Solid total returns

Singapore bonds have delivered good total returns this year, highlighting the fact that bond investing is more than just collecting interest income. Amid global trade and geopolitical uncertainties, investors are flocking to Singapore Dollar (SGD) Singapore bonds issued by both the government and corporates.

This is not just due to the country’s AAA credit rating and strong corporate fundamentals. In line with global trends, Singapore bond yields have declined steeply in recent months with the Singapore Government Securities (SGS) yield curve now below 2 percent across most maturities1. Going forward, global bond yields face further downward pressure now that the US Federal Reserve has resumed its rate cutting cycle.

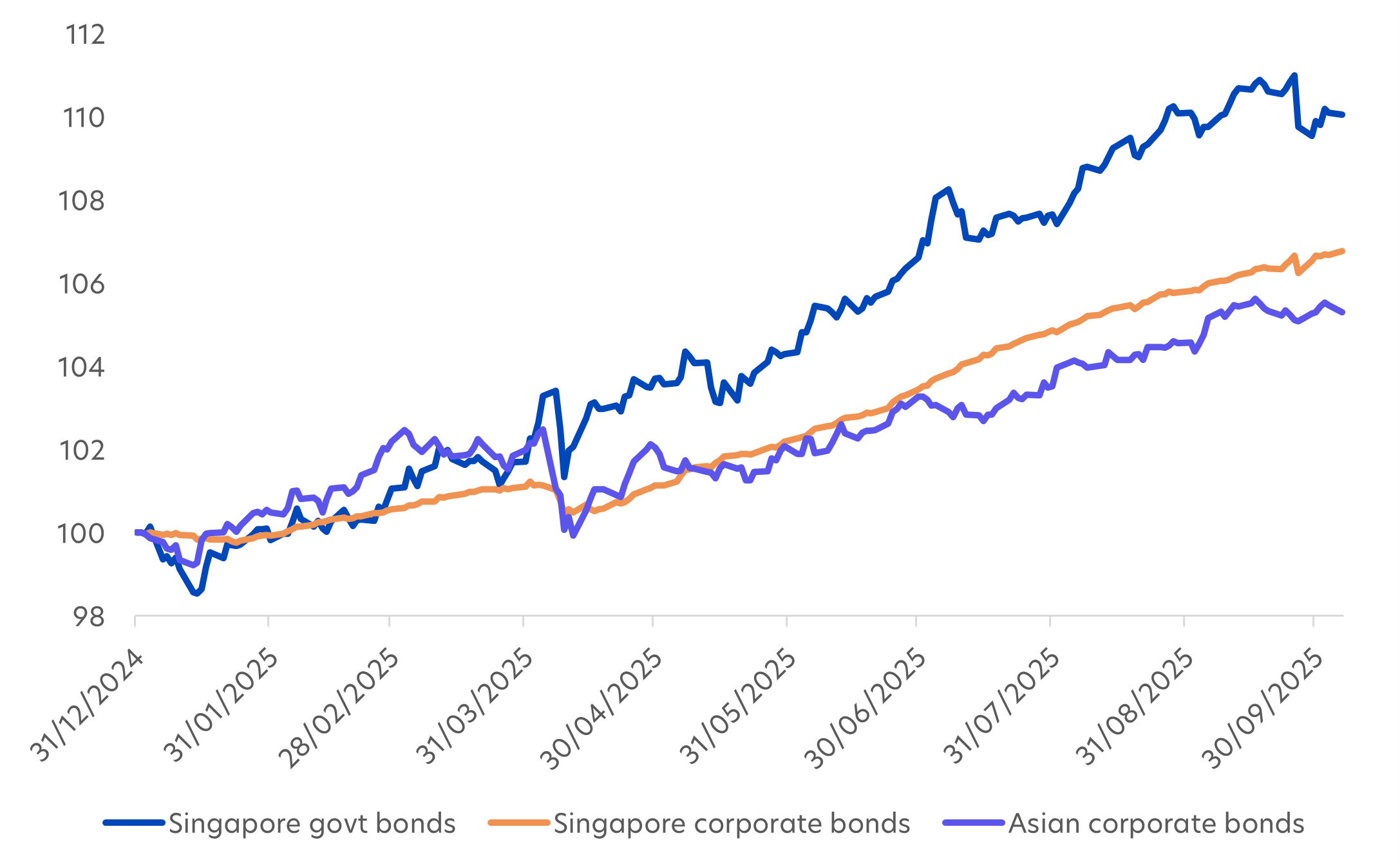

When yields drop, bond prices rise. Hence, on a total return basis, Singapore government and corporate bonds have returned 10 percent and 7 percent respectively so far this year. Notably, SGD corporate bonds outperformed their Asian peers while following a less-volatile trajectory, as seen in the chart below.

