Share:

Winning top prizes at an arcade can happen in two ways. One is to rely on luck, but that’s often expensive and may not be rewarding; the second, is to know the intricacy of how each game machine works and come up with a coherent strategy.

The same applies when building an education fund for your children with a huge focus is on higher education which often accounts for the lion’s share of the cost. It’s risky to “wait for when the time comes” before figuring out the expenses from tuition to living allowances. Keep in mind that your financial situation then may differ from today.

So, it’s best to understand – and plan – around the various ways to set up an educational fund:

Checking the rewards counter before you play

Arcades don’t all have the same costs and rewards. What may cost 200 tickets in one arcade could cost over 300 in another. Before you decide on a method of winning, have a clear picture of what you need to accumulate.

Likewise, you need to work out how much your child’s education will likely cost well ahead of time.

Public universities in Singapore typically charge between S$24,600 to S$39,600* a year in tuition fees, depending on the institution and course. Check if your child qualifies for the Ministry of Education’s Tuition Grant Scheme. Singapore citizens can receive significant subsidies from the government, so you won’t have to pay too huge an amount for tuition fees.

Sending your child overseas to study, though, is much trickier. Costs can vary widely between countries and courses. For instance, while a fully self-funded four-year law course at NUS costs about S$36,000, it’s a eight-fold increase at a private university in the US.

Furthermore, if you are sending your child abroad for further education, do take into consideration the cost of lodging, food, transport, healthcare, and entertainment, among others, as well. Be sure to check the average living cost in the country.

Speaking with a specialist in overseas education would also help you to clarify matters regarding costs. If you need further information on connecting with one, start your enquiries with the intended country’s embassy – the staff will be able to direct you to a relevant expert, or can connect you to the administrative office of your child’s dream school directly.

Do keep track of the currency exchange rates. The conversion rate between currencies poses another variation to keep in mind.

For instance, your child would like to attend a course in Germany that costs 35,000 Euros. At present this comes to about S$55,650 (1 Euro = S$1.59)1. However, if the Singapore dollar were to fall against the Euro by the time you send your child to university, e.g. 1 Euro is S$1.72, the course fee would then effectively become S$60,200, despite it still costing 35,000 Euros.

To use an arcade analogy, the tokens to play could vary in cost at different times; it could be a dollar for a token today, but S$1.50 for a token next month.

Thankfully, there are financial products, such as multi-currency accounts, which can help you manage foreign exchange (forex) rates. Do check with your local bank to find out more.

Another thing to consider is inflation. You would likely want to start saving up for your child’s tertiary education from early on. That’s because costs will inevitably rise. A S$20,000 course today might cost S$50,000 in another 15 years.

Building a higher education fund

After knowing the possible amount you would need to set aside for your child’s education, you can take these steps to build up a higher education fund:

- Know how much you need to save

- Create a budget plan

- Compare various plans for the best returns

- Protect the plan with insurance

- Review and optimise

1. Know how much you need to save

You can do this by checking with your bank, or with the help of a compound interest calculator online.

