- USD has fallen to a three-year low despite its safe haven status

- This is the result of both long-term foreign reserve trends, as well as recent US trade policies

- We believe this decline could abate in the short term, but USD weakness looks set to persist

Wayne Lau, Vice-President, Multi-asset Strategy

G7 disappointment

The G7 Summit this week was dominated by the resurgence of military conflict between Israel and Iran, and ended prematurely when President Trump announced his early departure.

But even before leaving, President Trump seemed to be in no mood to play ball. Ahead of the 9 July expiry of the tariffs pause, several leaders at the summit, including Japanese PM Ishida and European Commission President von der Leyen, tried but failed to strike trade deals with the US. Only UK PM Starmer was able to walk away with a deal to cut tariffs on car exports.

Dollar weakness

And in the background were simmering but largely unspoken concerns about the level of the USD. Forty years ago, the Plaza Accord was signed to support the devaluation of the dollar. Today, opposite forces are in play, and the USD is at a three-year low.

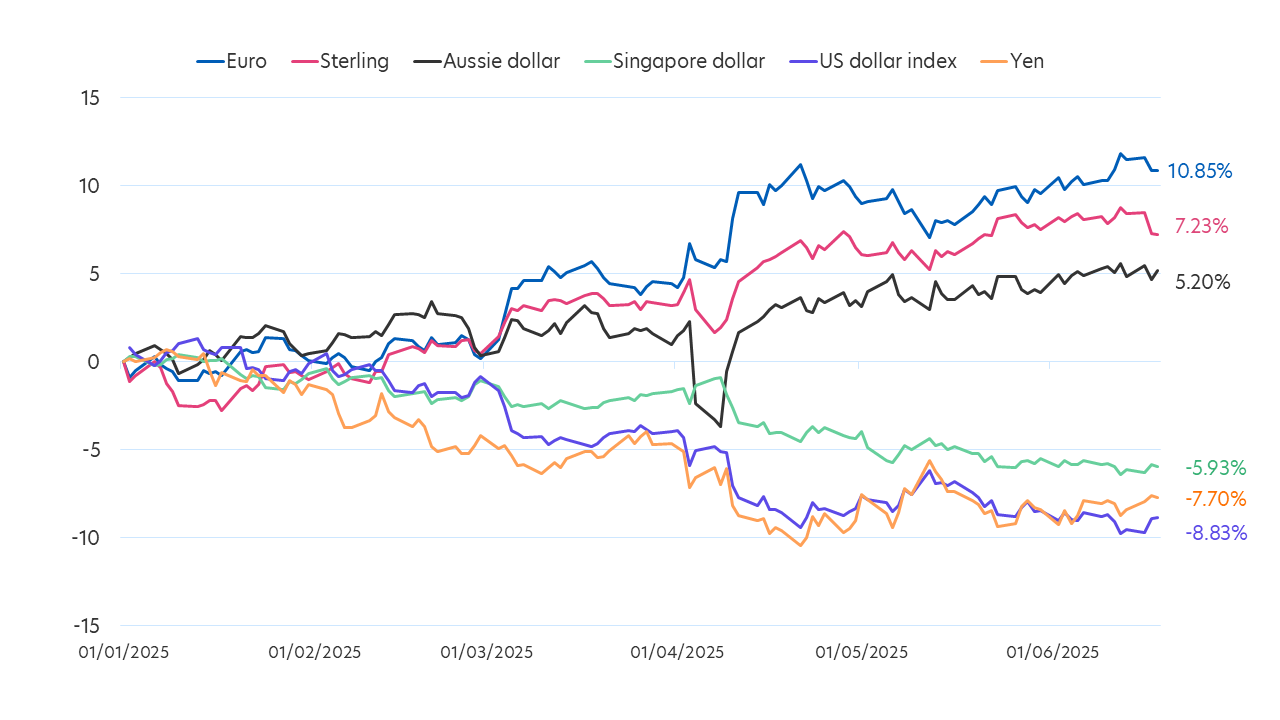

Viewed as a safe-haven currency, the USD traditionally benefits from crises. But having weakened by up to 10 percent against major currencies so far this year, there are no signs of a rush to buy the dollar, despite the worsening Middle East conflict.