Fig 1: YTD performance of Singapore vs Asian bonds

Source: Bloomberg, as of 6 Oct 2025. Singapore government bonds: Markit iBoxx ALBI Singapore Govt Total Return Index, Singapore corporate bonds: Markit iBoxx SGD Corporates Total Return Index, Asian corporate bonds: Markit iBoxx Asian USD Dollar Bond - SGD Hedged. Total return performance indexed to 100.

Longer duration, higher rates sensitivity

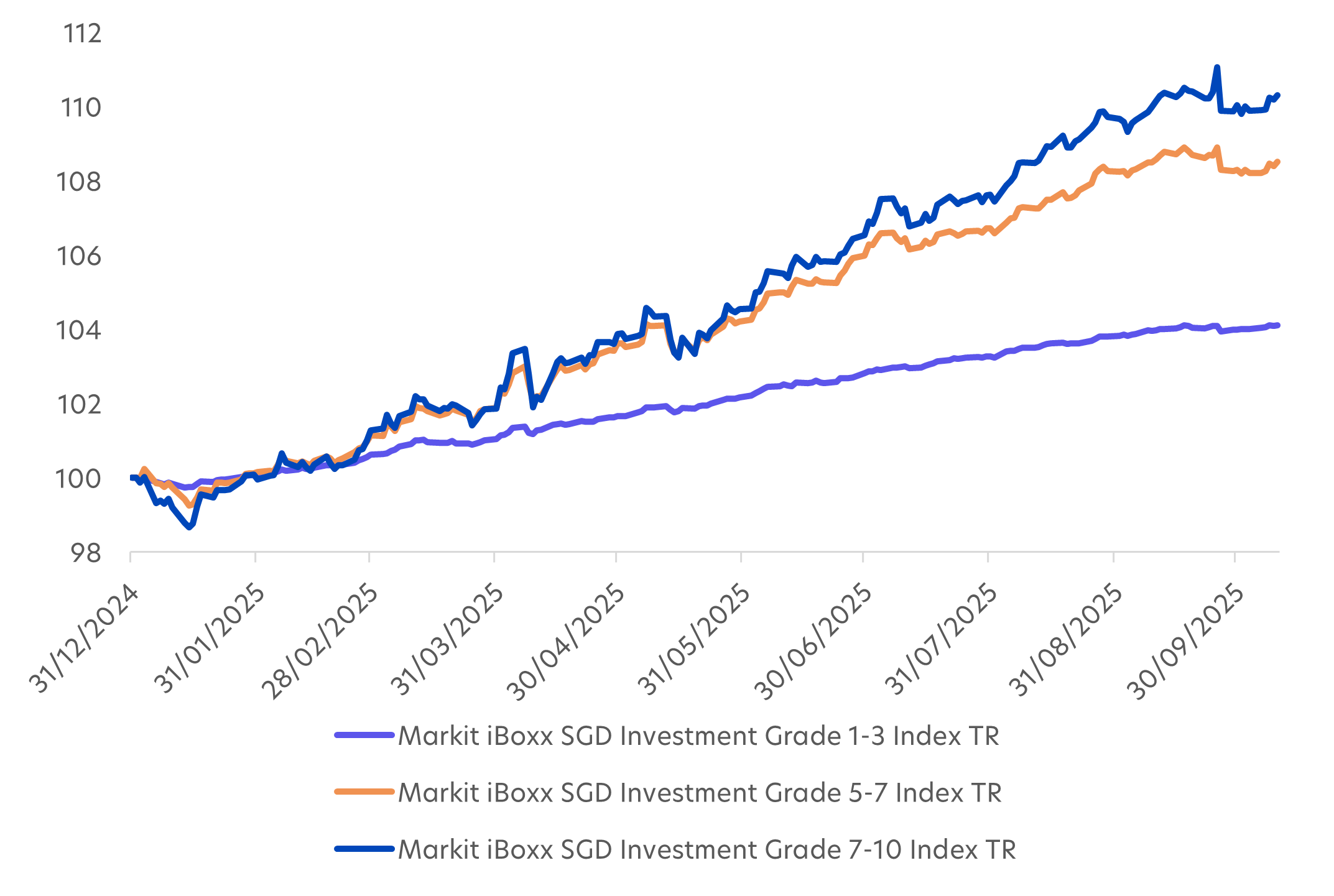

Duration impacts a bond’s sensitivity to interest rates. This means the longer the bond duration, the more its price responds when interest rates rise or fall. Typically, when interest rates fall by 1 percent, the price of a 5-year duration bond will gain by about 5 percent, and a 10-year duration bond will appreciate by about 10 percent. On the other hand, when rates rise, the negative effect is greater for a long duration bond than a short duration bond.

Going forward, Singapore bond yields look set to fall further given that the US has recently cut its interest rates and is expected to continue doing so next year. In this environment, long duration bonds have the potential for higher price gains relative to short duration bonds.

Fig 2: YTD performance of 1–3 year, 5–7 year, and 7–10 year duration bonds

Source: Bloomberg, as of 10 Oct 2025. Total return performance indexed to 100.

Introducing the United Singapore Bond Fund

Against this backdrop, the United Singapore Bond Fund (the “Fund”) offers a timely solution for investors. The Fund seeks both interest payments and capital appreciation by seeking longer duration opportunities within the SGD-denominated government and corporate bonds universe.

Here are some current Fund features:

1. Strong total returns

The Fund has generated attractive total returns of 9.24 percent over the past one year and 9.74 percent on a year-to-date basis (as of 30 September 2025).

Although the Fund’s weighted average yield to maturity is relatively modest at 2.57 percent p.a. (as of 30 September 2025), this is still higher than Singapore’s projected full-year inflation rate of between 0.5 percent and 1.5 percent for 20252.

Rather than yields, most of the Fund’s performance has come from price gains. The Fund’s long duration of 9.28 years has enabled it to benefit from interest rate movements. As the US Fed continues its rate cutting cycle, and Singapore bond yields continue to fall, the Fund’s duration positioning has the potential for even more price appreciation.

To further optimise performance, the Fund manager also actively monitors market conditions and takes profit on bonds that have become expensive. These proceeds are then reinvested in newly issued bonds that offer better relative value.

