- The US’ June inflation data was surprisingly benign

- Analysts are now wondering whether the US has beaten inflation while avoiding a recession

- If so, such a “goldilocks” scenario could be the catalyst for a rally in riskier assets

Markets celebrate latest inflation data

The US’ June Consumer Price Index (CPI) report released last week showed annual inflation at 3.0 percent. This represents a steady drop every month for the past year and a considerable distance from the 9.1 percent seen a year ago.

The news brought cheer to markets around the world. The S&P500 set a new high for 2023 and is up by 18 percent since the start of the year. To date, the index is only 5.0 percent off from its all-time high reached on 3 January 2022.

Most Asian stock markets also had their best week so far this year. Having lagged the US all year, there are hopes that Asia will start to close the gap. The latest inflation numbers suggest that the chance of a US interest rate peak in July is now higher than ever.

Meanwhile bond markets are also anticipating the end of rate hikes, with yields falling and prices rising steadily over the past two weeks. 2-year Treasury yields are down from 5.0 percent, close to this year’s high, to 4.7 percent. Similarly, 10-year Treasury yields fell from 4.0 percent to 3.8 percent over the same period.

Falling across the board

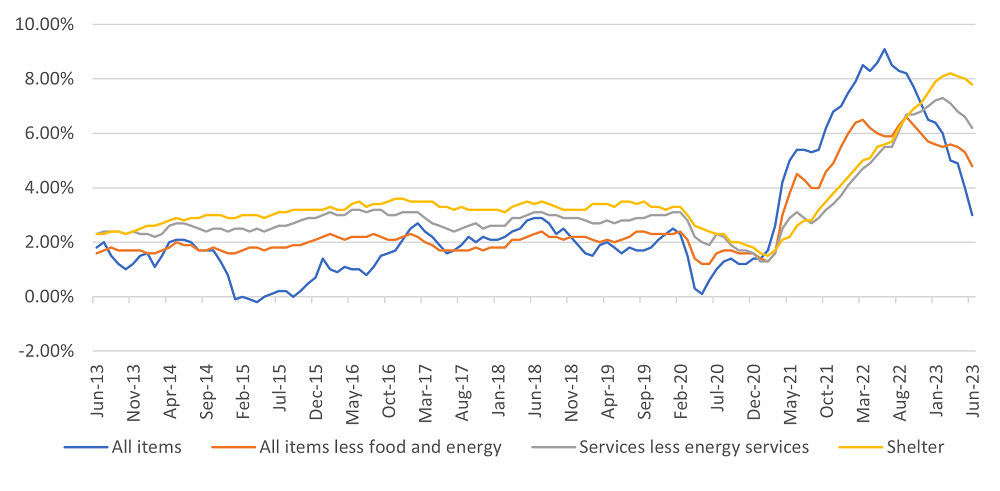

Unlike past CPI releases, this one has shaken the sceptics. Across almost all measures of inflation - whether it is headline (i.e. all items), or core (minus food and energy) or super-core (minus food, energy and housing) inflation - the US Bureau of Labour Statistics numbers show a decline.

Figure 1: CPI 12-month percentage change, selected categories

Source: US Bureau of Labour Statistics

Meanwhile, employment and wages appear to be holding up. In fact, adjusted for inflation, wages are 1.2 percent higher than a year ago. US consumer spending also remains robust. This suggests that the US is managing to lower its inflation without inflicting pain on its citizens, what economists refer to as a “goldilocks” scenario.

Is this for real?

Now they are left with two questions: firstly, is this a sustained trend or simply a blip, and secondly, is this good enough to satisfy the Fed?

In relation to the first question, it would appear that the prices of certain commodities and durables have lifted off the bottom and are slightly ticking up again. On the other hand, rental data are yet to reflect the actual softening in the rental market. So, although a reversal of the overall inflation trend looks increasingly unlikely, some economists are holding out for another month or two.

The second question is also causing a split among the experts. While the Fed has reiterated its 2.0 percent inflation target many times, it is unclear whether the Fed is willing to pause rate hikes for an extended period to see how things pan out. It is also possible, having witnessed the potential for NICE (non-inflationary, continued expansion), that the Fed decides to settle for a higher-for-longer interest and inflation rate.

What now for investors?

UOBAM analysts have noted over the last two quarters that the hard landing view was not holding water. As such, in our 3Q23 Quarterly Investment Strategy, titled “Upside risks outweigh downside risks we suggested that there was room for more investor optimism.

This most recent inflation data gives us even more confidence that both the US economy and US companies can grow despite liquidity that is tighter than it has been for decades. In fact, growth under such conditions points to solid fundamental drivers, rather than easy money.

As such, another month of positive data is likely to further bolster risk assets such as equities and non-investment grade bonds. However, should the market run too fast, it is not possible at this stage to rule out a correction later in the year. Those investors who have become heavily overweight in bonds may want to gradually bring their equity exposure back to neutral. However, as bond investments continue to offer attractive yields, they should resist a sharp swing from bonds to equities, even if stocks rally in the short term.

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person.You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.

UOB Asset Management Ltd. Company Reg. No. 198600120Z