Intermediate-duration bonds offer a yield pick-up

The US Federal Reserve has resumed its interest rate cutting cycle after a nine month break. Starting with 25 basis points (bps) last month, the Fed is expected to continue cutting this year and the next. This will put pressure on other central banks to do the same, thereby bringing down bond yields around the world.

Against this backdrop, investors who do not take steps to lock in yields will see their bond interest payments dwindle further. One way to maintain payments at current levels is to marginally lengthen the average duration of the bonds that they hold.

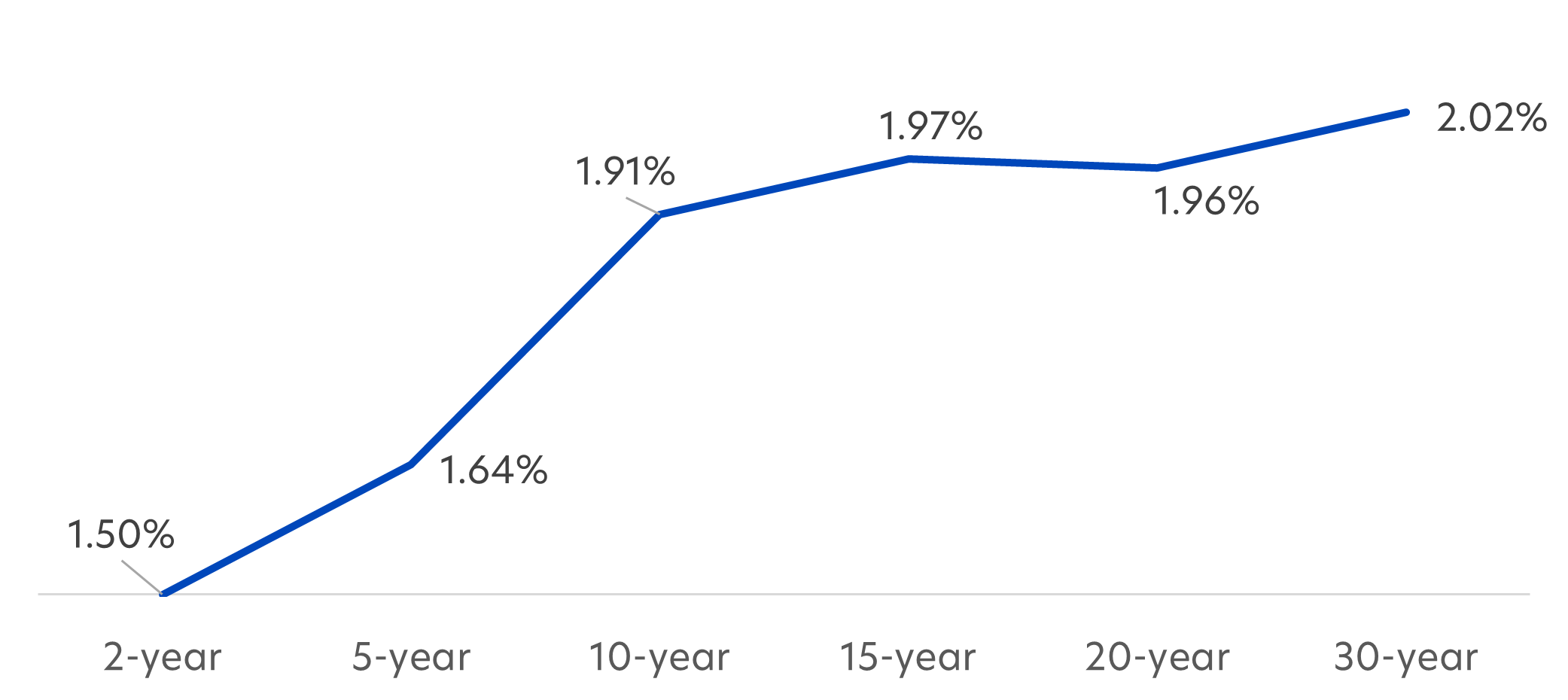

For example, 2-year Singapore Government Securities (SGS) Treasuries are yielding about 1.5 percent, compared to 1.9 percent yield for the 10-year1. Notably, the yield curve flattens out beyond this point, i.e. bond durations beyond 10-years do not see enjoy a corresponding increase in yields.