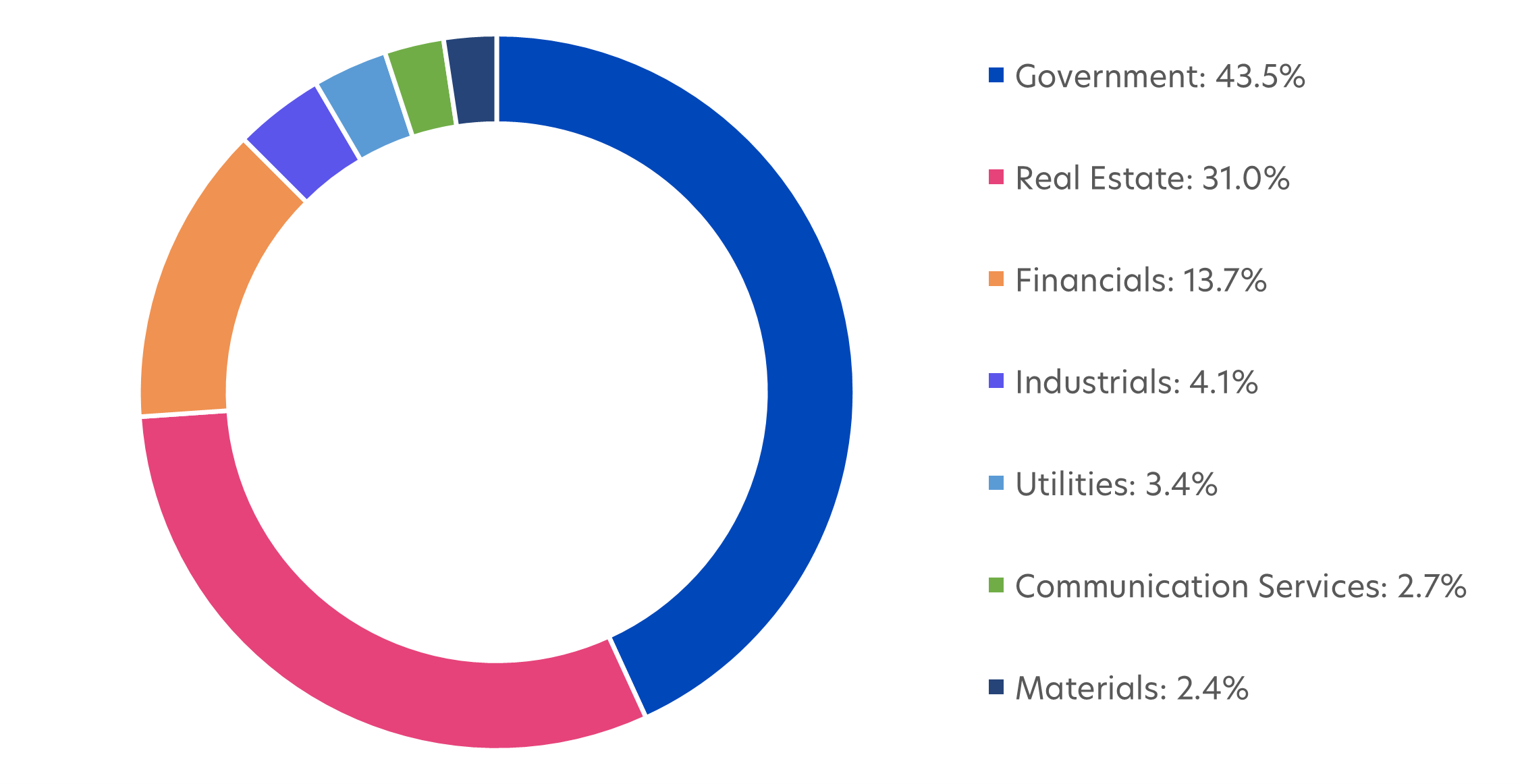

2. Diversified exposure to government and corporate bonds

To enhance its yield potential, the Fund holds an overweight position in corporate bonds (56 percent)3, which typically offer higher yields compared to government bonds. This allocation is also supported by the strong demand for Singapore corporate bonds.

The majority of the Fund’s corporate exposure comes from real estate bonds, issued by companies such as Starhill Global REIT and Frasers Property. Bonds from financial institutions like AIA Group and Credit Agricole and from industrial firms like Jurong Shipyard and Singpost Group also have a substantial presence.

The rest of the Fund is invested in Singapore government bonds which provide stability and help maintain the Fund’s solid investment grade “A” credit rating. At present, the top five holdings of the Fund comprise Singapore government bonds.

Fig 3: Fund sector allocation

Source: UOBAM, as of 30 September 2025

3. SGD exposure

As of 30 September 2025, the Fund is 84 percent invested in Singapore-based assets. This strong local exposure allows the Fund to benefit from the strength and popularity of the SGD, while also leveraging the stability of Singapore’s capital markets. These factors help reduce currency risk and contribute to consistent performance.

