- Market sentiment buoyed by US-China agreement to temporarily lower trade tariffs while seeking more permanent solutions

- We think the risks of a global recession has reduced and are upgrading our equity view from underweight to neutral

- However, investors should remain vigilant as the risks of a global growth shock has not been completely eliminated

Anthony Raza, Head of Multi-Asset Strategy

Is the worst over?

In the wake of heated anti-China and anti-US rhetoric, market watchers were not expecting much from the meeting between US and China trade representatives in Geneva this week.

So the announcement of a temporary but significant deceleration in the trade war between the US and China came as a welcome surprise. As part of a 90-day trade deal, US’s tariffs on China will drop from 145 percent to 30 percent, and China will lower its duties on US imports from 125 percent to 10 percent.

Markets globally have rallied on the news, amid hopes that this truce opens the door to a thawing of relations between the US and China, and more negotiations in the weeks to come.

We are upgrading our view to neutral

Following President Trump’s so-called Liberation Day, UOBAM put the probability of a US, and consequently a global, recession at 40 percent. Given the news that US and China are taking steps to drastically lower trade barriers, we are easing our recession risk estimates to 30 percent.

This in turn has caused us to upgrade our view on risk assets from underweight to neutral. We think markets in 2025 will ultimately be driven by whether or not “hard” economic data emerging from the US, Europe and Asia continues to hold up. While caution remains warranted, the chances of negative economic data are now looking more remote. As such, we feel that a more neutral investment stance is justified for the immediate term.

Reasons to be optimistic

- Recent “soft data" surveys suggest that businesses were considering delaying their investments and consumers were becoming less confident about further purchases. However, "hard" economic growth data, such as the unemployment rate and consumer spending, remains stable.

- We anticipate that most economic headwinds are concentrated in the US. Perceptions that US exceptionalism is under threat has also led to some unwinding of premium valuations for US assets. However, there may be opportunities in China and Europe as they rebound from weak levels in 2024.

- Global economies also stand to benefit from any potential US policy moves designed to counteract the effects of US tariffs. We continue to expect two or three more US rate cuts by the end of 2025. In addition, President Trump still has the option to cut taxes (as he did in his first term) in order to boost consumption.

Reasons to remain cautious

- The current market rebound indicates a fair degree of confidence in a policy reversal and resilience in the global economy. Nonetheless, caution regarding a potential growth slowdown is warranted given that the global economy is closer to a late-stage cycle with full employment.

- Our base case outlook is for continued expansion, but the risk of a growth shock leading to an employment downturn cannot be entirely disregarded. Conversely, the economy could face a wage/price spiral if employment holds up. Both possibilities would be negative for markets.

Five potential scenarios

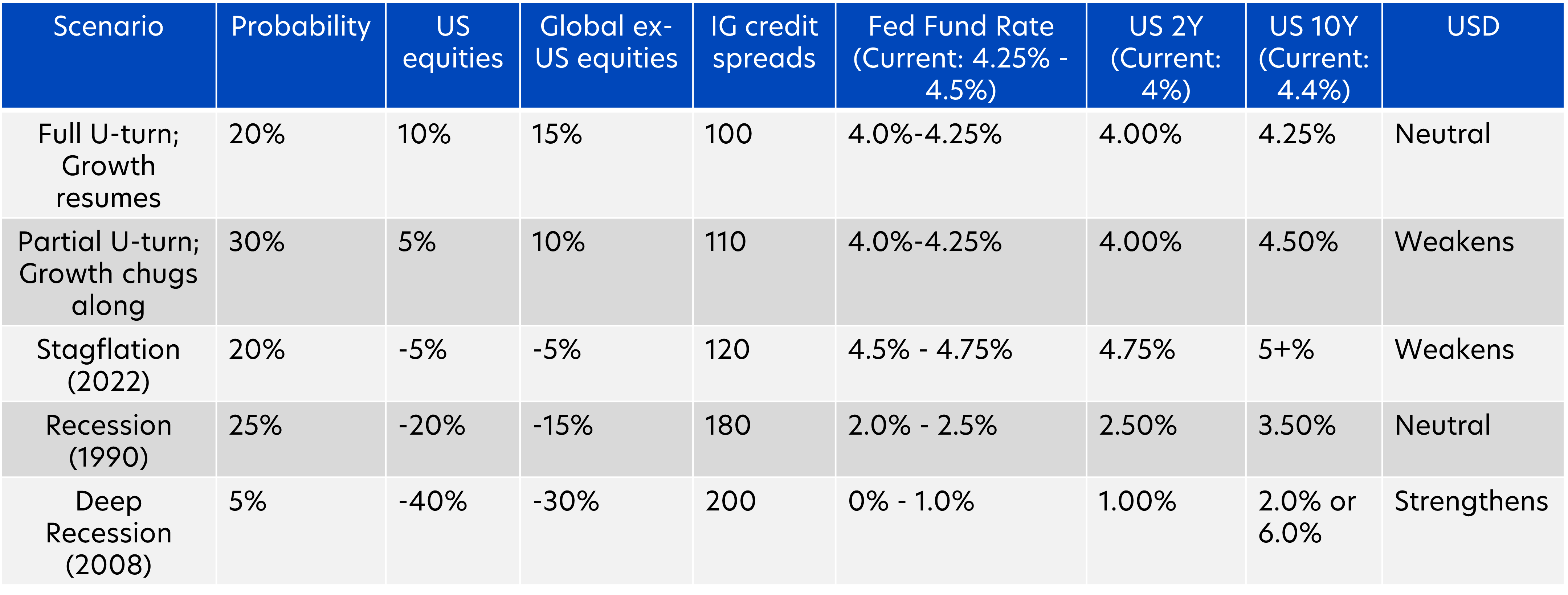

Here is a summary of the scenarios facing global economies. We think that the potential for a positive scenario (i.e. a full or partial policy U-turn) is equal to the negative scenarios. In each case, the table below highlights our outlook for global equity returns, US bond yields and spreads, and the USD.

This publication shall not be copied or disseminated, or relied upon by any person for whatever purpose. The information herein is given on a general basis without obligation and is strictly for information only. This publication is not an offer, solicitation, recommendation or advice to buy or sell any investment product, including any collective investment schemes or shares of companies mentioned within. Although every reasonable care has been taken to ensure the accuracy and objectivity of the information contained in this publication, UOB Asset Management Ltd (“UOBAM”) and its employees shall not be held liable for any error, inaccuracy and/or omission, howsoever caused, or for any decision or action taken based on views expressed or information in this publication. The information contained in this publication, including any data, projections and underlying assumptions are based upon certain assumptions, management forecasts and analysis of information available and reflects prevailing conditions and our views as of the date of this publication, all of which are subject to change at any time without notice. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. UOBAM does not warrant the accuracy, adequacy, timeliness or completeness of the information herein for any particular purpose, and expressly disclaims liability for any error, inaccuracy or omission. Any opinion, projection and other forward-looking statement regarding future events or performance of, including but not limited to, countries, markets or companies is not necessarily indicative of, and may differ from actual events or results. Nothing in this publication constitutes accounting, legal, regulatory, tax or other advice. The information herein has no regard to the specific objectives, financial situation and particular needs of any specific person. You may wish to seek advice from a professional or an independent financial adviser about the issues discussed herein or before investing in any investment or insurance product. Should you choose not to seek such advice, you should consider carefully whether the investment or insurance product in question is suitable for you.

This publication has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd. Company Reg. No. 198600120