Pimco ‘dominated’ flows into global fixed income products, while shorter-duration Singapore dollar strategies were also popular

By Ernest Chan | December 4, 2024

Singapore retail funds industry saw its strongest net inflows in the third quarter since 2021, with fund firms including Pimco, Lion Global Investors and UOB Asset Management benefitting from higher sales of fixed income and money market products.

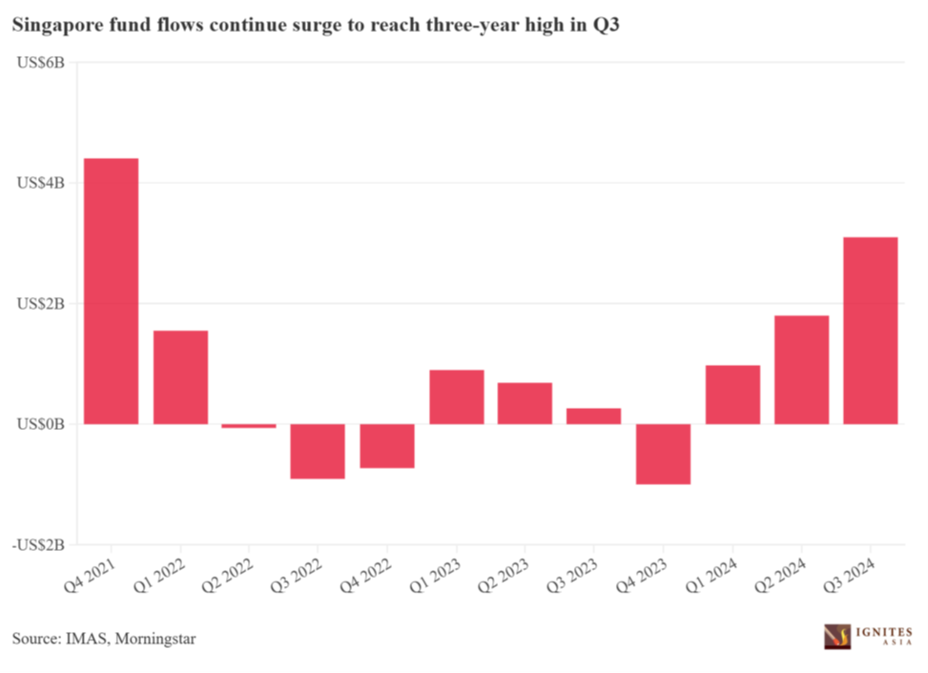

Singapore investors piled S$3.1bn (US$2.3bn) into local authorised and recognised mutual funds in the July to September period, a nearly 70 per cent jump from the S$1.8bn recorded in the previous quarter, according to the latest Morningstar Singapore fund flow report.

That marked the highest recorded inflow figure since the fourth quarter of 2021, when the local funds industry registered S$4.4bn in net inflows, data provided by the Investment Management Association of Singapore shows.

Fixed income funds led the way with S$1.9bn in net flows in the third quarter this year. This almost matched first half net sales for the fund category, which comprised S$906.9mn in the second quarter and S$1bn in the first quarter.

Arvind Subramanian, Singapore-based senior analyst for manager research at Morningstar, described third quarter fund flows as "largely a mirror of the trends" in the first six months of the year but with a "much higher level of inflows".

"While yields did fall in the third quarter of 2024, all major fixed income sectors still carry yields above their five-year average, making bonds more attractive for yield-seeking investors," Subramanian said on a webinar hosted by Morningstar on Tuesday.

Global fixed income funds recorded the highest net inflows with S$901.9mn, followed by Asia fixed income at S$781.1mn and US fixed-income at S$193.5mn.

The Pimco GIS Income Fund "dominated" allocations to the global fixed income strategies, according to the report.

The fund, which had US$88.6bn in assets as of end-October, returned 10.86 per cent over the past 12 months but minus 1.77 per cent over the previous month in its E, Accumulation shares portfolio.

Within the Asia fixed income space, Singapore dollar-denominated funds garnered "robust inflows" according to the report.

Lion Global's Lion-Maribank Saveplus Fund, with S$902.18mn in assets, and UOB AM's United SGD Fund, with more than S$2bn in assets, were among the biggest beneficiaries of these inflows.

"Reasonable inflows" into US fixed income funds were helped as bonds delivered "quite solid double-digit returns" over the past year amid lower shorter-term yields and tighter credit spreads, Subramanian added.

Singapore's money market funds also recorded a massive jump in inflows in the July to September period, growing over 140 per cent to S$1.5bn from S$622.2mn the previous quarter.

This also surpassed the total of S$800.2mn in money market inflows in the first half of the year.

Some Singapore investors still preferred "safe and predictable" options like money market funds, in face of volatility in other asset classes, Subramanian said.

The fixed income space has faced a "rollercoaster" this year, he said, noting that the 10-year US Treasury yield has bounced between 3.5 per cent and 4.5 per cent in 2024 alone.

Subramanian cautioned of the investment risks of money market funds as the higher yields currently available in such strategies may not be available in a few months as the Fed continues its rate-cutting path.

"You have the Fed rate cuts counterbalanced by a potentially higher supply, which should perhaps result in not a very sharp fall in interest rates," said Subramanian.

Singapore's equities funds saw a reversal in flows in the third quarter, posting net outflows of S$436.5mn after seeing slight inflows of S$261.2mn in the May to June period.

"Despite buoyant equity markets, equity inflows were languishing in quarter three," said Subramanian.

Asia Pacific ex-Japan equities funds saw the largest outflows at S$138.2mn. It was followed by other equities funds at S$87.9mn, global large-cap blend equities funds at S$87.2mn, China equities funds A shares at S$80.7mn and global large-cap growth equities funds at S$76.4mn.

Subramanian said that outflows from Asia Pacific ex-Japan funds came despite delivering "relatively strong returns", boosted by the China stimulus package that gave China stocks a bump in the third quarter.

Despite that surge in Chinese equities prices, there was still a "significant performance divergence" between Asian and global markets, and Singapore investors had a preference for developed market strategies, especially US equities products, he added.

Regional equities strategies in Singapore did see pockets of inflows, with investors attracted to US large- cap blend equities funds that pulled in S$75.4mn.

Subramanian said that despite lagging in the third quarter, US stocks had "greatly outpaced" international stocks over the past 12 months led by technology and communication services companies.

India equities funds also saw notable inflows at S$74.5mn, followed by global emerging markets equities funds at S$25.7mn and sector equities technology funds at S$25.1mn.

A "robust" growth outlook and strong macroeconomic fundamentals in the India equity market has helped to boost the profile of such funds in the past quarter, Subramanian said.

Allocation funds also saw significant growth in inflows, albeit from a smaller base, as net sales grew to S$126.4mn from S$42.5mn the previous quarter.

The moderate allocation category had the most net inflows by far at S$276.7mn.

Allianz Global Investors' Allianz Income and Growth and Franklin Templeton's Franklin Income strategies attracted a "dominant share" of the inflows into the moderate allocation category, according to the report.

Flexible allocation funds saw net inflows of S$60.6mn in the third quarter. Manulife Investment Management's Manulife Global Multi-Asset Diversified Income strategy was the biggest driver of these flows.

Ignites Asia is a copyrighted publication. Ignites Asia has agreed to make available its content for the sole use of the employees of the subscriber company. Accordingly, it is a violation of the copyright law for anyone to duplicate the content of Ignites Asia for the use of any person, other than the employees of the subscriber company.