Furthermore, SGD bonds present an attractive alternative for investors seeking to diversify away from USD-denominated assets, especially as the de-dollarisation trend picks up. The SGD has remained stable even during periods of market stress, underpinned by Singapore’s strong economic fundamentals and prudent monetary policy.

4. Higher returns, lower volatility than peers

Over the past three years, the Fund has delivered higher returns at lower risk than its Morningstar peer group average4. This stability stems from the Fund’s higher proportion of government bonds relative to its peers.

| Cumulative returns (%) | Annualised returns (%) | Risk (%) | ||

| Year-to-date | 1-year | 3-year | 3-year standard deviation | |

| United Singapore Bond Fund | 9.74 | 9.24 | 6.83 | 3.82 |

| Peers | 6.82 | 6.02 | 5.82 | 4.54 |

Source: Morningstar as of 30 September 2025. | Refers to United Singapore Bond Fund – Class A SGD Acc | Fund performance is calculated on a NAV to NAV basis. Past performance is not necessarily indicative of future performance. | Peers category (Morningstar): SGD Bond. Does not include the effect of the current subscription fee that is charged, which an investor might or might not pay.

However, investors should note that the Fund’s long duration makes it more volatile relative to funds that hold a majority of short (0 – 3 years) or intermediate (5 – 7 years) duration bonds. As such, the United Singapore Bond Fund is well suited for investors seeking long term capital gains, but want to avoid the price fluctuations associated with equity investments.

