- Singapore companies are global leaders in the Environmental, Social and Governance (ESG) space

- Singapore’s Green Plan is helping to drive new business opportunities across many companies and sectors

- The key ESG sectors in Singapore ranges from energy and waste treatment to food and finance

A Green National Agenda

Sustainability has long been a central part of Singapore’s development strategy. The country unveiled its first-ever Green Plan in 1992 and its latest in February this year (2021). The Singapore Green Plan 2030 sets ambitious targets to peak carbon dioxide emissions at 65 million tonnes by 2030 and halve emissions to 33 million tonnes by 2050.

To do this, Singapore is committed to using cleaner forms of fossil fuels in the short term while exploring greener options. To date, over 95 percent of Singapore’s fuel mix comes from natural gas. Coals comprises only one percent of the country’s fuel consumption, compared to nearly 30 percent in Japan and Germany.

Additionally, Singapore is expanding into renewable energy and recently completed construction of one of the world’s largest inland floating solar energy systems. Having grown its solar capacity by seven times since 2015, it is now one of the most solar-dense cities in the world and on course to meet its target capacity of two GWp of solar energy by 2030.

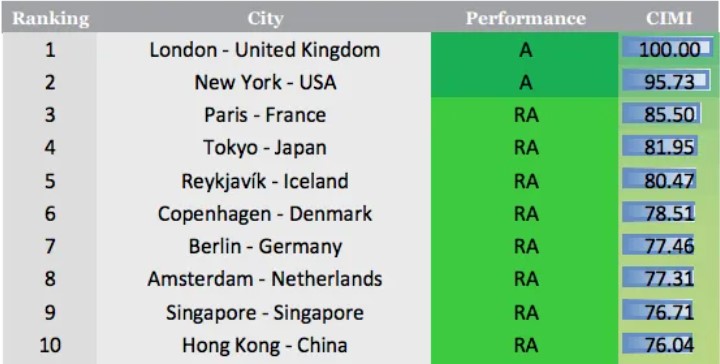

This long and pioneering role in sustainable development has garnered global recognition. Last year, according to the IESE Cities in Motion Index of 174 cities, Singapore was ranked the ninth smartest and most sustainable city in the world.

Figure 1:Top 10 City Ranking

Source: IESE Cities in Motion Index (CIMI), 2020

These accolades are based on some key policy successes, such as:

- 43 percent of Singapore’s buildings are green labelled, with the Singapore Green Building Masterplan calling for 80 percent of buildings to be sustainable by 2030.

- Singapore is the only country in the world to set a zero-growth rate for cars and motorcycles. Internal combustion engine vehicles are to be completely phased out by 2040.

- Singapore is ahead in meeting most of the 17 United Nations Sustainability Development Goals (SDGs).

- Singapore is among the 20 best-performing countries globally for emissions intensity, according to the International Energy Agency (IEA).

Singapore Companies Lead The Pack

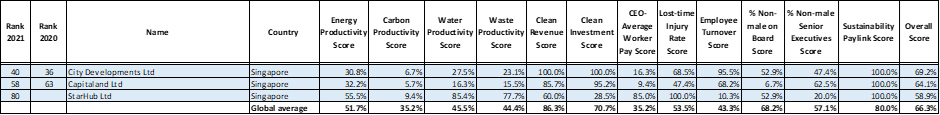

The Singapore government’s focus on ESG has spilled over into companies operating here. For example, three Singapore companies made it into the 2021 Global Most Sustainable Companies list.

City Developments (CDL) is first among 412 global real estate companies and 40th overall, CapitaLand is second among global real estate companies and Starhub is fourth in the global telecommunication sector. Interestingly, these companies’ overall sustainability rankings are above such global names as AstraZeneca, Alphabet - Google’s parent company, and even Tesla.

Figure 2: Singapore companies among the 2021 Global Most Sustainable Companies

Source: Corporate Knights, January 2021.

To maintain a close eye on ESG developments, there are now stringent sustainability reporting requirements for companies listed on the Singapore Exchange (SGX). Most have set specific sustainability goals and are measuring them consistently while assigning responsibility for such goals at the board and senior management level. There is also greater alignment of executives’ pay with their sustainability goals. In 2021, 26 percent of Singapore companies linked top executive remuneration to ESG performance, up from eight percent in 2019.