Fig 1: Singapore Government Securities Yield Curve

Source: MAS, 1 Oct 2025

Total returns matter

Also important to consider is the fact that longer duration bonds are more sensitive to interest rate movements. When interest rates fall, bond prices tend to rise, and this price rise will be more pronounced for longer duration bonds.

Within credits (i.e. corporate bonds), lower rates also reduce borrowing costs for corporates, resulting in improved cash flows and fundamentals. This can further support bond price appreciation across the investment grade and high yield credit segments.

As such, compared to short duration bonds, those in the intermediate 3 - 7 years duration range stand out in the current rate environment for having a higher potential for both yields and capital upside. And compared to very long duration bonds (>10 years), intermediate duration bonds match their yields without being overly affected by shifts in interest rate expectations.

About the United Asian Bond Fund

The United Asian Bond Fund (the “Fund”) fits nicely into this intermediate duration space. It invests in high quality bonds issued by Asian corporates, financial institutions, governments and their agencies. While the Fund’s duration allows for stable income and capital appreciation, the Asian bond exposure takes advantage of the region’s strong regional fundamentals, improving corporate credit profiles, and relatively higher yields.

Here are some current Fund features:

- Attractive yield

As of 31 August 2025, the Fund offers a weighted average yield to maturity of 5.85 percent p.a. - an attractive option in today’s lower interest rate environment. For comparison, the yield on the latest six-month Treasury bill (T-bill) has dropped to 1.44 percent p.a., down from 3.05 percent p.a. at the start of the year2. - High quality

The Fund holds investment grade bonds with an average credit rating of BBB. Such a positioning enables investors to benefit from higher yields than A-rated investment grade bonds, while avoiding the default risk of lower-rated bonds. In particular, the Fund manager looks out for undervalued bonds issued by companies with improving fundamentals. These bonds typically offer higher yields and the potential for credit spread tightening. - Positioned for rate cuts

With an intermediate duration of 4.75 years (as of 31 August 2025), the Fund appears to also be well-positioned for the US Federal Reserve’s rate cutting cycle. By holding bonds of intermediate duration, the Fund is able to lock in yields before interest rates decline further and benefit from potential bond price gains as rates fall. Over the past one year, the Fund has already shown positive returns of 3.9 percent (as of 31 August 2025). - Lower volatility than peers

Over the past three years, the Fund has delivered positive returns with lower risk. The Fund’s 3-year standard deviation is 4.6 percent, considerably lower than the 7.2 percent volatility of the widely-tracked J.P. Morgan Asia Credit Index (JACI) - Core3. The Fund’s standard deviation is also below that of its Morningstar peer group average4. - Diversified Asian bond exposure

The Fund currently holds 78 bonds from issuers across a wide range of Asian economies to capitalise on the region’s varied growth drivers. Bonds from China make up the largest allocation (18.8 percent), followed by Indonesia (13.8 percent) and Hong Kong (13.0 percent).