Fund details

| Fund Name | United Singapore Bond Fund |

| Investment Objective | The investment objective of the Sub-Fund is to maximise returns over the longer term by investing mainly in bonds denominated in Singapore Dollars (issued by entities incorporated or domiciled globally) and bonds denominated in foreign currencies (issued by entities incorporated or domiciled in Singapore). Apart from investments in bonds, the Sub-Fund may also invest in money market instruments (denominated in SGD or foreign currencies), bond funds (including funds managed by the Managers) and time deposits in any currency. Investments shall be made in accordance with the CPF Investment Guidelines. There is no target industry or sector. |

| Distribution Policy | Distributions (if any) will only be made in respect of the Distribution Classes of the Fund. The current distribution policy is to make regular quarterly distributions of up to 2.0% p.a.* * Distributions are not guaranteed. Distributions may be made out of income, capital gains and/or capital. |

| Fund Classes Available | Class A SGD Acc Class A SGD Dist |

| Subscription Mode | Class A SGD Acc: Cash, CPF-OA/SA, SRS Class A SGD Dist: Cash, SRS |

| Minimum Subscription | S$1,000 (initial); S$500 (subsequent) |

| Subscription Fee | Currently up to 2% |

| Management Fee | Currently 0.55% p.a. |

1Source: MAS, as of 1 Oct 2025

2Source: MAS, as of 10 Oct 2025

3Source: UOBAM, as of 30 Sep 2025

4Peers category (Morningstar): SGD Bond

| If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider: United Singapore Bond Fund

You may wish to seek advice from a financial adviser before making a commitment to invest in the above fund, and in the event that you choose not to do so, you should consider carefully whether the fund is suitable for you. |

Distributions will be made in respect of the Distribution Classes of the Fund. Distributions are based on the NAV per unit of the relevant Distribution Class as at the last business day of the calendar month or quarter. The making of distributions is at the absolute discretion of UOBAM and that distributions are not guaranteed. The making of any distribution shall not be taken to imply that further distributions will be made. UOBAM reserves the right to vary the frequency and/or amount of distributions. Distributions from a fund may be made out of income and/or capital gains and (if income and/or capital gains are insufficient) out of capital. Investors should also note that the declaration and/or payment of distributions (whether out of income, capital gains, capital or otherwise) may have the effect of lowering the net asset value (NAV) of the relevant fund. Moreover, distributions out of capital may amount to a reduction of part of your original investment and may result in reduced future returns. Please refer to the Fund's prospectus for more information.

All information in this publication is based upon certain assumptions and analysis of information available as at the date of the publication and reflects prevailing conditions and UOB Asset Management Ltd (“UOBAM”)'s views as of such date, all of which are subject to change at any time without notice. Although care has been taken to ensure the accuracy of information contained in this publication, UOBAM makes no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for the accuracy or completeness of the information.

Potential investors should read the prospectus of the fund(s) (the “Fund(s)”) which is available and may be obtained from UOBAM or any of its appointed distributors, before deciding whether to subscribe for or purchase units in the Fund(s). Returns on the units are not guaranteed. The value of the units and the income from them, if any, may fall as well as rise. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. An investment in the Fund(s) is subject to investment risks and foreign exchange risks, including the possible loss of the principal amount invested. Investors should consider carefully the risks of investing in the Fund(s) and may wish to seek advice from a financial adviser before making a commitment to invest in the Fund(s). Should you choose not to seek advice from a financial adviser, you should consider carefully whether the Fund(s) is suitable for you. Investors should note that the past performance of any investment product, manager, company, entity or UOBAM mentioned in this publication, and any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance of any investment product, manager, company, entity or UOBAM or the economy, stock market, bond market or economic trends of the markets. Nothing in this publication shall constitute a continuing representation or give rise to any implication that there has not been or that there will not be any change affecting the Funds. All subscription for the units in the Fund(s) must be made on the application forms accompanying the prospectus of that fund.

The above information is strictly for general information only and is not an offer, solicitation advice or recommendation to buy or sell any investment product or invest in any company. This publication should not be construed as accounting, legal, regulatory, tax, financial or other advice. Investments in unit trusts are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited, UOBAM, or any of their subsidiary, associate or affiliate or their distributors. The Fund(s) may use or invest in financial derivative instruments, and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund(s)’ prospectus.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd Co. Reg. No. 198600120Z