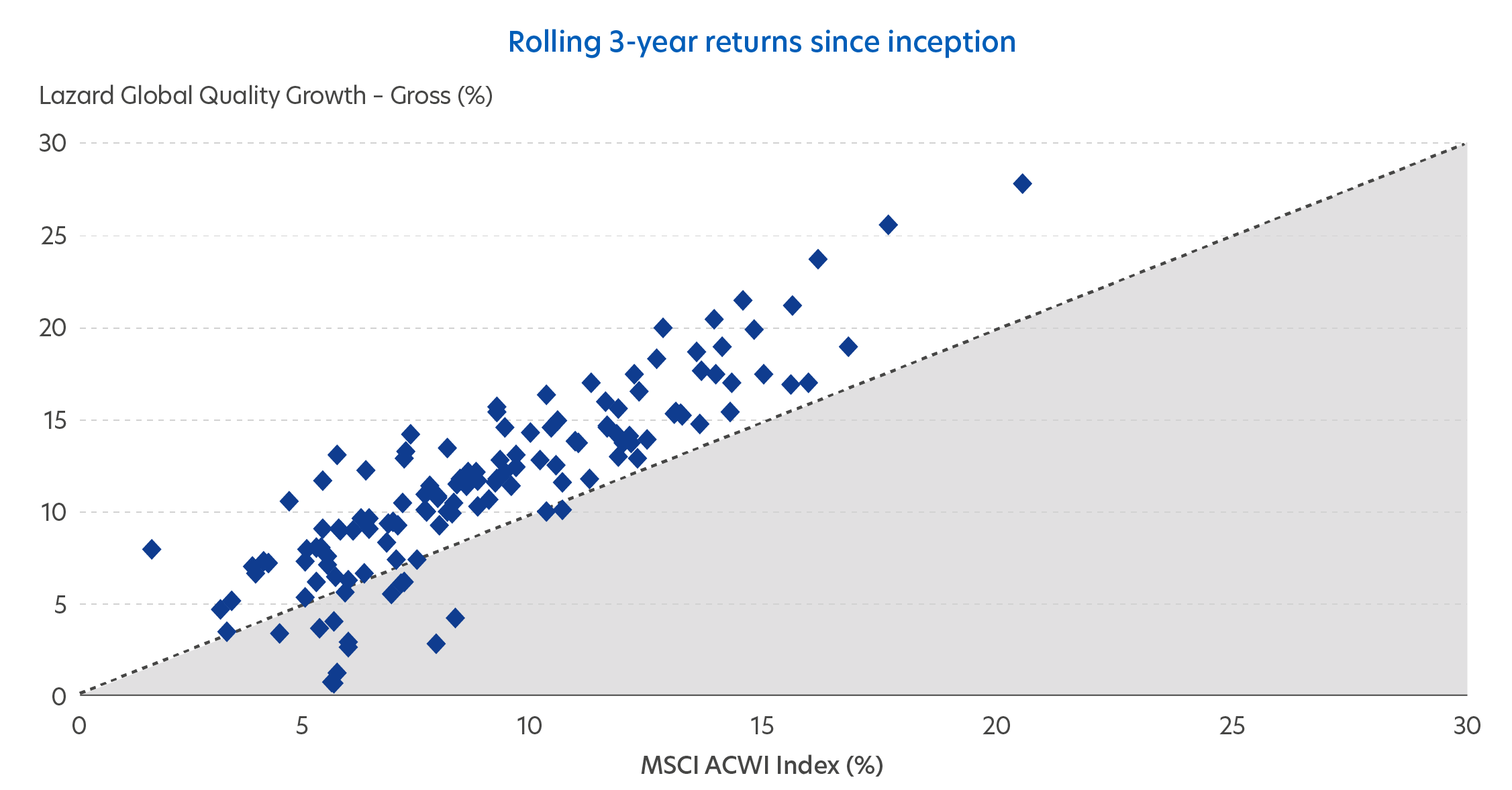

Compounders that sustain high financial productivity have historically outperformed the market. The chart below shows the underlying strategy's performance since its inception.

Source: Lazard, MSCI, as of 31 December 2024. USD terms. Rolling 3-year returns since inception: Calculated using monthly returns. Performance is presented on a gross of fees basis. The preliminary performance quoted represents past performance. Past performance is not an indicator of future results.

Each dot represents the underlying strategy's 3-year return through the month. The dots are mostly above the line, which means that the underlying strategy has largely outperformed the index over the same 3-year period.

3 ) Strategic portfolio composition

To ensure high quality, the Fund’s portfolio holds 40 to 50 names that are well diversified across sectors. While it has a focused approach, the Fund mitigates risks by avoiding taking large stakes in single holdings, with position sizing ranging between 2% and 5%.

The Fund also refrains from investing in sectors affected by external factors. As such, it does not have any holdings in sectors including Energy, Real Estate, Utilities and Materials.

4) Managed by global experts

Lazard Asset Management is a global investment advisory firm established in 1970, with a proven track record of helping institutions, governments, and individuals achieve their financial goals.

As part of the Lazard Group which has over 175 years of financial expertise, Lazard Asset Management offers a range of equity, fixed income, and alternative investment solutions. Operating from 24 cities across 20 countries with a global staff of over 1,100, Lazard Asset Management manages US$226.0 billion1 of assets around the world. Lazard’s Global Quality Growth team, comprising of experienced professionals with over two decades of sector expertise, focuses on investing in high-quality companies with sustainable competitive advantages.

Lazard’s Global Quality Growth team, comprising of experienced professionals with over two decades of sector expertise, focuses on investing in high-quality companies with sustainable competitive advantages.