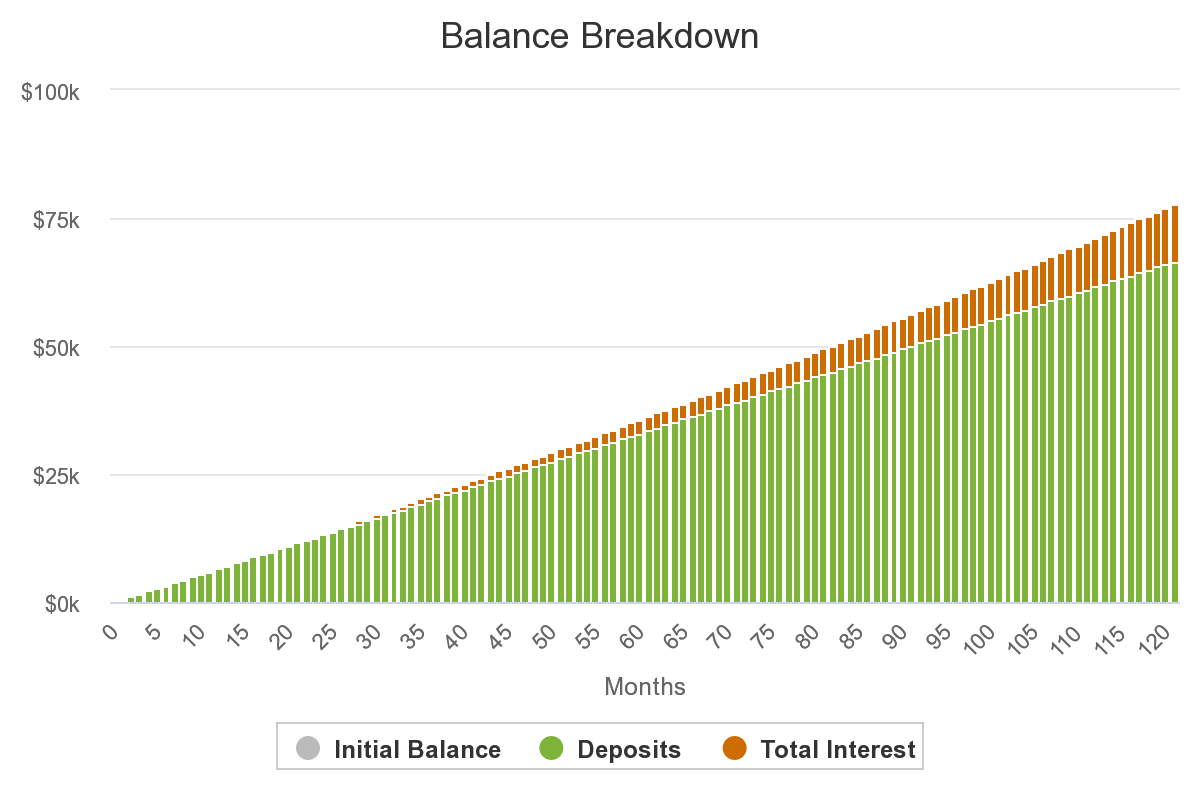

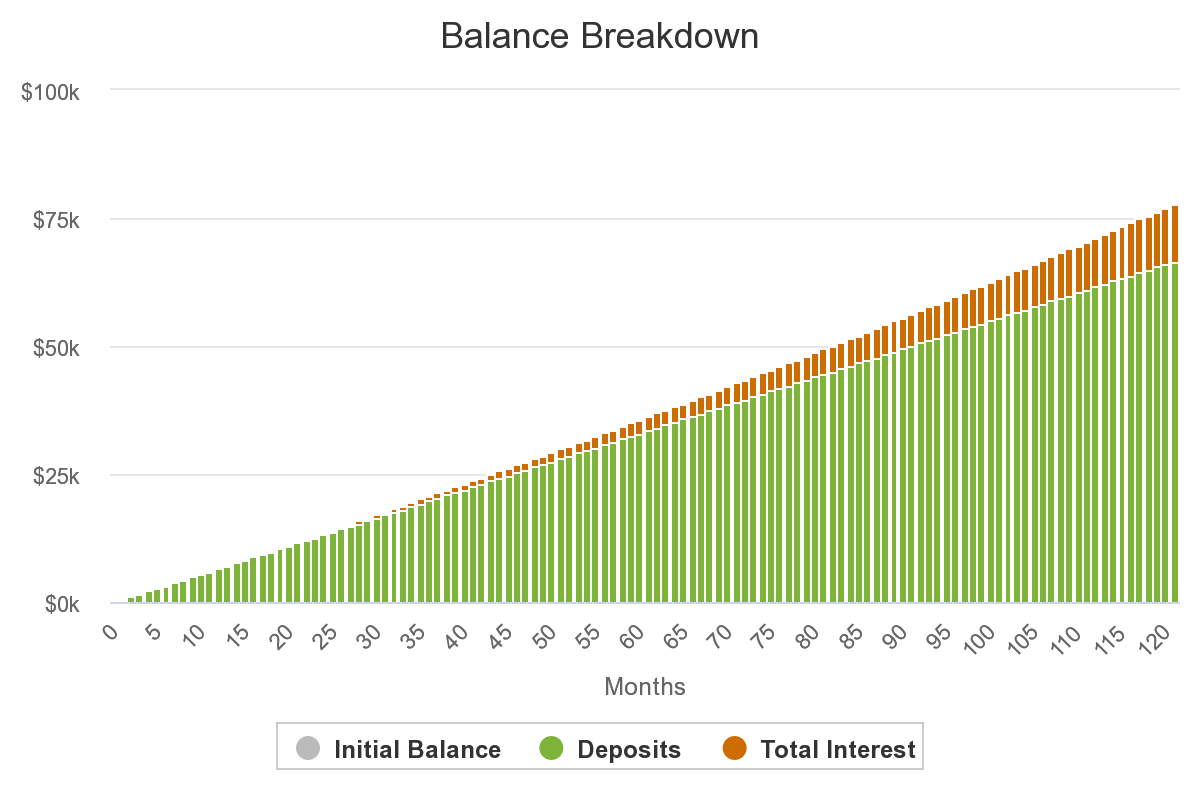

Let’s give you a scenario: Your child is 12 years old and university fees are about $55,800 currently. As he will be enrolling in 10 years, you do need to factor in inflation rates. In Singapore, 10 years of inflation is roughly three per cent per annum for education - this means you should aim to save around $77,300, at the minimum.

If you were to save $550 a month, compounding at three per cent per annum, you would accrue roughly $77,794 in about 10 years – this is enough for your child’s higher education fees.

Source: Monetary Authority of Singapore

Do note that this is based on the assumption that there are consistent returns of three per cent per annum. This is why your choice of financial product is so important - we will dive into this later.

This loose calculation also does not take into account factors such as transport, lodging, allowances, or currency exchange rates when studying abroad. So planning early is crucial to ensure your child receives the best education he or she can get.

2. Compare different plans for the optimal returns

There are no one-size-fits-all plans or foolproof methods. We have different income levels and risk profiles. One method that works for one family may not be right for another.

It’s a little like how some people can always win at a particular claw machine, but others are just wasting tokens.

Check some of the following to see if they’re right for you:

Stock trading, forex, options, and futures: The Stacker Machine

The stacker machine only looks like an easy way to win the top prize. Simply align the moving blocks by hitting the stop button to build a perfect “stack”, and you might win a Nintendo Switch or a new iPhone. However, arcade veterans know this is difficult to win. You need careful timing, and there’s a chance you’ll spend much more than the prize is worth.

Its closest financial equivalent is Do-It-Yourself (DIY) trading in forex, stocks, or options and futures.

You may get higher and quicker returns, if you know when to catch and release. The good thing is, you won’t have to pay management fees, which would incur from managed products such as unit trusts.

On the down side though, DIY trading is a high-risk, high-return type of investment. Learning how to trade is an involved process — it requires you to track markets, have an in-depth understanding of the assets traded, and know the basics of technical analysis.

Exchange Traded Funds (ETFs), or playing on different game machines