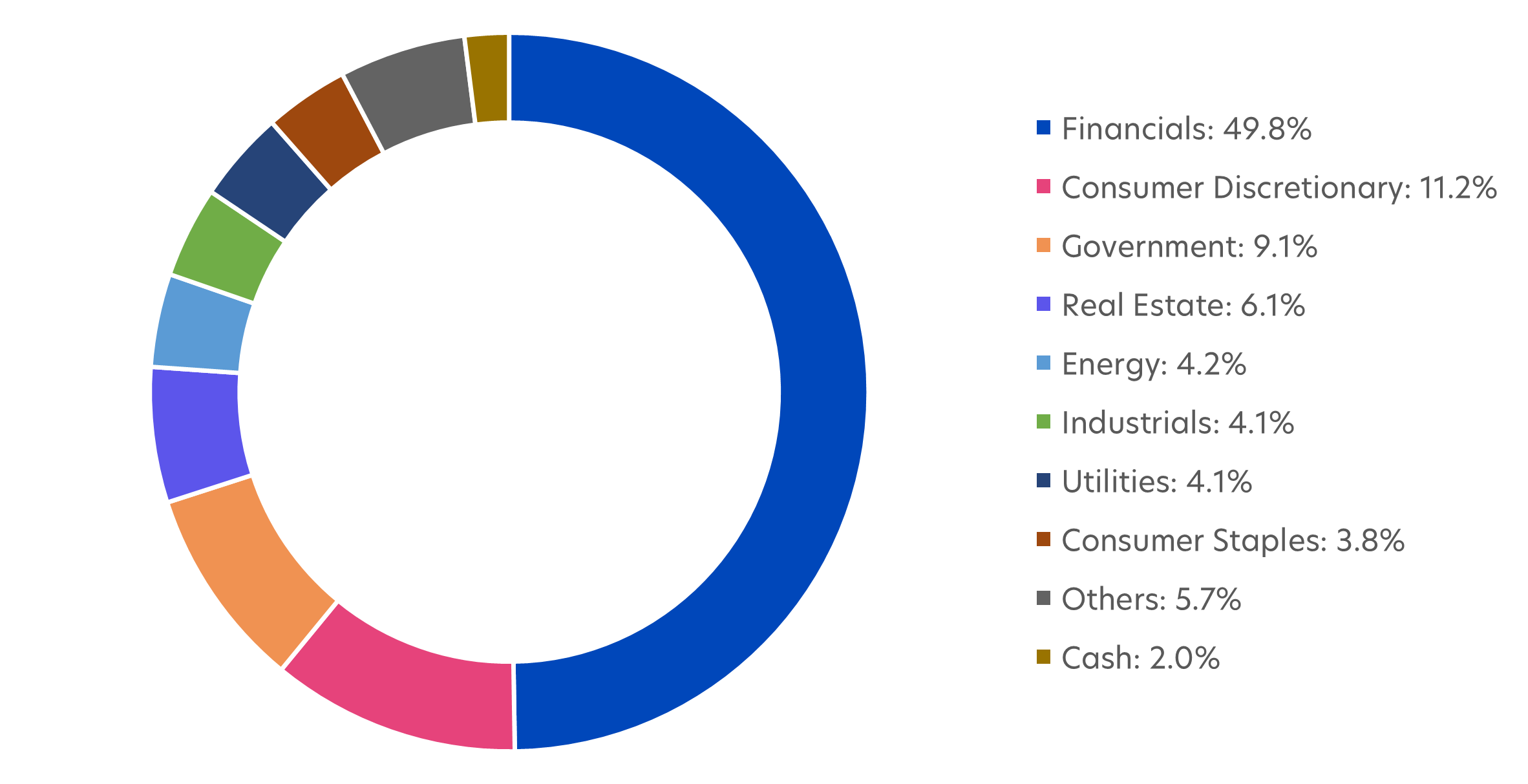

In terms of sector allocation, the Fund maintains a tilt towards the financials sector, which makes up 49.8 percent of the portfolio. This reflects the Fund manager’s conviction in the strength and reliability of Asian financial institutions, many of which have stable earnings, robust balance sheets, and are well-supported by their respective governments. Beyond financials, the Fund is also diversified across other key sectors including consumer discretionary, government and real estate.

Fig 2: Fund sector allocation

Source: UOBAM, 31 Aug 2025

Relative to peers

|

|

Weighted average Yield to maturity (%, p.a.) |

Credit quality |

Cumulative returns (%) |

Annualised returns (%) |

Risk (%) |

|

|

|

|

|

Year-to-date |

1-year |

3-year |

3-year standard deviation |

|

United Asian Bond Fund |

5.85 |

BBB |

-0.22 |

3.89 |

0.57 |

4.58 |

|

Peers |

5.44 |

BBB |

-0.27 |

3.79 |

2.38 |

4.96 |

Source: Morningstar as of 31 August 2025. | Refers to United Asian Bond Fund – Class SGD Dist | Fund performance is calculated on a NAV to NAV basis. Past performance is not necessarily indicative of future performance. | Peers category (Morningstar): Asian Bond. Does not include the effect of the current subscription fee that is charged, which an investor might or might not pay.