Fig 1: USD vs major currencies

Source Bloomberg/UOBAM

A perfect storm

The reasons for this USD weakness are multiple and include both long term factors as well as ones that are more tactical in nature. Structurally, central banks have been gradually diversifying their foreign currency reserves, and as a result, the USD’s share of total reserves has declined from 70 to 57 percent over the last two decades1.

While this de-dollarisation is longstanding, more recent concerns over the US government’s debt situation have prompted central banks and investors to offload some of their US Treasury holdings, further depressing the dollar.

Asia is taking the lead

The vicious cycle seems especially evident among Asian economies. It has been suggested that these economies are rethinking their USD-tilts, not just as a way to reduce their FX risks, but as a tactic in their trade negotiations with the US. The pressure to diversify their trading relationships is a further incentive to diversify their currency reserves.

In any case, Asian economies have a tendency to benefit from a weaker USD and are unlikely to resist this trend. Stronger local currencies help to improve their balance of payment positions and reduce the foreign-debt burden. It can also encourage stronger capital inflows as Asian assets become more attractive. That said, any upside may be limited by the fact that Asian monetary policies remain on an accommodative path with rate cuts expected over the medium term.

The Trump factor

A further factor that could put a lid on the USD is President Trump himself. He has often expressed his wish to see a weaker dollar and some would argue that this stands at the heart of his administration’s economic policy.

In fact, his dissatisfaction with the G7 (ex US) - backed world economic order stems from his belief that it systematically leads to an overvalued dollar. To counter this, some members of his administration have mentioned a “Mar-a-Lago Accord” which, like the Plaza Accord, would be designed to depreciate the USD. Such an accord now seems unnecessary, although notably, President Trump’s main target - the Chinese Yuan (CNY) - has barely risen against the USD.

UOBAM’s view

The USD’s free-fall mode since the start of 2025, despite real rate differentials against the DXY basket moving sideways, suggests an unwinding of the US exceptionalism narrative. Haphazard US policies, especially on the trade front, has resulted in lower foreign demand for USD-denominated assets.

In our view, after the current decline, the dollar is fairly valued and current positioning points to a possible near-term consolidation. That said, for the rest of 2025, we believe the dollar could trade in a similar fashion to that of 2017, where the dollar was weak in a period of an uncertain political environment. As such, we would urge investors to resist catching a falling knife and instead, to diversify their currency holdings, particularly to Asian currencies.

All information in this publication is based upon certain assumptions and analysis of information available as at the date of the publication and reflects prevailing conditions and UOB Asset Management Ltd (“UOBAM”)'s views as of such date, all of which are subject to change at any time without notice. Although care has been taken to ensure the accuracy of information contained in this publication, UOBAM makes no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for the accuracy or completeness of the information.

Potential investors should read the prospectus of the fund(s) (the “Fund(s)”) which is available and may be obtained from UOBAM or any of its appointed distributors, before deciding whether to subscribe for or purchase units in the Fund(s). Returns on the units are not guaranteed. The value of the units and the income from them, if any, may fall as well as rise, and is likely to have high volatility due to the investment policies and/or portfolio management techniques employed by the Fund(s).

Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. An investment in the Fund(s) is subject to investment risks and foreign exchange risks, including the possible loss of the principal amount invested. Investors should consider carefully the risks of investing in the Fund(s) and may wish to seek advice from a financial adviser before making a commitment to invest in the Fund(s). Should you choose not to seek advice from a financial adviser, you should consider carefully whether the Fund(s) is suitable for you. Investors should note that the past performance of any investment product, manager, company, entity or UOBAM mentioned in this publication, and any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance of any investment product, manager, company, entity or UOBAM or the economy, stock market, bond market or economic trends of the markets. Nothing in this publication shall constitute a continuing representation or give rise to any implication that there has not been or that there will not be any change affecting the Funds. All subscription for the units in the Fund(s) must be made on the application forms accompanying the prospectus of that fund.

The above information is strictly for general information only and is not an offer, solicitation advice or recommendation to buy or sell any investment product or invest in any company. This publication should not be construed as accounting, legal, regulatory, tax, financial or other advice. Investments in unit trusts are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited, UOBAM, or any of their subsidiary, associate or affiliate or their distributors. The Fund(s) may use or invest in financial derivative instruments and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund(s)’ prospectus.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd Co. Reg. No. 198600120Z