When entering a new arcade, it’s always great to play at separate machines, rather than putting all your tokens in the same game. Some games may be easier, some may be harder; especially racing games. Some of them just have easier tracks with fewer bends, or smoother steering. Balance out the "stingy" machines with the more generous ones by spreading your tokens.

This analogy works for an ETF. With an ETF, you don’t need to pick at specific stocks. Rather, you buy a basket of different stocks to invest in.

ETFs may ensure your capital is spread out to cover many companies to balance your risks. This means that a single company’s failure to perform won’t drag down your entire portfolio.

Additionally, it’s cheaper to diversify by purchasing units in an ETF, rather than purchasing stocks in many different companies yourself. Not to mention, the management fees for ETFs are also often lower compared to other investment options.

Robo-advisors, or getting “expert players” to help

If you’re new to the whole arcade scene, it’s best to get advice from veterans. They know which machines are easier to beat, which ones have the best coupon-per-token-spent ratio, and sometimes even the best time of day to play, so you can earn more bonus tokens.

Another way to get help is to learn “game hacks”. These can be found on YouTube or game forums. You can end up saving far more tokens than you’d spend by trial and error.

Likewise, robo-advisors can offer you “investment hacks”.

If you’re new to “the game”, using a robo-advisor can help you make the best automated investment decisions which are driven by algorithms. Without help, it can be challenging to interpret the charts and numbers, and work out which are the actual top performers. Getting started with robo-advisors like UOBAM Invest only takes a few minutes to set up, and you can get tailored advice for your financial goals right away.

For example, some funds may have been a top performer last year, but are below average over a five- or 10-year period based on the annualised returns. This is like an arcade machine that you happen to see the release of a lot of coupons; but you may not realise that it’s less rewarding than other machines.

Some investment products may be too complicated to even understand, such as certain structured notes. This is the equivalent of trying to figure out a machine where the instructions are in a foreign language, like the Japanese drumming game. You are likely to miss all your cues because you can’t read the song list.