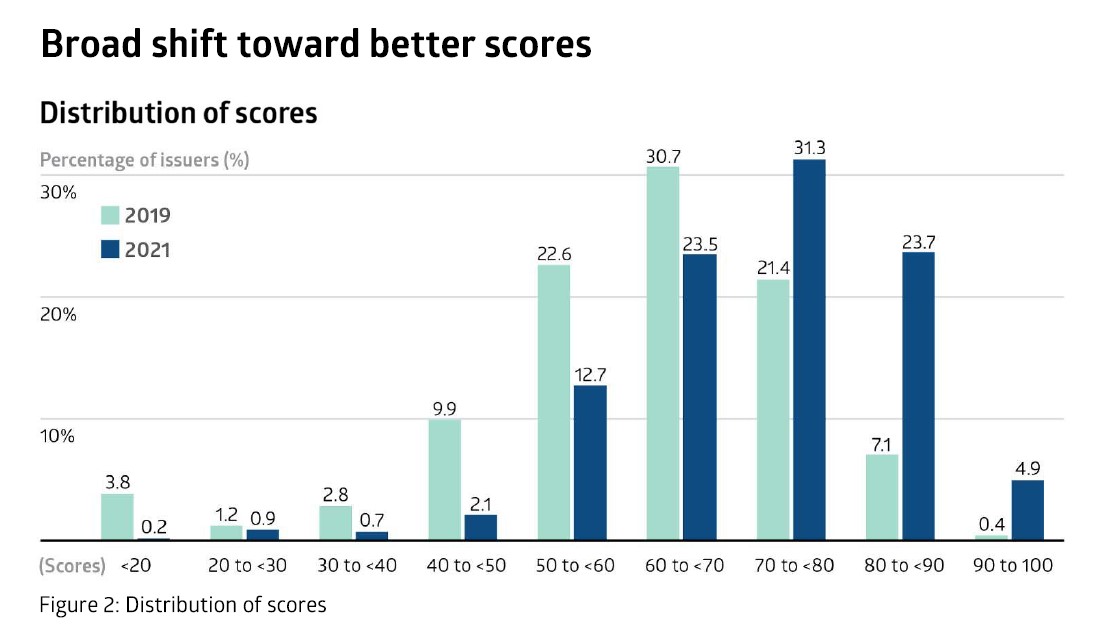

This has helped SGX-listed companies to significantly improve their sustainability scores even over the past two years, according to the Sustainability Reporting Review 2021 conducted by SGX and the Centre for Governance and Sustainability at NUS Business School (CGS). In 2021 vs 2019, those scoring 90 -100% grew from near zero to five percent of companies, while those scoring 80 - 90% grew from seven percent to nearly a quarter of all companies. A further third of companies now report scores of 70 - 80%.

Figure 3: Singapore-listed companies’ sustainability reporting scores improved from 2019-2021

Source: SGX-CGS Sustainability Review 2021, May 2021.

ESG-driven Singapore business opportunities

Going forward, sustainability considerations are likely to drive a plethora of new business opportunities for Singapore companies. There are three themes that will likely dominate:

1. Reducing environmental pollution

The Singapore Green Plan 2030 helps set out the roadmap for achieving a greener and cleaner environment. The plan notes the urgent need for:

- carbon and energy efficiency

- cleaner, low-carbon transport infrastructure

- improved sustainable water and waste treatment management

- adoption of the circular economy model

- better pollution prevention and control

Within this space, business opportunities include helping clients to transit to renewable energy; solutions for more sustainable methods for power generation, transmission and distribution; solutions for more resilient supply chains; and waste and water treatment and recycling.

Businesses will also be able to tap into the concrete targets set out in the Singapore Green Plan to help solidify their opportunities. These include installation of 60,000 electric-vehicle (EV) charging points nationwide and an 80 percent improvement in energy efficiency over 2005 levels for the best-in-class green buildings.