Fund details

|

Fund Name |

United Asian Bond Fund |

|

Investment Objective |

The Fund seeks to provide stable current income and capital appreciation by investing primarily in debt securities issued by Asian corporations, financial institutions, governments and their agencies (including money market instruments). |

|

Distribution Policy |

Distributions (if any) will only be made in respect of the Distribution Classes of the Fund. |

|

Fund Classes Available |

SGD |

|

Subscription Mode |

SGD: Cash, SRS |

|

Minimum Subscription |

S$1,000 (initial); S$500 (subsequent) |

|

Subscription Fee |

Currently up to 3%, Maximum 5% |

|

Management Fee |

Currently 1.1% p.a. |

1Source: MAS, as of 1 Oct 2025

2Source: MAS, as of 29 Sep 2025

3Source: UOBAM, BlackRock, as of 31 August 2025

4Peers category (Morningstar): Asian Bond.

|

If you are interested in investment opportunities related to the theme covered in this article, here is a UOB Asset Management Fund to consider:

|

Distributions will be made in respect of the Distribution Classes of the Fund. Distributions are based on the NAV per unit of the relevant Distribution Class as at the last business day of the calendar month or quarter. The making of distributions is at the absolute discretion of UOBAM and that distributions are not guaranteed. The making of any distribution shall not be taken to imply that further distributions will be made. UOBAM reserves the right to vary the frequency and/or amount of distributions. Distributions from a fund may be made out of income and/or capital gains and (if income and/or capital gains are insufficient) out of capital. Investors should also note that the declaration and/or payment of distributions (whether out of income, capital gains, capital or otherwise) may have the effect of lowering the net asset value (NAV) of the relevant fund. Moreover, distributions out of capital may amount to a reduction of part of your original investment and may result in reduced future returns. Please refer to the Fund's prospectus for more information.

All information in this publication is based upon certain assumptions and analysis of information available as at the date of the publication and reflects prevailing conditions and UOB Asset Management Ltd (“UOBAM”)'s views as of such date, all of which are subject to change at any time without notice. Although care has been taken to ensure the accuracy of information contained in this publication, UOBAM makes no representation or warranty of any kind, express, implied or statutory, and shall not be responsible or liable for the accuracy or completeness of the information.

Potential investors should read the prospectus of the fund(s) (the “Fund(s)”) which is available and may be obtained from UOBAM or any of its appointed distributors, before deciding whether to subscribe for or purchase units in the Fund(s). Returns on the units are not guaranteed. The value of the units and the income from them, if any, may fall as well as rise. Please note that the graphs, charts, formulae or other devices set out or referred to in this document cannot, in and of itself, be used to determine and will not assist any person in deciding which investment product to buy or sell, or when to buy or sell an investment product. An investment in the Fund(s) is subject to investment risks and foreign exchange risks, including the possible loss of the principal amount invested. Investors should consider carefully the risks of investing in the Fund(s) and may wish to seek advice from a financial adviser before making a commitment to invest in the Fund(s). Should you choose not to seek advice from a financial adviser, you should consider carefully whether the Fund(s) is suitable for you. Investors should note that the past performance of any investment product, manager, company, entity or UOBAM mentioned in this publication, and any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance of any investment product, manager, company, entity or UOBAM or the economy, stock market, bond market or economic trends of the markets. Nothing in this publication shall constitute a continuing representation or give rise to any implication that there has not been or that there will not be any change affecting the Funds. All subscription for the units in the Fund(s) must be made on the application forms accompanying the prospectus of that fund.

The above information is strictly for general information only and is not an offer, solicitation advice or recommendation to buy or sell any investment product or invest in any company. This publication should not be construed as accounting, legal, regulatory, tax, financial or other advice. Investments in unit trusts are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited, UOBAM, or any of their subsidiary, associate or affiliate or their distributors. The Fund(s) may use or invest in financial derivative instruments, and you should be aware of the risks associated with investments in financial derivative instruments which are described in the Fund(s)’ prospectus.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

UOB Asset Management Ltd. Company Reg. No. 198600120Z