A resource can be natural, like water or crude oil, or manufactured, like plastics and food products. In both cases, the drive to save the planet must involve moderating their use and limiting any waste.

In the first of our "Waste Not, Want Not" series, we explore the role of corporates in conserving water resources, and the impact that water scarcity can have on their bottom lines.

Highlights:

- There is high demand for clean water from populations and industries, resulting in water scarcity. This is made worse by extreme weather conditions.

- Water scarcity is becoming an important ESG issue. The potential financial impact to businesses in 2020 was estimated at US$301 billion.

- The food, manufacturing, energy, chemicals, pharmaceuticals, apparel, and mining sectors are at the forefront of water risks

- As an example, Taiwan’s semiconductor industry relies heavily on water in its chipmaking operations. Given recent droughts, water management is becoming a priority.

In June last year, Taiwan experienced its worst drought in 56 years. The typhoons that typically occur in Taiwan during the summer and autumn months failed to arrive. As a result, reservoir levels fell to below 20 percent of their normal capacity, forcing the authorities to impose water rationing in several counties and municipalities.

Taiwan’s water woes are far from the exception. Although more than 96 percent of Earth’s surface is covered in water, less than three percent of this is from freshwater sources and therefore consumable by humans. As global warming continues to give rise to more severe and extreme weather conditions, water supplies are frequently contaminated or destroyed, exacerbating clean water scarcity.

At the same time, the global demand for water is projected to increase by 55 percent by 2050. As with energy and food, population growth increases water demand. Most of this growth will take place in developing countries within the African and Asian continents where water scarcity is already a pressing issue.

A global and Asian challenge

As a result of this increasing demand and decreasing supply, water stress has become one of the most prominent consequences of climate change. The World Resources Institute estimates that 17 countries – home to a quarter of the world’s population – face "extremely high" levels of baseline water stress. This level is reached when on average every year, more than 80 percent of a country’s available supply is withdrawn due to irrigated agriculture, industries and municipalities.

Figure 1: India and Pakistan are the most water-stressed countries in Asia

National Rankings: Extremely High Baseline Water Stress

| 1. Qatar | 6. Libya | 10. UAE | 14. Pakistan |

| 2. Israel | 7. Kuwait | 11. San Marino | 15. Turkmenistan |

| 3. Lebanon | 8. Saudi Arabia | 12. Bahrain | 16. Oman |

| 4. Iran | 9. Eritrea | 13. India | 17. Botswana |

| 5. Jordan |

Source: wri.org/aqueduct 2019

Part of the problem is that much of the wastewater in these countries are not re-used. In the MENA (Middle East and North Africa) region, this is the case for over 80 percent of wastewater but some initiatives are taking shape. Oman, for example, treats all of its collected wastewater and re-uses 78 percent of it.

In Asia, while only two countries – India and Pakistan – feature in the list of 17 extremely water-stressed countries, India alone has more than three times the population of the other 16 countries combined. India’s water resources from its rivers, lakes and streams are severely overdrawn, but so are its groundwater resources, largely to provide water for irrigation. Overall, it is estimated that 300 million people in Asia Pacific have no access to potable clean water or basic water infrastructure services, and 1.2 billion lack adequate sanitation.

Materiality of water risks

Water scarcity, flooding and pollution risks are an increasingly pertinent ESG issue that can affect a company’s bottom line. According to CDP, a charity specialising in environmental disclosures, the total potential financial impact of water risk to businesses in 2020 was up to US$301 billion. The food, manufacturing, energy, chemicals, pharmaceuticals, apparel, and mining sectors account for 70 percent of the world’s water use and therefore are at the forefront of these risks.

This is because companies that use large amounts of water in their business operations, and/or have facilities in water stressed regions, are facing mounting costs. These typically relate to increased operating expenses, capital expenditures, insurance payments, litigation and compliance costs, and disruption to production. To mitigate against these costs, companies are investing in new modes of operation totalling US$55 billion in 2020, according to CDP estimates.

- Within the food industry, companies are adopting water saving and water re-use measures. Some are also promoting sustainable agricultural practices.

- Within manufacturing and materials, the focus is on adopting water saving and re-use measures and developing flood emergency plans.

- With apparels, textile manufacturing and raw material production is particularly water intensive. Expenditure is dominated by investment in technology to address regulatory risks associated with pollution.