Managed funds, or the claw machine

With the claw machine, you have some control over where the claw moves. However, the process of gripping the toy and carrying it to the slot are beyond your control. Pay attention to more than just moving the claw – you also need to track which machines are too packed (making it hard to retrieve the toys), too empty (higher chance of an “empty” grab), or which have a lower chance of winning.

Just like managed funds, most often in the form of unit trusts, they all have their own specialisations, such as bond funds and equity funds, or funds that focus on emerging markets or gold.

While you have control over which fund you choose, you can’t control how the fund operates. A full-time fund manager handles the buying and selling and your eventual returns depend on how the fund manager handles your investment. However, you have little to no control over the investment direction (other than deciding when to sell it off).

It’s also inevitable to expect a higher management fee, because you’re paying a professional to help you invest.

Low-risk products, which are like the “easy” games

One of the easiest arcade games is when you bounce a basketball into the hoop. It doesn’t give out many coupons because of how easy it is. After your first few throws, you’ll find it gets easier to score.

Another “easy” game is whack-a-mole, where you have to hit lit buttons or plastic figures that pop out of holes. A lot of players “cheat” at this by getting help from friends and family (they hit the moles with their hands), so the rewards are quite low.

Since it’s an easy game, you just need a few more rounds to accumulate your rewards. It’s one of the ways to ensure everyone gets a small prize.

You can equate this with low-risk products like insurance endowment plans or Singapore Savings Bonds (SSBs). You might be interested in fixed-income products, such as vanilla bonds that pay out a fixed amount, regardless of market volatility.

These products typically make up one part of your plan to build a higher education fund, because of its low returns. SSBs, for instance, typically have returns of between 2% to 3% if held to maturity for 10 years.

However, you won’t be able to grow sufficient funds on time, if you only invest in low-risk products. It is important to have a balance in your mix of low-risk, low-return products, with a few higher-risk investments.

3. Create a budget plan

Can you afford to set aside S$550 per month?

For most people, it’s sufficient to follow the 50/30/20 rule. This states that 50 percent of your income should go to necessary expenses, 30 percent can go to wants and desires, while 20 per cent goes into savings.

So, with S$10,000 a month in combined income for instance, S$5,000 can go to bills, S$3,000 can go to entertainment, and S$2,000 can go to savings - this is more than enough to cover your child’s education fund.

If your situation is not as ideal, however, you may need to cut out unnecessary expenses such as entertainment to increase your savings.

If you use tools like UOBAM Invest, it can help you to budget the right amount to spend and save, right down to each day.

4. Protect the plan with insurance

Do ensure you have sufficient life insurance, hospitalisation insurance, and critical illness coverage.

Without insurance, medical emergencies could cause you to liquidate your assets and derail your savings plan. For example, you may be forced to sell off units in your ETF or unit trust funds to pay for medical bills which will disrupt your returns and could mean that it will take longer to build the education fund.

Furthermore, if an unfortunate event were to happen, you can rest assured your child’s education will be fully funded for, if you have sufficient (and the right type of) insurance.

5. Review and optimise

Going for the grand prize? Take notes, review, and optimise!

If you want the grand prize in an arcade, or a consistent stream of rewards, you need to know how each machine works. Take note of the machines that give the best pay-outs, how much you spend on each machine (i.e. the token-to-coupon ratio), and which methods give the best results over time.

The same goes with building your children’s education fund. The financial planning involved is not a one-off process. You would need to review how the various funds and products are performing at specific intervals like every 6 months or annually.

For example, if your savings plan has a targeted return of three per cent per annum, then you need to ensure your financial products are not falling below this level – if they are, it may be time to make a switch.

Investments strategies are not a one-size-fits-all

There’s no universal way to win at every arcade, the right investment methods differ for everyone.

The amount of time you have to invest and your emotional risk tolerance play important roles in saving for your child’s education funds. Hence, it’s best to use a robo-advisor to help you vary your approach, so you can prepare for your child’s education as soon as possible. UOBAM Invest is one such robo-advisor which you can leverage to build a sufficient education fund for your child. Not only can it tailor your portfolio based on your financial needs and situation, it can also help you come up with budget plans and tracking expenses, so you can keep track of your spending.

Remember, it is never too early to start building up your child’s tertiary education fund and getting automated help from a robo-advisor will help start you on the right foot.

1XE Currency Converter (XE.com), December 21, 2020