2. Climate change

As an island and land-scarce city-state, Singapore is particularly vulnerable to rising sea levels, supply-chain disruptions and other existential threats from climate change. There is therefore an increasingly urgent need for:

- enhanced climate-resilient infrastructure

- urban farming and other food security solutions

- sustainable infrastructure development and maintenance

- green building design and construction

- sustainable facilities management

Over the next decade, Singapore aims to diversify its imported food sources while growing 30 percent of the nation’s nutritional needs locally. To achieve this, incentives are in place for the agri-food sector to increase productivity and adopt innovative practices. Companies are being encouraged to participate in building an R&D ecosystem for urban food production and alternative proteins technology. There are corresponding business opportunities in areas such as specialised logistics with cold chains; agricultural and food technology; food processing and packaging, and urban agriculture building and engineering services.

3. Green financing

The sustainability push is creating a growing need for loans and bonds that are specifically granted for green and sustainable projects. The Monetary Authority of Singapore (MAS) estimates that within the ASEAN region, green investment of US$200 billion will be needed per year for the next nine years.

The MAS’ Green Finance Action Plan aims to reduce the borrowing costs of sustainable bonds and loans and provide certainty as well as expediency to the industry. Solutions include:

- Defrayed cost of securing external reviews

- Sustainable lending frameworks

- Standardised lending criteria and simplified processes

Today Singapore is the biggest green finance market in ASEAN, accounting for almost half of all sustainable loans and bonds issued in the region. S$8 billion of green, social and sustainability bonds have been issued in Singapore since 2017 to develop new energy projects, improve buildings’ energy efficiency and finance social enterprises. Financial institutions here are also starting to offer specialised products such as sustainability-linked catastrophe bonds. As ASEAN’s needs for green financing grows, Singapore financial institutions will likely cement their lead, based on their experience, frameworks, infrastructure and brand recognition.

ESG materiality matters for UOB Asset Management (UOBAM)

The trend towards ESG-focused businesses opens up opportunities for investors to benefit. Numerous studies over the years have shown that investments in sustainable companies generate better returns and lower risk than non-sustainable ones.

However, ESG investing rests on the ability to differentiate between noise and signal. The UOBAM Sustainability Office focuses on what is known as materiality, that is, the important and verifiable ESG risks, opportunities, events and trends that can impact a company’s present and future earnings. This relies not only on intimate knowledge of a company’s fundamentals, but also an understanding of sector profiles and local industry standards.

For example, factors such as a company’s good employment practices, anti-corruption policies or codes of conduct can significantly boost its ESG credentials. Materiality also differs from sector to sector. For example, the consumer staples and materials sectors stand to benefit the most from supply chain integrity.

Conversely, companies can find themselves on the wrong side of sustainability regulations and this can turn out to be an extremely expensive risk. UOBAM assesses that by 2050, up to US$20 trillion of assets in the building, energy and industry sectors have the potential to become “stranded”, that is, prematurely devalued or written down due their inability to meet ESG standards.

Framework for Sustainable Investing

Over the past five years, UOBAM has implemented a proprietary Sustainable Investments Framework. This framework focuses on deep fundamental and sustainability research while leveraging the firm’s local expertise throughout Asia. Dedicated sustainability specialists are in place across the firm’s regional investment teams.

The UOBAM framework is deployed firmwide and enables the integration of ESG screening into all asset classes and investment processes via the firm’s proprietary Materiality Map. This map assigns E, S and G weights to companies across 11 sectors. Added to this is support provided by the latest digital automation and AI solutions.

Sustainable Singapore

Sustainability is rapidly becoming the new normal, and this is certainly the case for Singapore. There are concerted efforts by the government to transition into a smart city built on a bedrock of sustainable infrastructure, practices and policies. Meanwhile, the Singapore private sector has begun to strongly embrace ESG mandates in recognition of the credibility, earnings potential and investment focus that such mandates can bring.

Singapore’s sustainability agenda is set to grow further. There are constant calls for national targets to be more closely aligned to international climate change treaties such as those outlined in the Paris Agreement, and Singapore is striving to meet these. This year’s UN climate change conference, COP26, will once again highlight the need to act more quickly and to reach net zero carbon emissions by 2050.

This opens the door for even more aggressive action by all stakeholders, including the Singapore government and Singapore-based companies. The Singapore market is clearly ripe for selective ESG-driven growth opportunities that UOBAM is well positioned to uncover.

UOBAM became a signatory of the United Nations Principles for Responsible Investment (UNPRI) in January 2020.

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd ("UOBAM") and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.