- Within power generation, there is significant capital expenditure on diversification into renewable energy sources and lowering the temperature of discharged cooling water.

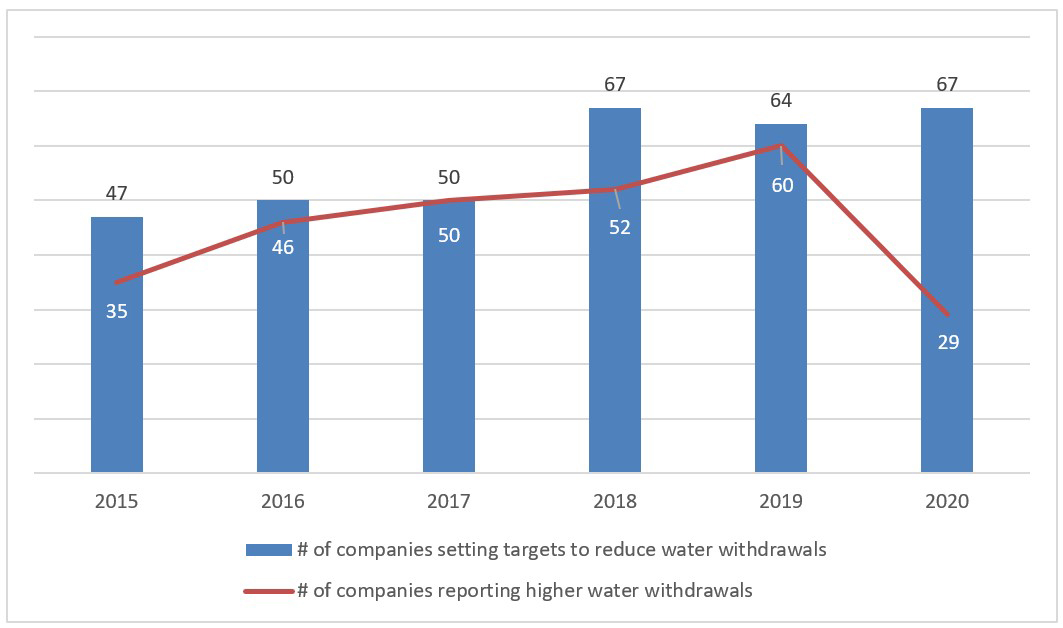

These measures are starting to take effect. For the first time since CDP started their freshwater withdrawal surveys, the trend of companies reporting increased withdrawals fell in 2020. This was likely the result of companies setting withdrawal reduction targets two years previously, largely based on water savings and re-use. However, improving the supply chain and supplier performance is still a relatively untapped opportunity in dealing with water risks, so there is room for further improvement.

Figure 2: Companies reporting increased withdrawals fell in 2020

Trend in water withdrawals: 2015 - 2020

Source: CDP Water Report 2020

Case Study: Taiwan’s semiconductor industry

The financial risks and implication arising from water risks need to be taken into account and may not be fully priced in by investors.

For example, Taiwan’s semiconductor industry relies heavily on water use in its chipmaking operations. The chip-fabrication process relies on large volumes of pure and high quality water supply in order clean the wafers and chip surfaces from particles and chemicals. The industry was thrust into the limelight when the country’s Baoshan No.2 Reservoir – one of the primary sources of water for Taiwan’s semiconductor industry – fell to seven percent of its normal water level.

Some of the world’s largest semiconductor foundries operate the bulk of their water-intensive chip fabrication businesses in Taiwan. Their water intensity increased by 20 percent from 2015 to 2019, and each company can use more than 150,000 tons of water daily. As these companies continue to expand their advanced semiconductor fabrication, it is likely that they will become even more reliant on freshwater sources unless steps are taken to enhance their water management plans. This includes increasing their water recycling rate and installing reclaimed water plants to reduce their water dependency.

However, more extreme weather events are anticipated in Taiwan making the freshwater supply more volatile. Investors will need to factor in this water risk when valuing Taiwan’s semi-conductor earnings.

Evaluating Water Risks

Water risk is an ESG issue that is becoming increasingly relevant to companies and investors. The potential financial implications should not be ignored.

Companies that are more resilient to water risk, water stress and climate-related risks may face less earnings impact, are potentially better positioned for sustainable transition and can become potential leaders in their industries. On the other hand, affected companies that fail to actively invest in water management stand to be penalised by the market.

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.